The adjuster will contact the claimant (or the claimant's personal injury lawyer) to request documentation relating to the claim. The adjuster will usually request documents such as medical bills, proof of earnings (for lost income claims), tax returns, and proof of property damage.

Full Answer

Can you negotiate a settlement with an insurance claims adjuster?

If you’ve never been involved in a car accident, you probably don’t know what it takes to negotiate a settlement with an insurance claims adjuster. Most people think that insurance is a straightforward system. They pay a certain amount in premiums in return for coverage when a car accident causes damage or physical injuries.

What happens when you get a demand letter from an adjuster?

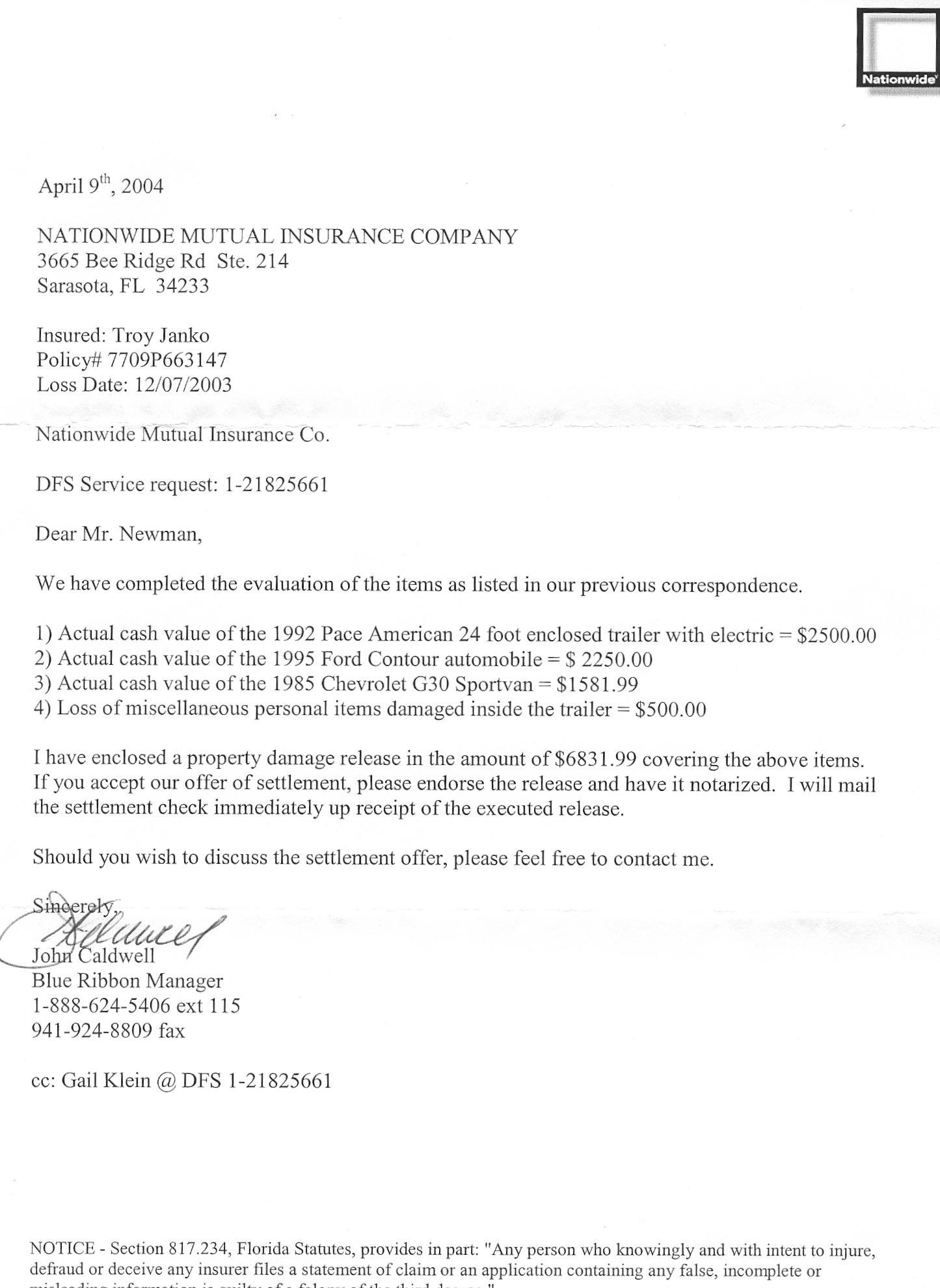

Once the insurance company receives your demand letter, the claims adjuster will probably respond with a letter of their own. In most cases, it is a rejection letter that disputes the value of your claim. Often, they make a counteroffer that is much lower than the real value of your claim.

Why do insurance companies use claims adjusters to get less?

This is just one of the tactics insurance companies use to pay less. Remember, the claims adjuster works for the insurance company. It’s their job to save the insurance company as much money as possible.

How do you write a settlement letter to a claims adjuster?

The introduction letter explains to the claims adjuster that you’re interested in settlement negotiations. The section should consist of about two paragraphs. The first paragraph should include a list that states: the date of the incident, the alleged insured at fault, a brief description of what happened.

What should you not say to an adjuster?

Never say that you are sorry or admit any kind of fault. Remember that a claims adjuster is looking for reasons to reduce the liability of an insurance company, and any admission of negligence can seriously compromise a claim.

Can you ask the insurance company for a settlement?

Once you've made an estimate, you'll need to send a demand letter to the insurance company demanding fair compensation. A Demand Letter is a formal letter that outlines all of the damages you incurred from your accident. The objective with your demand letter is to make a case for the compensation you're entitled to.

How do you negotiate a higher settlement?

Let's look at how to best position your claim for success.Have a Settlement Amount in Mind. ... Do Not Jump at a First Offer. ... Get the Adjuster to Justify a Low Offer. ... Emphasize Emotional Points. ... Put the Settlement in Writing. ... More Information About Negotiating Your Personal Injury Claim.

Can you argue with an insurance claims adjuster?

After considering their argument, you can form a counter-argument. An adjuster can bring up a few things, however, that you should prepare for. When you enter negotiations with the insurance company and/or claims adjuster you should have a desired settlement in mind, as well as a minimum settlement you will accept.

Do insurance companies want to settle quickly?

Insurance companies want to settle cases right away, because they don't want you to have an opportunity to speak to a personal injury lawyer. If an insurance company is offering you any money, it is always advisable that you at least have a consultation with an attorney.

Do insurance companies try to get out of paying?

Insurance companies will seek to decrease or eliminate payments for injuries caused by an insured person's actions. After becoming injured, victims of accidents want nothing more than to move on from the traumatizing experience.

How do you respond to a low settlement offer?

Steps to Respond to a Low Settlement OfferRemain Calm and Analyze Your Offer. Just like anything in life, it's never a good idea to respond emotionally after receiving a low offer. ... Ask Questions. ... Present the Facts. ... Develop a Counteroffer. ... Respond in Writing.

Should I accept first offer of compensation?

Unless you have taken independent legal advice on the whole value of your claim, you should not accept a first offer from an insurance company.

How long does it take to negotiate a settlement?

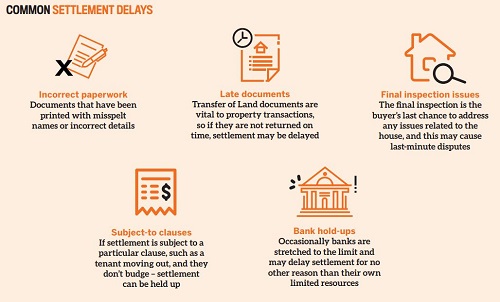

The average settlement negotiation takes one to three months once all relevant variables are presented. However, some settlements can take much longer to resolve. By partnering with skilled legal counsel, you can speed up the negotiation process and secure compensation faster.

What happens if insurance doesn't pay enough?

If your insurance claim check is not enough, take a second (or third, or fourth) look through your insurance policy to see if you can find anything that might help you win your case against your insurance company to get them to give you a higher settlement.

How do you negotiate with an adjuster?

If you are wondering how to negotiate with an insurance adjuster during an auto total loss claim, there are some steps you can follow.Determine what the vehicle is worth. ... Decide if the initial offer is too low. ... Negotiate with your insurance adjuster. ... Hire an attorney. ... Obtain a written settlement agreement.More items...•

How long does it take to receive compensation after accepting offer?

In some cases, insurers will process the compensation payout within a few days. In most cases, though, you will have to wait between two and four weeks to receive your compensation.

What do I do if my insurance offer is too low?

Here are five steps to take if the insurance company is lowballing you:Get Help from an Attorney. ... Make Sure It Is Actually a Lowball Offer. ... Figure Out Why the Insurance Company Is Lowballing You. ... Collect the Evidence You Need to Prove Your Claim. ... Keep Negotiating and/or File a Lawsuit in Court.

How long does it take to get a settlement offer?

The average settlement negotiation takes one to three months once all relevant variables are presented. However, some settlements can take much longer to resolve. By partnering with skilled legal counsel, you can speed up the negotiation process and secure compensation faster.

How do you negotiate a total loss settlement?

If you are wondering how to fight an insurance company for a totaled car, here are five helpful tips for negotiating a better settlement.Gather All Evidence and Documentation. ... Prepare a Thorough Counteroffer. ... Look for Comparable Values in Your Area. ... Get the Insurance Company's Offer in Writing. ... Make Your Counteroffer.

How do you respond to a low settlement offer?

Steps to Respond to a Low Settlement OfferRemain Calm and Analyze Your Offer. Just like anything in life, it's never a good idea to respond emotionally after receiving a low offer. ... Ask Questions. ... Present the Facts. ... Develop a Counteroffer. ... Respond in Writing.

What happens after a successful negotiation process with a claim adjuster?

After a successful negotiation process with a claim adjuster, the insurance company may offer an amount primarily. The amount is not enough to carry on your treatment cost and loss of damage. You have the way to reject or deny the first offer made by the insurance company. There is no chance to reduce the loss amount.

What is a claim adjuster?

A claim adjuster is a person who collects information about an accident from a different source. He is the case handler and investigates the accident to make a report against your demand letter. He goes to the spot, checks the vehicle, takes hospital records, gets a statement from the eye witness, and collect information from the police report and more information if needed.

How to negotiate an insurance claim?

An adjuster from the insurance company will arrange a negotiation table where your demand will be reviewed and checked. The first call of the insurance company to pay an amount, adjuster will make weakness and strengths of the claim. Both of you and adjuster will have a lot of points and there may be disagreement with the adjuster. But you don’t worry because you have evidence and all related paper-based information to support the negotiation process on behalf of your case.

How does negotiation work?

How Negotiation Process Works. The negotiation process is really a critical issue because the insurance company will try to reduce the compensation amount. But you may lawfully get your compensation according to the insurance policy . The insurance company must pay for the injured person as compensation.

Why is a demand letter important?

This letter is so important because this letter is going to the insurance company to make sure you can get fair and maximum compensation due to an accident. This demand letter also should be strong enough to make the insurance company arrange your compensation.

Why is it important to hire an attorney?

An attorney makes every difficult issue simple and your negotiation process may be easier as an attorney has vast knowledge in dealing with this issue. It is also an important issue to learn that your insurance value will be higher in case the insurance company knows that you have hired an attorney.

What is demand letter?

A demand letter is a paper that explains your loss amount as demand to either your own insurance company or at fault’s driver’s insurance e company. You can sue to at fault’s drivers’ insurance company if the driver has the full liability of the accident. A demand letter is the starting process to negotiate a settlement.

What is a claim adjuster?

If you're negotiating a personal injury claim with an insurance company, you'll probably be dealing with a "claims adjuster.". It may be helpful to understand how the adjuster typically operates before you put together a written demand letter, and certainly before you accept (or reject and counter) a personal injury settlement offer.

What do adjusters think about in a personal injury case?

In order to value the case, the adjuster has to think about two things: 1) what are the claimant's chances of winning at trial if a personal injury lawsuit is filed in court, and 2) how much might a jury award the plaintiff in damages?

What does an insurance adjuster do?

Just like an attorney, an insurance adjuster will want to investigate and get a full understanding of the facts of the underlying accident and the claimant's injuries and other losses (called " damages " in legalese).

What documents do you need to file a personal injury claim?

The adjuster will usually request documents such as medical bills, proof of earnings, tax returns, and proof of property damage.

What is a third party claim?

If you're making a claim with the insurance company of the person you think is responsible for your accident, you're making a "third party" claim. The first thing the adjuster will want to find out is what the policyholder (that's the person you're saying is at fault for the accident) has to say about what happened. Besides talking to the insured person to hear his or her story firsthand, the adjuster will read any police report or accident report related to the incident.

What percentage of settlement is offered?

For example, the insurer may require that the first offer be 40% of the value of the case. There is no industry-wide standard on this. Different insurers have different procedures. Learn more about factors that determine personal injury settlement value.

Is there an industry wide standard for personal injury settlements?

There is no industry-wide standard on this. Different insurers have different procedures. Learn more about factors that determine personal injury settlement value. One very important point is that adjusters often have leeway to adjust the first offer depending on who they are dealing with.

What does a claims adjuster do?

Claims adjusters will determine how much it will cost to repair your car. But knowing the actual value of your car can help you when you negotiate for a more fair claim. An insurance company’s first offer will most likely be extremely low. Do not accept this initial offer.

What to not say to an insurance adjuster?

What Not to Say to an Insurance Adjuster. Remember that the insurance claim adjuster works for the insurance company of the at-fault party. They will do everything they can to reduce the settlement amount you will be paid after your accident. One way they do this is by trying to get you to admit some liability.

What is the statute of limitations for an auto adjuster in Florida?

They also may try to claim you took too long. This is to try to scare you into thinking you are outside the statute of limitations window. The statute of limitations in Florida for auto accidents is four years. If they are delaying contact, the best way to fight back is to hire an attorney.

What is a personal injury settlement?

Your personal injury settlement can include compensation for medical bills, lost wages, property damages, and your pain and suffering. It is critical for accident victims to have proper representation. When you partner with our personal injury attorney, we will make sure insurance adjusters give you everything you are entitled to.

How to negotiate an auto insurance claim?

An insurance company’s first offer will most likely be extremely low. Do not accept this initial offer. When negotiating, you should keep these factors in mind: 1 The true value of your automobile 2 A fair settlement for damages to your automobile or other property damages 3 Medical bills, both immediately following the accident and for potential long-term medical expenses 4 Pain and suffering caused by the accident 5 Lost wages or income due to missing work from your injuries

How to interview a doctor for insurance?

Working With Doctors: Insurance agents will sometimes interview your doctor with close-ended questions. Your doctor must talk about your condition in detail. This will help to avoid unintentionally downplaying your injuries. Insurance companies may also conduct an independent medical examination. This will be with a doctor of their choice. If your insurance company requests this, talk with your personal injury attorney first.

What is a fair settlement?

A fair settlement for damages to your automobile or other property damages. Medical bills, both immediately following the accident and for potential long-term medical expenses. Pain and suffering caused by the accident. Lost wages or income due to missing work from your injuries.

What is settlement demand?

In lawyer talk, a “settlement demand” refers to your request for a specific amount of money to settle the case (i.e., “we will accept $150,000 to settle this case, that is our demand.”) This can happen before a lawsuit is filed or after.

What happens if you write a demand letter for an accident?

If your case does not settle, and you wrote your own demand letter, you can (in limited circumstances in under specific scenarios) be cross-examined and impeached on your summary of the accident in that letter. The phrasing you used to describe the accident can be craftily used by an insurance lawyer to kill your case.

What is an injury impact statement?

A car accident impact statement, sometimes called an injury impact statement, is an exhibit (a separate document) that is attached to your demand letter and included as part of the settlement demand package that you send to the insurance adjuster to begin negotiations to settle your claim.

How long does it take to understand a personal injury case?

It takes years, and hundreds of cases, to understand case values in personal injury cases and calculating their worth . Kindly put, you do not know how much your case is worth.

What is demand letter?

The demand letter gives the insurance company that knowledge. It really is just what it sounds like – a letter, sent to the insurance company for the driver that caused your accident. If multiple other cars/drivers caused your accident, the letter would be sent to all of them.

How to write a police report for a demand letter?

1: Keep the Liability Story Short and Simple. Assuming the police report’s narrative is helpful for you, include a copy of the police report and use that description in your demand letter. Do NOT add any more to that description. Remember, anything you say can and will be used against you.

What does a lawyer do when you have a personal injury claim?

In most, but not all, personal injury claims, the lawyer will write a demand letter to the insurance company to get that money for you.

1. Asking Leading Questions

Adjusters often ask questions to prompt the claimant to say something that hurts their claim. These questions often seem safe to an unsuspecting claimant who doesn’t realize they’re making statements that could reduce their compensation.

2. Minimizing Your Injuries and Treatment

Insurance companies don’t want to pay any more than they have to for your injuries. The adjuster will likely try to minimize the seriousness of your injuries or say your treatment was excessive.

3. Arguing Your Lost Wages

Some injured claimants will “milk” their time off work after an injury. Adjusters can be so jaded that they think everyone does this. Make sure you can verify the days you missed work with doctor’s orders and a statement of lost wages from your employer.

4. Making Lowball Offers

The initial settlement offer will likely be much lower than you deserve. Again, don’t get upset or lash out at the adjuster. It’s just business to them.

5. Blaming You for the Accident

Adjusters often try to reduce injury claim payouts by trying to pin some of the blame for the car accident on the victim.

7. Downplaying Your Pain and Suffering

Adjusters will always try to reduce the amount they pay for non-economic damages, also known as pain and suffering. There are no objective measurements, like bills or receipts, to quantify these damages.

Wrapping Up a Fair Accident Settlement

Sharon did her homework before she sent her demand for compensation to the insurance company. She calculated what her claim was worth and knew that both sides would have to compromise to reach a fair settlement.

What is a demand letter for insurance?

A demand letter is a factual summary of your claim, which includes all injuries (major or minor), loss of wages, emotional trauma (if applicable), and property damage.

What is the Proper Structure of a Demand Letter?

A demand letter should be broken down into three separate parts. In this section, the elements that should be included in the heading, the body, and the conclusion of the letter will be explained.

When Should You Send Your Demand Letter?

You may want to know when is the best time to send a demand letter. A lot of people send their demands right after the accident/incident occurs, which usually results badly. Here is the reason why. If a demand letter is sent too prematurely, then you won’t be able to list all your damages and expenses. Always wait to give your letter to the insurance company after your medical condition is stable and your doctor has given you a long-term outlook on what your health will look like in the future. After doing this, you will have exact estimations of your present damages and future ones.

What is the background of an insurance claim?

Background – The background is only a more descriptive summary of the incident that occurred. Describe where you were and what you were doing immediately before the accident, then how the accident occurred. Keep in mind, that your information must stay factual! If it didn’t happen, is irrelevant to the incident, or there is no proof to verify, then leave it out of the background. Your summary is the meat and potatoes of settlement. Anything you ask the insurance company is based on the description of the events that is listed in the demand letter. Any contradictory or wrong information could hurt your settlement.

What is insurance editorial guidelines?

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

Is a demand letter necessary?

A demand letter isn’t necessary but we strongly recommend writing one. How to write a demand letter to settle your insurance claim starts with a proper structure, from the heading to the conclusion. Read our guide to write a convincing demand letter to settle any insurance claims you may be waiting on.

Is Advertiser Disclosure affiliated with any insurance company?

Comparison shopping should be easy. We are not affiliated with any one insurance company and cannot guarantee quotes from any single insurance company.