Does Kinder Morgan stock pay dividends?

HOUSTON, April 20, 2022 -- ( BUSINESS WIRE )--Kinder Morgan, Inc.’s (NYSE: KMI) board of directors today approved a cash dividend of $0.2775 per share for the first quarter ($1.11 annualized), payable on May 16, 2022, to stockholders of record as of the close of business on May 2, 2022.

What are Wall Street's target price targets for Kinder Morgan's shares?

15 Wall Street analysts have issued twelve-month price objectives for Kinder Morgan's shares. Their predictions range from $20.00 to $25.00. On average, they anticipate Kinder Morgan's share price to reach $22.05 in the next year. This suggests a possible upside of 8.1% from the stock's current price.

How did Kinder Morgan's earnings compare to analysts' estimates?

The pipeline company reported $0.27 earnings per share for the quarter, meeting the consensus estimate of $0.27. The pipeline company had revenue of $5.15 billion for the quarter, compared to analysts' expectations of $3.67 billion. Kinder Morgan had a trailing twelve-month return on equity of 7.82% and a net margin of 13.76%.

What are Kinder Morgan's (KMI) stock price expectations for next year?

8 equities research analysts have issued 12 month price objectives for Kinder Morgan's stock. Their KMI share price forecasts range from $18.00 to $25.00. On average, they anticipate the company's stock price to reach $21.29 in the next year. This suggests a possible upside of 12.1% from the stock's current price.

See more

How does Kinder Morgan make money?

Kinder Morgan is focused on cash flow and makes its money typically by charging fees for use of the capacity of its pipelines, terminals and other assets.

Did KMI increase dividend?

For 2022, KMI budgeted to generate net income attributable to KMI of $2.5 billion and declare dividends of $1.11 per share, a 3% increase from the 2021 declared dividends.

Who owns Kinder Morgan stock?

2014: In August, KMI acquires all of the publicly held shares/units of KMP, KMR and EPB in an approximately $76 billion transaction which closes on November 26.

Is KMI a good investment?

Kinder Morgan Inc's trailing 12-month revenue is $17.7 billion with a 13.7% profit margin. Year-over-year quarterly sales growth most recently was 63.5%. Analysts expect adjusted earnings to reach $1.195 per share for the current fiscal year. Kinder Morgan Inc currently has a 5.9% dividend yield.

What is the dividend payout ratio for KMI?

KMI Dividend Safety GradeKMIKMI 5Y Avg.Cash Flow Payout Ratio (FY1)50.17%171.13%Free Cash Flow Yield to Dividend Yield Ratio (TTM)0.80%1.16%Dividend Yield to Dividend Payout Ratio (TTM)5.70%5.52%Dividend Coverage Ratio (FY1)1.061.0123 more rows•Aug 1, 2022

What is Rich Kinder worth?

7.3 billion USD (2022)Richard Kinder / Net worthKinder is one of the seven self-made billionaires from Houston on the list, with a net worth of $11 billion. In 2020, he was ranked No. 103 on the Forbes 400 list of the richest people in America.

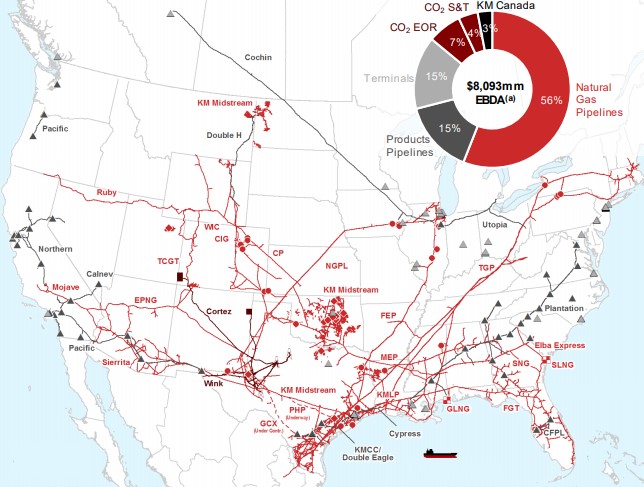

How many miles of pipeline does Kinder Morgan have?

approximately 83,000 milesKinder Morgan is one of the largest energy infrastructure companies in North America. We own an interest in or operate approximately 83,000 miles of pipelines and 141 terminals. Our pipelines transport natural gas, gasoline, crude oil, carbon dioxide (CO2) and more.

Who is Kinder Morgan competitors?

Kinder Morgan competitors include Enbridge, EnLink Midstream, ConocoPhillips and Williams.

What is the ex dividend date for KMI?

Kinder Morgan's previous ex-dividend date was on Jul 28, 2022. Kinder Morgan shareholders who own KMI stock before this date received Kinder Morgan's last dividend payment of $0.28 per share on Aug 14, 2022. Apple's next ex-dividend date has not been announced yet.

Is KMI a monthly dividend?

Regular payouts for KMI are paid quarterly.

What months does KMI pay dividends?

KMI Dividend HistoryEx/EFF DATETYPEPAYMENT DATE01/31/2020CASH02/18/202010/30/2019CASH11/15/201907/30/2019CASH08/15/201904/29/2019CASH05/15/201942 more rows

Is Ford going to raise dividends?

Ford Stock Jumps As Auto Giant Affirms Outlook, Hikes Dividend After Q2 Earnings Crush. Ford (F) reaffirmed 2022 outlook and hiked the Ford stock dividend late Wednesday after crushing earnings estimates for the second quarter.

What is Kinder Morgan's dividend yield?

The current dividend yield for Kinder Morgan is 5.93%. Learn more on KMI's dividend yield history.

How much is Kinder Morgan's annual dividend?

The annual dividend for KMI shares is $1.11. Learn more on KMI's annual dividend history.

How often does Kinder Morgan pay dividends?

Kinder Morgan pays quarterly dividends to shareholders.

When was Kinder Morgan's most recent dividend payment?

Kinder Morgan's most recent quarterly dividend payment of $0.2775 per share was made to shareholders on Monday, August 15, 2022.

Is Kinder Morgan's dividend growing?

Over the past three years, the company's dividend has grown by an average of 13.94% per year.

What track record does Kinder Morgan have of raising its dividend?

Kinder Morgan has increased its dividend for the past 5 consecutive years.

When did Kinder Morgan last increase or decrease its dividend?

The most recent change in the company's dividend was an increase of $0.0075 on Wednesday, April 20, 2022.

What is Kinder Morgan's dividend payout ratio?

The dividend payout ratio for KMI is: 103.74% based on the trailing year of earnings 92.50% based on this year's estimates 92.50% based on next...

When did Kinder Morgan last increase or decrease its dividend?

The most recent change in Kinder Morgan's dividend was an increase of $0.0075 on Wednesday, April 21, 2021.

What is Kinder Morgan's dividend yield?

The current dividend yield for Kinder Morgan (NYSE:KMI) is 6.51%. Learn more

Is Kinder Morgan's dividend growing?

Over the past three years, Kinder Morgan's dividend has grown by 47.93%.

When is Kinder Morgan's dividend due?

HOUSTON-- (BUSINESS WIRE)-- Kinder Morgan, Inc.’s (NYSE: KMI) board of directors today approved a cash dividend of $0.2625 per share for the fourth quarter ($1.05 annualized), payable on February 16, 2021, to common stockholders of record as of the close of business on February 1, 2021. This dividend represents a 5% increase over the fourth quarter of 2019.

What is Kinder Morgan?

Kinder Morgan, Inc. (NYSE: KMI) is one of the largest energy infrastructure companies in North America. Access to reliable, affordable energy is a critical component for improving lives around the world.

What is KMI net income for 2020?

For the full year 2020, KMI reported net income attributable to KMI of $119 million compared to $2,190 million in 2019. Net income attributable to KMI for the full year 2020 included a combined $1,950 million of non-cash impairments associated with our Natural Gas Pipelines Non-Regulated and CO 2 reporting units. KMI’s 2020 full year DCF of $4,597 million was down 8% from $4,993 million in 2019. Adjusted EBITDA of $6,962 million was down 9% from $7,618 million in 2019. The decreases in DCF and Adjusted EBITDA are consistent with previous guidance provided during 2020, and are primarily attributable to pandemic-related reduced energy demand and commodity price impacts, as well as the impact of the KML and U.S. Cochin sale in the fourth quarter of 2019.

How much will KMI make in 2021?

For 2021, KMI’s budget contemplates $2.1 billion in net income attributable to KMI, or $0.92 earnings per share, declared dividends of $1.08 per share, a 3% increase from the 2020 declared dividends, DCF of approximately $4.4 billion ($1.95 per share), and Adjusted EBITDA of approximately $6.8 billion. KMI also expects to invest $0.8 billion in expansion projects and contributions to joint ventures during 2021. KMI expects to generate $1.2 billion of DCF in excess of discretionary expenditures and dividend payments. KMI also expects to end 2021 with a Net Debt-to-Adjusted EBITDA ratio of approximately 4.6 times.

How is DCF calculated?

DCF is calculated by adjusting net income attributable to Kinder Morgan, Inc. for Certain Items (Adjusted Earnings), and further by DD&A and amortization of excess cost of equity investments, income tax expense, cash taxes, sustaining capital expenditures and other items. We also include amounts from joint ventures for income taxes, DD&A and sustaining capital expenditures (see “Amounts from Joint Ventures” below). DCF is a significant performance measure useful to management and external users of our financial statements in evaluating our performance and in measuring and estimating the ability of our assets to generate cash earnings after servicing our debt, paying cash taxes and expending sustaining capital, that could be used for discretionary purposes such as dividends, stock repurchases, retirement of debt, or expansion capital expenditures. DCF should not be used as an alternative to net cash provided by operating activities computed under GAAP. We believe the GAAP measure most directly comparable to DCF is net income attributable to Kinder Morgan, Inc. DCF per share is DCF divided by average outstanding shares, including restricted stock awards that participate in dividends. (See the accompanying Tables 2 and 3.)

What is the fourth quarter net income of KMI?

KMI is reporting fourth quarter net income attributable to KMI of $607 million, compared to net income attributable to KMI of $610 million in the fourth quarter of 2019; and distributable cash flow (DCF) of $1,250 million, an 8% decrease from the fourth quarter of 2019.

Where is Kinder Morgan pipeline located?

Kinder Morgan Louisiana Pipeline began construction on its approximately $145 million Acadiana expansion project to provide 945,000 dekatherms per day (Dth/d) of capacity to serve Train 6 at Cheniere’s Sabine Pass Liquefaction facility in Cameron Parish, Louisiana. The project is anticipated to be placed into commercial service as early as the first quarter of 2022.

Why is Kinder Morgan's payout ratio above 75% not desirable?

Payout ratios above 75% are not desirable because they may not be sustainable. Based on EPS estimates, Kinder Morgan will have a dividend payout ratio of 116.13% in the coming year. This indicates that Kinder Morgan may not be able to sustain their current dividend. View Kinder Morgan's dividend history.

How much does Kinder Morgan make?

Kinder Morgan has a market capitalization of $40.20 billion and generates $11.70 billion in revenue each year. The pipeline company earns $119 million in net income (profit) each year or $0.88 on an earnings per share basis.

What is MarketBeat community ratings?

MarketBeat's community ratings are surveys of what our community members think about Kinder Morgan and other stocks. Vote “Outperform” if you believe KMI will outperform the S&P 500 over the long term. Vote “Underperform” if you believe KMI will underperform the S&P 500 over the long term. You may vote once every thirty days.

What is the ticker symbol for Kinder Morgan?

Kinder Morgan trades on the New York Stock Exchange (NYSE) under the ticker symbol "KMI."

What is the P/E ratio of Kinder Morgan?

The P/E ratio of Kinder Morgan is 21.12 , which means that it is trading at a more expensive P/E ratio than the Oils/Energy sector average P/E ratio of about 10.77.

What is Kinder Morgan?

Kinder Morgan, Inc. operates as an energy infrastructure company. The firm engages in the operation of pipelines and terminals that transport natural gas, gasoline, crude oil, carbon dioxide (CO2) and other products and stores petroleum products chemicals and handles bulk materials like ethanol, coal, petroleum coke and steel. It operates through the following segments: Natural Gas Pipelines, CO2, Terminals, Product Pipelines and Kinder Morgan Canada. The Natural Gas Pipelines segment engages in the ownership and operation of major interstate and intrastate natural gas pipeline and storage systems, natural gas and crude oil gathering systems and natural gas processing and treating facilities. The CO2 segment focuses on the production, transportation and marketing of CO2 to oil fields that use CO2 as a flooding medium for recovering crude oil from mature oil fields to increase production. The Terminals segment consists of the ownership and operation of liquids and bulk terminal facilities located throughout the U.S. and portions of Canada that trans load and store refined petroleum products, crude oil, chemicals, ethanol and bulk products, including coal, petroleum coke, fertilizer,

Is KMI a dividend payer?

KMI has a dividend yield higher than 75% of all dividend-paying stocks, making it a leading dividend payer. Kinder Morgan has been increasing its dividend for 3 consecutive year (s), indicating that it does not yet have a strong track record of dividend growth. The dividend payout ratio of Kinder Morgan is 122.73%.

When was the Kinder Morgan case settled?

In November 2010, Shawnee County District Court Judge David Bruns in Topeka, Kansas granted final approval of a $200 million settlement of a class action lawsuit arising from the leveraged buyout of Kinder Morgan, Inc. Not only is the case one of the largest securities class action cases to be settled in 2010, it is also believed to be the largest post-merger common fund settlement ever.

Where is Kinder Morgan located?

Kinder Morgan was a preeminent energy transportation and distribution company that, while incorporated in Kansas, was headquartered in Houston, Texas. As an energy infrastructure provider, it owned an interest in or operated over 50,000 miles of oil and gas pipelines and terminals.