Ask your mortgage lender to accept a full and final settlement offer of payment (sole name)

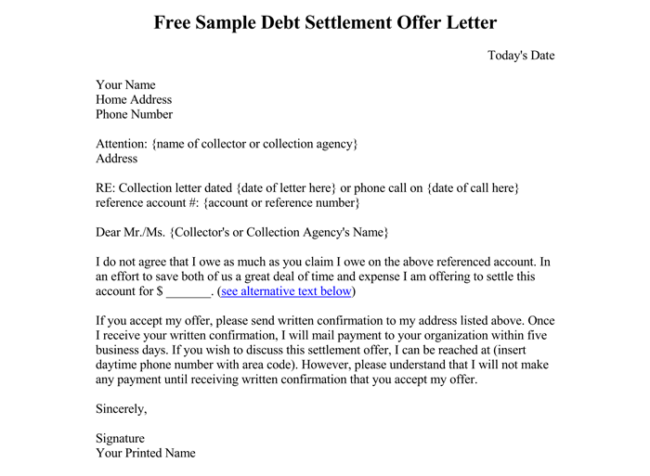

- Fill in your contact details, account number and any extra information you want to include in the grey shaded areas.

- Today’s date will be added automatically.

- Sign each letter and enclose a copy of your budget if needed.

Full Answer

How should I respond to settlement offer?

How Should I Respond to the First Workers Comp Settlement Offer? Here are some tips for handling the insurer’s opening offer: #1: Ask the Insurer How it Calculated the Offer . A reasonable workers comp settlement should include fair amounts for: Unpaid medical expenses. Future medical bills. Lost wages. The potential for lost earnings in the ...

Should I write a debt settlement offer letter?

What Your Settlement Letter Should Include

- The letter should be on company letterhead, regardless of whether you’re dealing with a collection agency or the original creditor. ...

- The letter should include a date so you know when the settlement offer was made.

- Make sure the correct account number is listed on the debt settlement letter. ...

How to get money while waiting for a settlement?

- Family. In many cases, family should be the first place you look for financial assistance. ...

- Friends. Sometimes a nearby friend is better than a far away relative. ...

- Church or other Religious Organization. If you have a regular place of worship, make them aware of your need. ...

How to build a settlement offer?

How to Build A Settlement Offer

- Prioritize the Issues. : Make a list of all the issues and organize them by order of priority. ...

- Determine Settlement Ranges. : For each issue, identify what would be your ideal settlement and what is the lowest offer you would accept.

- Filter Your Tone and Arguments. ...

What is a reasonable offer to settle a debt?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

How do you propose a settlement offer?

Treat the letter as a contract between you and your creditor. Include your personal information and account number for easy identification. You'll need to outline the amount you can pay and what you expect in return. If you want to propose a good settlement offer, consider offering around 30 percent of what you owe.

How do you negotiate a settlement?

Identify, gather and produce the most important information early. Settlement negotiations are most effective at the proverbial sweet spot, when each side has the information it believes it needs to make a judgment about settlement but before discovery expenses allow the sunk costs mentality to take hold.

How do I write a letter to offer a settlement?

Writing the Settlement Offer Letter Include your personal contact information, full name, mailing address, and account number. Specify the amount that you can pay, as well as what you expect from the creditor in return. A good starting point for negotiation could be offering around 30% of the amount that you owe.

How much should I offer as a full and final settlement?

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

Is it better to settle or pay in full?

Generally speaking, having a debt listed as paid in full on your credit reports sends a more positive signal to lenders than having one or more debts listed as settled. Payment history accounts for 35% of your FICO credit score, so the fewer negative marks you have—such as late payments or settled debts—the better.

Is it better to settle or go to court?

Settlements are usually faster and more cost-efficient than trials. They are also less stressful for the accident victim who would not need to testify in front of a judge or hear the defence attempt to minimize their injuries and symptoms.

What should I ask for in a settlement agreement?

8 Questions to Ask if You've Been Offered a Settlement AgreementIs the price right? ... How much will I pay for legal advice? ... Have I been offered a reference? ... How much time would legal action take? ... Are there any restrictive covenants in your agreement? ... Do I have to pay tax on my agreement?More items...

How do I write an application for a full and final settlement?

Dear Sir, I had resigned from my position of (Designation) in the company on (Date). Before the last date of service and notice period, I had completed all the handing over formalities duly. I was told that I would get a full and final settlement amount of ___________ towards the pending salary and other dues.

What is a settlement proposal?

Settlement proposal means a proposal for effecting settlement of a contract terminated in whole or in part, submitted by a contractor or subcontractor in the form, and supported by the data, required by this part.

How do you negotiate with a bank one time settlement?

Yes, it's possible to negotiate with your lender and get your debts settled by paying a part of the outstanding balance....ConclusionReduce the monthly minimum payments.Alternate payment plan.Ask for temporary pause in loan/credit card repayments until your financial situation gets better.

What is a settlement proposal?

Settlement proposal means a proposal for effecting settlement of a contract terminated in whole or in part, submitted by a contractor or subcontractor in the form, and supported by the data, required by this part.

Are settlement offers good?

While settling an account won't damage your credit as much as not paying at all, a status of "settled" on your credit report is still considered negative. Settling a debt means you have negotiated with the lender and they have agreed to accept less than the full amount owed as final payment on the account.

How do you write a full and final settlement letter?

Dear Sir, I had resigned from my position of (Designation) in the company on (Date). Before the last date of service and notice period, I had completed all the handing over formalities duly. I was told that I would get a full and final settlement amount of ___________ towards the pending salary and other dues.

How do I write a debt settlement agreement?

The following terms and conditions should be included in a settlement.Original creditor and collection agent's company name.Date the letter was written.Your name.Your account number.Outstanding balance owed on the account (optional)Amount agreed to as settlement.More items...

Why do credit card companies offer settlements?

Credit card companies will be more willing to offer extend a settlement if you are experiencing financial difficulty or some type of hardship. Provide them with all of the details. You may want to settle a credit card to help reduce your debt load. Offer the settlement to the credit card company.

How much of a credit card settlement is acceptable?

Tips. As a rule of thumb, settlements in the amount of 50 to 70 percent of the balance are acceptable. Some credit card companies will settle for 20 to 70 percent of the balance. Warnings.

What to do if you have a large lump sum of cash?

If you have a large lump sum of cash, such as a tax refund or bonus, you may want to settle your credit card debt. When you call the credit card company have a target figure in mind to offer as a settlement. Call the credit card company and explain your circumstances.

Can a credit card company accept a settlement offer?

A credit card company is more likely to accept your offer if they think you will file a petition for bankruptcy, which means they will not receive anything. Ask for the offer in writing. Once you have successfully negotiated a settlement offer, make sure the credit card company provides you with the details in writing.

Can you settle credit card debt?

An excessive amount of credit card debt may lead you to ask for a settlement. When you settle your debts, you are making an agreement with the credit card company to pay an amount less than the full balance. Credit card companies do not readily disclose the fact that settlements are available. A credit card company will not let you settle your account unless you are at least 90 days past due. You can usually settle any where from 50 to 70 percent of your outstanding balance.

What Is a Settlement Offer Letter?

The main reason to negotiate a debt settlement is to find debt relief, but it can also save you money. When you eliminate debt through a debt settlement, you’ll also decrease your use of credit, which will increase your credit score.

Things To Consider While Pursuing Debt Settlement

As with each form of debt relief, debt settlement has advantages and disadvantages .

Steps To Take if You Seek a Settlement Offer

The first decision for you to make is whether you will negotiate the debt settlement yourself or hire debt settlement professionals to negotiate on your behalf. Professionals can help you, especially if you believe that you lack the communication skills necessary to negotiate with debt collectors.

Writing the Settlement Offer Letter

A debt settlement letter is, in effect, a written legal contract. It’s important to make direct, explicit, and detailed statements.

Debt Settlement Letter Template

This letter is in reference to the account number identified above and its outstanding debt. Due to financial difficulties, I am unable to pay the outstanding balance in full. [ Explain your hardship to the creditor here.]

How to negotiate a settlement offer?

Discuss the Terms of Your Offer. Clearly outline the terms of your settlement offer. Often settlements require confidentiality agreements and a stipulation that both parties will release any legal claims arising from the incident. Include a time frame for the claimant to accept the offer. Be sure to include the date the offer expires in your letter.

Why Offer a Settlement?

Settling a case out of court can save you money, time, and stress. Because a court case can be long-term and expensive , you might decide to settle even if you disagree with the claimant’s version of the incident that caused their loss. A settlement demand letter allows you to express your disagreement and offer a lower settlement amount.

What to do when a claimant sends a demand letter?

Offer a Reasonable Settlement. When a claimant sends a demand letter, they ask for a larger amount of money than they expect to receive. Their demand letter opens negotiation. Your settlement demand letter continues that negotiation. Offer a smaller amount than the claimant demands but large enough to tempt the claimant to settle out of court.

What is a settlement demand letter?

A settlement demand letter is a letter in which the writer expresses their willingness to settle a case out of court and offers a settlement. You might write a settlement demand letter if you have received a claimant’s demand letter and wish to respond with a settlement counteroffer. This letter is a written response to ...

Why do you settle out of court?

Note: You might decide to settle out of court because you are not required to admit guilt to offer a settlement. You can deny responsibility for the incident and still offer to settle. Offering to settle might be preferable to a court case in which a jury determines your guilt or innocence.

How to dispute a claim in a letter?

In the body of your letter, dispute the claim and offer your perspective of the incident. Backup your viewpoint with evidence, such as a police report. Enclose a copy of any evidence you discuss in your letter.

What is a settlement offer letter?

A Settlement Offer Letter is a communication between two parties in a dispute. The dispute does not have to be in a court of law, although most of the time, it is. One party sends the other party this Settlement Offer Letter, with the proposed terms for a complete settlement between the parties. Rather than a formal legal document, this letter can ...

What information is entered in a settlement agreement?

The parties' identifying details and contact information will be entered, as well as the proposed settlement terms.

What happens if a dispute is not litigated?

If the dispute is not being litigated, details of the incident at the heart of the parties' dispute will be entered.

Is a settlement agreement a legal document?

Although the terms listed in this letter will generally become the terms of the Settlement Agreement, this letter does not create a legally binding contract.

Is a settlement offer letter legal?

Although settlement agreements can be governed by both state and federal law, this Settlement Offer Letter is not a legal document, so it is simply a best practice to give the recipient of the letter as much information as possible about the terms of the proposed settlement.

What is a final settlement letter?

Use this letter to help you negotiate a full and final settlement offer with a creditor. This is a type of offer where you ask the creditor to accept part of the amount you owe and write off the rest. You can find information about how to use this letter in our fact sheet Full and final settlement offers.

What information do you need to fill out on a sandbox?

Fill in your contact details, account number and any extra information you want to include in the grey shaded areas.

What to do if you agree to a settlement?

If you agree to a repayment or settlement plan, record the plan and the debt collector’s promises. Those promises may include stopping collection efforts and ending or forgiving the debt once you have completed these payments. Get it in writing before you make a payment.

What to do if you don't recognize the creditor?

If you don’t recognize the name of the creditor, you can ask what the original debt was for (credit card, mortgage foreclosure deficiency, etc.) and request the name of the original creditor. After you receive the debt collector’s response, compare it to your own records.

How to contact a debt collector?

Any debt collector who contacts you to collect a debt must give you certain information when it first contacts you, or in writing within 5 days after contacting you, including: 1 The name of the creditor 2 The amount owed 3 That you can dispute the debt or request the name and address of the original creditor, if different from the current creditor.

How to talk to a debt collector about your debt?

Explain your plan. When you talk to the debt collector, explain your financial situation. You may have more room to negotiate with a debt collector than you did with the original creditor. It can also help to work through a credit counselor or attorney.

How long does it take for a debt collector to contact you?

Any debt collector who contacts you to collect a debt must give you certain information when it first contacts you, or in writing within 5 days after contacting you, including: The name of the creditor. The amount owed. That you can dispute the debt or request the name and address of the original creditor, if different from the current creditor.

How long does a debt have to be paid before it can be sued?

The statute of limitations is the period when you can be sued. Most statutes of limitations fall in the three to six years range, although in some jurisdictions they may extend for longer.

When will debt collectors have to give notice of eviction moratorium?

All debt collectors must follow the Fair Debt Collection Practices Act (FDCPA). This can include lawyers who collect rent for landlords. Starting on May 3, 2021, a debt collector may be required to give you notice about the federal CDC eviction moratorium.

Ask your mortgage lender to accept a full and final settlement offer of payment (sole name)

Use this letter to help you negotiate a full and final settlement offer with your lender. This is a type of offer where you ask the lender to accept part of the amount you owe and write off the rest. You can find information about how to use this letter in our fact sheet Mortgage shortfalls.

Letter in joint names

You can choose to send a letter in your own name or in joint names. You may have a debt in joint names, or want to write to your creditors together because you have worked out a joint budget.