How to Reject an Insurance Settlement Offer After a Car Accident

- Calculate Your Loss. Gather as much information as you can to document your losses and support your case. For instance,...

- Decline the Offer. Determine the minimum amount you will accept. Use this amount as a guide but do not share this...

- Negotiate with Your Insurer. Wait for the insurance company to...

- State that the offer you received is unacceptable.

- Refute any statements in the adjustor's letter that are inaccurate and damaging to your claim.

- Re-state an acceptable figure.

- Explain why your counteroffer is appropriate, including the reasons behind your general damages demands.

How do I decline an insurance company's settlement offer?

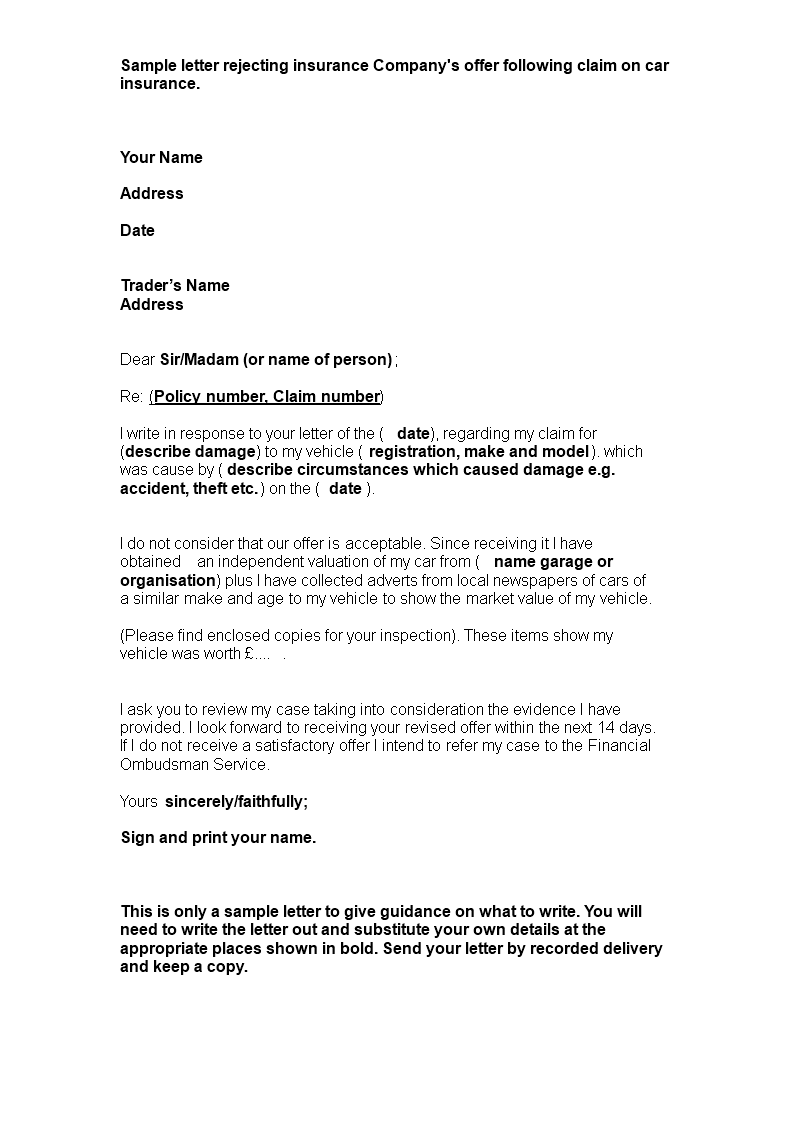

Write a formal letter to decline the insurance company's initial offer. The letter should detail the facts of the accident and your injuries and include your request for a settlement in the amount you have calculated. Include copies of your supporting documents in with the letter. Wait for the insurance company to contact you.

What should I do if I receive a settlement offer letter?

Once you have the settlement offer letter, you have the right to make a counter demand if you find the offer unacceptable. Compare what the insurance company has offered to your record of costs and losses, and the maximum payment provided by the insurance policy.

How to reject the initial offer of the insurance company?

In a written letter, you should reject the initial offer of the insurance company by emphasizing the following points: Clearly state that you do not find the initial settlement offer acceptable; Lists the specific reasons why the initial settlement offer is not acceptable; and

Can I reject a settlement offer before I receive my offer?

You can’t send your rejection letter until you receive the adjuster’s first settlement offer, but you can call the adjuster if there is an unreasonable delay after submitting your demand. Most adjusters will take their time in making personal injury settlement offers.

How do you counter offer an insurance settlement?

From the standpoint of procedure, you will need to make a counter-offer in writing. Be sure you send your letter to the appropriate person, whether that be an insurance adjuster or an attorney. Make it clear that you are rejecting their initial offer and include your reasons for doing so.

How do you respond to a settlement offer?

Steps to Respond to a Low Settlement OfferRemain Calm and Analyze Your Offer. Just like anything in life, it's never a good idea to respond emotionally after receiving a low offer. ... Ask Questions. ... Present the Facts. ... Develop a Counteroffer. ... Respond in Writing.

How do you write a counter offer letter for a settlement?

What To Include In Counter Offer. In the letter, you will need to refer to the offer made by the insurance company and when it was made. You will then need to reiterate why you think you are owed damages from the other party and why you think that offer was low.

What happens if you ignore a settlement offer?

When someone rejects a settlement offer, it is automatically terminated and can not be accepted at a later time. From here, you can negotiate or make a counteroffer, but will be up to the other party if they want to accept or reject the offer.

Is it good to accept a settlement offer?

Never accept a settlement offer until your doctor understands the full impact of your injuries. Maximum medical improvement is the milestone in your recovery where the doctor acknowledges that there is nothing more they can do for you.

Should you accept the first offer of compensation?

Unless you have taken independent legal advice on the whole value of your claim, you should not accept a first offer from an insurance company.

How do you negotiate a settlement with an insurance claims adjuster?

Let's look at how to best position your claim for success.Have a Settlement Amount in Mind. ... Do Not Jump at a First Offer. ... Get the Adjuster to Justify a Low Offer. ... Emphasize Emotional Points. ... Put the Settlement in Writing. ... More Information About Negotiating Your Personal Injury Claim.

How do you reject a counter offer sample?

State your rejection clearly That doesn't mean you need to be harsh, but being brief and direct is key. For example, you can say, "After serious consideration, I have decided to decline the offer that you extended to me last Thursday."

How do you respond to an offer letter asking for more money?

"I'm very excited about the position and know that I'd be the right fit for the team. I'm also excited about your offer, and knowing that I'll bring a lot of value to the table based on my experience that we discussed during the interviews, I'm wondering if we can explore a slightly higher starting salary of $60,000.

Are settlement offers confidential?

Section 1119(c) states that “all communications, negotiations, or settlement discussions by and between participants in the course of a mediation shall remain confidential” (emphasis added).

Can settlement negotiations be used as evidence?

The Senate amendment provides that evidence of conduct or statements made in compromise negotiations is not admissible. The Senate amendment also provides that the rule does not require the exclusion of any evidence otherwise discoverable merely because it is presented in the course of compromise negotiations.

Are settlement negotiations discoverable?

Settlement negotiations are not protected from discovery by a settlement-negotiation privilege. Although the Federal Circuit declined to create a settlement-negotiation privilege, it did not hold that settlement negotiations are presumptively discoverable.

What percentage should I offer to settle debt?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

What is a Rule 49 offer to settle?

Rule 49 is a self-contained scheme containing cost incentives and penalties designed to encourage litigants to make and accept reasonable offers to settle. [3] An “offer to settle” is the term used for a written offer made by one party to another party to resolve one or more claims in a proceeding.

What happens if you pay a settlement offer?

As long as your creditors accept your offer – i.e. agree to sum of money in the settlement offer – they will accept partial settlement of your debt in exchange for writing off the remaining amount you owe. If the settlement offer is big enough, the money will be shared equally among all of your creditors.

How do you negotiate a settlement with an insurance claims adjuster?

Let's look at how to best position your claim for success.Have a Settlement Amount in Mind. ... Do Not Jump at a First Offer. ... Get the Adjuster to Justify a Low Offer. ... Emphasize Emotional Points. ... Put the Settlement in Writing. ... More Information About Negotiating Your Personal Injury Claim.

What happens if I reject a settlement offer?

Scenario 3: Protect Your Legal Rights by Filing a Lawsuit The most dramatic result of a rejected settlement offer is a lawsuit against the party wh...

How do you negotiate a settlement with an insurance claims adjuster?

Have a Settlement Amount in Mind. Do Not Jump at a First Offer. Get the Adjuster to Justify a Low Offer. Emphasize Emotional Points. Put the Settle...

How do you politely decline a settlement offer?

Always reject a settlement offer in writing. Type a letter to your contact at the insurance company listing the reasons you think that their offer...

How do you write a letter to reject a settlement offer?

That you will not accept the initial settlement offer; The reasons why you feel you deserve a higher settlement amount; Each of their low-offer rea...

When should a letter be sent to a person who rejected an offer to be rejected?

The letter should be sent as soon as possible after the offer to be rejected was made but in any event, before commencing any action in court. In order to prove that the letter was sent, the sender may wish to send it by registered post, or keep a receipt or other proof of posting.

How long does it take for an insurance company to respond to a claim?

Once the document has been completed, simply post it to the insurers, and wait for them to respond. If the insurers do not respond within 14 days it may be necessary to consider further action with the financial ombudsman service, or legal action (such as in the small claims court ).

What is initial settlement offer?

The initial settlement offer is the insurance company's way of feeling you out. Do not lose your cool over something you can not control. You are, most likely, going to get low-balled on the initial offer. The insurance company's priority is maximizing profit, not looking out for your well-being.

Why do insurance companies throw out a single figure?

It is common for the insurance company to throw out a single figure in hopes that the one amount will be enough to fool you into a cheap settlement. By having the adjuster break down the offer, you can identify where the insurance company may be shorting your claim.

How long does it take for an insurance company to offer an insurance policy?

The amount of time it takes to receive an initial offer from the insurance company can widely vary. In more minor accidents, the insurance company may fling an initial offer at you with a few days or a week or two of the accident. Generally, the more complex or severe the accident, the more time it will take for the insurance company ...

How often should I call a claims adjuster?

You should call the claims adjuster regularly, I would say at least once a week, until an initial offer is given! If the claims adjuster contacts you and gives an offer over the phone, please tell them to reduce the offer to writing and sent to you certified mail. Any offer that is received from the insurance company should be broken down into its component parts (medical bills, lost wages, future treatments, pain and suffering, etc.). It is common for the insurance company to throw out a single figure in hopes that the one amount will be enough to fool you into a cheap settlement. By having the adjuster break down the offer, you can identify where the insurance company may be shorting your claim.

What does a claims adjuster do after receiving a claim?

Upon receiving the claim and / or the demand letter and making an initial offer, the claims adjuster will conduct an investigation that in a lot of ways will mirror the investigation done by your personal injury attorney. The claim adjuster will interview witnesses, review police reports, review your medical records, and read the demand letter. In cases that involve more severe injuries and claimed damages, the claims adjuster will visit the scene of your accident. Upon completion of this investigation, the claims adjuster at that point will usually make the initial settlement offer.

What happens if you hold on to your settlement money?

By holding on to your settlement money for a longer period of time, the insurance company is essentially earning income off the money that is rightfully yours and in essence they are mitigating their own payout. You need to take a proactive role in bringing your claim to a close and securing a favorable settlement offer!

What is the second biggest mistake that I see personal injury victims make?

Behind taking a low-ball initial offer prior to consulting an personal injury attorney, the second biggest mistake that I see personal injury victims make is that they allow the negotiation to stall. The victim gets an initial offer and thank goodness has good enough sense to know that the offer is terrible and they decline the offer. But then the victim kinda gets stuck into a mindset of "now what do I do?"

How do you politely decline a settlement offer?

Always reject a settlement offer in writing. Type a letter to your contact at the insurance company listing the reasons you think that their offer is too low. Back up these reasons with concrete evidence attached to the letter. Finally, provide a counteroffer of a sum you think is more reasonable.

How do you write a letter to reject a settlement offer?

That you will not accept the initial settlement offer; The reasons why you feel you deserve a higher settlement amount; Each of their low-offer reasons, and your responses; The higher settlement amount that you will accept.

What happens if I reject a settlement offer?

Scenario 3: Protect Your Legal Rights by Filing a Lawsuit The most dramatic result of a rejected settlement offer is a lawsuit against the party who injured you, the insurance company, or both.

How to get a sample from US legal forms?

To get a sample from US Legal Forms, users only need to sign up for an account first. If you’re already registered on our service, log in and select the document you need and purchase it. Right after buying templates, users can find them in the My Forms section.

What should a settlement letter include?

Your letter should also include a demand for a settlement amount slightly lower than your claim’s initial demand.

How to write a letter to a client about negligence?

In your letter, discuss each of your specific damages and underscore that the company’s client’s negligence was what directly caused you to suffer your damages. Point to the pieces of evidence you submit alongside your claim to illustrate the extent of each expense. State your interest in avoiding litigation to settle the claim but your willingness to do so if it becomes necessary. Going to court is an expensive, exhausting process for all parties involved.

What happens when you file a personal injury claim after a car accident?

When you file a personal injury claim after a car accident, you will likely receive a lowball offer following your claim and demand for compensation. Do not take this offer personally or feel that your claim is not worth much money – insurance providers operate for profit, so their goal is to get claimants to accept the lowest settlements possible in order to maximize their profits.

How do insurance adjusters work?

Know How Insurance Adjusters Work. The first settlement offer you receive will almost always be lower than the amount of money you need to cover your damages. It is also lower than the amount of money you can secure through your personal injury claim. The initial offer a claimant receives is generally the lowest amount of money ...

Why is it important to keep in contact with your claims adjuster?

Remain in frequent contact with your claims adjuster to encourage him or her to quickly make a settlement offer.

What evidence is used to support a demand for compensation?

In a personal injury claim, evidence used to support a demand for compensation can include: Medical documentation such as x-rays, doctors’ commentaries, and observations from witnesses; Bills for auxiliary medical expenses like a mobility aid, over-the-counter medication, and bandages; and.

What is a counter letter?

The counter letter is the document that you send to the insurance company rejecting its initial offer and outlining your reasons for the rejection. This is where your adjuster’s written offer enters the equation – by seeing how he or she arrived at the initial settlement figure, you and your lawyer can break down the expenses of your case to negotiate a higher settlement amount.

How to counter an insurance settlement offer?

When you receive the initial settlement offer in writing, examine the reasons the insurance adjuster has given for the low settlement amount . Each of these points will become a part of your counteroffer letter, and you should respond to each and every one. Your counteroffer letter will reassert your original position described in your demand letter, as well as respond to each of their low-offer reasons in turn. Keep your emotions out of the letter and stick to facts, such as the extreme pain and suffering you have had to endure and the frustration and hassle of attending medical treatments. Be professional, courteous, and confident, and never attack the claims adjuster personally in your counteroffer letter.

How to reject a settlement offer?

To reject the initial offer, you will create a counteroffer and send it via mail to the insurance company claims adjuster. This letter should state: 1 That you will not accept the initial settlement offer; 2 The reasons why you feel you deserve a higher settlement amount; 3 Each of their low-offer reasons, and your responses; 4 The higher settlement amount that you will accept.

What is a lowball offer from an insurance adjuster?

The initial offer you receive from the insurance adjuster will almost always be a "lowball" offer. They may defend their low offer by claiming that you were partially at fault for the accident that caused your injuries, or that the injuries you suffered weren't severe enough to warrant a greater amount. They may also question the amount of pain and suffering you experienced. They will aggressively defend their position of a low offer because this will often intimidate people into simply accepting the low offer. Do not ever accept the initial offer unless it is a fair offer.

How to reject an insurance offer?

To reject the initial offer, you will create a counteroffer and send it via mail to the insurance company claims adjuster. This letter should state:

What happens after an insurance adjuster investigates a personal injury claim?

After the insurance company has fully investigated your personal injury claim, they will make their first offer of settlement. Their investigation may include witness interviews, examination of the police reports and medical records pertinent to your case, and the demand letter you've forwarded to them. By the time the insurance adjuster presents an offer, they will feel confident about who was liable for the injuries you've suffered and property damage incurred, and what those are worth as a dollar amount.

What to do in a counteroffer letter?

Your counteroffer letter will reassert your original position described in your demand letter, as well as respond to each of their low-offer reasons in turn. Keep your emotions out of the letter and stick to facts, such as the extreme pain and suffering you have had to endure and the frustration and hassle of attending medical treatments.

How long does it take to get a settlement offer from insurance?

The initial settlement offer that comes from the insurance company can come at any time after you've filed your claim . Some personal injury claimants have to wait weeks to receive the offer, and some receive it rather quickly. Unfortunately, there is no set time in which the initial offer must be made.

How to decline an insurance offer?

Write a formal letter to decline the insurance company's initial offer. The letter should detail the facts of the accident and your injuries and include your request for a settlement in the amount you have calculated. Include copies of your supporting documents in with the letter.

Why should you reject an insurance adjuster offer?

Because the claim adjuster works in the interest of the insurance company, the amount offered for settlement may be less than fair. If you are not satisfied, you should reject the offer and negotiate a mutually beneficial settlement.

How to negotiate with insurance company?

Wait for the insurance company to contact you. This begins the negotiations, which, from this point, typically happen over several phone calls. The company will make a counteroffer for a much lower amount than you proposed. You may accept the offer, if it is reasonable, or respond with a counter-proposal that is lower than your original amount but higher than the company's proposal.

How much to increase settlement amount for auto accident?

Calculate the total cost of all the factors affected by the auto accident, such as medical bills, lost wages and auto repair, and increase this amount by about 20 percent to 25 percent. A claim that is too high or too low can put you at a disadvantage. Insurance companies typically offer the lowest possible settlement amount when it is obvious that the claimant is uninformed.

Who has the upper hand in negotiating a settlement?

Insurance companies usually have the upper hand in negotiating a settlement when the self-representing claimant is inexperienced and uninformed. An experienced insurance lawyer can help evaluate the initial offer and negotiate a better settlement from the insurance company in a shorter amount of time.

What happens when you submit a claim letter to an insurance company?

When a person submits a claim letter to an insurance company, whether it’s for a car accident, medical malpractice, personal injury or other reason, the insurance company will respond with a first offer. At this point, the claimant has the right to make a counter offer, and in most cases, this is the best thing to do.

What to do if a claimant wants to lower the amount?

If the claimant wants, they can enter into negotiations and send several letters that gradually lower the amount they will accept. It is also important for the claimant to mention any emotional suffering. This will not have a dollar value, but it is strong support of a higher settlement.

Why do insurance companies make low offers?

The first offer given by the insurance company will most likely be very low and not be their last offer. They may purposefully make a low offer to see if the claimant knows what he or she is doing. This is why it is recommended to negotiate for a higher offer.

What should an insurance adjuster do if the first offer is very close to the claimant's minimum amount?

If the insurance adjuster’s first offer is very close to the claimant’s minimum amount, the claimant should adjust their expectations upward.

Who does a letter go to when a claimant is at fault?

In most cases, the letter goes to the at-fault party’s insurance company to make it clear that the claimant suffered injuries because of the fault of the company’s insured person.

Should the claimant decide on the lowest amount they have calculated is fair for their claim?

The claimant should decide on the lowest amount they have calculated is fair for their claim and keep it in mind during negotiations, but not reveal it to the insurance company. If the insurance adjuster’s first offer is very close to the claimant’s minimum amount, the claimant should adjust their expectations upward.

Is an insurance company required to give a fair settlement?

The insurance company is not required by law to give a claimant a fair settlement. There are some adjusters who want to treat claimants fairly and some who take advantage of the claimant’s naiveté to offer a less than fair amount.