Remember, the auto insurance company is responsible for paying your medical bills up to the limits of the policy. This means that if your health insurance company pays $10,000 for medical expenses after an accident, they expect to be repaid that $10,000 out of any payment or settlement you receive.

Full Answer

What is the average settlement for a car accident with no fault insurance?

This is because no-fault insurance results in you having much lower out of pocket medical bills. All things equal, less out of pocket medical bills means a smaller car accident injury settlement amount. And the $18,417 average settlement amount is for private passenger cars.

How much did you get for a car accident lawsuit?

We also sued the United States. They paid an additional $125,000. In sum, we settled the entire case for $325,000. Like most car accident cases with serious injury and plenty of insurance coverage, most of the settlement was for pain and suffering.

How long does it take to settle a car accident case?

Basically, we settled the case in less than 9 months after the crash. About 70% of the total settlement was for his pain and suffering. The rest of the settlement was for his medical bills.

Does my health insurance company get reimbursed when I receive a settlement?

Bottom Line: Yes, your health insurance company will get reimbursed when you receive a settlement that includes medical expenses after an accident. When you work with a Memphis personal injury attorney from Bailey & Greer, PLLC, they understand the complex issues regarding subrogation.

Can Medi cal take my settlement?

Medi-Cal can't take more than 50% of your settlement. If you fail to notify the government that you're filing a lawsuit, the DHCS can take legal action against you to obtain Medi-Cal reimbursements.

How do insurance companies calculate a settlement?

How Do Insurance Companies Determine Settlement Amounts?The type of claim you are making. ... The policy limits and amounts allowed for recovery. ... The nature and extent of your injuries. ... The long-term effects of your accident on your life. ... The strength of your case. ... The distribution of fault. ... Previous matters.

What reduces the amount paid in a claims settlement?

Car insurance coverage The insurance company pays up to the policy limits. They also reduce the settlement by the amount of any applicable deductible. Car insurance coverage can limit the amount of a settlement even if the damages are greater than the policy limits.

What is the formula for personal injury settlements?

The formula goes like this: Damages = Economic damages x 1.5 (based on the injury severity) + lost income. For instance, assuming you fractured an arm in a motor collision and the medical expenses sum up to $10,000. Let's also assume that the injury made you miss 2 months of work which would have paid you $20,000.

How are medical claims calculated?

Medical reimbursement comes under Section 80D, wherein the maximum limit prescribed is Rs. 15,000 p.a. If bills regarding medical reimbursement are not submitted on time by an employee, 30% of Rs. 15,000 will then become the taxable amount. However, while filing tax returns, employees can reclaim 30% of the amount.

How will personal injury claim affect my insurance?

If you make a personal injury claim after a car accident, it may affect your car insurance premium if it is part of a claim that includes the repairs to your vehicle. This is because even if the accident was not your fault, your insurer may consider that you have a higher risk of having further accidents in the future.

How is settlement money divided?

The percentage of the settlement or judgment that attorneys charge does vary slightly, usually between 25% to 50%, depending on the type of case being handled.

How do insurance companies negotiate cash settlements?

Let's look at how to best position your claim for success.Have a Settlement Amount in Mind. ... Do Not Jump at a First Offer. ... Get the Adjuster to Justify a Low Offer. ... Emphasize Emotional Points. ... Put the Settlement in Writing. ... More Information About Negotiating Your Personal Injury Claim.

How long does it take to get paid after a settlement?

While rough estimates usually put the amount of time to receive settlement money around four to six weeks after a case it settled, the amount of time leading up to settlement will also vary. There are multiple factors to consider when asking how long it takes to get a settlement check.

How do you calculate emotional pain and suffering?

These types of compensation are called pain and suffering. Generally, pain and suffering awards will be calculated by adding up the economic damages and multiplying them by a number between 1.5 and 5, depending on the severity of the injury.

How much money can you get from a neck injury?

How much is a neck injury worth? It will vary depending on the type of injury, but the average payout for a neck injury is between $5,000 and $50,000. Soft tissue neck injury claims are worth between $5,000 and $20,000 on average. Neck disc injury cases that result in surgery average over $200,000.

How do I calculate my claim amount?

The actual amount of claim is determined by the formula: Claim = Loss Suffered x Insured Value/Total Cost. The object of such an Average Clause is to limit the liability of the Insurance Company. Both the insurer and the insured then bear the loss in proportion to the covered and uncovered sum.

How is a settlement figure calculated?

To calculate your settlement figure, the lender will add up your remaining monthly instalments between now and the end of your agreement and take away any future interest that you won't need to pay. Finally, any arrears will be added. You'll receive your settlement figure in writing to confirm.

Do I have to accept the first offer from an insurance company?

you don't have to accept any offer that's made to you. If you do accept an offer it might be lower than the compensation you would have got if you'd used a solicitor or gone to court instead. don't feel under any pressure to make a decision quickly.

How is compensation calculated for multiple injuries?

The general principle is that compensation for multiple injuries is calculated on a case-by-case basis. The actual award may be more or less than the sum total of what would be awarded for the individual injuries, depending on the overall impact on a claimant's life.

How are damages calculated in personal injury cases?

The damages to which you are entitled are typically calculated based on the severity of your injuries, the underlying circumstances of the incident in question, and whether the case settles or proceeds to a trial. The following factors are typically considered: Medical treatment expenses.

How Car Accident Settlements are Divided

Car accident settlements are divided between each party that provided financial assistance during a case. For instance, if health insurance paid for injury treatment before a case settled, they are paid back that amount from the settlement.

How Medical Bills Are Paid After a Settlement

In Kentucky, immediate medical bills are often paid through the accident victim’s PIP coverage up to the policy limits, typically $10,000. Once PIP coverage is exhausted, most medical bills will run through the victim’s personal health insurance. At this point, an accident victim can file a personal injury case against the at-fault driver.

What if My Healthcare Provider is Overcharging?

Medical providers can overcharge for medical costs related to car accident injury treatment. Overcharging is often the result of balance billing, or when a healthcare provider bills a patient for the difference between the cost of medical care and the amount the patient’s health insurance provider paid.

Negotiating the Cost of Your Medical Bills

Accident victims have the right to negotiate the cost of medical bills without the process impacting the total settlement amount the victim is owed. In most personal injury lawsuits, medical expenses are negotiated after a settlement has been decided to ensure that the victim receives enough compensation to reimburse the appropriate parties.

Protecting Your Personal Injury Settlement with David Bryant Law

If you are awarded a personal injury settlement, medical expenses, legal costs, and other accident-related fees will be deducted from your accident settlement. As the accident victim, you will be entitled to keep the remainder of the payout for damages like pain and suffering and lost wages.

What happens when you pay premiums for insurance?

You paid premiums that generated profits for an insurance company and its executives and now the carrier wants more from you. Having suffered an injury subjects you as a plaintiff [ a person making a personal injury claim once a lawsuit is file] to laws that are basically unfair and a corruption of justice.

What is medical lien claim?

Here is what you need to know about medical lien claims, which is a system of legally approved claw backs from your recovery in your personal injury case at your expense.

What happens if Medicare is not paid?

If a Medicare lien is not paid from your recovery, the government can bring a lawsuit against everyone: the insurance company paying a settlement, your attorney, and defense attorneys and you, plus penalties and interest.

How do lien collectors get paid?

Remember that the lien collection companies pay their employees a commission for collecting from you and have monthly, quarterly, semi-annual and annual quotas that must be met and also bonuses for exceeding the quotas. You will get a better lien reduction at the end of a month or quarter when the collection agents need to meet collection goals or move their winnings to a higher level. Simply being a tough negotiator and dragging out a “We’re not paying” position can get a better deal. For example, in a severe burn injury claim Kaiser submitted a lien for $3,502,820. After an extended negotiation, arguing all of the issues outlined below, a final payment of $1,250,000 was accepted. Results differ in every case but fighting for the best result is worth the effort.

Why are medical insurance liens specious?

Medical insurance liens by definition are specious because they are fabricated amounts that do not completely resemble the insurance company’s financial position in your case. Although a given sum was paid in reimbursement, you are never told what side deals the insurance company made with the hospital or medical conglomerate providing services. For example, there are quarterly readjustments made by carriers to hospitals depending on the specifics of the specialty contract negotiated by the hospital or hospital chains and the lawyers for Blue Cross and other carriers. This topic cannot be adequately addressed in this article, but the point is clear. The numbers generated by the carrier benefit the carrier.

Who administers the collection process for Medicare?

When a settlement is made, notice must be given to the Center for Medicare Services, which administers the collection process and at that time it prepares a notice of the amounts of “conditional payments” which is bureaucratic jargon for the amount of its lien.

Does California have to pay back a medicare lien?

Medi-Cal liens are funded under the Affordable Care Act which pays for the “expansion” population in the state’s Medi-Cal program. California is required to pay back the feds whenever it recovers any funds through a lien and the state cannot waive the debt. If Medi-Cal reduces a lien, in cases of hardship, by more than 50% the Department of Public Health must repay the U.S. government from the state’s general fund. This impacts lien reduction.

How much can you get from a car accident settlement?

Car accident settlement amounts can range from just a few hundreds dollars, to a potentially thousands, hundreds of thousands, or more.

How much does a spinal injury settlement cost?

Non-paralysing spinal injury settlements can range from $75,000 to $100,000. Life-threatening injuries will frequently result in a settlement at or above the high end of this range.

What are the most common injuries in car accidents?

Spinal Injuries. Spinal injuries, like a herniated disk, are some of the most common injuries suffered in car accidents. Unfortunately, injury to the spine can have serious consequences, and even operations related to herniated disks can cause unexpected complications. When estimating how much to expect from a car accident settlement, ...

Why is it so hard to determine the average settlement for a car accident?

Because car accidents can result in such a wide range of injuries, its difficult to determine average settlements. Here are some estimates to help you get an idea of how much you could expect from a car accident settlement based on the severity of the injury.

What are the expenses of a car accident?

Car accidents come with lots of expenses above and beyond the injuries to those involved, most commonly including the cost of damage to your vehicle and various medical expenses. Lost wages, or the amount of money you were unable to earn as a result of your injury, can also contribute to this factor.

Why is a jury more likely to award more money for an accident?

If, on the other hand, surgery was involved, and the accident resulted in many cuts and bruises, a jury may be more likely to award more money because the injury is more serious. This is even more true for accidents that result in permanent or long-term pain or disability.

How much does a long lasting injury cost?

Settlements for long-lasting injuries can range from roughly $50,000 to $100,000.

Why Can Medicaid Take Money From My Injury Settlement?

Arkansas law and federal law require Medicaid to be reimbursed if Medicaid has paid for your treatment. Medicaid may look for repayment from the other party, by getting involved in your court case. They may also seek repayment from the your settlement, if you receive one.

Can Medicaid Force Me To Pay Money From My Settlement?

The short answer is yes. In fact, the law can hold you or your attorney responsible to pay Medicaid’s claim. Your settlement agreement will contain language stating that you do agree to satisfy its claim from the settlement proceeds.

Can you take a car accident case to trial?

Instead, you could take the case to trial. Every personal injury case is different, so it is important to think about this carefully. There is a chance that you might get awarded a larger amount at a jury trial. There is also a chance that you may not get awarded anything at all. This is the biggest reason why a significant percentage of personal injury cases involving car accidents are settled before trial.

Does a car accident settlement cover medical expenses?

In addition, your car accident injury settlement should also cover future medical expenses. For example, if you have to take prescription medications for an extended amount of time, your potential car accident injury sett lement should cover these expenses as well. Or, if you have to see a medical specialist for an extended amount of time as a result of your injuries, your car accident injury settlement should cover this as well.

Will Your Medical Bills Be Paid Through an Injury Settlement?

Yes. Any medical bills that you have incurred should be covered by the car accident injury settlement. This is going to be one of the main components of any settlement that is reached between yourself and the insurance company or the other driver. Of course, you may also have health insurance that is covering some of your medical bills already. Your health insurance provider may have a lien on a portion of the settlement. Therefore, if you have already paid some of your medical expenses, such as those involving the emergency room, your health insurance company may seek to recover some of the medical bills that you have already been charged. Ultimately, this is better for you because you may not have to write a check to cover this portion of your medical expenses. Instead, your health insurance company will simply recover these funds directly from the settlement.

How to get the most money from an auto accident?

However, having a big injury is the first step to getting the most money from an auto accident. As soon as possible, you (or your lawyer) needs to preserve any evidence. This includes, preserving any event data recorders (“black boxes”) in the vehicles.

How much did Allstate pay for a pedestrian's foot?

Allstate paid $10,000 after a driver ran over a pedestrian’s foot. He claimed a soft tissue foot and ankle injury.

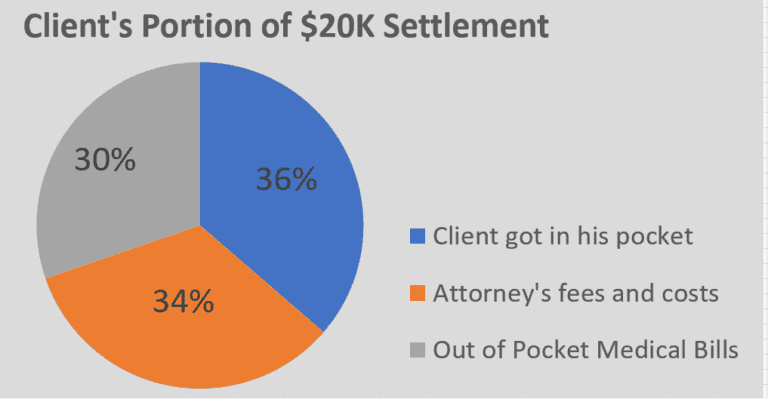

How Much Did He Get in His Pocket?

After my attorney’s fees and costs, and me paying his medical bills and health insurance lien, Pat got $29,235 in his pocket. In other words, he got 59% of the payout in his pocket.

What insurance did Cesar have?

Cesar had insurance on his van with United Auto Insurance Company (UAIC). UAIC took his recorded statement (with me also on the phone). Cesar’s personal injury protection (PIP) on his car insurance paid $10,000 to the hospital and his medical providers.

How long do you have to document your lost wages?

If you’ve missed work due to the car accident, you need to document your lost wages. Ask your employer to complete a 13 week wage and salary verification statement. This can be used to prove your lost wages. The above is an oversimplification of how car accident settlements work.

How much did CNA pay for Uber?

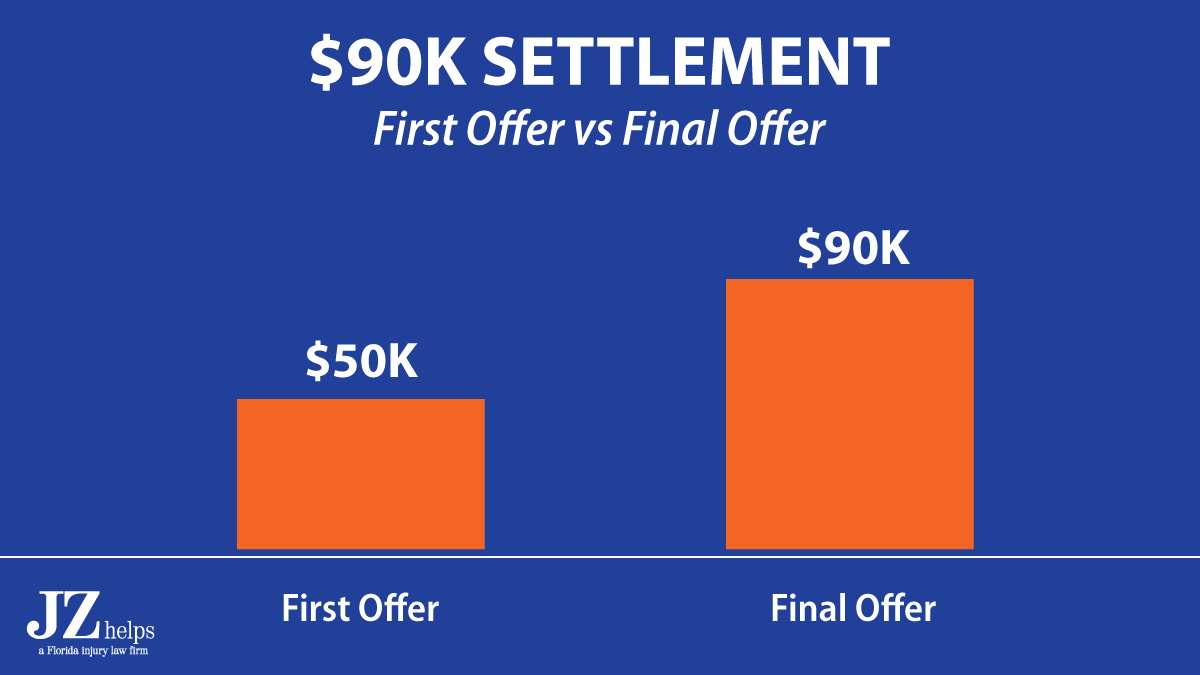

CNA’s first offer was $150,000. In May 2018, CNA paid me $260,000 to settle the Uber driver’s personal injury claim . This image shows the comparison between CNA’s first offer and the settlement: This is about 17 times greater than the average settlement for a car accident.

What to do if you have a serious injury?

If you have serious pain, tell a doctor about it . If your doctor does not document your injury in your medical records, do not expect a big payout. You need to know how much your case is worth in order to get the most money possible. This is the toughest step for someone without a lawyer.

How Does a Hospital Make a Claim on a Settlement?

She has health insurance through an HMO, and gives that information to the hospital, but also tells the hospital that she was injured by a defective product. Hospitals, without a patient's permission, may file a lien on an accident insurance settlement within a certain period (often between ten and thirty days) after they have provided care . The hospital files a lien against any settlement Jane receives.

What happens when an insurance company pays for an accident?

When a patient is in an accident, he or she may require extensive medical services. The amount that is left over after an insurer pays its portion can be very high. The patient legitimately owes this money, and the hospital legitimately can collect it from the proceeds of the accident settlement. However, sometimes hospitals will try to get a second slice of the pie by billing the patient not only for the portion he owes after the insurer has paid its part, but also the difference between the charge contracted with the insurer and its regular charge. In our chest x-ray example, that means that the hospital would try to claim $30 plus the discounted $50 from the patient's injury settlement. This can add up quickly! This practice, known as "balance billing," is illegal in some states. However, some hospitals are apparently ignoring the law where auto insurance liability settlements are involved.

How do Health Care Providers Overreach?

A health insurance company will contract with a hospital to pay a certain percentage or certain fixed amount for each type of charge. For example, a hospital's normal charge for a chest x-ray may be $150. The insurer may contract to cap the total payment due for a chest x-ray at $100. In turn, the insurer's contract with its customers may require the insurer to pay 70 percent of the cost of x-rays. Therefore, if a patient receives a chest x-ray, the insurer will pay $70 (70 percent of the $100 agreed cost), and the patient will have to pick up the remaining $30.

How long does it take for a hospital to file a lien on an accident?

Hospitals, without a patient's permission, may file a lien on an accident insurance settlement within a certain period (often between ten and thirty days) after they have provided care. The hospital files a lien against any settlement Jane receives. The insurer settled with Jane for $10,000. Her hospital bills amounted to $5,000, 70 percent ...

How much money did Jane owe the hospital?

The amount she owed personally was $2,500. However, rather than collecting $2,500 through the lien, the hospital collected $5,000-the $2,500 Jane owed plus $2,500 that it would have charged if not for the discount contracted between it and Jane's insurer. In many places, the hospital broke the law.

Who's on the hook for the additional $50 of the hospital's regular charge?

Who's on the hook for the additional $50 of the hospital's regular charge? Nobody. The hospital's contract with the insurer effectively resets the price of the x-ray for the insurer and its policyholders.

Is balance billing legal in Michigan?

In addition, the attorney general of Maryland and Florida's and Arkansas' insurance commissioners have specifically warned health care providers that "balance billing" is illegal. Michigan's public health regulations specifically state that the practice is forbidden. As the practice continues, it is expected that courts in more states will rule that the practice is illegal, and that more states will take an official stance.

How do medical liens get paid?

Medical liens get paid out of a personal injury settlement or judgment. When accident victims are unable to pay for the costs of their care, some healthcare providers may choose to provide that care in exchange for a medical lien. They then recover the costs of that medical care from the defendant if the victim’s personal injury case succeeds.

What happens if a person loses a personal injury case?

If an accident victim agrees to a medical lien in order to pay for his or her medical care, but then loses the personal injury case, the victim will still be liable under the lien. This means that the victim will be personally responsible for paying his or her medical bills under the lien agreement. If the victim cannot pay, the healthcare provider and lienholder can invoke their legal rights to collect the debt.

What is subrogation in insurance?

Subrogation is the legal process of an insurance company recouping from the defendant what it had paid to the plaintiff. Insurers generally retain their right to subrogation in their insurance policy. It most often happens in the context of medical expenses and a personal injury lawsuit. Auto insurance companies can also recover subrogation from victims who have benefited from med pay insurance. Even the government can take from your claim with a Medicaid lien or one through the Veteran’s Administration.

How does a healthcare provider perfect a lien?

Once the lien agreement has been signed, the provider will perfect the lien by notifying the interested parties about the agreement. By perfecting the lien, the healthcare provider guarantees that they will be paid from the personal injury verdict or settlement, first. They come even before the victim, who would be the case’s plaintiff.

What is a medical lien?

A medical lien, sometimes referred to as a hospital lien, is an agreement between a patient and his or her healthcare provider. The legally binding contract is known as a lien agreement. Liens are most frequently used when the patient has no other way to pay for the care they need after being hurt in an accident.

What would happen if there was no subrogation?

However, if there were no subrogation, then victims would receive a windfall. They would have their medical bills paid for by their insurer. Then they would recover reimbursement for their medical bills in a successful personal injury claim.

Can a hospital lien be subrogated?

The insurer can then pursue its right to subrogation against the defendant in the case in order to recoup the amount it paid to the victim. Many states limit how much the insurer can take in subrogation. Those limitations do not exist for hospital liens.

What happens when you suffer a serious injury in an auto accident?

When you suffer a serious injury in an auto accident, or any other type of accident that was caused by another person’s negligence, you seek medical care and your insurance company pays the bill.

How much does Sam's insurance cover?

His health insurer covers the $90,000 in medical expenses after the accident. While he is recovering, Sam works with a personal injury attorney who files a lawsuit against the at-fault driver. After the settlement with the insurance company for the negligent driver, Sam receives $160,000, which is supposed to cover his medical bills, ...

What would have happened if Sam did not pursue a negligence lawsuit against the other driver?

What would have happened if Sam did not pursue a negligence lawsuit against the other driver? His health insurance company might pursue subrogation on their own in order to recover their costs. If they are successful in recovering their costs and the amount of your deductible, they must reimburse you.

What is subrogation in insurance?

What it means, is that your health insurance provider initially pays your medical expenses and then looks to recover that money from the party who is actually responsible for the injury (the insurance company of the at-fault party in the accident).

Does insurance get reimbursed for medical expenses after an accident?

Bottom Line: Yes, your health insurance company will get reimbursed when you receive a settlement that includes medical expenses after an accident.

Can you be reimbursed twice for medical expenses?

If your insurance provider covered your medical expenses, and then you received payment for your medical expenses in the settlement, you have essentially been reimbursed twice . In a case such as this, your health insurer is going to come looking to be reimbursed for the amount they have already paid. In the insurance industry, the term ...