You can find settlements belonging to you from a bankruptcy case, insurance company or even class action lawsuits. When assets are liquidated, the trustee uses the funds to pay the creditors. The payments are generally issued in the form of a check.

Full Answer

How do I settle my Discover credit card debt?

Discover Card Debt settlement programs You can work with a debt settlement organization or try dealing with the company yourself. customer service representatives can be a starting point of contact, but it is often necessary to ask for a supervisor or to escalte the issue. Discover Card can be contacted at (866) 567-1660.

Is 20% a good settlement from Discover Card?

So while the person who received a great deal, 20% was obviously even better. Another person received a settlement letter from Discover Card that was offering to settle and reduce the debt for 40% of their unpaid bills. They called them up after they received this.

How do I find unclaimed settlement checks?

If you search in a specific state, you'll see any unclaimed property, bank accounts or other assets reported in that state only. If you've lived in multiple states, go to each state website to run a search. The claim process varies by state, but you'll generally just need to produce proof of identity for an unclaimed settlement check.

Can I negotiate a settlement with discover after judgement?

I do not see settlements after judgment for less than 50% often at all. It is far better to negotiate a settlement prior to judgment, and prior to be sued too. But there are instances where defending a collection lawsuit from Discover will lead to the best savings result. I can email you a list in your state. Just post what state you are in.

How do I settle with Discover?

You can pursue this by calling customer service at 1 (800) 347-2683 or by reaching out to a representative using their online help center. However, if you are determined to pursue debt settlement, you can ask for that option instead.

How do I find my perfect settlement?

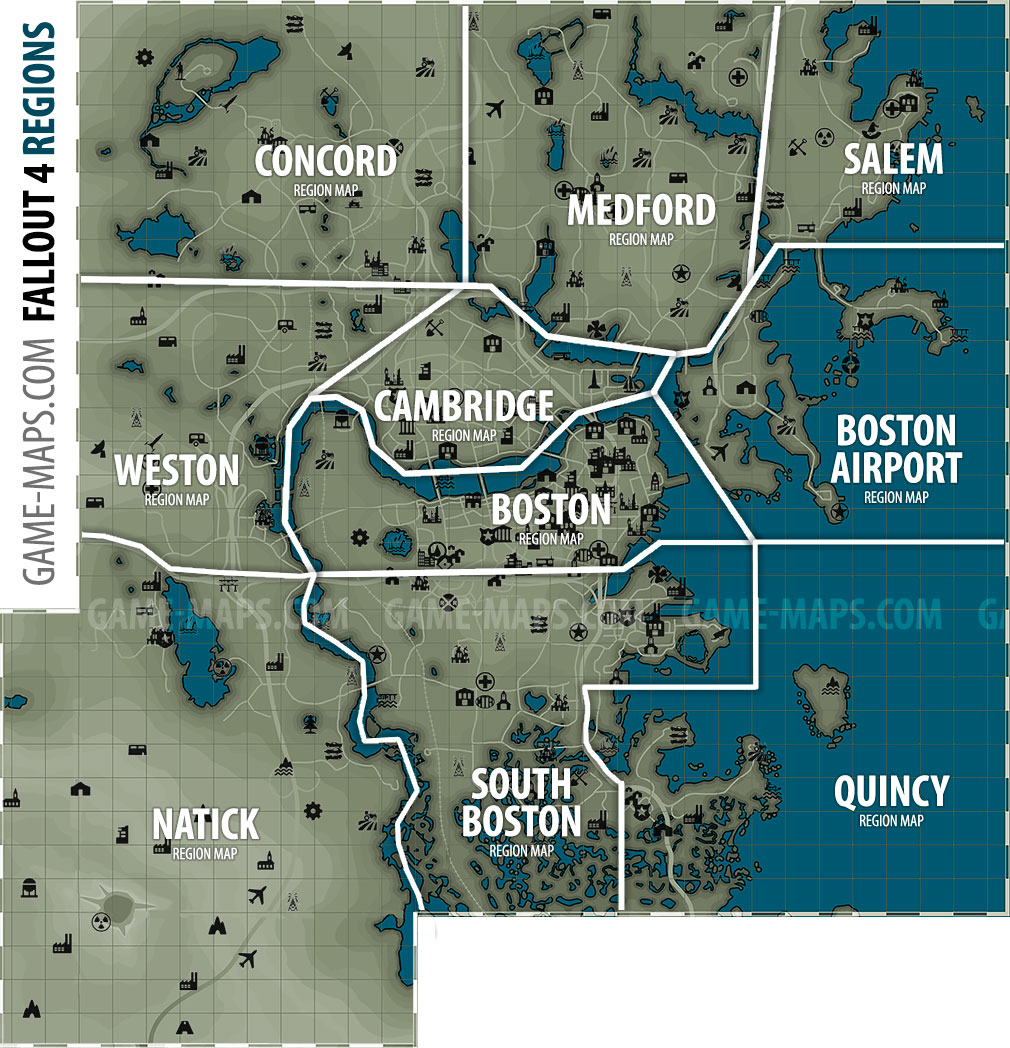

4:026:12How To Get The Perfect Settlement - No Man's Sky - YouTubeYouTubeStart of suggested clipEnd of suggested clipThere's nothing set in stone. So once you go ahead and activate a planetary chart then one of theseMoreThere's nothing set in stone. So once you go ahead and activate a planetary chart then one of these settlements will spawn. If you will. So in this case it spawned perfectly.

How do I find settlements on certain planets?

If you want to specifically choose which planet or moon your settlement will be on, then ignore the quest completely and instead go to the nearest space station. Talk to the cartographer there, and you'll be able to buy a settlement map (it'll cost 5 navigational data).

How do you ask a bank for a settlement?

Ask them if you can speak to the bank official or the manager in the debt settlement department. Explain the severity of your situation. Make it obvious that you have arranged a part of money in regards to settlement of the account before the money gets used up elsewhere.

How do settlements work?

A settlement agreement works by the parties coming to terms on a resolution of the case. The parties agree on exactly what the outcome is going to be. They put the agreement in writing, and both parties sign it. Then, the settlement agreement has the same effect as though the jury decided the case with that outcome.

How do you use a settlement chart?

0:448:08NO MAN'S SKY FRONTIERS PERFECT SETTLEMENT GUIDE ...YouTubeStart of suggested clipEnd of suggested clipAnd in case you don't know what i'm talking about uh you just come up here in the space stationMoreAnd in case you don't know what i'm talking about uh you just come up here in the space station whatever system you're in and you come to the cartographer. And it costs five navigational data to

How do I find other settlements NMS?

If all else fails, finding a new settlement is the top priority in No Man's Sky, head to the Cartographer in any space station or in the Anomaly. Settlement Charts can be purchased for five Navigation Data, and all that needs to be done is to find the follow the chart's guidance to a new settlement.

Are there settlements on every planet NMS?

There are several settlements per planet and they can be in close proximity or far away. Planets have multiple settlements. They can be found with Settlement Charts, purchased from the space station cartographer.

Is there only one settlement per system NMS?

Are there more than one settlements on one planet or only one per star system? You can only be overseer of one settlement at a time. If you accept being overseer of another settlement you will lose your previous one. Exactly one per save.

Is settlement good for credit?

Loan settlements impact on the CIBIL score When a loan is termed settled, it is viewed as a negative credit behaviour and the borrower's credit score drops by 75-100 points. The CIBIL holds this record for over 7 years.

Is it worth it to settle debt?

In general, paying off the total amount of debt you owe is a better option for your credit. An account that appears as "paid in full" on your credit report shows potential lenders that you have fulfilled your obligations as agreed, and that you paid the creditor the full amount due.

What is a reasonable full and final settlement offer?

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

How is settlement money divided?

The percentage of the settlement or judgment that attorneys charge does vary slightly, usually between 25% to 50%, depending on the type of case being handled.

What is the usual result of a settlement?

After a case is settled, meaning that the case did not go to trial, the attorneys receive the settlement funds, prepare a final closing statement, and give the money to their clients. Once the attorney gets the settlement check, the clients will also receive their balance check.

How are personal injury settlements paid?

When a settlement amount is agreed upon, you will then pay your lawyer a portion of your entire settlement funds for compensation. Additional Expenses are the other fees and costs that often accrue when filing a personal injury case. These may consist of postages, court filing fees, and/or certified copy fees.

How do I get my settlement from NMS?

If all else fails, finding a new settlement is the top priority in No Man's Sky, head to the Cartographer in any space station or in the Anomaly. Settlement Charts can be purchased for five Navigation Data, and all that needs to be done is to find the follow the chart's guidance to a new settlement.

How much can you settle debt with Discover?

The staff at Consumer Recovery Networkclaim that people can reach settlements ranging from 40 to 60 percent of the original debt, but adds that some accounts are flagged for no negotiations at all. Discover's debt settlement department bases their decisions on prior account usage, how long the person has been a customer and a "collectability" assessment.

Why do credit card companies settle debt?

To begin with, negotiating debt and arriving at settlements allows them to recover some of their money . Issuers also have the incentive to hold onto customers and will help people to forge lifelong relationships that could later be profitable. Company representatives may also be more willing to help people when they are facing dire situations like job loss or bankruptcy.

Why do people get into debt?

People get into debt because they lose jobs, face emergencies or have bad spending habits, but credit card issuers can sometimes help borrowers in these situations. The Discover Card settlement department works with issues like these all the time, and they also have a Financial Education Centerto help customers learn more about credit management and getting assistance.

How long does Discover debt consolidation last?

Discover debt consolidation loans are offered in terms from 36 to 84 months , and may be available for account holders who are at least 18 years old, have minimum household incomes of $25K and are U.S. citizens or permanent residents.

How long does it take for Discover to get charged off?

Discover cards get "charged off" when account holders are six months behind on payments. The debt is still owed, but the card cannot be used. For the best chances at a settlement, it is better to contact Discover's debt settlement department before this happens. It is also recommended to contact them in the last few weeks before that cutoff date. Otherwise, they might mark down the debt as being non-collectible.

What time does Discover call?

Call Discover at 1-800-767-1146 or 1-800-DISCOVER between 8 a.m. and 10 p.m. Eastern Standard Time weekdays or between 9 a.m. to 2 p.m. weekends. If you log into your account online, you can send a secure e-mail or initiate a live chat to discuss your situation.

What do you need to demonstrate in a negotiation?

You must demonstrate that your financial situation has deteriorated to where it's no longer possible for you to meet your obligations. If you've lost your job, or suffered a medical emergency that's caused a catastrophic rise in bills, for example, you need evidence of that in the negotiation.

What is the settlement agreement with National Systems America?

On January 14, 2021, the Division signed a settlement agreement with National Systems America, LP (NSA) to resolve claims based on its independent investigation into whether the company engaged in discrimination based on citizenship status in the hiring and employment eligibility verification processes in violation of 8 U.S.C. § 1324b (a) (1) (B) and (a) (6). The company recruits employees using a foreign company as its agent, and directly hires them to perform IT work for NSA clients. IER’s investigation concluded that the company (1) engaged in a pattern or practice of recruiting and hiring only U.S. citizens or U.S. citizens and lawful permanent residents for certain positions without legal justification, in violation of 8 U.S.C. § 1324b (a) (1) (B); and (2) on numerous occasions, requested copies of Permanent Resident Cards to confirm the citizenship status and work authorization of candidates who identified themselves as lawful permanent residents during the applicant screening process, in violation of 8 U.S.C. § 1324b (a) (6). Under the settlement agreement, the company will pay a civil penalty of $34,200 to the United States and train its employees on the requirements of the INA’s anti-discrimination provision, and be subject to departmental reporting requirements.

What is the settlement agreement with Adaequare?

(Adaequare) to resolve an independent investigation into whether the company engaged in citizenship or immigration status discrimination in violation of 8 U.S.C. § 1324b (a) (1) (B). IER’s investigation concluded that the company, which recruits workers for other entities, engaged in discrimination in the hiring or recruitment/referral for a fee processes by considering only applicants who were U.S. citizens and lawful permanent residents when filling a job for a client. Under the settlement agreement, the company will pay a civil penalty to the United States, train its employees on anti-discrimination obligations, and be subject to departmental reporting requirements.

What is the settlement agreement with Chancery Staffing?

On February 18, 2020, the Division signed a settlement agreement with Chancery Staffing Solutions LLC, aka TransPerfect Staffing Solutions , a legal staffing company headquartered in New York, NY. The Division had previously filed a lawsuit in May 2019 alleging that from at least April 4, 2017 to at least July 7, 2017, the company (while operating as TransPerfect Staffing), had implemented a client directive restricting its recruitment and hiring of attorneys for a document review project to U.S. citizens only, and later, to U.S. citizens without dual citizenship. Under the settlement agreement, Chancery Staffing will pay a civil penalty of $27,000, provide back pay to victims identified during the term of the settlement agreement, and participate in Division-provided training on the anti-discrimination provision contained in 8 U.S.C. § 1324b. Chancery Staffing will also obtain supporting documentation from clients that request a citizenship status restriction when staffing a project to help ensure that any such restriction is lawful.

What was the settlement agreement with Tuscany Hotel and Casino?

On October 10, 2012, the Department of Justice issued a press release announcing a settlement agreement with Tuscany Hotel and Casino resolving a lawsuit alleging the company discriminated against certain non-U.S. citizen s during the employment eligibility verification and reverification processes by requesting those individuals to provide more or different documents or information than required under Form I-9 rules based on their citizenship status. Under the terms of the settlement agreement, Tuscany agreed to pay a civil penalty of $49,000 to the government and full back pay to an economic victim. Tuscany will also receive OSC-sponsored training regarding the anti-discrimination provision of the INA, be subject to reporting and monitoring requirements, and will revise its employment eligibility verification procedures.

When did ChemArt settle?

ChemArt (Unfair Documentary Practices and Retaliation) June 2020. On June 3, 2020, IER signed a settlement agreement with ChemArt, a Rhode Island manufacturing company, resolving claims that the company discriminated against a worker during the employment eligibility verification process and then retaliated against her.

What is the Ikon settlement agreement?

On December 8, 2020, the Division signed a settlement agreement with Ikon Systems , LLC , resolving claims that Ikon routinely discriminated against U.S. workers (U.S. citizens, U.S. nationals, recent lawful permanent residents , asylees, and refugees) by posting job advertisements specifying a preference for applicants with temporary work visas, and that Ikon failed to consider at least one U.S. citizen applicant who applied to a discriminatory advertisement. Specifically, IER’s investigation found that from at least May 8, 2019, to September 21, 2019, Ikon posted at least eight job advertisements for information technology (“IT”) positions that solicited applications from non-U.S. citizens with immigration statuses associated with certain employment-based visas and, in so doing, harmed U.S. workers by unlawfully deterring or failing to fairly consider them for hire, including the Charging Party. Under the agreement, Ikon will pay a civil penalty of $27,000 to the United States, revise its policies and procedures, train relevant employees and agents on the requirements of the INA’s anti-discrimination provision, and be subject to departmental reporting requirements during the agreement’s two-year term. Separately, Ikon will pay the $15,000 to the Charging Party.

When did R.E.E. sign a settlement agreement?

On August 5, 2019, the Division signed a settlement agreement with R.E.E. Inc. d/b/a McDonald’s (“R.E.E.”) resolving charge-based and independent investigations into the company’s employment eligibility verification practices at McDonald’s franchises in the Texas Rio Grande Valley.

How long does Discover debt settlement last?

One customer had two accounts. They started the debt settlement process and program with Discover during the fall of 2008. While it was not possible to get some of the debt waived, they did come back and offer a hardship program. The program is to last for a period of one year. It was a great offer in that it reduced their minimum monthly payment by about 50% and it also lowered the interest rate down to 5%. While it wasn’t their top goal of getting the principal reduced, cutting the rate down and the monthly payments was a tremendous help.

What happened to Discover credit card?

In December 2019, a Discover Credit Card Holder lost their job and their wife was in the hospital. The balance due at that time was $12,371. The customer called Discover and asked for a settlement, which did not work.

How much was the original credit card debt?

The original credit card debt was around $5,000, then they want ahead and added all sorts of late charges and fees, which ended up bringing the total to over $6,000. Unfortunately the debt settlement company they were working with would only negotiate on the original starting balance of $5,000.

How to contact Discover Card?

Discover Card can be contacted at (866) 567-1660.

Does Discover offer debt settlement?

While Discover Card has a reputation of being difficult to get credit card assistance from, they do offer some hardship type services and also debt settlement programs to certain customers. Note that if you don’t pay them on time or proactively notify them of your financial challenges, then Discover will aggressively pursue unpaid bills. The company will often send the balances to collection agencies, in particular Zwicker and Associates PC.

Can you negotiate with Discover?

In addition some other ways to get assistance from Discover can include a lower interest rate, or debt management plans. Learn more on these Discover card hardship program.

Does Discover have a settlement?

Discover also has several different types of credit cards, and settlements may be possible on all of them. A customer that lives in California had the card that provides a rebate on their gasoline. They had about a $3500 balance on their account and missed a couple payments. The individual called the company multiple times, asked for a supervisor, and explained their situation. After about 10 calls, the company eliminated about 30% of their balance and provided two years for them to pay the balance on the account.

How to contact Discover debt?

If you would like to consult with me about your Discover debt you can reach me at 800-939-8357, choose option 2. If you are dealing with an attorney collecting for Discover, and want affordable legal help to handle the court process while working toward settlement, fill out a profile on this site and get help.

How long does it take to get a Discover card charged off?

Settling your Discover card before it gets charged off (6 months late), is most often going to be accomplished by speaking with a collections/recovery representative employed by Discover.

How do creditors deal with debt?

Creditors deal with things the way they want to; assignment and contingency collection agencies do things a certain way (often as dictated by creditors placing debt with them); debt buyers manage their operations and collection files in the way that makes sense for them. They can all make changes to their practices and recovery goals due to changes in the economy, internal data, legislative changes at the state and federal level, lawsuits they may have defended and lost, or succeeded in, new case law, decisions from higher courts, etc. Consumers electing for arbitration was an effective way to cause creditors and debt collectors to treat the file as a hot potato after the National Arbitration Forum was shut down several years ago. The effectiveness of the strategy was/is real, but is ebbing towards non effective as card holder agreements have been adjusted to eliminate clauses, arbitrators see this as a ploy, and creditors, like Discover, dig in and become stubborn. Stubborn can mean Discover, and other banks, are willing to spend the money taking some of the cases all the way through – even though the costs can far exceed what they can collect (especially given the fact that if they win the consumer can elect for bankruptcy).

Does Jay owe Discover money?

In the first comment Jay left on the other thread he said he owes a debt to Discover for 5200, but is being encouraged to dispute it. I do not know the context of what Jay read, or any comment exchange he had on another site, so I do not know if there was an outline given for the strategic purpose of disputing a debt Jay already knows is legitimate. But it does not matter. The general strategic purpose for disputing a legitimate debt is to buy time for some other reason, or with the expectation that the debt will be treated as a “hot potato”.

Can you settle a judgment debt after the fact?

If they get a judgment they are likely going to want to collect on it. But you can settle judgment debts for less, and set up payments after the fact too.

Does 1k settlement include attorney fees?

If you have an offer to settle fro 1k from Glasser and Glasser, that will typically also include attorney fees. How is the letter worded regarding what they will accept as settlement?

Should someone in Jay’s situation try the hot potato approach with his Discover credit card?

Should someone in Jay’s situation try the hot potato approach with his Discover credit card? No. Not in my opinion. Not when his goal is to resolve it, avoid being sued, and move on with his life.

How long does it take Discover to settle?

After 3-4 months of non-payment, Discover will send you a 40% settlement letter...unless there is something exceptional about your situation. They always refuse to talk settlement or hardship until the account is at least 3 months delinquent. The best pre-chargeoff settlement with Discover I have heard about is 30%.

What does it mean when a settlement is paid on your credit report?

A settlement will usually be marked on your report as "paid in settlement for less than the full amount owed."

How to negotiate a debt settlement?

Additionally, do the math on what settlement you can afford, both as a lump sum and in terms of monthly payments. Only sign a debt settlement agreement letter if you are confident you can afford the settlement.

What is debt settlement?

Debt settlement is the process of negotiating a lower repayment amount for an unsecured debt ( typically credit card debt). Debt settlement ends with the party who owes the money making a lump-sum payment to the creditor for the reduced amount, satisfying the person’s repayment obligation. A debt settlement agreement can.

What happens if you settle a debt?

The process of debt settlement will send your credit into a nosedive and ruin your relationship with your creditors. You also risk getting sued and the creditor refusing to settle. On the other hand, you could potentially resolve your debt problems by paying a fraction of the amount owed.

What happens when a debt settlement company agrees to settle a debt?

When an agreement has been reached, funds will be transferred out to settle the debt.

How many debt settlements are successful?

There’s also the risk that they’ll sue the debt holder for payment. … read full answer. Only about 10% of debt settlement cases are successful. When a settlement can’t be reached, debt holders are still responsible for the entire debt, unless they pursue an option like bankruptcy.

How much does Discover pay off debt?

Discover may settle debt for 30% to 60% of the original balance, according to our research. The percentage will vary based on whether the debt is still with Discover or in the hands of a debt collection company, as well as the financial situation of the person who owes the debt, and the age of the debt. Refer to the most recent notice sent regarding the debt in question to determine whom to contact about settling.

How long does a settlement stay on your credit?

This settlement will remain on your credit history for seven years and may cause your credit score to dip by over 100 points.

What form do you file if you are insolvent?

If you were insolvent at the time of settlement, you can file form 982 to avoid tax liability on the 1099 income.

Do you get a 1099 for a CA settlement?

It's important to see that language in their settlement letter so that the remaining debt isn't sold to a CA. Given the size of the debt assuming you settle, you'll more than likely receive a 1099 for the cancellation of the debt and have to pay taxes on it next year. Keep us posted on what you decide.