In 2018, there were a total of 902,449 accounts settled by debt settlement companies, according to a 2019 report by John Dunham & Associates. However, the aggregate number of open accounts was 2.9 million, spread over 400,000 consumers. Enrolled debt in debt settlement programs in 2018: $5.1 billion

Full Answer

How does a debt settlement company work?

The borrower engages with a debt settlement company, who advises the borrower to withhold debt payments to her creditor and to instead make debt payments to the debt settlement company. The debt payment schedule proposed by the company is as follows:

How many Americans are in debt?

American household debt hit a record $13.21 trillion in 2018. If you had to write that check it would read $13,210,000,000,000. Lucky for you, that debt is shared by about 300 million people. But who are the most likely to get into debt?

What are the consequences of a debt settlement?

Although a debt settlement lowers the amount of debt outstanding and allows the borrower to avoid bankruptcy, there are significant repercussions to be considered, such as: 1. No debt settlement

What is the average amount of credit card debt per person?

People in the highest 10% of annual income had an average credit card debt of $12,600, according to a 2021 ValuePenguin analysis of Census and Federal Reserve reports. The average debt based on income scale: $290,000 and more – $12,600 $152,000 to $290,999 – $9,780

What is the percentage of debt settlement?

What percentage of a debt is typically accepted in a settlement? A creditor may agree to accept anywhere from 40% to 50% of the debt you owe, but it could go as high as 80%. The original creditor is likely to be looking for a higher percentage repayment.

What is the success rate of debt settlement?

Completion rates range from 35% to 60%, with the average around 45% to 50%. While most companies defined a completion as having all debts settled, there were two that considered a client completed if they had settled at least 80% of the debt and one if they had settled at least 50% of the debt.

What percentage of America is debt free?

And yet, over half of Americans surveyed (53%) say that debt reduction is a top priority—while nearly a quarter (23%) say they have no debt. And that percentage may rise.

How much debt does the average American have 2020?

$92,727As of 2020, the average American has $92,727 of debt. This amount includes credit card balances, auto loans, mortgages, personal loans, and student loans. The average amount of debt varies by generation.

Will debt collectors settle for 30%?

Lenders typically agree to a debt settlement of between 30% and 80%. Several factors may influence this amount, such as the debt holder's financial situation and available cash on hand.

Is it better to settle a debt or pay in full?

It is always better to pay off your debt in full if possible. While settling an account won't damage your credit as much as not paying at all, a status of "settled" on your credit report is still considered negative.

At what age should you be debt free?

A good goal is to be debt-free by retirement age, either 65 or earlier if you want. If you have other goals, such as taking a sabbatical or starting a business, you should make sure that your debt isn't going to hold you back.

How much debt does the average US citizen have?

Even though household net worth is on the rise in America (at $141 trillion in the summer of 2021)—so is debt. The total personal debt in the U.S. is at an all-time high of $14.96 trillion. The average American debt (per U.S. adult) is $58,604 and 77% of American households have at least some type of debt.

What is the average person's credit card debt?

On average, Americans carry $6,194 in credit card debt, according to the 2019 Experian Consumer Credit Review.

Who is the most in debt person?

Former Société Générale rogue trader Jérôme Kerviel owes the bank $6.3 billion.

What is the biggest debt in America?

Consumers in the United States had 15.24 trillion dollars in debt as of the third quarter of 2021, the majority of which was home mortgages, at 10.44 trillion U.S. dollars. Student loan debt was the second largest component, totaling 1.58 trillion U.S. dollars. Why is consumer debt important?

What is considered a lot of debt?

Debt-to-income ratio is your monthly debt obligations compared to your gross monthly income (before taxes), expressed as a percentage. A good debt-to-income ratio is less than or equal to 36%. Any debt-to-income ratio above 43% is considered to be too much debt.

How much less will debt collectors settle for?

Offer a Lump-Sum Settlement Some want 75%–80% of what you owe. Others will take 50%, while others might settle for one-third or less. Proposing a lump-sum settlement is generally the best option—and the one most collectors will readily agree to—if you can afford it.

How long does it take to improve credit score after debt settlement?

between 6 and 24 monthsHowever, a debt settlement does not mean that your life needs to stop. You can begin rebuilding your credit score little by little. Your credit score will usually take between 6 and 24 months to improve. It depends on how poor your credit score is after debt settlement.

What is a reasonable full and final settlement offer?

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

What percentage should I ask a creditor to settle for after a Judgement?

If you decide to try to settle your unsecured debts, aim to pay 50% or less. It might take some time to get to this point, but most unsecured creditors will agree to take around 30% to 50% of the debt. So, start with a lower offer—about 15%—and negotiate from there.

How many clients did the debt settlement review analyze?

The review analyzed 400,000 clients and 2.9 million accounts enrolled in debt settlement programs from 2011 to 2017. As you can see in the chart above, only 5% of clients do not achieve a settlement within the first year.

What is the size of the debt settlement industry?

For instance, the HTF Market Report put the value of the debt settlement industry at $438.6 million in 2018. Here we will consider the number of settlements, debt enrolled, number of consumers, revenue, and total economic output.

What is a debt settlement?

A debt settlement is an agreement to reduce the balance a creditor will accept as payment in full. Instead of declaring bankruptcy, consumers negotiate terms that will allow them to resolve debts they can’t afford to pay in full. Consumers can negotiate directly with lenders or hire debt resolution professionals.

Why do debt settlement companies have credit cards?

That is because personal loans don’t leave lenders much of recourse once they report an account as delinquent to credit reporting agencies.

What is the American Fair Credit Council?

After the 2010 FTC ruling, the leading debt settlement companies created the American Fair Credit Council, a trade group that helps debt settlement companies comply with FTC regulations and follow best practices.

What happens if you don't make a payment to creditors?

Debt settlement is based on the idea that if you don’t make payments, creditors may accept a lower amount to avoid the risk of a borrower declaring bankruptcy. The process of debt settlement usually requires consumers to make monthly payments to an escrow bank account until there is enough money for the debt settlement company to negotiate with creditors.

Why are debt settlements harder?

Debt settlements occur in all states, but because of government restrictions and regulations, it is harder for consumers to access professional debt settlement services in certain states. Not surprisingly, the number of settlements in those states is much lower.

What is the average debt?

The average debt based on income scale: 1 $290,000 and more – $12,600 2 $152,000 to $290,999 – $9,780 3 $95,00 to $151,999 – $6,990 4 $59,000 to $94,999 – $4,910 5 $35,000 to $58,999 – $4,650 6 Less than $34,999 – $3,830

How much debt will the average American have in 2021?

Economists debate that, but there’s little doubt that people spend more when they’re making more. The average American has $90,460 in debt, according to a 2021 CNBC report. That included all types of consumer debt products, from credit cards to personal loans, mortgages and student debt.

What is debt to income ratio?

Debt to income ratio is a key indicator of financial health. It’s determined by taking you monthly expenditures and dividing that number by your monthly income. For instance, if your bills amount to $5,000 a month and you make $7,500 a month, your DTI is 66%. It also means you are dire need of financial overhaul.

How much has student loan debt increased in 2019?

That was an increase of 6% over 2019, the highest annual growth jump in over a decade. Student loan debt increased the most (12%), followed by mortgage debt (7%) and personal loan debt (6%). But credit card debt dropped $73 billion, a 9% decrease from 2019 and the first annual drop in eight years.

What is the maximum DTI for a mortgage?

The maximum DTI you can have to qualify for a mortgage is usually 43%. Most financial advisors recommend keeping your DTI at 30% or lower.

How many black college graduates have student loans?

About 40% of Black graduates have student loan debt from graduate school, while 22% of white college graduates have graduate school debt. About 60% of Asian bachelor’s degree holders have educational loan debt. That figure increases to 67% for Hispanic and Latino student borrowers, and 70% for white borrowers.

Why is education important for debt?

The more educated you are, the more debt you have. That’s because higher education leads to higher income, and higher income leads to higher spending.

How much did debt settlements rise during the Great Recession?

The report also shows debt settlements rose dramatically during the Great Recession to a peak of $11.4 billion. More than half of these settlements occurred within a year of the account first becoming delinquent. Debt settlement and credit counseling became less common after that recession, but recently settlements have been on the rise following changes in delinquencies and credit tightness.

Is debt settlement common after recession?

Debt settlement and credit counseling became less common after that recession, but recently settlements have been on the rise following changes in delinquencies and credit tightness. These trends may repeat in future economic downturns.

How Do Debt Settlement and Debt Relief Companies Work?

Debt settlement companies work with creditors to negotiate the terms of your debt to make repayment more manageable. On average, including fees, consumers save 30% off their original debt, according to the industry group American Fair Credit Council.

Pros and Cons of Debt Settlement and Debt Relief Companies

Before you sign up with a debt settlement company, make sure you understand both the benefits and drawbacks of their services.

If You Decide to Use a Debt Settlement Company

Using a debt settlement company usually only makes sense if you have a significant amount of unsecured debt. The typical client for debt relief services may have seven accounts – including at least one that is delinquent – and more than $25,000 in unsecured debt, according to the AFCC.

Debt Settlement Red Flags

Not all debt settlement companies are created equal, and some unscrupulous businesses prey on unsuspecting people. The following are all red flags that indicate you should keep looking for a different firm:

How to Settle Your Own Debt

The services offered by debt settlement companies can be valuable, but they aren’t anything you can’t do for yourself.

Alternatives to Debt Settlement Companies

Settling debts on your own isn’t your only option if you are over your head in debt. You could also try the following:

Resources

Other websites with helpful information and resources regarding debt settlement include the following:

How long does a debt settlement company have to make payments?

The debt payment schedule proposed by the company is as follows: After three months of making payments to the debt settlement company, ...

What would a debt settlement company advise the borrower to do?

During the process, the debt settlement company would advise the borrower to stop making payments to their creditors and instead make payments to the debt settlement company (albeit at a lower payment rate).

What is a debt covenant?

Debt Covenants Debt covenants are restrictions that lenders (creditors, debt holders, investors) put on lending agreements to limit the actions of the borrower (debtor). Intercreditor Agreement. Intercreditor Agreement An Intercreditor Agreement, commonly referred to as an intercreditor deed, is a document signed between one or more creditors, ...

What happens if a debt settlement falls through?

If a debt settlement falls through, the borrower will end up with more than the initial debt owed.

How to settle a debt?

In a debt settlement, the borrower may engage with a debt settlement company, who would act on the borrower’s behalf. The typical process for a debt settlement is as follows: 1 The borrower explains their financial situation to a debt settlement company. 2 During the process, the debt settlement company would advise the borrower to stop making payments to their creditors and instead make payments to the debt settlement company (albeit at a lower payment rate). 3 The debt settlement company would put the payments made by the borrower into a savings account#N#Savings Account A savings account is a typical account at a bank or a credit union that allows an individual to deposit, secure, or withdraw money when the need arises. A savings account usually pays some interest on deposits, although the rate is quite low.#N#. 4 Once the savings account’s reached a certain threshold, the debt settlement company would engage with the borrower’s creditors to negotiate a debt settlement. 5 If negotiations are successful, the debt settlement company would retain a portion of the money in the savings account (it is collected as fees by the debt settlement company) and distribute the remainder to the borrower’s creditors.

How long does bankruptcy last?

Avoiding bankruptcy. A debt settlement allows the borrower to avoid bankruptcy. Depending on the country, consumer bankruptcy can last up to ten years – significantly impacting the credit score of a borrower. In addition, declaring bankruptcy can potentially impact employability.

What is the legal status of a non-human entity that is unable to repay its outstanding debts?

Bankruptcy Bankruptcy is the legal status of a human or a non-human entity (a firm or a government agency) that is unable to repay its outstanding debts. , the borrower may attempt to reach a debt settlement with their creditors. In a debt settlement, the borrower may engage with a debt settlement company, who would act on the borrower’s behalf.

What Is A Debt Settlement?

What Is The Size of The Debt Settlement Industry?

Debt Settlements by State

Demographic Data on Debt Settlement Consumers

What Is The History of The Debt Settlement Industry?

Industry Trends – Household Debt

The Future of The Debt Settlement Industry

- The latest household debt and credit report by the Federal Reserve Bank revealed that total household debt increased by $192 billion. That is a 1.4% growth over the first quarter of 2019 and the 20th consecutive quarter increase. Our current household debt peak is $1.2 trillion higher in nominal terms than the previous peak of $12.68 trillion in ho...

The Pandemic Impact on Debt

Average American Debt by Age

Debt and Education

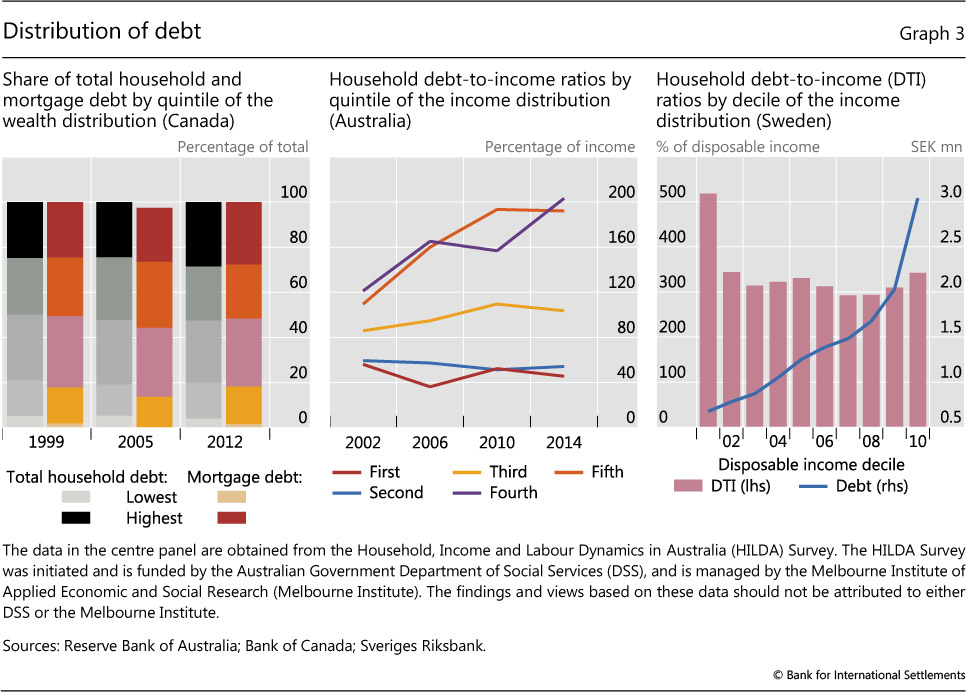

Average Debt to Income Ratios

Debt and Family Type

Debt and Income

Debt and Minorities

Debt and Gender

Student Loan Debt