Full Answer

What are the most pressing questions clients ask about accelerated settlement?

Here, two team members from Broadridge Consulting Services — David Gibson and David Smith — answer some of the most pressing questions that clients ask about the impact of accelerated settlement and how they can prepare their firms. What makes the move to T+1 unique from previous settlement date compressions?

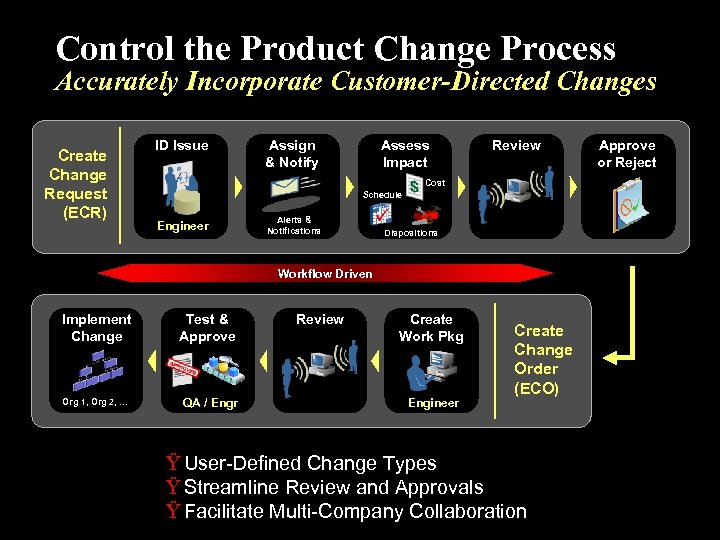

How should firms approach the move to accelerated settlement?

The key is to approach the move to accelerated settlement in a methodological manner. A readiness roadmap is required to help firms understand the impact and decide what to prioritize.

Will the settlement cycle be shortened?

The intensity and events of the past year were the impetus to accelerate the conversation of shortening the settlement cycle. Even in the face of unprecedented volatility and volume, panelists noted the viability of the current settlement system.

Is your business ready for a one-day settlement cycle?

Adapting to a one-day settlement cycle (T+1) by the first half of 2024 will require updating your firm’s trade financing, technology infrastructure, and operational processes. The challenges and costs of preparing for T+1 are likely to be significantly different than with past moves to T+3 and T+2.

Why do settlements take 2 days?

Usually, there is interest charged on these borrowed funds, however, the interest does not begin until the settlement date of the stock bought with the borrowed funds. Since the settlement date of the sold stock being borrowed against will come before that of the bought stock, normally there is no interest charged.

What is settlement process?

Settlement can be defined as the process of transferring of funds through a central agency, from payer to payee, through participation of their respective banks or custodians of funds.

How does CNS settlement work?

How the Service Works. On settlement date, all trades due to settle are netted by issue to a net long (buy) or a net short (sell) position, and then are further netted with any new miscellaneous activities, including ID Net transactions, and open positions from the previous day.

What is t1 settlement?

T+1 means that trade-related settlements must be done within one day of the transaction's completion. Trades on Indian stock exchanges are currently settled in two working days after the transaction is completed (T+2).

Can you settle before settlement date?

To wrap it up, it is indeed possible to change the settlement date. In reality, it is not a particularly unusual situation for the settlement to be moved, as a property sale is not only between the buyer and the seller but is also organised with banks, real estate agents and solicitors.

What is pending settlement mean?

Related Definitions Pending Settlement means the agreement between the Company and its shippers in the Company's FERC tariff rate case filed on July 1, 2013 (Docket Number RP13-1031), which agreement has received certification from the presiding administrative law judge and is awaiting final approval from the FERC.

What is rolling settlement?

Rolling settlement is the clearing of trades over a predetermined series of days. The idea is to allow trades to hit an investor's or trader's account soon after they occur, rather than waiting for a specific day of each month (i.e. account settlement).

What is free of payment?

free of payment (FoP) A transfer of securities without a corresponding transfer of funds.

What is FOP settlement?

FOP settlement involves delivery of the securities without a simultaneous transfer of funds – hence 'free of payment'. Funds may either be remitted by other, mutually agreed means, or payment may not be made at all.

What does t 2 settlement mean?

trade date plus two daysFor most stock trades, settlement occurs two business days after the day the order executes, or T+2 (trade date plus two days). For example, if you were to execute an order on Monday, it would typically settle on Wednesday. For some products, such as mutual funds, settlement occurs on a different timeline.

Can I sell on t2 day?

The moment you sell the stock from your DEMAT account, the stock gets blocked. Before the T+2 day, the blocked shares are given to the exchange. On T+2 day you would receive the funds from the sale which will be credited to your trading account after deduction of all applicable charges.

What is the 3 day rule in stocks?

In short, the 3-day rule dictates that following a substantial drop in a stock's share price — typically high single digits or more in terms of percent change — investors should wait 3 days to buy.

What happens during settlement?

Settlement is the process of paying the remaining sale price and becoming the legal owner of a home. At settlement, your lender will disburse funds for your home loan and you'll receive the keys to your home. Generally, settlement takes place around 6 weeks after contracts are exchanged.

What is the settlement step of the payment process?

Once a transaction has been approved, settlement is the second and final step. This is when the issuing bank transfers the funds from the cardholder's account to the payment processor, who then transfers the money to the acquiring bank. The business will then receive the authorized funds in its merchant account.

What is clearing and settlement process?

Settlement involves exchanging funds between the two banks, while clearing can end without any interbank money movement. In the clearing process, funds move between the recipient's or sender's bank account and their bank's reserves.

What does settlement mean in finance?

Settlement involves the delivery of securities or cash from one party to another following a trade. Payments are final and irrevocable once the settlement process is complete. Physically settled derivatives, such as some equity derivatives, require securities to be delivered to central securities depositories.

Key Points

Overfunding your debt settlement savings account has multiple benefits, including completing the program at a faster pace.

Accelerate Your Settlement Program by Overfunding Your Next Savings Deposit With Your Tax Refund or Stimulus Check

The process of debt settlement involves skilled negotiators who have mutually beneficial relationships with creditors and collectors, negotiating on your behalf, to settle past due or charged-off accounts for less than the full balance owed.

How do smart contracts help with atomic settlement?

Whereas DLT provides a real-time, single source of truth, smart contracts can be utilised to facilitate securities and cash settlement in what would create an ecosystem supporting atomic settlement, namely the simultaneous transfer of cash and securities. This could help market users procure massive operational and cost savings, especially as instantaneous settlement would remove the need for CCPs. Similarly, the emergence of central bank digital currencies (CBDCs) could play a role in bringing about T+0. CBDCs – namely digital iterations of fiat currencies issued by central banks, 7 which are stored on a DLT – engineer efficiencies in securities settlement by using central bank money. As investment into these technologies increases, the possibility of delivering on T+0 will grow.

Is T+0 a settlement cycle?

While there is scepticism about the merits of introducing a T+1 settlement cycle without impacting the value chain, market practitioners are also open to the concept of T+0, otherwise known as instantaneous or atomic settlement. Again, the benefits of shorter settlement cycles (e.g. less counterparty risk, capital and liquidity savings) ring true for T+0 just as they do for T+1. It is also clear that many of the barriers inhibiting T+1 will likely be the same obstacles hampering the future adoption of T+0. “New technologies could help the industry overcome these underlying problems,” suggests Clarke. “Rather than accelerating the settlement cycle to T+1 using existing technology and processes, forward-thinking post-trade providers believe that the industry should leverage innovative technologies such as DLT (distributed ledger technology) and smart contracts to achieve T+1 or directly to T+0.” So how can this be done?

What were the impetus to accelerate the conversation of shortening the settlement cycle?

The intensity and events of the past year were the impetus to accelerate the conversation of shortening the settlement cycle.

What is the T+1 settlement?

The successful transition to a T+1 settlement provides an opportunity for the industry to modernize not only settlement infrastructure but improve many processes in the ecosystem. However, there are implications, including the U.S. being on a different cycle than other regions, hence, these changes need to be done thoughtfully.

How many transactions does NSCC clear?

Pozmanter explained that NSCC typically clears about 200 million transactions on an average day, netting to a factor of 98%, with margins of $6 to $8 billion that DTCC collects from the industry. Between the heightened trading during the initial days of the pandemic last year, to the events surrounding the meme stock activity in 2021, market volatility and volume have skyrocketed. As a result, DTCC began to see many days with an excess of 300 million transactions. Volume peaked in January 2021 at 474 million transactions to NSCC and margin of over $30 billion. These days of increased volatility are also seen at various points in the year, including during index rebalancing.

What is the T+1 in financial markets?

The journey to T+1 gives the entire financial markets ecosystem a unique opportunity to look at the way processes work to not only move to T+1, but also T+0 and this move is achievable with the current technology and platforms, and many transactions today are executed this way. Pozmanter explained, “T+1 is an interim step for the industry as well as a stopping point to T0. Real-time gross settlement scenario is probably not practical given today’s volumes as the industry would lose tremendous benefits, including netting, the impact on financing, securities lending and buy-side activity.”

What are the benefits of a shortened settlement?

The benefits of shortened settlement include a reduction in capital requirements, which translates to improved liquidity and pricing to the end investor.

Does DTCC have accelerated settlement?

DTCC’s current structure and technology already allow accelerated settlement. The firm will begin to publish this data daily and review with clients to ensure a common understanding of what those transactions represent and how they can be facilitated into a T+0 process. “Currently, NSCC and DTC settle thousands of transactions on T+1 and T+0 on a daily basis. NSCC trades real-time settlement until 11:30AM and bilateral transactions settle instantaneously at DTC till the close of the day,” Pozmanter added.

Is T+2 a two day settlement?

It was just a few years ago when the industry moved from three-day to two-day settlement. Pozmanter noted that since the settlement cycle was shortened to T+2, DTCC has been continually reviewing the impacts, systems and processes of securities settlement today, and the merits of further acceleration, including T+1, T+0 and real-time gross settlement. And the recent excessive volume and volatility was the catalyst for DTCC’s white paper, “ Advancing Together: Leading the Industry to Accelerated Settlement .”

1. Alteration of the Structure

It is possible to reorient or move the structure based on the site, location, and function to achieve a better foundation settlement condition. The movement of the building is feasible in rural areas where the value of land is low.

2. Alteration of the Foundation

The deep foundation is the most commonly adopted option used to tackle excessive settlement of a building under consideration. Various types of deep foundations are available that can be selected based on the type of soil and material, equipment, and required skill availability.

3. Alteration of Soil Properties

Different soil improvement methods are available from which engineers can select a suitable option based on the nature of the structure and type of soil on the construction site. The expertise plays a crucial role in the selection of soil treatment techniques.