To record a settlement cost, a corporate bookkeeper debits the corresponding settlement expense account and credits the vendors payable account. Operational Dilemma An operational dilemma may arise if a company cannot precisely determine the amount it will pay to settle a contract or purchase order.

Full Answer

How do you record settlement costs in accounting?

To record a settlement cost, a corporate bookkeeper debits the corresponding settlement expense account and credits the vendors payable account. An operational dilemma may arise if a company cannot precisely determine the amount it will pay to settle a contract or purchase order.

What is a settlement expense?

A settlement expense may be associated with a real estate transaction or a charge a business incurs as part of a legal proceeding. Mortgage-related settlement costs refer to cash a borrower pays for things like land surveying, property appraisal, legal work and insurance.

What is a settlement statement on a loan?

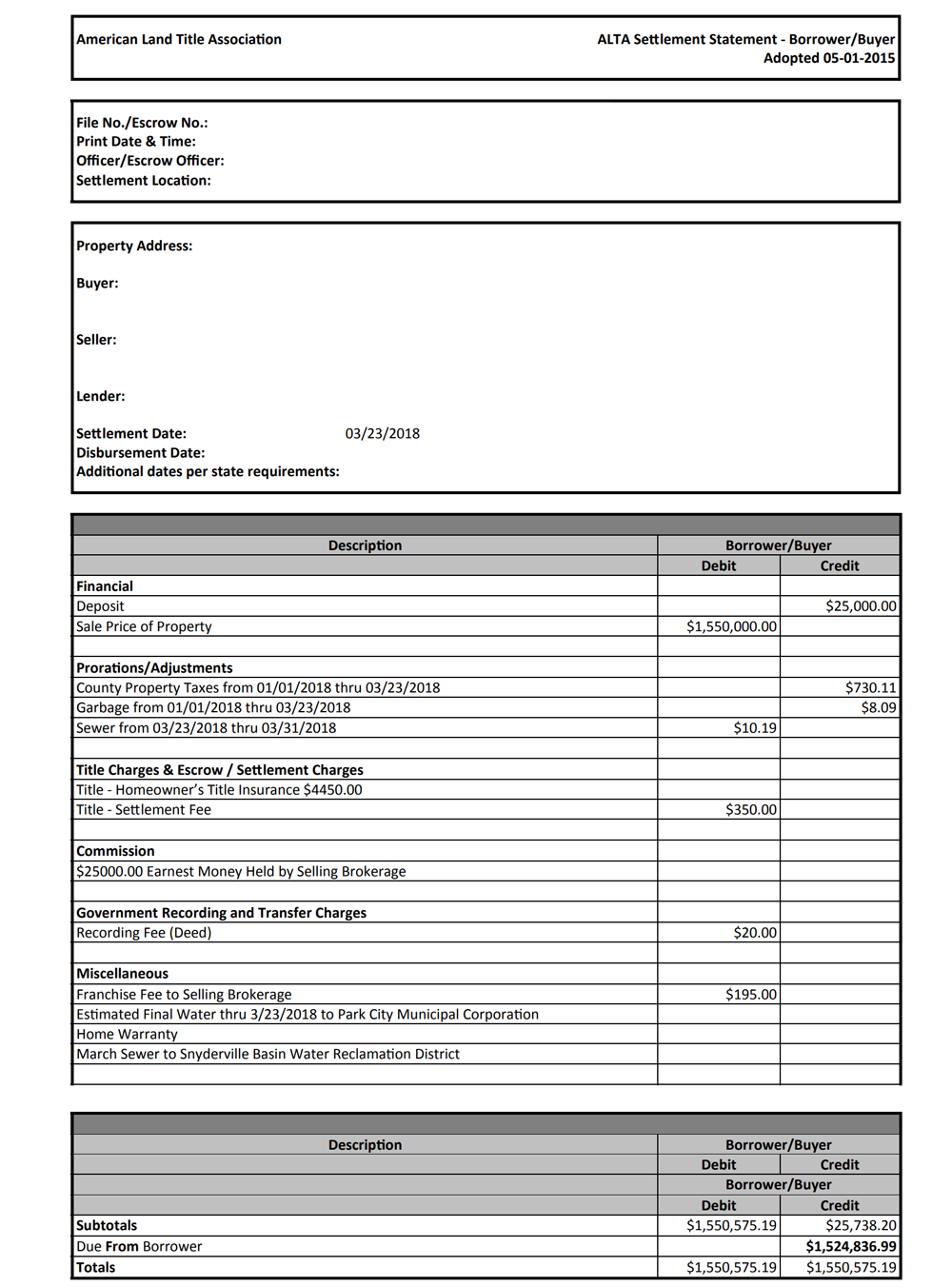

Or a lender sends a settlement statement to a borrower containing all fees of the borrower’s purchase using the loaned money including interest, closing cost, and all other fees the borrower needs to pay. Settlement statement analysis often inform or remind the client of the total amount of money they owe their service provider.

What is a settlement charge on a mortgage?

Settlement Expenses. A settlement expense may be associated with a real estate transaction or a charge a business incurs as part of a legal proceeding. Mortgage-related settlement costs refer to cash a borrower pays for things like land surveying, property appraisal, legal work and insurance.

How do I record settlement charges?

How to Record a HUD Settlement StatementCredits – will list the gross amount owed to the seller at the time of settlement closing:Debits – will list the charges of the seller at the time of settlement closing:Debits – will list the gross amount owed by the buyer at the time of statement closing:More items...•

Are closing costs expensed or capitalized?

In addition to the capitalized closing costs tied to your property, most costs associated with obtaining a loan must be capitalized rather than immediately deducted. These include loan origination/processing/underwriting fees, purchased points, appraisals, credit reports, etc. Add them up from your closing statement.

Where does the purchase price appear on a settlement statement?

Where does the purchase price appear on the settlement statement? debit for the buyer credit for the seller. Where does the buyers new loan appear on the settlement statement? Credit buyer- The buyers debit column lists all the charges to the buyer; the credit column shows how the buyer is going to pay the charges.

What are some common costs associated with the settlement of a real estate transaction?

Seller costs. One of the larger closing costs for sellers at settlement is the commission for the real estate agents involved in the real estate transaction. ... Loan payoff costs. ... Transfer taxes or recording fees. ... Title insurance fees. ... Attorney fees. ... Additional closing costs for sellers.

Do closing costs get added to basis?

Closing costs that can be deducted when you sell your home Some closing costs may be used to reduce the taxes on selling a house. They're added to your “basis” — a measure of the total costs you paid when your home was purchased. These may include: Owner's title insurance.

Do you depreciate closing costs?

Basis, Closing Costs, and Capital Expenses As you depreciate the property, the costs used to close on the house will essentially be depreciated, as well. Therefore, you actually deduct the closing costs over time, rather than deducting most of them immediately when you purchase the real estate.

How are expenses handled that the seller has incurred but have not yet been billed for at the time of closing?

How are expenses handled that the seller has incurred but have not yet been billed for at the time of closing? These items are paid in arrears.

What is debit and credit in settlement statement?

A debit is money you owe, and a credit is money coming to you. The debit section highlights items that are part of the total dollar amount owed at closing. This includes the amount due for closing and title costs, which are generally split between the buyer and the seller- who pays how much is generally negotiable.

How do you balance a closing statement?

4:0613:06How To Read A Closing Statement - YouTubeYouTubeStart of suggested clipEnd of suggested clipSo it starts with the agreed upon sale price. And then debits and credits are applied to both buyerMoreSo it starts with the agreed upon sale price. And then debits and credits are applied to both buyer and seller. And then all of the numbers are added and subtracted at the very bottom.

How are costs allocated between the buyer and seller?

How are costs allocated between the buyer and seller? Explanation: Local custom may dictate which party pays each cost, but the parties are always free to negotiate.

Who pays expenses and receives income for the day of closing?

If the buyer assumes the seller's existing mortgage or deed of trust, the seller usually owes the buyer an allowance for accrued interest through the date of closing. Unpaid& expenses that are owed by the seller, but not due at the closing are called accrued expenses. These expenses will later be paid by the buyer.

What expenses are paid by the seller?

Here's a look at some of the common expenses a seller will have to pay at closing:Agent commission.Transfer tax.Title insurance.Prorated property taxes.HOA fees.Credits toward closing costs.Seller attorney fees.Any escrowed money promised to the buyer.

Are closing costs tax deductible in 2021?

In The Year Of Closing If you itemize your taxes, you can usually deduct your closing costs in the year in which you closed on your home. If you close on your home in 2021, you can deduct these costs on your 2021 taxes.

How many years do you amortize closing costs?

Closings costs on a rental property fall into one of three categories: Deduct upfront in the current year. Amortize over the loan term. Add to basis (capitalize) and depreciate over 27.5 years.

Can you subtract closing costs from capital gains?

Capital Gains Tax The price you paid for the home is also called the tax basis. The closing costs associated with selling the rental property that are tax deductible, discussed above, can be used to lower overall basis (or price you paid for the home), thus potentially lowering the capital gains tax.

What loan costs are capitalized?

Capitalized Loan Fees means, with respect to the Macerich Entities, and with respect to any period, any upfront, closing or similar fees paid by such Person in connection with the incurrence or refinancing of Indebtedness during such period that are capitalized on the balance sheet of such Person.

What is settlement expense?

Settlement Expenses. A settlement expense may be associated with a real estate transaction or a charge a business incurs as part of a legal proceeding. Mortgage-related settlement costs refer to cash a borrower pays for things like land surveying, property appraisal, legal work and insurance.

When does a company record settlement expenses?

In other words, it posts expense entries when service providers have fulfilled their part of the contractual agreement. For example, if a business wants to buy a commercial building and lawyers have finished preparing all legal documents pertaining to the transaction, the company will record legal fees when it receives attorneys' bills -- not when it pays them. To record a settlement cost, a corporate bookkeeper debits the corresponding settlement expense account and credits the vendors payable account.

When do financial managers record settlement costs?

Financial managers record settlement costs when they are both probable and reasonably estimable. If not, managers disclose the extent and nature of the settlement contingencies at the bottom of a corporate balance sheet. They also tell investors whether settlement losses are probable, reasonably possible or remote.

David Geloran Follow

Pension plans tend to have large, long-term liabilities, and their impact on financial statements attracts attention. However, pension accounting is complicated, and the footnotes are painfully long and difficult to understand.

David Geloran

I find it very helpful to try to put to paper what I have learned about a topic, to help me solidify my understanding and be able to present that material in a more articulate manner. I am not an accountant – so if I have misstated anything, please reach out to me to discuss.

What Is a Settlement Statement?

Settlement statement defines the document which discloses the summary writing of the transaction between the service provider and the client.

What to consider when writing a settlement statement?

Either way, one needs to consider many things when writing a settlement statement. Here are some of those things: Know your purpose in writing the settlement statement. You should have a goal in mind as to why you are writing a settlement statement. If you don’t have one, don’t write it.

Why do both parties need to check the contents of a document?

Both parties need to check the contents of the document thoroughly in order to avoid future conflicts and lawsuits. This will serve as one of the final agreements both parties will undergo upon the completion of their transaction. The process, however, might vary from one service provider to another, so the client also need to review the process properly.

Why do people use financial statements?

People involved in business also make use of statements in conducting their business operations. Financial statements express a company’s financial status, operations, and plans over a certain time period. This goes to show that statements are reliable even in the world of business.

Is a statement a reliable source of information?

Most of us are aware that statements are reliable sources of information. Statements vary from being accounts of people about certain topics (as in statement of purpose ), to being used as an evidence in the court of law (as in witness statements ). These, among other things prove that statements are useful sources of facts and information.

What happened to my small corporation's tree roots?

My (small) corporation's tree roots caused damage to several people's homes. The two sides' attorneys went back and forth on this for over a year. The homeowners threatened taking the corporation to court. The corporation acquired a new attorney. The new attorney advised the corporation to settle and to pay for the repairs to the homes. The corporation did so . None of the parties ever filed papers in court.

Did the corporation acquire a new attorney?

The corporation acquired a new attorney. The new attorney advised the corporation to settle and to pay for the repairs to the homes. The corporation did so. None of the parties ever filed papers in court.

What is HUD-1 Settlement Statement?

The HUD-1 Settlement Statement: This form lists both the buyer’s and seller’s side of the transaction and is signed by both parties. It is published by the US Department of Housing and Urban Development. You’ll want to look at the buyer’s side, which is separated into credits and debits.

What expenses are deductible on a closing statement?

These include property taxes, prepaid mortgage interest, assessments from an HOA, and insurance. There is no difference in reporting for these expenses when they occur as part of closing than in any other case.

WHAT IS MY BUYER'S CLOSING STATEMENT?

Your closing statement is the form which lists the property to be transferred, any borrowed funds, and all costs to complete the transaction. Different forms are used depending on the requirements of the transaction and the lawyers involved. The three most common are:

Why is it important to record closing statements?

Getting it right is important because the journal establishes your basis for the lifetime of your property and may contain substantial deductible expenses.

What are closing costs?

The most common of these closing costs are title fees/insurance, surveys, recording fees, legal fees, and transfer taxes. Any amount you agree to pay on behalf of the seller, such as back taxes or real estate commissions, is also capitalized.

Why do you need a journal entry on closing statement?

Creating a journal entry from your buyer’s closing statement is one of the more complex transactions on the way to properly keeping books as a real estate investor. It is also one of the more important - calculating your basis in a new property is the starting point for all future depreciation, capital gains, or 1031 exchanges. Additionally, many expenses that can be immediately deducted as an investor are on the closing statement; if you miss them you’ll be stuck with a higher tax bill than necessary.

Why do buildings and land appear as debits in your journal?

Both buildings and land appear as debits in your journal to establish them as assets on the balance sheet. Calculating this split is important because the building value will depreciate over the course of your ownership of the property while the land will not.