If you are adding money to a fund you already own, check the box next to the fund and type in the dollar amount. If you are buying a new fund, check the box next to Add another Vanguard mutual fund. You can type in the fund name, symbol, or number.

Full Answer

What can I do with MY vanguard settlement fund?

The role of your settlement fund You should consider keeping some money in your settlement fund so you're ready to trade. You can use your settlement fund to buy mutual funds and ETFs (exchange-traded funds) from Vanguard and other companies, as well as stocks, CDs (certificates of deposit), and bonds.

How do I add funds to MY vanguard account?

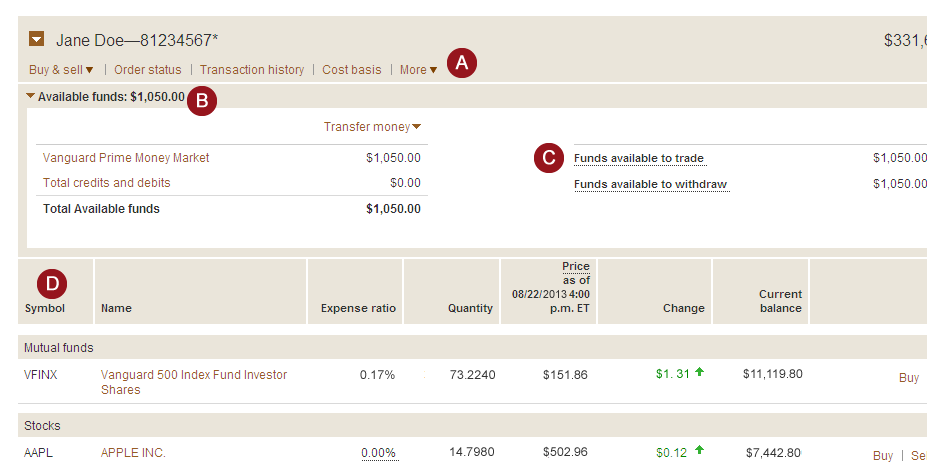

First, navigate to Buy & Sell under the main navigation My Accounts tab. Select Buy Vanguard funds in the Vanguard mutual funds section. Next, on the Buy Vanguard funds page, select the account you want to add funds to in the Where’s the money going? section. If you’re adding money to an existing fund, check the box next to the fund.

How do I transfer money from my bank to Vanguard?

Move money from your bank account to your Vanguard account through an electronic bank transfer (EBT) or wire. Send scheduled automatic deposits from your bank account to your Vanguard account. Send income directly from your employer, the government (including tax refunds), or other sources electronically to your Vanguard account.

How do I buy and sell shares in Vanguard?

To complete this process, you need to have a bank account linked to your Vanguard account. You can learn how to link a new bank account here. First, navigate to Buy & Sell under the main navigation My Accounts tab.

How do I add money to my Vanguard account?

How do I send money from my bank to Vanguard?From the Vanguard homepage, search "Buy funds" or go to the Buy funds page. ... Select the checkbox next to an existing fund. ... Once you select a checkbox, a textbox will appear below it. ... When you enter fund information in the text box, fund choices will appear.More items...

What is a settlement fund in Vanguard?

Your settlement fund is used to pay for and receive proceeds from brokerage transactions, including Vanguard ETFs®, in your Vanguard Brokerage Account.

Do you have to keep money in Vanguard settlement fund?

While you're not required to have a balance in your settlement fund at all times, keeping some money in the settlement fund has these advantages: You're more likely to have money to pay for purchases on the settlement date, when your account will be debited for the amount you owe.

How do I put money into my Vanguard ETF?

You need a brokerage account to invest in ETFs (exchange-traded funds)....Choose an account type based on what you're saving for. General investing (joint, individual, or UGMA/UTMA account) ... Open your account online in about 10 minutes. ... Add money to your settlement fund.

Can Vanguard settlement fund lose money?

You could lose money by investing in the Fund. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so.

How long does it take for funds to settle Vanguard?

Each trade settles in 2 business days, so you'll be late paying for stock X, which you bought on Monday. Any 3 violations in a rolling 52-week period trigger a 90-day funds-on-hand restriction. During this time, you must have settled funds available before you can buy anything.

Why can't I withdraw my money from Vanguard?

When you sell funds you'll need to wait for the trade to settle before you can withdraw the cash. This normally happens 2 business days after the trade completes.

Should I put my emergency fund in an index fund?

Generally, it's not a good idea to invest your emergency fund. Unexpected expenses, of course, are totally unpredictable and when you invest your emergency fund, you run the risk of possibly losing your initial investment if the value of your assets falls below what you purchased them for.

Where should you put your emergency fund?

It's best to keep your emergency fund separate from your other bank accounts....Where Are the Best Places to Keep an Emergency Fund?High-Yield Savings Account. ... Money Market Account. ... Certificate of Deposit. ... Traditional Bank Account. ... Roth Individual Retirement Account.

What is the interest rate on Vanguard settlement fund?

The expense ratio is 0.16% ($16 annually for every $10,000 invested) and the seven-day SEC yield, which reflects the interest earned after deducting fund expenses for the most recent seven-day period, is 0.01%. The one-year return as of March 31 was 0.14%.

Can I direct deposit to Vanguard?

Yes. You can have as many Direct Deposit sources as you like. You must set up the service for each Direct Deposit source separately.

Can I buy Vanguard funds directly?

Key Takeaways. Investors can buy and sell Vanguard mutual funds and ETFs through any number of brokerage firms and financial advisors. If you buy directly through Vanguard, you may benefit from lower fees, better customer service, and additional product research.

What are settled funds?

What are settled funds or settled cash? You guessed it: Settled funds are basically the inverse of unsettled funds. Proceeds from selling a security become settled funds after the settlement period has ended. Similarly, cash you deposit or wire into your brokerage account to use for trading is considered settled.

What is a settlement account?

an account containing money and/or assets that is held with a central bank, central securities depository, central counterparty or any other institution acting as a settlement agent, which is used to settle transactions between participants or members of a commercial settlement system.

Can you withdraw from a Roth IRA settlement fund?

Re: Does Roth IRA at Vanguard have a separate settlement fund? yes its separate, do not withdraw anything.

What is mutual fund settlement?

The settlement date for a mutual fund trade is the date on which the transaction is considered to be finalized and closed. Money that a customer owes must be available in their account to cover the shares purchased by the trade settlement date.

How much investment is required for Vanguard Total Stock Market Index fund?

The minimum investment requirement for that fund is $3,000.

How long does it take to transfer money to Vanguard?

A transfer from your bank to your Vanguard account can take a few days before the money is cleared and ready to use. So having that money ready is crucial.

What Is A Settlement Fund?

A settlement fund is a fund where your money sits after you sell your investments or receive dividends. You can withdraw that money and transfer it to your regular checking account.

Where do dividends go?

Dividends you receive from your stocks or other securities go directly to your settlement fund. So if you want to grow your investments, set your account to “reinvest” so that the dividends can automatically be used to buy more shares.

Does a settlement fund earn interest?

Your settlement fund will earn you some interest on the money it contains , but not a lot. To learn more about the interest, visit Vanguard.

How to add another Vanguard mutual fund?

If you are buying a new fund, check the box next to Add another Vanguard mutual fund. Then type in the fund name, symbol, or number. If you aren’t sure which fund, you can view a list of Vanguard mutual funds by clicking the Select from a list of our fundslink.

Who holds Vanguard assets?

All investing is subject to risk, including the possible loss of the money you invest. Brokerage assets are held by Vanguard Brokerage Services, a division of Vanguard Marketing Corporation, member FINRA and SIPC.

Do you need to move money into settlement fund?

Note:If you’re buying a brokerage product like a stock or ETF, you’ll need to move money into your settlement fund to cover the trade.

Does Vanguard have a contribution?

Vanguard.com defaults to a contribution. If this isn’t a contribution select Yesin the question that states Is this a rollover from an employer-sponsored plan or IRA? Then continue with the transaction.

Is Vanguard a brokerage?

Vanguard funds not held in a brokerage account are held by The Vanguard Group, Inc., and are not protected by SIPC. Brokerage assets are held by Vanguard Brokerage Services, a division of Vanguard Marketing Corporation, member FINRA

Step 1

This example is for illustrative purposes only and is not a recommendation to buy or sell a particular security.

Step 2

From the Holdings tab, find the Transact drop down menu. Select Buy Vanguard funds to begin your IRA contribution.

Step 3

Next, in the Where’s the money going? section, choose the account you’d like to contribute to. If you are completing a rollover from an employer-sponsored plan or IRA, select Yes, otherwise select No when prompted. Add a new fund by searching for its name, symbol or number, and enter the amount you’d like to contribute.

Step 4

Then, in the Where’s the money coming from? section, select your funding method. Click Continue.

Step 5

Review the Consent to electronic delivery of fund prospectus and click Accept. Note: You must click Accept to complete your contribution online.

Step 7

If you’ve previously signed up for e-delivery, your confirmation will be sent to you electronically. If not, you can choose your preferred delivery method for your confirmation. Click Continue. You’re all set!

Does buying another fund count as a contribution to an IRA?

In that case then yes buying another fund doesn’t count as another contribution.

Is $4K USD in savings enough for moving out at 18?

Hey everyone, I'm 17 and will be 18 by the end of the school year. My mom and dad don't want me to live with them really, so from a young age I was told that by your 18 move out. Since I was 15 I've done numerous side hustles, jobs etc. To save up some money and in total I have around $4,778 dollars to my name. It's in my own bank account.