How to calculate accounts receivable collection period?

Formula: Accounts Receivable Collection Period = Average Receivables / (Net Credit Sales / 365 days) Or. You can calculate The Accounts Receivable Collection Period by. 365/ Account receivable turnover ratio. Averaged accounts receivable here are the averages receivable outstanding at the beginning and at the end of the periods.

How do I calculate the collection period for net credit sales?

Note: When you take Net Credit Sales over 365 days, you will get averaged net credit sales per day. This will be used with averaged accounts receivable to find the period in which accounts receivable are outstanding. Another way to calculate the collection period is that you can utilize the account receivable turnover ratio for the calculation.

How do you calculate average accounts receivable?

Average accounts receivable ÷ (Annual credit sales ÷ 365 Days) The method used to calculate it can have a profound impact on the resulting calculation of the average collection period. Here are several variations on the concept, with a critique of each one: This is the ending receivable balance for the month.

How to calculate the accounts receivable (AR) payment period?

Assess the Accounts Receivable Payment Period of the company. Here is the formula: Accounts Receivable Payment Period = Average Receivables / (Net Credit Sales / 365 days) Net Credit Sales =1,000,000 USD

How do you calculate receivable settlement period?

The average collection period is calculated by dividing a company's yearly accounts receivable balance by its yearly total net sales; this number is then multiplied by 365 to generate a number in days.

What is average settlement period for receivables?

For Company A, customers on average take 31 days to pay their receivables. If the company had a 30-day payment policy for its customers, the average accounts receivable turnover shows that, on average, customers are paying one day late.

How do you calculate average days pay accounts receivable?

How to Calculate Average Days in ReceivablesFind the company's ending accounts receivables and credit sales for the year. ... Divide the credit sales by 365. ... Divide the ending accounts receivable by the credit sales per day to find the average days in receivables.

How do you calculate accounts receivable turnover and average collection period?

One formula for calculating the average collection period is: 365 days in a year divided by the accounts receivable turnover ratio. An alternate formula for calculating the average collection period is: the average accounts receivable balance divided by the average credit sales per day.

How do I calculate my average period?

Begin on day one of your period and count the number of days until your next period, which is day one of your next cycle. Track for 3 months and add the total number of days. Divide that number by three and you'll have your average cycle length.

What is the formula for calculating accounts receivable?

You can also calculate average accounts receivable by adding up the beginning and ending amount of your accounts receivable over a period of time and dividing by two.

How do you calculate average collection period in Excel?

Average Collection Period Formula= 365 Days /Average Receivable Turnover ratio. Average Collection Period = 365/ 8.

What does an average collection period of 30 days indicate for a company?

An average collection period of 30 days for a company indicates that customers purchasing products or services on credit take around 30 days to clear pending accounts receivable.

How do I calculate average days in Excel?

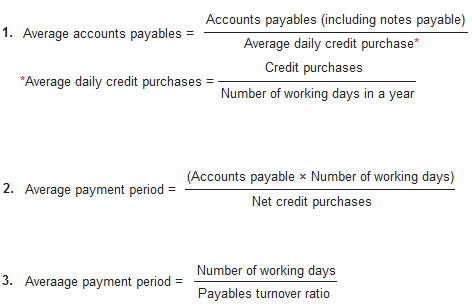

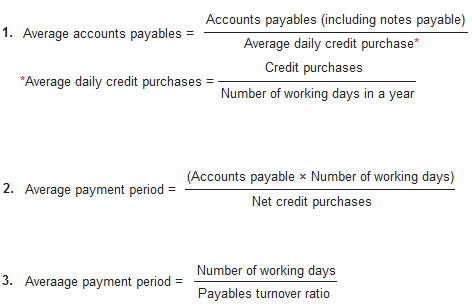

The formula to measure the average payment period is as follows:Average Payment Period = Accounts Payable / (Credit Purchases / Number Of Days)Average Accounts Payable = (Beginning AP + Closing AP) / 2.

What is a good average payment period?

90 days2. What is an ideal average payment period? An ideal average payment period is considered to be 90 days by many companies. Any payment significantly higher than 90 days would indicate that the company is taking too long to pay off its credit.

What does an average collection period of 30 days indicate for a company?

What does an average collection period of 30 days indicate for a company? The company has a 30 day collection policy. The company collected on sales and re-loaned the money 30 times during the year.

What is a good receivables turnover ratio?

An AR turnover ratio of 7.8 has more analytical value if you can compare it to the average for your industry. An industry average of 10 means Company X is lagging behind its peers, while an average ratio of 5.7 would indicate they're ahead of the pack.

What is the Average Accounts Receivable Calculation?

Average accounts receivable is the average amount of trade receivables on hand during a reporting period. It is a key part of the calculation of receivables turnover, for which the calculation is:

Month-End Balance Calculation

This is the ending receivable balance for the month. It is not an average at all, since it is comprised of a single data point, and so can yield highly variable results from month to month. Though it is the simplest option, we do not recommend it.

Average of Consecutive Month-End Balances for Two Months

Perhaps the most common calculation for average accounts receivable is to sum the ending receivable balances for the past two months and divide by two.

Average of Consecutive Month-End Balances for Three Months

This calculation is based on the ending receivable balances in the past three months. It suffers from the same problems as using the balances at the end of the last two months, but probably also covers the full range of dates over which the typical company has receivables outstanding.

Average of Consecutive Year-End Balances

This is the sum of the ending receivable balances at the end of the last two years, divided by two. These two figures are so far apart in time that it is quite unlikely that they will relate to credit sales in any given month, so the result is likely to be a skewed calculation of average collection time.

Average of all End-of-Day Balances

This is an average of the amount of receivables outstanding as of the end of each business day, divided by the number of days being used to compile the average (presumably at least one month).

Summary

In short, we suggest using an average of the consecutive month-end balances for the past three months, which minimizes calculation effort while still yielding a representative average over the likely collection period.

How long is the average accounts receivable collection period?

Once you have your variables in the equation, you can simply divide to solve the equation. In the example, the equation solves as 365/9.125= 40 days. Understand your result. The result of 40 indicates that the average accounts receivable collection period is 40 days .

How often do companies calculate accounts receivable?

Companies can calculate the accounts receivable collection period using a rolling average accounts receivable balance that changes every three months. The calculated accounts receivable collection period will fluctuate each quarter based on seasonal sales activity.

How to calculate accounts receivable turnover ratio?

This is a company's annual net credit sales divided by its average balance in accounts receivable for the same time period. This calculation tells how many times a company's accounts receivable turns over.

How to track credit sales?

Mismanaged accounts can lead to slow or late payments and default. One way to keep track of credit sales is to analyze the related financial ratios, such as the average collection period. Learning how to calculate the accounts receivable collection period will help your business keep track of how quickly payments can be expected.

What does a low number mean in accounts receivable?

A lower figure is better. This means that customers are paying the company in a timely manner. If customers pay in a shorter amount of time, the company then has less funds tied up in accounts receivable and more funds available to use for other purposes. A low number also indicates that customers are less likely to default on credit payments.

How many times does a company turn over accounts receivable?

This means its accounts receivable is turning over approximately 9 times per year. On the face of it, this seems beneficial to the company. However, suppose the company's credit terms require customers to pay within 20 days.

What is net credit sales?

Net credit sales equals all of the sales on credit less all sales returns and sales allowances. Sales on credit are non-cash sales where the customer is allowed to pay at a later date. Sales returns are credits issued to a customer due to a problem with the purchase.

How to calculate average collection period?

All we need to do is to divide 365 by the accounts receivable turnover ratio.

Why is knowing the collection period important?

There are two reasons for this –. First, a huge percentage of the company’s cash flow depends on the collection period. Second, knowing the collection period beforehand helps a company decide means to collect the money that is due to the market.

Can a company sell seasonally?

A company may sell seasonally. In that case, the formula for the average collection period should be adjusted as per the necessity. If for seasonal revenue, the company decides to the Collection period calculation for the whole year, it wouldn’t be just.

What is the settlement period?

Settlement Period Settlement date is used in the securities industry to refer to the period between the transaction date when an order is executed to the settlement date.

Why is it important to calculate the average collection period?

Calculating the average collection period for any company is important because it helps the company better understand how efficiently it’s collecting the money it needs to cover its expenditures.

Why is the average collection period important?

The average collection period figure is also important from a timing perspective to help a company prepare an effective plan for covering costs and scheduling potential expenditures to further growth. For obvious reasons, the smaller the average collection period is, the better it is for the company. It means that a company’s clients take less time ...

How long does it take for ABC to collect?

It means that Company ABC’s average collection period for the year is about 46 days. It is slightly high when you consider that most companies try to collect payments within 30 days.

What does it mean when a company collects bills faster?

It means that a company’s clients take less time to pay their bills. Another way to look at it is that a lower average collection period means the company collects payment faster. A fast collection period may not always be beneficial as it simply could mean that the company has strict payment rules in place. The rules may work for some clients.

How to find average accounts receivable?

Some companies want to know the average accounts receivable, and this is done by adding up all of the accounts receivable amounts and dividing by how many line items there are. You can also calculate average accounts receivable by adding up the beginning and ending amount of your accounts receivable over a period of time and dividing by two.

How to calculate accounts receivable turnover ratio?

This is the first step in calculating the accounts receivable turnover ratio. To calculate the net credit sales, subtract the sales returns and sales allowances from the sales you've made on credit.

What is accounts receivable?

Accounts receivable (AR) is an account on a company's balance sheet that represents the money that a customer owes to a business for products or services a customer has received and paid for on short-term credit. The party that has supplied the products or services would list their accounts receivable items on their financial balance sheet as an asset because you will receive the money on a future date.

How to calculate how long it takes a customer to pay for a credit card?

You can also calculate how long it takes a customer, on average, to pay your company for the purchases they've made on credit by dividing the days of the year by your accounts receivable turnover ratio.

What is the difference between accounts receivable and accounts payable?

While accounts receivable is the money that a customer or client owes to a business that has provided them with products or services, accounts payable is what a business owes to other businesses, like their vendors.

Why do accounts receivable go on the balance sheet?

Even though accounts receivable represents money that is owed to a business, these amounts go on a balance sheet as assets because the payment is incoming from the customer at some point. It's common to include schedules on the balance sheet that keep you informed of the status of these payments.

Why is account receivable turnover important?

The accounts receivable turnover ratio is useful for companies because it gives the business owner an idea of how well the company is managing its revenue and assets. A better turnover ratio means that a company has been more successful at receiving payments from customers over a given period of time for products or services they have delivered.

What is the collection period for accounts receivable?

Definition: Accounts receivable collection period sometime called the days sales outstanding is simply mean the period (number of days) in which credit sales are collected from customers . This ratio is very important for management to assess the collection performance as well as credit sales assessments. Account receivable collection period ...

How to calculate collection period?

Another way to calculate the collection period is that you can utilize the account receivable turnover ratio for the calculation. Just divide 365 days with turnover ratio.

How many days does it take to get averaged net credit sales?

Note: When you take Net Credit Sales over 365 days, you will get averaged net credit sales per day. This will be used with averaged accounts receivable to find the period in which account receivable outstanding.

What is averaged accounts receivable?

Averaged accounts receivable here are the averages receivable outstanding at the beginning and at the end of the periods. In case you can’t find the averages, the ending balance of receivables could be used instate.

What is collection period?

Account receivable collection period measures the average number of days that credit customers usually make the payment to the company. The short period of days identified the good performance of collection or credit assessment, and the long period of days represents the long outstanding. This will subsequently affect the cash flow of the company.

Can you compare accounts receivable period to another period?

However, for a fair assessment, comparing this Accounts Receivable Payment Period with another period, competitors or expectations are highly recommended.

Can long outstanding accounts receivable lead to bad debt?

First, long outstanding accounts receivable could potentially lead to bad debt and the effect is adverse than the risk of late collection. This is because the company could not even get the cash from sales of its goods or services but lose them as expenses. This will subsequently lead to poor financial performance.

How long does it take to collect a company's receivables?

The average collection period, therefore, would be 36.5 days—not a bad figure, considering most companies collect within 30 days. Collecting its receivables in a relatively short—and reasonable—period of time gives the company time to pay off its obligations.

How Is the Average Collection Period Calculated?

In order to calculate the average collection period, divide the average balance of accounts receivable by the total net credit sales for the period. Then multiply the quotient by the total number of days during that specific period.

What Is an Average Collection Period?

The term average collection period refers to the amount of time it takes for a business to receive payments owed by its clients in terms of accounts receivable (AR). Companies use the average collection period to make sure they have enough cash on hand to meet their financial obligations. The average collection period is an indicator of the effectiveness of a firm’s AR management practices and is an important metric for companies that rely heavily on receivables for their cash flows .

Why is a lower average collection period more favorable than a higher one?

A lower average collection period is more favorable than a higher one because it indicates the organization is more efficient in collecting payments. But there is a downside to this, as it may indicate that its credit terms are too strict, which could cause it to lose customers to competitors with more lenient payment terms.

Why do companies calculate the average collection period?

Companies calculate the average collection period to ensure they have enough cash on hand to meet their financial obligations. A low average collection period indicates that an organization collects payments faster.

Why do banks have receivables?

For example, the banking sector relies heavily on receivables because of the loans and mortgages that it offers to consumers. As it relies on income generated from these products, banks must have a short turnaround time for receivables. If they have lax collection procedures and policies in place, then income would drop, causing financial harm.

Why is it important for real estate companies to bill at appropriate intervals?

These industries don’t necessarily generate income as readily as banks, so it’s important that those working in these industries bill at appropriate intervals, as sales and construction take time and may be subject to delays.

What is the average payment period?

Average payment period refers to the average time period taken by an organization for paying off its dues with respect to purchases of materials that are bought on the credit basis from the suppliers of the company, and the same doesn’t necessarily have any impact on the company’s working capital .

How to calculate average accounts payable?

Average Accounts Payable = (Beginning balance of the accounts payable + Ending balance of the accounts payable) / 2

What happens if a payment period is short?

However, if the payment period is very short, then it shows that the company is not able to take full advantage of the facility of credit terms. Credit Terms Credit Terms are the payment terms and conditions established by the lending party in exchange for the credit benefit.

How many days are in a year?

Days = Number of days in the period. In the case of a year, generally, 360 days are considered.

What is total credit purchase?

Total Credit Purchases = It refers to the total amount of credit purchases made by the company during the period under consideration. Days = Number of days in the period. In the case of a year, generally, 360 days are considered.

How to find average accounts receivable?

We can calculate the Average Accounts Receivable for the year by adding the Beginning and Ending Accounts receivables and dividing the total by 2.

How long does it take for Jagriti to collect receivables?

On an average, the Jagriti Group of Companies collects the receivables in 40 Days.

Can you compare a company's credit policy with the competitors?

We can also compare the company’s credit policy with the competitors on the average days taken by the company from credit sale to the collection and can judge how well a company is doing.

Can Anand Group change credit terms?

Anand Group of companies can make changes in its credit term depending on the collection period policy.