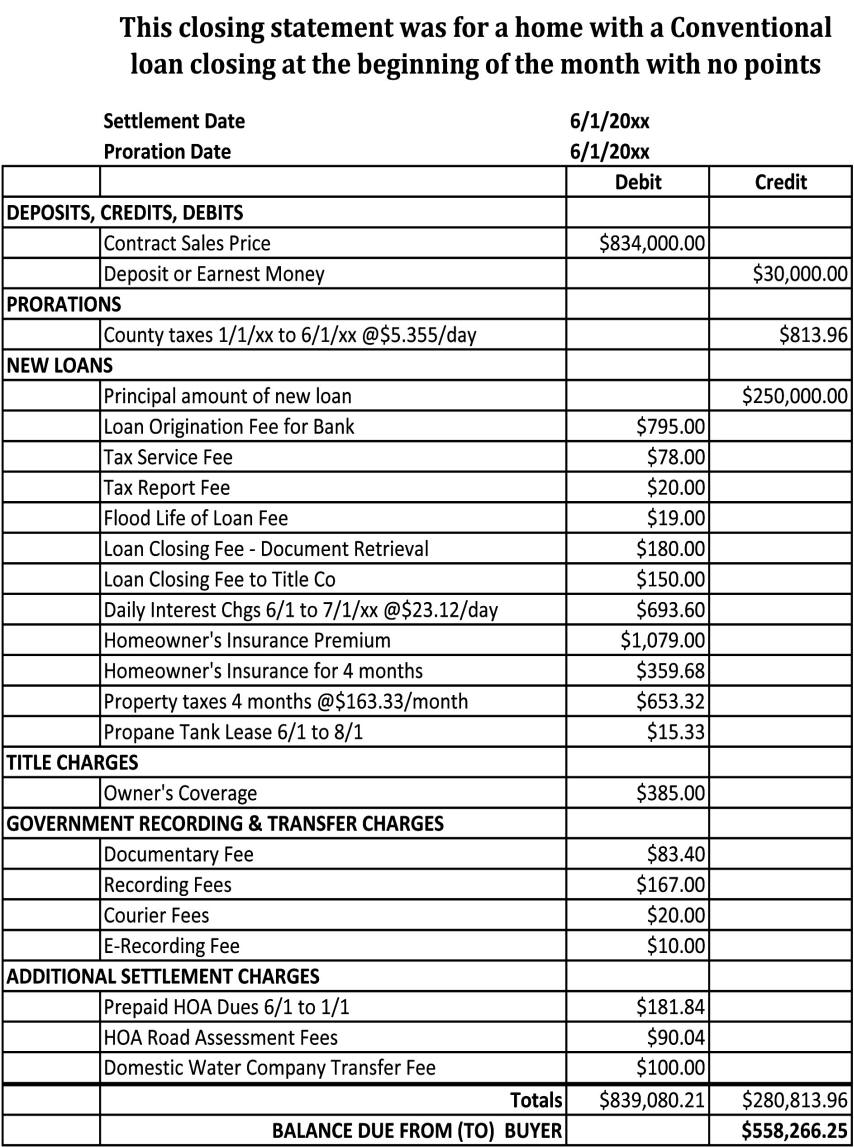

The closing statement is the final estimate of all charges and credits for buying the home. This document includes the sale price, your cash to close escrow, your loan amount, and all the other costs paid through escrow to settle the sale, including credits and prorations. This document is also known as the HUD 1 Settlement Statement.

What is a HUD settlement statement?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction.

Where does the settlement statement go when closing a house?

Depending on what state you’re in, the settlement statement, a separate document, will be prepared by either an attorney, a title company, or an escrow firm, and the actual closing will be held at the offices of one of these three locations. See what type of closing your state requires using the map below.

What is a settlement statement in real estate?

The Seller’s Closing Statement, or Settlement Statement, is an itemized list of fees and credits that shows your net profits as the seller, and sums up the finances of the entire transaction. This is one of many closing documents for seller. Who prepares the settlement statement?

What is a settlement house?

- Lutheran Settlement House What is a Settlement House? The Settlement House Movement began in the late 19 th century as a response to waves of European immigrants and wide-spread poverty and labor abuses in American cities during industrialization.

What is settlement of a house?

What is settlement? Property settlement is a legal process that is facilitated by your legal and financial representatives and those of the seller. It's when ownership passes from the seller to you, and you pay the balance of the sale price. The seller sets the settlement date in the contract of sale.

What is a settlement Doc?

Definition. A settlement document records the vendor data that is created when settlement is performed for home delivery or agency services for each employee or service company.

Is a settlement statement the same as closing disclosure?

When you are in the process of closing, you will receive a settlement statement. They arrive three days before closing from your lender. This document is commonly known as the “closing disclosure.” Essentially, this is for buyers to review in advance before closing.

What is the primary purpose of the settlement statement?

A The primary purpose of the settlement statement is to set forth all of the financial details of closing, showing each party's costs and credits.

What is a settlement statement for home purchase?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance.

What is a settlement letter?

A settlement letter is a letter that provides a quote for the amount you need to pay in order to settle your vehicle finance account in full.

What is the difference between closing and settlement?

A closing is often called "settlement" because you, as buyer, along with your lender and the seller are "settling up" among yourselves and all of the other parties who have provided services or documents to the transaction.

What happens at settlement for the seller?

At settlement, your lender will disburse funds for your home loan and you'll receive the keys to your home. Generally, settlement takes place around 6 weeks after contracts are exchanged. Your conveyancer or solicitor can check and negotiate the settlement period with the seller.

Is settlement date same as closing date?

"Settlement date" and "closing date" are synonymous terms referring to the date when a property's seller and buyer meet to finalize the deal. At this time, the deed to the property is transferred from the seller to the buyer and all pertinent paperwork is completed.

How do you explain a settlement statement?

A settlement statement is a document summarizing all costs owed by or credits due to the homebuyer and seller (or borrower if refinancing). The document also includes the purchase price of the property, loan amount and other details.

Which disclosure is required by the Real Estate Settlement Procedures Act?

What Information Does RESPA Require To Be Disclosed? If necessary, your lender or mortgage broker must provide an Affiliated Business Arrangement Disclosure. This disclosure indicates that the lender, real estate broker, or other participant in your settlement has referred you to an affiliate for a settlement service.

How do you write a settlement statement?

A settlement agreement should be in writing....Those requirements include:An offer. This is what one party proposes to do, pay, etc.Acceptance. ... Valid consideration. ... Mutual assent. ... A legal purpose.A settlement agreement must also not be "unconscionable." This means that it cannot be illegal, fraudulent, or criminal.

When should I receive the HUD-1 Settlement Statement?

In such case, the completed HUD-1 or HUD-1A shall be mailed or delivered to the borrower, seller, and lender (if the lender is not the settlement agent) as soon as practicable after settlement.

Which two items will appear on a closing disclosure?

Closing disclosure form sectionsLoan information. This section should match your loan estimate regarding the loan term, loan purpose and loan program (conventional, FHA, VA or USDA).Loan terms. ... Projected payments. ... Costs at closing. ... Late payment fee. ... Escrow account.

Where do I find closing statements?

If you find at a later time you need a copy of your closing statement, contact the settlement agent for the home purchase. Other parties that may have copies of the settlement documents include your real estate agent, or the financial institution that holds the loan for the property.

How do you write a settlement statement?

A settlement agreement should be in writing....Those requirements include:An offer. This is what one party proposes to do, pay, etc.Acceptance. ... Valid consideration. ... Mutual assent. ... A legal purpose.A settlement agreement must also not be "unconscionable." This means that it cannot be illegal, fraudulent, or criminal.

What is a HUD-1 settlement statement?

This five-page document combines the previous HUD-1 Settlement Statement, the Truth in Lending Act disclosures and the Good Faith Estimate. On its own, however, a settlement statement can be defined as a document which fully summarizes all fees that both a borrower and lender will be required to pay during the settlement of a loan.

What is included in closing disclosure?

The first is for your loan calculations, which include the total number of payments you'll make over the life of the loan, your finance charges and your APR. Section two lists other disclosures, such as your appraisal and contract details. The third section contains contact details for the lender, the buyer's real estate agent, the seller's agent and the settlement agent. The final section is where you sign and date that you have received and reviewed the document.

What is page 2 of closing costs?

Page 2 is dedicated to all the details associated with your closing costs. It is here that you'll want to examine origination charges, like application and underwriting fees, and service fees, such as appraisals and credit reports. There's also a section for other costs that include things like taxes and government fees, initial escrow payments due at closing and real estate commissions.

When is a closing disclosure required?

All lenders are required to provide a Closing Disclosure at least three business days prior to any settlements or refinance closing dates. This time gives you a chance to review the terms of the document and ensure they are close to or match the estimates that were given by the lender at the beginning of the process.

What is page 4 on a loan?

Page 4 is exclusively for loan disclosures. It is here that you will learn how much a late payment will cost you, if the lender will accept a partial payment and whether or not you will have an escrow account. Should the lender not require an escrow account, page 4 will reveal if you are being charged an escrow waiver fee.

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

Who is responsible for preparing the settlement statement?

Whoever is facilitating the closing — whether it be a title company, escrow firm, or real estate attorney — will be responsible for preparing the settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What does an impound account do at closing?

At closing the buyer sets up an impound account that allows them to bundle the cost of their mortgage principal, taxes, mortgage insurance, and other monthly costs into one payment. The lender likes this because they can make sure the new owner will keep up to date with all the payments associated with the home.

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.

What is settlement in real estate?

The settlement is the final stage in the home transaction. This is when the ownership of the property will be transferred from the seller to the buyer. The funds will be distributed in the form of a check to the sellers, the real estate agents that were involved in the sale will receive a check for the commissions that they earned, ...

How many times do you sign a settlement?

The escrow company will have the documents ready; they will just need to be signed. Buyers will sign their names anywhere from 10 to 30 times during this process. There are many important things that happen on the day of the settlement.

Who gets the keys to a house when the deed is signed?

The deed will be signed over from the seller to the buyer. Once this is signed, the ownership is transferred from the seller to the buyer, and the buyer will also receive the keys to the home. The title company will file the new deed with the government, showing the buyer as the new homeowner.

Who provides settlement services?

The decision about who provides settlement (also known as closing or escrow) services varies from one market to another. In many places, the buyer chooses the settlement company, but in others the seller chooses. When closing on a house, the buyer will provide funds to buy your home and the settlement agent will review the sales agreement to determine what payments you’ll receive. The title to the property is transferred to the buyers and arrangements are made to record that title transfer with the appropriate local records office.

What do you need to do before closing on a house?

Before closing on a house, you need to get to the settlement table. You’re near the end of the process of selling your home, but don’t breathe a sigh of relief just yet. While it’s certainly true that you can lighten up on the perfectionism required to show your home at any moment, as a seller you still need to cooperate with your buyer, ...

What are adjustments at closing?

At a typical closing, adjustments are made to the final amounts owed by the buyer and you as the seller. For example, if you’ve been paying your property taxes through an escrow account, you may be credited extra for prepaid taxes or you may receive less money at settlement if the property taxes haven’t been paid properly.

How long can you rent back a house?

Generally, you’re restricted to a maximum rent-back of 60 days because lenders would require ...

Can you move onto your next home after a settlement?

Once the settlement papers are signed and the house keys are transferred, you’re free to move onto your next home.

Can you negotiate a settlement date with a buyer?

Buyers and sellers typically negotiate a settlement date that is mutually agreeable. If you have sold your home and are not yet ready to move into your next residence, you can sometimes negotiate a “rent-back” with the buyer that allows you to stay in the home after the settlement by paying rent to the buyer.

What was the settlement house movement?

What was the settlement house movement? The settlement house movement was a social movement that supported the idea of creating large housing projects to provide mobility for the working class. It grew out of a desire for reform that had already had effects in several other areas, such as the creation of numerous charities to help people in poverty. Widespread support for this idea began in Great Britain in the 1860s and quickly spread to other Western countries such as the United States and Canada. The Industrial Revolution and its social effects, such as long working hours, the safety hazards of the factory system, and the self-absorption of industrialists, alarmed the idealistic Christian Socialists who desired to help the poor rise above their condition through education and moral improvement.

How successful were settlement houses?

Settlement houses were successful in some ways but not in others. They failed to eliminate poverty and all of its causes, but they were able to alleviate some of them.

How did settlement houses help the poor?

How did settlement houses help the poor? Settlement houses provided the environment for the poor tenants to create social clubs, community groups, and cultural events. This promoted fellowship between the residents. Education programs were also conducted under the auspices of the houses. For example, the kindergarten program initiated at Hull House served up to 24 students. Adults and youth attended lecture series from community leaders and university graduates and educators.

What was settlement work?

Settlement work was concerned with helping the poor as a social class rather than on an individual basis. It was theorized that if members of the poor working class lived in proximity to educated, refined people, their work morale and education status would improve as well. To aid this, half of the tenants of these houses were ''refined'' graduates of upper-class colleges who lived there to aid the working class by association. House organizers hoped that the sub-culture of higher education would elevate the paradigm of the poor and help them to rise out of their situation.

What did administrators of houses do?

Administrators of the houses and educators worked not only with the tenants of the houses but also with leaders of the community, including factory owners and politicians. Services offered included infant nurseries, job training, and medical care. Although the founders of the houses had high aspirations, many of the workers who had the most interaction with the working class were amateurs who could not have much effect.

What were some examples of settlement houses?

In Cleveland, Ohio, for example, different settlement houses served different immigrant populations. Hiram House, for example, mostly worked with Jews, Italian immigrants, and African Americans. East End Neighborhood House and Goodrich House served east European immigrants.

Who founded the first settlement house in Great Britain?

Samuel and Henrietta Barnett founded the first Settlement House, Toynbee Hall, in Great Britain.

What is HUD-1 Settlement Statement?

Janet Wickell. Updated January 29, 2020. The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called closing agents, to itemize all charges imposed upon a borrower and seller for a real estate transaction.

Who studied the statement of sale?

Most buyers and sellers studied the statement on their own, with the assistance of their real estate agent and the settlement agent. The idea was that the more people who reviewed it, the more likely it became that errors would be detected.

When Is the HUD-1 Distributed?

Before October 3, 2015, RESPA stated that borrowers should be given a copy of the HUD-1 at least one day prior to settlement. 5 However, entries could easily still be coming in, right up until a few hours before closing.

What is HUD-1 form?

The statutes of the Real Estate Settlement Procedures Act (RESPA) required that the HUD-1 form be used as the standard real estate settlement form in all transactions in the United States that involved federally related mortgage loans. 2.

When did the closing disclosure change?

Borrowers began receiving a form called the Closing Disclosure instead of a HUD-1 for most kinds of mortgage loans after October 2015. The change was in response to the TILA RESPA Integrated Disclosures, or simply TRID, which overhauled the way mortgages are processed and disclosed. 3.

What is the 701 and 702 section?

This section deals with the commissions paid to real estate agencies. Lines 701 and 702 show how the commissions are split between two participating agencies. 6

What is tabulated before being brought forward to page 1 in Section L or page 2?

Many entries are tabulated before being brought forward to page 1 in Section L or page 2. Columns contain charges that are paid from either the borrower's or the seller's funds. Your closing statement probably won't have entries in all these lines.

What is a document on the way to closing?

Documents on the Way to Closing. Addendums, amendments, or riders include anything that alters or amends the terms of your original purchase contract. These types of document might clarify the names on title or the spelling of the seller's or buyer's name. They might correct a street address.

What is closing statement?

The closing statement is the final estimate of all charges and credits for buying the home. This document includes the sale price, your cash to close escrow, your loan amount, and all the other costs paid through escrow to settle the sale, including credits and prorations. This document is also known as the HUD 1 Settlement Statement. The Consumer Financial Protection Bureau replaced it with the closing disclosure in 2015. 7

What is seller disclosure?

Seller disclosures include material facts about things like lead-based paint. They might include a transfer disclosure statement, and other written warranties, guarantees, or disclosures that the seller provides. These documents are often the basis for future lawsuits against sellers when they fail to disclose an issue that becomes apparent later. 4

What is escrow instructions?

Escrow instructions often supersede the purchase contract and spell out the financial terms and conditions of the agreement between buyers and sellers. They authorize an escrow agent to perform specific acts on behalf of the parties involved.

What is a repair addendum?

A repair addendum specifies the particular type of work to be completed.

What is included in closing disclosure?

Other inspections and work-related documents could include contractor invoices and permits. The closing disclosure includes all the final costs for your mortgage, laid out in a manner that you might not understand even though the government tries to make it simple for you.

Can you save a realtor's documents on a computer?

Most documents are digitized in some form, especially those related to the transaction. Your realtor or transaction coordinator can probably offer you a safe download to store many of these documents safely on your computer or on a storage drive.