A typical life settlement payout will be around 20% of your policy size, but the range could be anywhere from 10% to 25%+. For example, if you have a policy valued at $300,000 and you choose to sell it in a life settlement, your final return will be around $60,000.

What is a a life settlement?

A life settlement is the sale of a life insurance policy by the policy owner to a third party. The seller typically gets more than the cash surrender value of the policy but less than the amount of the death benefit. The third party continues to pay the policy’s premiums and then collects the death benefit when the insured dies.

What is the average value of a life insurance settlement?

Magna Life Settlements estimated that the average policy face value in life settlements was $1.24 million in 2018. A life settlement can make sense if your need for cash is greater than your need for providing a life insurance payout to your current beneficiaries. Your kids might be grown and no longer count on support from you.

Will a life settlement buy out my life insurance policy?

Most life settlement companies will not buy out a life insurance policy unless it has a face value of $50,000 or more. There are only a few types of life insurance policies that can be sold through a life settlement.

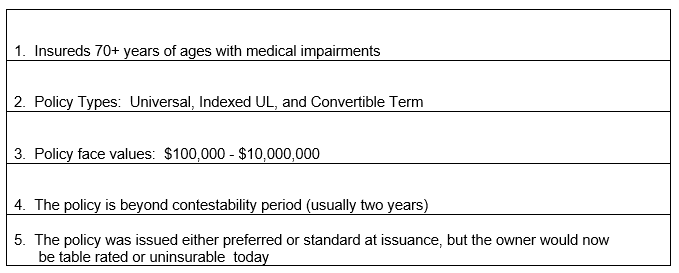

How do you qualify for a life insurance settlement?

To qualify for a life settlement, the policyholder must usually be over 65 and have a policy with a face value of at least $100,000. The Policy must also be “non-recourse,” meaning that the insurer cannot cancel the policy if the premiums are not paid.

How much can you sell a $100 000 life insurance policy for?

Pros and Cons to Selling your Life Insurance Policy On average, if you have a $100,000 life insurance policy, you will be receiving about $25,000. The next big advantage is that you won't have to make any more premium payments on your insurance policy.

What happens after 30 year term life insurance?

Generally, when term life insurance expires, the policy simply expires, and no action needs to be taken by the policyholder. A notice is sent by the insurance carrier that the policy is no longer in effect, the policyholder stops paying the premiums, and there is no longer any potential death benefit.

Are life settlements a good idea?

Life settlements can be a valuable source of liquidity for people who would otherwise surrender their policies or allow them to lapse—or for people whose life insurance needs have changed. But they are not for everyone. Life settlements can have high transaction costs and unintended consequences.

Do you get your money back with term life?

By law, if you cancel a term life insurance policy within 30 days of purchasing it, the company must refund any money you paid. In addition, if you pay some of your premiums ahead of schedule and then cancel your policy, the company should return those early pre-payments.

At what age should you stop term life insurance?

If you want your life insurance to cover your mortgage, consider how many years you have left until you pay off your house. You don't want your policy to expire after 20 years if your mortgage payments will last another decade after that.

What happens if I live longer than my term life insurance?

What happens if you live longer than your life insurance term? Your coverage ends if you outlive your term life policy. Before it expires you can choose to convert your policy to permanent insurance, buy a new policy, or go without coverage, depending on your needs.

Is a life settlement tax Free?

Is A Viatical Settlement Taxable? Most of the time, viatical settlements are not taxable. Settlement proceeds for terminally ill insureds are considered an advance of the life insurance benefit. Life insurance benefits are tax-free, and so it follows that the viatical settlement wouldn't be taxed, either.

Are life settlements taxable?

To recap: Sale proceeds up to the amount of the cost basis are not taxable. Sale proceeds above the cost basis and up to the policy's cash surrender value are taxed as ordinary income. Any remaining sale proceeds are taxed as long-term capital gains.

What is an alternative to a life settlement?

The most common of alternatives to a life settlement is known as an Accelerated Death Benefit (ADB). An ADB, also called “Living Benefit”, allows you to receive a portion of your death benefit from your insurance company.

What happens after 20 year term life insurance?

What does a 20-year term life insurance policy mean? This is life insurance with a policy term of 20 years. If the policyholder dies during that time, the life insurance company pays a death benefit to his or her beneficiaries, often dependents or family. After 20 years, there is no more coverage, and no benefit paid.

What happens after 10 year term life insurance?

After 10 years, the policy expires. That means you will no longer have coverage. The death benefit coverage of the policy also only lasts until the end of the term. For example, if the insured dies within the 10-year term, their designated beneficiary will get a lump-sum payment as stated in the policy.

What happens if I stop paying my term life insurance?

Life Insurance Term: If you stop paying premiums, your coverage lapses. Permanent: If you have this type of policy, you will have the following choices: Cash out the policy. This means that you can stop paying the premium and collect the available cash savings.

What happens to term insurance after maturity?

Maturity benefits are the sum assured along with bonuses that your life insurance provider pays to you when you survive the policy tenure. Thus, maturity benefits turn regular life insurance products into saving instruments. However, term insurance offers pure protection without any maturity benefits.

What's the longest term life insurance policy you can get?

40-year term life insurance is the longest-available term length. You may not be aware of this because it isn't as common as 10-, 20- or 30-year plans. Protective Life Insurance and Legal & General (also known as Banner Life) are the only companies that offer 40-year term insurance policies.

How Do Life Insurance Settlements Work?

Typically, a life settlement transaction will be an option for those 65 years and older with a policy worth at least $100,000 in death benefits. This is not always the case, but it’s a good place of reference for you to compare to. A typical life settlement payout will be around 20% of your policy size, but the range could be anywhere from 10% to 25%+. For example, if you have a policy valued at $300,000 and you choose to sell it in a life settlement, your final return will be around $60,000.

Are Life Settlements Tax Free?

In short, no, life settlements are not tax free. They are taxable to the extent that you turn a profit upon selling the policy. Life settlement proceeds greater than the amount of premiums you have paid are treated. If you’re concerned about a life settlement increasing your tax liability, you should talk with a financial advisor about how to offset the gains through other investments and tax strategies.

What Is a Life Settlement?

A life settlement refers to the sale of an existing insurance policy to a third party for a one-time cash payment. Payment is more than the surrender value but less than the actual death benefit. After the sale, the purchaser becomes the policy's beneficiary and assumes payment of its premiums. By doing so, they receive the death benefit when the insured dies.

What happens when you take a life settlement?

This is typical for people who no longer work for the company. By taking a life settlement, the company can cash out on a policy that was previously illiquid. Life settlements generally net the seller more than the policy's surrender value, but less than its death benefit.

How does a life insurance settlement work?

How Life Settlements Work. When an insured party can no longer afford their insurance policy, they can sell it for a certain amount of cash to an investor— usually an institutional investor. The cash payment is primarily tax-free for most policy owners. The insured person essentially transfers ownership of the policy to the investor.

What happens to a viatic settlement after the insured dies?

After the insured party dies, the new owner receives the death benefit. Viatical settlements are generally riskier because the investor basically speculates on the death of the insured. Even though the original policy owner may be ill, there's no way of knowing when they will actually die.

What happens when you sell a life insurance policy?

By selling it, the insured person transfers every aspect of the policy to the new owner. This means the investor who takes over the policy inherits and becomes responsible for everything related to the policy including premium payments along with the death benefit. So, once the insured party dies, the new owner—who becomes the beneficiary after the transfer—receives the payout.

What happens to the death benefit after a policy is sold?

After the sale, the purchaser becomes the policy's beneficiary and assumes payment of its premiums. By doing so, they receive the death benefit when the insured dies.

Why do people sell life insurance?

There are many reasons why people choose to sell their life insurance policies and are usually only done when the insured person doesn't have a known life-threatening illness. The majority of people who sell their policies for a life settlement tend to be older people—those who need money for retirement but haven't been able to save up enough. That's why life settlements are often called senior settlements. By receiving a cash payout, the insured party can supplement their retirement income with a largely tax-free payout.

What is life settlement?

A life settlement occurs when you sell your existing life insurance policy to a third party for a one-time payment. Life settlements offer an alternative to cashing out your policy—a.k.a. getting the policy’s cash surrender value or cash value. After selling your policy, the buyer pays your premiums and receives the death benefit when you die. You may qualify for a life settlement if you are over 65 years old and have had your policy long enough to meet your state’s minimum. Typically, the death benefit of your policy must be at least $100,000.

How to start a life insurance settlement?

You can start the life settlement process by submitting a questionnaire, authorization, insurance carrier illustrations, and your past five years of medical records. The company does complete a background check to prevent fraud. Coventry also offers a retained death benefit, allowing you to keep part of your policy’s payout after you stop paying premiums.

Why do people give up life insurance?

As you get older, your life insurance policy only becomes more costly. It may even become unaffordable, so it's easy to see why so many people give up their policies. A 2019 study from the Society of Actuaries and LIMRA found that 4% of life insurance policies—worth billions of dollars—lapse every single year. 1 But if you need money, there is an alternative you may not have considered: life settlements.

What is premium insurance?

Premiums. Premiums are the amount paid to keep a life insurance policy in force. When a policy is sold to a life settlement company, premiums are now paid by the company, and not the individuals.

What is the number one life insurance settlement provider?

Coventry earned the top spot on our list because of the company’s size and strong reputation. The company pioneered the life settlement industry by creating a secondary market for life insurance over 35 years ago. It’s the country’s biggest life settlement provider by a large margin—accounting for 40% of all transactions in 2020. Coventry was named the number-one life settlement provider in 2020 by The Deal. 2

How long does it take to sell Coventry insurance?

The sales process may take up to 30 days. Coventry also offers a retained death benefit, allowing you to keep part of your policy’s payout after you stop paying premiums. To qualify, you must be at least 65 years old or have a serious health condition with a life expectancy of less than 20 years.

How long does it take to get a life settlement from Abacus?

You may also accomplish the same thing by calling their team. The company completes a federal background check with the sales process taking 14 to 21 days.

What is life settlement?

A life settlement is the sale of a life insurance policy by the policy owner to a third party. The seller typically gets more than the cash surrender value of the policy but less than the amount of the death benefit. The third party continues to pay the policy’s premiums and then collects the death benefit when the insured dies.

How do life settlements work?

Most life settlements are handled through brokers. Brokers must be licensed and have a fiduciary duty to represent the policy owner. They will put a policy on the market in an “auction” and get bids from multiple buyers, says Siegel, whose company, Suncrest Benefits, is a life settlement broker. “Their goal is to get [policy owners] the maximum price possible,” he says.

Who Qualifies for a Life Settlement?

Age and health of the insured person are the two key factors when it comes to selling a life insurance policy. Typically, you need to be old enough or sick enough for investors to be willing to take on the risk of buying your policy, Freedman says.

Why do investors prefer to buy policies from people with shorter life expectancies?

Investors don’t want to risk paying premiums on a policy for someone who could live for decades. That’s why investors prefer to buy policies from people with shorter life expectancies. “The shorter the life expectancy, the greater the value is to the investor,” Freedman says.

How much commission does Siegel get?

The average commission his company gets is 22% of the amount of a life settlement payment. Commissions can vary from broker to broker.

What happens to a policy once it is sold?

What will happen to the policy once it’s sold? Some buyers will buy policies and then turn around and sell them for more to other investors, Siegel says. If your policy is being sold and resold, you might not know who will end up owning it—and you have to ask yourself if you’re comfortable with that.

How many states require life insurance to notify policy owners of the alternatives to surrendering a policy?

Only six states require life insurance companies to notify policy owners of the alternatives to surrendering a policy or letting it lapse, according to the Life Insurance Settlement Association. If you work with a financial planner, discuss whether a life settlement is appropriate for your situation.

What is a life settlement broker?

A life settlement broker can provide a fair assessment of your policy’s cash value and allow you to make the decision if you want to keep your policy in force.

How much can you sell life insurance at 65?

People 65 or older can typically sell their life insurance policy as long as the face value of the policy exceeds $100,000. Many life insurance companies allow you to add a conversion rider to your term policy when you first buy it — sometimes at an extra cost.

What is viatical settlement?

A viatical settlement can help people dealing with a terminal illness who need to extract cash from their life insurance policy. Or, you may want to convert down the line to take advantage of a permanent policy’s cash value benefits. If you bought your term policy years ago, you might not know whether your policy is convertible or not.

What happens if you don't have your life insurance policy?

If you don’t have your original policy documents, call the agent or insurance company directly and have them check for you. A life settlement is the process of selling your life insurance policy to a third-party company or investor for cash. The average payout in a life settlement option is 22% of the policy’s face value.

What to do if your life insurance doesn't have riders?

If your policy doesn’t have either of these riders, or receiving cash now outweighs their benefits, a life settlement is a good option to consider.

What happens if you have an unconverted term policy?

Keep in mind — if you have an unconverted term policy, you will get nothing when the policy expires.

When can you convert to universal life?

State Farm, for instance, allows you to convert your policy to whole or universal life until age 75. TIAA Life allows you to convert your policy at any point during the initial term, regardless of your age.

Who must contact the Life Insurance carrier for a 1099-SB?

If a 1099-SB is not received in the same timeframe, then the Policy Owner (Seller) must contact the Life Insurance Carrier directly and ask that the Life Insurance Carrier’s accounting department complete and resend the form directly to the Policy Owner (Seller).

Should a life insurance settlement be considered before selling?

The tax implications of a life insurance settlement should be considered prior to the sale of the life insurance policy. We strongly recommend that a policy owner seek professional tax advice prior to accepting any life settlement offers. The taxation for a life settlement transaction was simplified with the implementation of the TCJA.

Is there a cash surrender value for a life insurance settlement?

The settlement amount is less than the cost basis and there is no cash surrender value. In Revenue Ruling 2020-05, it states in the, “Holdings” section number 2 that the policy owner (“A”) recognizes a long-term capital loss of $25,000 upon the sale of the life insurance settlement contract.

Is 100% of life insurance settlement capital gain?

Based on the IRS Guidelines, if a term life insurance policy is sold, then 100% of the life settlement proceeds should be treated as a capital gain.