You can contact the debt collection agency in writing and offer a settlement figure. Generally, you should start the negotiation by offering approximately 25 percent of the debt. You can make a counter offer if the agency's settlement offer is too high or it rejects your offer.

- Learn about the debt. ...

- Plan for making a realistic repayment or settlement proposal. ...

- Negotiate with the debt collector using your proposed repayment plan.

How to negotiate a settlement with a debt collection agency?

Negotiate a settlement with the debt collection agency. You can negotiate in 2 ways. A debt collection agency may contact you with a settlement offer. You can contact the debt collection agency in writing and offer a settlement figure. Generally, you should start the negotiation by offering approximately 25 percent of the debt.

How to ask a credit card company for a settlement?

How to Ask for a Settlement. You may want to settle a credit card to help reduce your debt load. Offer the settlement to the credit card company. You can start with a settlement figure of 30 to 35 percent of your outstanding balance. Tell the credit card company this is the amount you are prepared to pay as a settlement for your credit card debt.

Should you write a debt settlement request letter?

Writing a debt settlement request letter is a good way to negotiate your debt and to agree on a new financial agreement to either pay down or pay off your financial obligations. In terms of credit reporting, debt buying, and debt collection, paying off a debt without a documented written statement could prove to be a huge mistake.

Should you propose a settlement to collectors?

By proposing a settlement, you can pay off the debt quickly, usually for less than the original amount. The collection agent is incentivized to get you to pay as much money as possible with the least amount of effort on their part. The agent works on commission and gets a portion of whatever you pay.

Can you negotiate a settlement with a collection agency?

Believe it or not, though, it's possible to negotiate with a collection agent and end up paying less than you owe. Why is that? Because the collection agency bought the original debt from your creditor, most likely for a substantial discount. That means they don't have to recover the entire amount to make a profit.

What percentage should I offer to settle a debt?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

What should you ask for when settling a debt?

7 Things to Get in Writing When You Settle a DebtDebt validation notice. ... Total amount to be paid. ... Payment schedule. ... Promise to stop collection efforts. ... Guarantee to report the debt as paid in full – not “settled” ... Breach of agreement terms. ... Authorization from the right person.

How do I negotiate a debt settlement?

A 6-step DIY debt settlement planAssess your situation. ... Research your creditors. ... Start a settlement fund. ... Make the creditor an offer. ... Review a written settlement agreement. ... Pay the agreed-upon settlement amount.

Will debt collectors settle for 30%?

Lenders typically agree to a debt settlement of between 30% and 80%. Several factors may influence this amount, such as the debt holder's financial situation and available cash on hand.

What is the 11 word phrase to stop debt collectors?

If you need to take a break, you can use this 11 word phrase to stop debt collectors: “Please cease and desist all calls and contact with me, immediately.” Here is what you should do if you are being contacted by a debt collector.

Will debt collectors settle for half?

Some want 75%–80% of what you owe. Others will take 50%, while others might settle for one-third or less. Proposing a lump-sum settlement is generally the best option—and the one most collectors will readily agree to—if you can afford it.

Is it better to settle or pay in full?

Paid in full means the remaining balance of your debt, including interest, was paid off. Paying in full is an option whether your account is current, past due or in collections. It's better to pay in full than settle in full when it comes to paying off debt.

Do settlements hurt your credit?

While settling an account won't damage your credit as much as not paying at all, a status of "settled" on your credit report is still considered negative. Settling a debt means you have negotiated with the lender and they have agreed to accept less than the full amount owed as final payment on the account.

How do you propose a settlement offer?

Writing the Settlement Offer Letter Include your personal contact information, full name, mailing address, and account number. Specify the amount that you can pay, as well as what you expect from the creditor in return. A good starting point for negotiation could be offering around 30% of the amount that you owe.

What happens if a debt collector won't negotiate?

If the collection agency refuses to settle the debt with you, or if the agency or creditor agrees to settle, but you renig on your end of the agreement, the collection agency or creditor may decide to pursue more aggressive collection efforts against you, which may include a lawsuit.

How do I get a collection removed?

You can ask the current creditor — either the original creditor or a debt collector — for what's called a “goodwill deletion.” Write the collector a letter explaining your circumstances and why you would like the debt removed, such as if you're about to apply for a mortgage.

What percentage should I offer a full and final settlement?

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

Do settlements hurt your credit?

While settling an account won't damage your credit as much as not paying at all, a status of "settled" on your credit report is still considered negative. Settling a debt means you have negotiated with the lender and they have agreed to accept less than the full amount owed as final payment on the account.

What percentage should I ask a creditor to settle for after a Judgement?

If you decide to try to settle your unsecured debts, aim to pay 50% or less. It might take some time to get to this point, but most unsecured creditors will agree to take around 30% to 50% of the debt. So, start with a lower offer—about 15%—and negotiate from there.

How to send a payment to a collection agency?

Send the payment along with a letter to the debt collection agency. You should send the payment by certified mail so you have confirmation that it receives the money.

Who may contact you with a settlement offer?

A debt collection agency may contact you with a settlement offer.

How long can a debt collector collect on a debt?

Each state has a statute of limitations on how long a creditor has to collect on a debt. For example, debts from 10 years ago may be considered zombie debts-or debts too old to collect on. You won't have to settle the debt if the collection agency tries to collect on a zombie debt.

What is debt collection agency?

Learn more... A debt collection agency is a third party company hired to collect debt owed to a creditor such as a credit card issuer. Typically, the creditor has given up collecting the debt, but still wants the money. Since the debt collection agency has assumed the role of acquiring the money you owe, its representatives may constantly call ...

How long does a debt stay on your credit report?

The statute of limitations has nothing to do with how long the debt stays on your credit report. Typically, debt stays on your credit report for 7 years.

Who sets the statute of limitation?

In the United States, statutes of limitation are set by state governments, and in other countries, by the national government.

Can you make a counter offer to a settlement?

You can make a counter offer if the agency's settlement offer is too high or it rejects your offer. The counter offer is an alternative offer. You may have to go through the negotiation process several times. Accept the terms of the agreement in writing.

Why do credit card companies offer settlements?

Credit card companies will be more willing to offer extend a settlement if you are experiencing financial difficulty or some type of hardship. Provide them with all of the details. You may want to settle a credit card to help reduce your debt load. Offer the settlement to the credit card company.

How much of a credit card settlement is acceptable?

Tips. As a rule of thumb, settlements in the amount of 50 to 70 percent of the balance are acceptable. Some credit card companies will settle for 20 to 70 percent of the balance. Warnings.

What to do if you have a large lump sum of cash?

If you have a large lump sum of cash, such as a tax refund or bonus, you may want to settle your credit card debt. When you call the credit card company have a target figure in mind to offer as a settlement. Call the credit card company and explain your circumstances.

Can a credit card company accept a settlement offer?

A credit card company is more likely to accept your offer if they think you will file a petition for bankruptcy, which means they will not receive anything. Ask for the offer in writing. Once you have successfully negotiated a settlement offer, make sure the credit card company provides you with the details in writing.

Can you settle credit card debt?

An excessive amount of credit card debt may lead you to ask for a settlement. When you settle your debts, you are making an agreement with the credit card company to pay an amount less than the full balance. Credit card companies do not readily disclose the fact that settlements are available. A credit card company will not let you settle your account unless you are at least 90 days past due. You can usually settle any where from 50 to 70 percent of your outstanding balance.

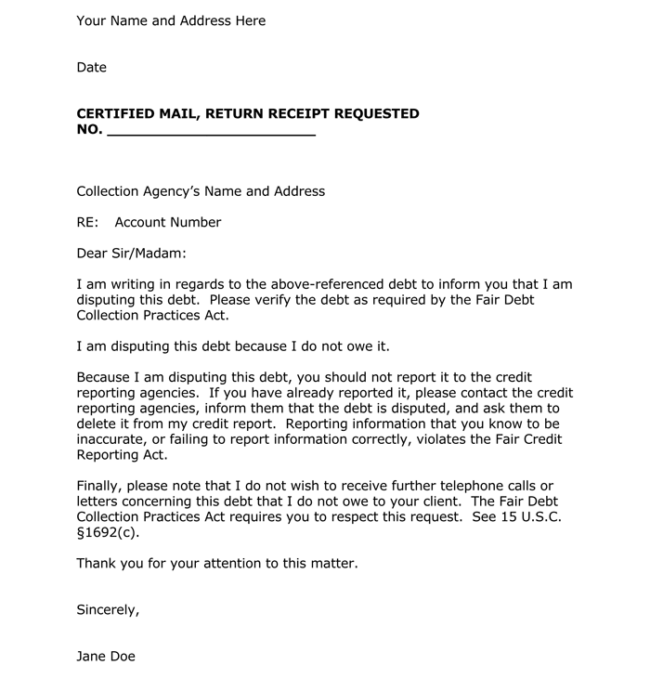

What is a debt settlement request letter?

Writing a debt settlement request letter is a good way to negotiate your debt and to agree on a new financial agreement to either pay down or pay off your financial obligations.

Why do we need a debt settlement letter?

Writing a well-written debt settlement letter is a great tool if you’re seeking a plausible solution to protect your credit score or avoid bankruptcy.

What to do when creditor agrees to offer?

When the creditor agrees to your offer, it’s crucial that you keep up with your payment plan. Develop a budget and stick to it at all costs.

Why do collections agencies pressure people?

Collection agencies often pressure people since they get a percentage of your settlement.

Can anything you say in a letter be held against you?

Therefore, anything you say in your letter can be held against you in the event you have to go to court and face legal action.

Is it bad to pay off a debt without a written statement?

In terms of credit reporting, debt buying, and debt collection, paying off a debt without a documented written statement could prove to be a huge mistake.

Why do collections agencies settle?

Why is that? Because the collection agency bought the original debt from your creditor, most likely for a substantial discount. That means they don’t have to recover the entire amount to make a profit. By proposing a settlement, you can pay off the debt quickly, usually for less than the original amount.

How does a collection agent work?

The collection agent is incentivized to get you to pay as much money as possible with the least amount of effort on their part. The agent works on commission and gets a portion of whatever you pay.

How does a credit bureau agent work?

The agent works on commission and gets a portion of whatever you pay. The best outcome is to get this debt off your back by paying a lump sum and getting a receipt and a commitment from the agency to update the status of your account on your credit report to reflect payment. Here’s how to do it.

What to do if you get a no?

If you get a “no,” ask to speak to a supervisor. The supervisor may say no also, or make a counter-offer. Try to figure out the amount he or she really wants. For example, if the supervisor offers to waive two months’ interest if you pay the principal that’s due on a loan, perhaps the agency would actually waive three or four months of interest. Try making a counter-offer.

What to say when an agent makes an offer?

If the agent makes an offer, for example to waive interest, reduce payments or let you skip a payment, you can respond by saying, “I see,” without committing immediately. The agent may then ask for something in exchange such as paying higher interest. Don’t give up more than you get.

What to do if you don't pay your credit card bill?

If the agency doesn’t do so, send any and all written evidence that you paid the bill to the credit bureau. Be sure that you understand how much, if any, of the debt was forgiven.

What to do if an agent keeps playing hardball?

If the agent keeps playing hardball, insisting that you pay a certain amount you can’t afford, don’t let them trap you. It’s fine to politely hang up and call back a day later. Successful negotiations may take weeks. As you continue to negotiate, tell the agent you want them to report the bill as paid in full.

How long does it take for a collection agency to get money?

In most cases, the collection agencies will want the money sent to them within 48 hours.

What happens if debt collectors see the whole world trying to get money from you?

If the debt collectors see that the whole world is trying to get money from you, they're going to take a good deal when they see one.

Why do creditors settle for less?

Creditors will often settle for less when they think they've only got one chance to get at least some of their money. If they know you're unemployed but they see a small window of opportunity to get money from a third party, they may take it.

What happens if you talk to creditors about assets?

If you start talking about assets you have, the creditors assume they can get more out of you. Telling them that the money you have is coming from a third party , though, will let them know your debts may be a lost cause.

Can you pay in one lump sum?

Some creditors don' t care whether you pay in one lump sum or in an extended payment plan. For others, however, if you can pay in a lump sum, they may give you a discount on what you owe. Without revealing that you may have that chunk of cash lying around, ask if there's a discount for one payment, Tayne says.

What happens if you pay a debt to a collection agency?

If you settle for a lesser amount, you and the collection agency can agree in writing that the debt will be accepted at a lower rate and be reported as "paid in full" or "paid as agreed." The account will still stay on your credit history, but it may have less of a negative impact over time.

What happens if you become delinquent on a credit card?

If you become significantly delinquent on a credit account, it's possible the debt may wind up in collections. This means your original lender has sent your account to a collection agency, which has in turn assigned one or more collectors to contact you repeatedly in an effort to see the debt paid.

Can a collection agency accept a debt?

However, while some collections agencies will accept your debt at a lesser amount, this option is never guaranteed. Often, a collection agency will push to collect the full balance on what you owe and you will still be responsible to pay off your debt in full.

What is debt settlement?

Key Takeaways. Debt settlement is an agreement between a lender and a borrower to pay back a portion of a loan balance, while the remainder of the debt is forgiven. You may need a significant amount of cash at one time to settle your debt. Be careful of debt professionals who claim to be able to negotiate a better deal than you.

What are the downsides of debt settlement?

The Downsides of Debt Settlement. Although a debt settlement has some serious advantages, such as shrinking your current debt load , there are a few downsides to consider. Failing to take these into account can potentially put you in a more stressful situation than before.

Why do credit cards keep putting you on a debt?

It is usually because the lender is either strapped for cash or is fearful of your eventual inability to pay off the entire balance. In both situations, the credit card issuer is trying to protect its financial bottom line—a key fact to remember as you begin negotiating.

Why would a credit card company drop you?

In other words, your lender may drop you as a client because of your poor track record of paying back what you owe.

How long to cut down on credit card spending?

To raise your chances of success, cut your spending on that card down to zero for a three- to six-month period prior to requesting a settlement.

How to negotiate a credit card?

Start by calling the main phone number for your credit card’s customer service department and asking to speak to someone, preferably a manager, in the “debt settlements department.”. Explain how dire your situation is.

Is debt settlement good for you?

Although a debt settlement has some serious advantages, such as shrinking your current debt load, there are a few downsides to consider. Failing to take these into account can potentially put you in a more stressful situation than before.

What to do if a credit collector doesn't send proof?

Otherwise, if the collector doesn't send sufficient proof, send the collector a cease and desist letter asking they stop contacting you and dispute the debt with the credit bureaus. 8

What to do if you can't get a debt collector to accept a lower payment?

Even if you can't get the collector to agree to accept a lower payment, you may be able to work out an arrangement to pay off the debt in installments. Knowing how to negotiate with debt collectors will help you work out a payment solution that helps you take care of the debt collection account for good. 1.

How long does it take for a debt collector to send you a notice?

5 Approach all debt collections with a healthy dose of skepticism. Within five days of contacting you, the collectors must send you a debt validation notice.

How do debt collectors work?

Debt collections can happen to even the most financially responsible consumers. A bill may slip your mind, you may have a dispute with the creditor over how much you really owe, or billing statements can get lost in the mail before you ever know the debt exists.

How to contact debt collectors?

Here are a few things you should know: 4 1 Debt collectors can only call you between 8 a.m. and 9 p.m. 2 They can't harass you or use profane language when speaking to you. 3 They can't threaten to take action that's illegal or that they don't intend to follow through with. 4 Debt collectors can only contact your employer, family members, and friends to contact information about you.

How long does it take for a debt validation notice to be sent?

Within five days of contacting you, the collectors must send you a debt validation notice. This notice lists how much money you owe, names the entity to which you owe it, and details steps you can take if you believe there's been a mistake. 6

How do junk debt buyers make money?

Or, junk debt buyers earn profits on debts they've purchased for just pennies on the dollar. 2 . Collectors only make money when consumers pay the debt. They can't seize property or take money from consumer bank accounts unless they sue and obtain a court judgment and permission to garnish the consumer's wages. 3 . 2.