Full Answer

How to pay for closing costs?

- Present A Strong Offer: The easiest way to get the other party to cover closing costs is to present them with a strong offer. ...

- Offer A Quick Close: Truly great real estate deals favor both parties. ...

- Make Fewer Demands: No seller appreciates too many demands. ...

How much are closing costs for the buyer?

What are the typical real estate closing costs for buyers?

- Closing costs for buyers. Here is a quick breakdown of home buyer closing costs.

- Appraisal fees. ...

- Credit report fees. ...

- Mortgage origination fee. ...

- Title insurance policy fees. ...

- Escrow fees. ...

- Home inspection fee. ...

- Attorney fees. ...

- Documentation fees. ...

- Loan discount point fees. ...

What is the average closing cost for a buyer?

New data reveals the average closing costs are $6,693 across all home buyers, and slightly less for first-time buyers. You may be able to negotiate part of your closing costs.

Are closing costs negotiable?

Some closing costs are negotiable: attorney fees, commission rates, recording costs, and messenger fees. Check your lender’s good-faith estimate (GFE) for an itemized list of fees. You can also use your GFE to comparison shop with other lenders.

What is a fee settlement?

Settlement fee means a charge imposed on or paid by an individual in connection with a creditor's assent to accept in full satisfaction of a debt an amount less than the principal amount of the debt.

How much are closing cost in Missouri?

Average Closing Costs By StateStateAverage Closing Costs (Including Taxes)Average Closing Costs (Excluding Taxes)Missouri$1,571.05$1,571.05Montana$3,020.65$3,020.65Nebraska$2,714.81$2,152.23Nevada$5,585.68$3,870.6047 more rows

Is settlement and closing the same thing?

A closing is often called "settlement" because you, as buyer, along with your lender and the seller are "settling up" among yourselves and all of the other parties who have provided services or documents to the transaction.

How much are closing costs in Colorado?

Average closing costs by stateStateAverage home sale priceAverage closing costs with taxesColorado$424,479$3,672Georgia$231,593$3,658Maine$259,925$3,654Arizona$296,978$3,63147 more rows•Sep 28, 2020

Who pays closing cost?

Typically, buyers and sellers each pay their own closing costs. A home buyer is likely to pay between 2% and 5% of their loan amount in closing costs, while the seller could pay 5% to 6% of the sale price to their real estate agent. But it doesn't always work out that way.

Do sellers pay closing costs in Missouri?

Seller closing costs are fees you pay when you finalize the sale of your home in Missouri. These include the costs of verifying and transferring ownership to the buyer and many are unavoidable. In Missouri, you'll pay about 0.5% of your home's final sale price in closing costs, not including realtor fees.

What not to do after closing on a house?

What Not To Do While Closing On a HouseAvoid Big Charges on a Credit Card. Do not rack up credit card debt. ... Be Careful with Trends. ... Do Not Neglect Your Neighbors. ... Don't Miss Tax Breaks. ... Keep Your Real Estate Agent Close. ... Save That Mail. ... Celebrate!

How long is settlement usually?

Settlement is the process of paying the remaining sale price and becoming the legal owner of a home. At settlement, your lender will disburse funds for your home loan and you'll receive the keys to your home. Generally, settlement takes place around 6 weeks after contracts are exchanged.

How does settlement work when buying a house?

What is settlement? Property settlement is a legal process that is facilitated by your legal and financial representatives and those of the seller. It's when ownership passes from the seller to you, and you pay the balance of the sale price. The seller sets the settlement date in the contract of sale.

Does seller pay closing costs?

The real estate commission or the broker's fee has to be paid by the seller at the time of closing. And the rest of the charges and expenses are the buyer's responsibility. Unless the terms of the deal dictate otherwise, it is the responsibility of the buyers to pay the closing costs.

Does seller pay closing costs in Colorado?

In Colorado, sellers typically pay for title and closing fees, owner's title insurance, and recording fees.

Can closing costs be included in loan?

Including closing costs in your loan — or “rolling them in” — means you are adding the closing costs to your new mortgage balance. This is also known as financing your closing costs. Lenders may refer to it as a “no-cost refinance.” Financing your closing costs does not mean you avoid paying them.

How are Missouri closing costs calculated?

In Missouri, it's typical for buyers to pay 2-5% of the purchase price of a home. The average closing costs for Missouri buyers are around $3,700, according to Zillow Research. However, these figures can vary depending on where you live. For example, the median home value in the state of Missouri is $161,500.

Who pays for title insurance in Missouri?

the sellerMissouri is one of the few states that does not enforce a real estate transfer tax. Title Insurance. Title insurance protects the buyer in case there are any liens or disputes about the house's title. Even though this is for the benefit of the buyer, the seller typically pays this one-time cost.

Who pays property taxes at closing in Missouri?

Missouri sellers' closing costs include prorated taxes. Closing costs refer to the expenses a buyer and a seller must pay when property ownership transfers from one party to the other. In Missouri, some closing costs are paid by the seller.

How many months of property taxes are collected at closing in Missouri?

At least one year advance plus two months worth of homeowner's insurance premium will be collected. In addition, taxes equal approximately to two months in excess of the number of months that have elapsed in the year are paid at closing. (If six months have passed, eight months of taxes will be collected.)

How much does closing cost add up to?

Seller closing costs typically add up to 1-3% of the sale price, while buyers generally owe around 3-5%. How much you'll actually pay will depend on the laws and conventions in your local area, as well as your negotiations with the buyer or seller.

How do closing costs work?

At the end of a typical home sale, both the seller and buyer pay an assortment of taxes and transaction-related fees that are collectively called "closing costs."

What is loan cost?

Loan costs: Fees that the buyer's lender charges to process and approve the loan. Loan costs are usually paid by the buyer.

What are closing costs when buying a house?

When you buy or sell a house, you must pay a set of taxes and other fees called closing costs. These expenses cover the cost of finalizing the sale and transferring the property's title into the buyer's name.

How much cash can you bring to closing?

This can limit the amount of cash you need to bring to closing. However, there's likely a limit to how much help you can receive, which could be as low as 3% depending on what kind of mortgage you're getting.

What to ask when negotiating a purchase agreement?

When you're negotiating a purchase agreement, you can ask the other party to cover fees or taxes you'd typically pay. Or you can ask them to contribute a lump sum toward your overall closing cost burden.

How to keep money in your pocket on closing day?

If you want to keep more money in your pocket on closing day, your best bet is to work with a real estate agent who offers built-in savings. Clever can help you find one!

What is settlement fee?

In real estate, a settlement fee is a charge that covers expenses in excess of the amount a person pays to purchase or sell a property. Settlement fees can encompass many types of expenses, but often include such things as application and attorney ’s fees, loan origination fees, and fees for title searches.

What is a point fee?

Points are fees that are charged a single time and can be negotiated with a lender to lower the interest rate a borrower will pay on a mortgage in exchange for paying a particular sum up front.

Do appraisers charge fees?

Appraisers and home inspectors charge fees, which are often included in settlement fee totals. In most cases, the settlement fees a seller pays are negotiable. In order to make his home more attractive or easier to buy, a seller may agree to pay one or more of the settlement fees usually paid by the buyer.

Is it legal to have a seller assist with a settlement fee?

Having the seller assist with a settlement fee is usually legal, as long as the seller's contribution is detailed in the official agreement between the buyer and seller and doesn't violate any terms set by the lender.

Is an appraisal included in settlement fees?

Lenders may also require an inspection by a professional home inspector in order to analyze the structure of the property and look for evidence of issues such as termites. Appraisers and home inspectors charge fees, which are often included in settlement fee totals.

How much are closing costs?

In general, closing costs average 1-5% of the loan amount. Though, closing costs vary depending on the loan amount, mortgage type, and the area of the country where you’re buying or refinancing.

How to get closing cost estimate?

The best way to get an accurate closing cost estimate is to apply for your upcoming purchase or refinance loan.

How long does a mortgage lender have to pay for insurance?

In general, lenders collect at least one year’s premium at loan closing and pay the insurance company. The amount of this fee depends on the value of your home, the amount of insurance coverage, and the yearly premium.

What is escrow fee?

The escrow fee (also known as the settlement fee or closing fee) is based on the loan amount and/or purchase price, so expect to pay more on higher cost homes.

What is escrow company?

The escrow company handles all the funds involved in the transaction. They make sure all parties pay and get paid appropriately. For example, at closing, the lender wires in loan funds and the buyer wires the down payment and closing costs. The escrow company then pays off any existing loans on the home, pays third-party service providers, and wires the rest of the funds to the seller. The escrow company also handles getting all of the loan documents signed and notarized.

What are closing costs for a home loan?

Closing costs cover a variety of fees related to the processing of a mortgage and required prepaid items like homeowners insurance and property taxes.

How to get an accurate estimate of closing costs?

The best way to get an accurate estimate of your loan’s costs is after your mortgage application is processed, and you receive an itemized closing cost sheet from your lender. Request your estimated closing costs from a mortgage professional.

What are closing costs?

Your closing costs include a number of different fees that are all associated with your financing of the purchase of the property. These typically include your origination fee, recording fees, points, the cost of the title insurance, title insurance endorsements, attorney fees, and the payment of private mortgage insurance on the home.

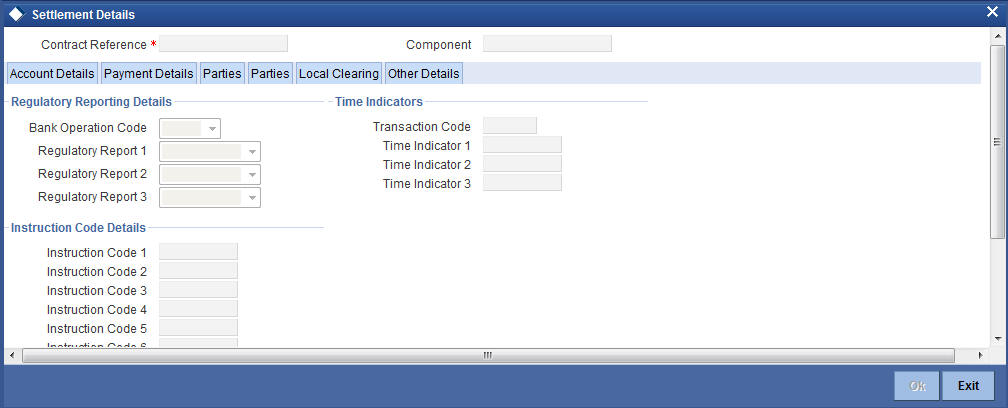

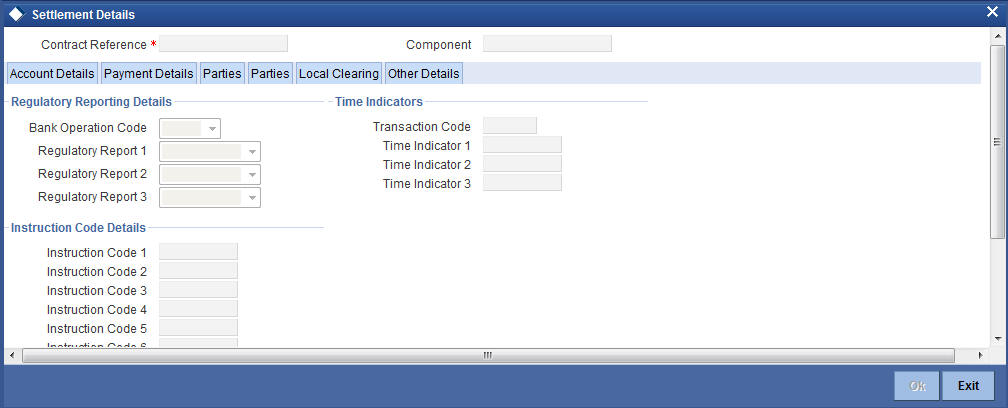

What is settlement on HUD?

The settlement is the finalization of your purchase of real estate property. The fees associated with this sale are referred to as your settlement costs. Your settlement cost will be detailed on your HUD-1 statement, often referred to as your Settlement Statement.

Why do we review closing statements before closing?

Then before closing we will review the closing statement to make sure the closing company didn't make any mistakes that will cost you money . You could end up paying more in closing cost through mathematical error or improper reading of the contract by the closing company. You would be amazed at the credits and other monies that were supposed to be given to the buyer at closing that were not on the closing statement upon on first review.

What does a realtor estimate?

In addition, your Realtor will provide you with an estimate of your expenses at the time of writing your purchase offer. This estimate will include best guesses for the charges the lender will be charging you for. The lender's cost include document preparation, processing fees and credit report.

Who pays for title insurance in Florida?

Northeast Florida is a little different then the rest of the country in that Sellers typically pay for the title insurance cost on a purchase transaction. For this reason the Seller typically picks the closing agent or closing attorney and is responsible for those associated cost. However, if you are refinancing your home then you will be responsible for the title insurance.

Why are the amount you pay not identical?

The amount that you must pay are not identical due to the fact that you each have certain expenses that are specific to your particular position as buyer or seller. Sometimes, it is prearranged prior to the closing for the seller to pay some of your costs as Buyer.

How much are closing costs?

Typically, home buyers will pay between about 2 to 5 percent of the purchase price of their home in closing fees. So, if your home cost $150,000, you might pay between $3,000 and $7,500 in closing costs. On average, buyers pay roughly $3,700 in closing fees, according to a recent survey.

Who pays closing fee?

Closing Fee or Escrow Fee: This is paid to the title company, escrow company or attorney for conducting the closing. The title company or escrow oversees the closing as an independent party in your home purchase. Some states require a real estate attorney be present at every closing.

How can home buyers avoid closing costs?

You can also avoid upfront fees on your loan by getting a no-closing cost mortgage, in which you don’t pay any of the closing costs when you close on the mortgage.

What is application fee?

Application Fee:This fee covers the cost for the lender to process your application. Before submitting an application, ask your lender what this fee covers. It can often include things like a credit check for your credit score or appraisal as well. Not all lenders charge an application fee, and it can often be negotiated.

How long do you have to put down escrow for property taxes?

Escrow Deposit for Property Taxes & Mortgage Insurance: Often you are asked to put down two months of property tax and mortgage insurance payments at closing.

How long before closing should you give closing disclosure?

Remember that you can shop around and you may be able to find other lenders who are willing to offer you a loan with lower fees at closing. At least three business days before your closing, the lender should give you Closing Disclosure statement, which outlines closing fees.

What is closing cost?

Closing costs are fees associated with your home purchase that are paid at the closing of a real estate transaction. Closing is the point in time when the title of the property is transferred from the seller to the buyer. Closing costs are incurred by either the buyer or seller.

Who pays settlement fee?

Settlement: This fee is paid to the settlement agent or escrow holder. Responsibility for payment of this fee can be negotiated between the seller and the buyer.

What is document preparation fee?

Document Preparation: This fee covers the cost of preparation of final legal papers, such as a mortgage, deed of trust, note or deed.

What is origination fee?

Origination: The fee the lender and any mortgage broker charges the borrower for making the mortgage loan. Origination services include taking and processing your loan application, underwriting and funding the loan, and other administrative services.

What is appraisal charge?

Appraisal: This charge pays for an appraisal report made by an appraiser.

What are points on a loan?

Points: Points are a percentage of a loan amount. For example, when a loan officer talks about one point on a $100,000 loan, this is 1 percent of the loan, which equals $1,000. Lenders offer different interest rates on loans with different points. You can make three main choices about points. You can decide you don’t want to pay or receive points at all. This is a zero-point loan. You can pay points at closing to receive a lower interest rate. Alternatively, you can choose to have points paid to you (also called lender credits) and use them to cover some of your closing costs.

What is real estate commission?

Real estate commission: This is the total dollar amount of the real estate broker’s sales commission, which is usually paid by the seller. This commission is typically a percentage of the selling price of the home.

Who pays the surveyor fee?

Survey: The lender may require that a surveyor conduct a property survey. This is a protection to the buyer as well. Usually the buyer pays the surveyor’s fee, but sometimes this may be paid by the seller.

What is title settlement fee?

The title settlement fee, or closing fee, is a charge from the title company to cover the administrative costs of closing. Title companies may or may not list out the individual costs of the fee.

How much does a home buyer pay for closing costs?

Home buyers can typically expect to pay 2% – 5% of the loan amount in closing costs. One of the main costs is a title fee. Here we’ll cover what title fees are, who pays them and how much they cost.

What Are Title Fees?

Title is the right to own and use the property. Title fees are a group of fees associated with closing costs. These fees pay a title company to review, adjust and insure the title of the property.

How to find closing costs?

You can find title fees and overall closing costs on a couple documents: 1 Closing disclosure: Your closing disclosure will break down total closing costs, including title fees, in an itemized list. 2 Loan estimate: The loan estimate will list your total closing costs, along with title service fees, and tell you the cash you need to bring to close.

How much does title fee vary?

Title fees change from company to company and from location to location. They can also change depending on what’s included. In general, closing costs, which title fees are a large part of, cost from 2% – 5% of the total loan amount.

How much does it cost to record a deed?

The national average for this charge is around $125.

What is abstract of title?

The abstract is the summary of the title search from the title company. It compiles the details of the search and the related official documents and communicates them in a concise manner. Abstract of title fees can range from $200 – $400 for an update to the abstract to $1000+ if a new abstract of title must be created.

How much does a seller pay for closing costs?

Closing costs for sellers of real estate vary according to where you live, but as the seller you can expect to pay anywhere from 6% to 10% of the home’s sales price in closing costs at settlement. This won’t be cash out of the seller’s pocket; rather it will be deducted from the profit on your home—unless you are selling with very low equity on your mortgage. In this case, sellers may need to bring a little cash to the table to satisfy your lender—and some closing costs may be held in escrow.

What are closing costs for sellers?

Additional closing costs for sellers of real estate include liens or judgments against the property; unpaid homeowners association dues; prorated property taxes; escrow fees; and homeowners association dues included up to the settlement date.

What are the taxes that are included in closing costs?

Transfer taxes, recording fees, and property taxes are key parts of a seller’s closing costs. Transfer taxes are the taxes imposed by your state or local government to transfer the title from the seller to the buyer. Transfer taxes are part of the closing costs for sellers.

Why is my mortgage payoff higher than my mortgage balance?

This is because of lenders’ prorated interest on the mortgage.

What is title insurance?

Title insurance fees are another fee to keep in mind when you sell real estate. As part of closing costs, sellers typically pay the buyer’s title insurance premium. Title insurance protects buyers and lenders in case there are problems with the title in a real estate deal.

How much commission does a real estate agent get for a $350,000 purchase?

For a $350,000 purchase price, the real estate agent’s commission would come to $21,000. Buyers have the advantage of relying on sellers to pay real estate agent commissions. 2. Loan payoff costs. Most home sellers often seek out a sales price for their home that will pay off their mortgage and satisfy their lenders.

Do you have to include closing costs when selling a house?

Also, don’t forget to estimate some of the closing costs associated with preparing to sell, such as cosmetic repairs or improvements to make your home more attractive to buyers. Those closing costs may be returned with a higher sales price, but you should still include them in your calculations.

How to calculate closing costs?

Calculating closing costs involves adding up all of the various fees and charges a homebuyer pays when taking ownership of a home, like lender charges and settlement services, as well as pre-paid and escrow amounts. We include every possible fee that you could be charged when closing a home, including title insurance, inspection fees, appraisal fees and transfer taxes. In fact, we replicate an entire Loan Estimate that you would get from a potential lender for your specific area. We track the cost of each fee by city and state to give you the best estimate on closing costs.

What is the government's closing cost form?

The government-mandated closing costs form is called a Loan Estimate (formerly known as a Good Faith Estimate).

What is origination charge?

Origination charge: This is the standard fee lenders charge for the service of getting you a loan. Typically, this money is used to pay the broker or loan officer who got you the loan. It’s the originator’s commission on the deal. Origination charges are typically higher for borrowers with lower credit, but 1% of the loan amount is not unusual.

How much does it cost to close on a house?

The best guess most financial advisors and websites will give you is that closing costs are typically between 2 and 5% of the home value. True enough, but even on a $150,000 house, that means closing costs could be anywhere between $3,000 and $7,500 – that’s a huge range! While your lender is required to provide a Loan Estimate explaining your closing costs within three days of your submitting a loan application, that often occurs when you have already selected a home and are trying to finalize a deal. Not a great time to learn about thousands of dollars in fees you didn’t see coming.

Why are closing costs so difficult to determine?

Part of the reason closing costs (also called settlement costs) are so difficult to determine ahead of time is that they aren’t one line item, but rather a collection of different expenses that arise for different reasons. Some depend on the state in which you’re buying your home, others on the county.

How much does an appraisal cost?

Appraisers typically charge around $300 to $500 for their services.

When do you pay prepaid interest on closing?

Prepaid daily interest: If you are closing on your home in the middle of the month, you may need to pay interest covering the days until your first full month in the home begins .