Click through to the settlement claim form and fill out online. Simply provide the necessary info such as your name and address, products information you purchased, and then submit your claim. They will mail your check once to the address your provided once your claim has been approved.

Full Answer

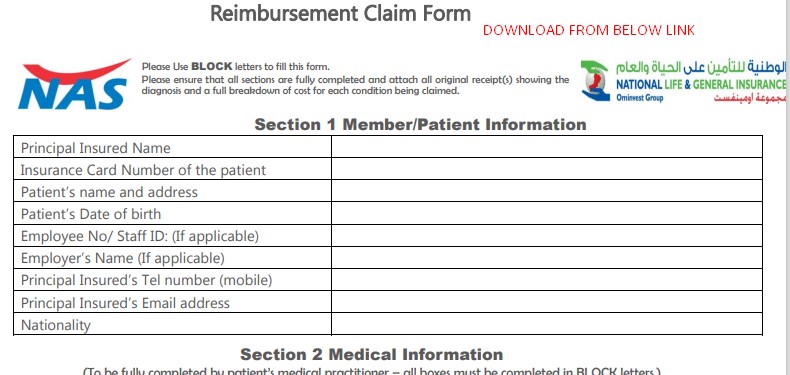

When to use affidavit for claim settlement in bank?

When To Use Affidavit For Claim Settlement In Bank? An affidavit for claim settlement in bank is used typically when a depositor dies. The family members, or more often the spouse, of the deceased individual often stands the right to inherit whatever money is left behind in the bank account of the deceased.

What is a claim settlement?

Claim settlement is the process by which an insurer pays money to the policyholder as compensation for an accident or vehicle injury. Tools exist that allow you to automate the entire process.

Can I claim cash from a class action lawsuit settlement?

Please see what other class action settlements you might qualify to claim cash from in our Open Settlements directory! TD Bank agreed to pay over $41 million as part of a class action lawsuit settlement to resolve claims that it wrongfully charged non-sufficient funds fees, or NSF fees, after retrying transactions.

How to file a claim against a bank after a death?

The spouse/ family member in question will be expected to file what is called as an Affidavit for Claim Settlement to the required bank. Such an affidavit will contain a declaration part and an affirmation part. The document will also contain the date of death of the deceased. Some banks may even ask for the death certificate.

How do you do a bank settlement?

To facilitate the process, the merchant must open a merchant account and sign an agreement with the acquiring bank specifying the terms & conditions and settlement of transactions for the merchant. Such banks charge transaction fees for their service.

How long do banks hold settlement checks?

Cashing in Your Settlement Check With Your Bank Generally, a bank can hold funds: For up to two business days for checks against an account at the same institution. For up to five additional days for other banks (totaling seven days)

How do you handle settlement money?

Here is a list of steps to take once you receive a settlement.Take a Deep Breath and Wait. ... Understand and Address the Tax Implications. ... Create a Plan. ... Take Care of Your Financial Musts. ... Consider Income-Producing Assets. ... Pay Off Debts. ... Life Insurance. ... Education.More items...

What is a settlement account in banking?

Settlement account is an account that is used in Balance of Payment (BOP) accounting to keep track of central banks' reserve asset dealings with one other. The official settlement A/c keeps track of transactions that involve foreign exchange reserves, bank deposits, special drawing rights (SDRs) and gold.

Can a bank refuse to give you your money?

Yes. A bank must send you an adverse action notice (sometimes referred to as a credit denial notice) if it takes an action that negatively affects a loan that you already have. For example, the bank must send you an adverse action notice if it reduces your credit card limit.

How long does it take for a $30000 check to clear?

Most checks take two business days to clear. Checks may take longer to clear based on the amount of the check, your relationship with the bank, or if it's not a regular deposit. A receipt from the teller or ATM tells you when the funds become available.

How long does it take to get paid after a settlement?

While rough estimates usually put the amount of time to receive settlement money around four to six weeks after a case it settled, the amount of time leading up to settlement will also vary. There are multiple factors to consider when asking how long it takes to get a settlement check.

What to do with a $100000 settlement?

What to Do with a $100,000 Settlement?Sort Out Tax Implications.Find a Financial Advisor.Pay Off the Debts.Invest in a Retirement Home.Start a Business or Help Friends and Family.Donate the Money to the Needy.Final Words.

How is settlement money divided?

The percentage of the settlement or judgment that attorneys charge does vary slightly, usually between 25% to 50%, depending on the type of case being handled.

What is clearing and settlement in banking?

Clearing involves network operators routing messages and other information among financial institutions to facilitate payments between payers and payees. Interbank settlement is the discharge of obligations that arise in connection with faster payments either in real-time or on a deferred schedule.

How is a settlement recorded in accounting?

Settlement date accounting is an accounting method that accountants may use when recording financial exchange transactions in the company's general ledger. Under this method, a transaction is recorded on the "books" at the point in time when the given transaction has been fulfilled.

What is the difference between payment and settlement?

Settlement in "real time" means payment transaction is not subjected to any waiting period. "Gross settlement" means the transaction is settled on one to one basis without bunching or netting with any other transaction. Once processed, payments are final and irrevocable.

How long does a bank hold a check over $10000?

Essentially, any transaction you make exceeding $10,000 requires your bank or credit union to report it to the government within 15 days of receiving it -- not because they're necessarily wary of you, but because large amounts of money changing hands could indicate possible illegal activity.

How long will bank hold large check?

According to banking regulations, reasonable periods of time include an extension of up to five business days for most checks. Under certain circumstances, the bank may be able to impose a longer hold if it can establish that the longer hold is reasonable.

How do you get a bank to release a hold on a check?

Contact Your Bank You can ask your bank to provide an explanation for the hold or sometimes even to release the hold. In most cases, you won't be able to do anything about the hold though, and because all banks have them, you can't switch banks to avoid them either.

What happens when you deposit over $10000 check?

Depositing a big amount of cash that is $10,000 or more means your bank or credit union will report it to the federal government. The $10,000 threshold was created as part of the Bank Secrecy Act, passed by Congress in 1970, and adjusted with the Patriot Act in 2002.

What is the importance of bank instructions?

Banks should view these instructions as very critical element for bringing about significant improvement in the quality of customer service provided to survivor (s) / nominee (s) of deceased depositors / locker hirer / depositor of safe custody articles.

What happens if you don't have a nominee clause?

Accounts without the survivor / nominee clause: In case where the deceased depositor had not made any nomination or for the accounts other than those styled as “either or survivor” (such as single or jointly operated accounts), banks are required to adopt a simplified procedure for repayment to legal heir (s) of the depositor keeping in view the imperativ e need to avoid inconvenience and undue hardship to the common person. In this context, banks may, keeping in view their risk management systems, fix a minimum threshold limit, for the balance in the account of the deceased depositors, up to which claims in respect of the deceased depositors could be settled without insisting on production of any documentation other than a letter of indemnity.

What is access to safe deposit lockers?

Access to the safe deposit lockers / return of safe custody articles (with survivor/nominee clause): If the sole locker hirer nominates a person, banks should give to such nominee access of the locker and liberty to remove the contents of the locker in the event of the death of the sole locker hirer.

How long does it take to settle a claim in a bank?

Time limit for settlement of claims: Banks should settle the claims in respect of deceased depositors and release payments to survivor (s) / nominee (s) within a period not exceeding 15 days from the date of receipt of the claim subject to the production of proof of death of the depositor and suitable identification of the claim (s), to the bank’s satisfaction.

What is MOP in banking?

Simplified operational systems / procedures: As per the direction of Reserve Bank, the Indian Banks’ Association (IBA) has formulated a Model Operational Procedure (MOP) for settlement of claims of the deceased constituents, under various circumstances, consistent with the instructions contained in this circular, for adoption by the banks. The banks should, therefore, undertake a comprehensive review of their extant systems and procedures relating to settlement of claims of their deceased constituents (i.e., depositors / locker-hirers / depositors of safe-custody articles) with a view to evolving a simplified policy / procedures for the purpose, with the approval of their Board, taking into account the applicable statutory provisions, foregoing instructions as also the MOP formulated by the IBA.

What is premature termination of term deposits?

Premature Termination of term deposit accounts: In the case of term deposits, banks are required to incorporate a clause in the account opening form itself to the effect that in the event of the death of the depositor, premature termination of term deposits would be allowed . The conditions subject to which such premature withdrawal would be permitted may also be specified in the account opening form. Such premature withdrawal would not attract any penal charge.

When should banks prepare inventory?

Preparing Inventory: Banks should prepare an inventory before returning articles left in safe custody / before permitting removal of the contents of a safe deposit locker as advised in terms of Notification DBOD.NO.Leg.BC.38/ C.233A-85 dated March 29, 1985. The inventory shall be in the appropriate Forms set out as enclosed to the above Notification or as near thereto as circumstances require.

When To Use Affidavit For Claim Settlement In Bank?

An affidavit for claim settlement in bank is used typically when a depositor dies. The family members, or more often the spouse, of the deceased individual often stands the right to inherit whatever money is left behind in the bank account of the deceased.

How To Make It Legally Enforceable And Valid?

To make the affidavit valid, you must print it on stamp paper and swear before an official who has the power to witness a swearing. The official then attests the affidavit, making it a valid legal document.

How to prepare an affidavit for settlement?

To prepare an affidavit for claim settlement, you can simply fill in your details into our comprehensive, pre-drafted form. Post filling in your details, do a thorough review and print it on stamp paper of designated value. Alternatively, you can simply prepare the document online and allow us to handle the printing.

What is the name of the document that a spouse or family member must file to get money from a deceased person?

The spouse/ family member in question will be expected to file what is called as an Affidavit for Claim Settlement to the required bank.

What is a death claim letter?

Death claim letter is usually addressed to the insurance company, human resource department of some other organization to claim the money or the other belongings of the person who has passed away. Unsatisfactory service, product or commitment results in a direct claim.

What is a professional claim letter?

A professional claim letter to a bank can settle your problems related with the bank. If you want to make complain or want to settle some issue that is unfair according to you, you can use this tool. A formal letter of claim can provide you with a quick and appropriate solution. It covers the relevant detail in simple language.

What is a claim appeal letter?

It is typically written to the business partner/ associates/ clients/ customers etc. Claim appeal letter is a typical letter written to claim for insurance. It is addressed to the authorized officer of the insurance company. A formal demand or claim letter is an important tool of the claim negotiation process.

What is a blunt claim?

A blunt or straight claim shows that the service provider/ vendor/money borrower is actually responsible or guilty. Claim letter to a business issue is the most common form of letter practiced in the business organization. It is typically written to the business partner/ associates/ clients/ customers etc.

What is a formal demand letter?

A formal demand or claim letter is an important tool of the claim negotiation process. If you have not received the desired product or service, making claim is your legal right. A formal written claim can increase your chance of settlement.

Where to write a disclaimer for a deceased person?

The legal heirs or claimants of a deceased person can write a letter of disclaimer to the bank where the deceased was holding account (s). Such a letter is written to the bank requesting final settlement of the balance amount lying in the account and credit of the money to their respective accounts. The bank may insist on the claimants ...

Can you pay FDs in the name of the deceased?

We have to advise that we have no objection to your paying the balance amount lying in the said account with your bank and the FDs in the name of the Late (Name of the deceased account holder) to the following claimants.

Can you add videos to your watch history?

Videos you watch may be added to the TV's watch history and influence TV recommendations. To avoid this, cancel and sign in to YouTube on your computer.