You can do so by selecting: Report>>Under Transaction Snaphot>>>Settlement Batch>>>Submit (a date range of a few days may need to be selected if a high volume merchant) A problem batch will display an error in red and have a box to check prior to hitting the Re-Attempt Settlement. Common Errors

Full Answer

What are batch and settlement in credit card processing?

It’s important to understand that while credit card transactions are processed in real time – meaning that when a transaction says it has been approved, it has been approved by the customer’s bank almost instantly – actually receiving those funds to your merchant bank account is not a real-time process. That’s where batches and settlements come in.

How often do merchants settle their batches?

For most merchants, settlement is typically done automatically at a set time each day. However, some merchants, like retailers and restaurants, prefer to manually settle their batches during their end-of-day cash out.

How can I grow my business with nmi?

Grow your revenue by offering more value to your merchants using NMI’s full commerce enablement platform. Create new revenue streams and increase merchant loyalty by providing a wide range of payment processing tools to your merchants under your own bank brand.

Why choose nmi for payments processing?

No matter what your industry or business model, NMI has a solution designed to streamline your payments processing. One-size-fits-all payment solutions don’t offer the flexibility most businesses need to scale.

How do I settle a batch in NMI?

To adjust the settlement time simply select the desired processor and select the appropriate time from the drop-down menu. Once you have the correct settlement time you make select "Update Settlement Schedule". You may view the history of changes made the settlement schedule on this screen by select "Show History".

What does NMI mean for payment method?

Network Merchants, Inc., or NMI, is a payment gateway service that provides processing for high risk merchant accounts. It has a high level of customization and allows users to pay using many methods. Moreover, NMI processes billions of dollars in payments each year, making it one of the largest gateways worldwide.

How do I add someone to my NMI account?

Log in to the merchant's gateway account >> Click on 'Options' >> Click on 'Settings' >> Under 'General Options' click on 'User Accounts' >> Click on the username that you would like to edit their permissions and notification.

Why is my credit card machine saying settlement failed?

While rare, occasionally a transaction will fail when the property attempts to settle credit cards. This can happen due to a guest exceeding their credit limit after the properties auth has expired, a card being canceled prior to settlement, a security 'hold' by the card holder's bank, or other reasons.

Is NMI payment safe?

NMI uses a PCI-compliant customer vault system that stores all secure payment info in a separate encrypted space. A business can secure card numbers, shipping addresses, routing numbers, and other sensitive details in a separate virtual vault. The data can be called upon through a virtual terminal as necessary.

Is NMI a payment processor?

NMI offers more payment processor and device options than anyone else in the industry.

How do I setup my NMI gateway?

NMI is a provider of electronic commerce and payment solutions....Configure the NMI Payment GatewayNavigate to Settings > Payments > Setup Payment Gateway.Click Gateway Type field and select NMI.Click create gateway.Specify field values.Click save gateway information.

How do you settle a batch on a credit card machine?

0:030:51How to Settle a Batch on the Ingenico Desk 3500 Credit Card TerminalYouTubeStart of suggested clipEnd of suggested clipBegin by pressing the six key select yes or no to close the batch and deposit your funds. Here youMoreBegin by pressing the six key select yes or no to close the batch and deposit your funds. Here you will see the total of sales and returns in the batch. Press the Left bar key to accept.

What is the batch settlement process?

During batch processing, the merchant sends the authorization codes for every credit card transaction to its payment processor, and the processor categorizes the transactions by the bank that issued each customer's credit card. Each of those banks then remits the payments to the merchant in a step called settlement.

What happens if you dont settle the batch?

If you don't settle within 24 hours, you're subject to higher interchange fees – typically in the range of 0.25% – 0.50%. For this reason, we always recommend settling on any day you process sales.

What does it mean when it says transaction not permitted to cardholder?

Transaction Not Permitted to Cardholder: What Does it Mean? Error code 58 means the transaction is not permitted to the cardholder. This error code means that the customer's card issuer cannot process the transaction. It also means the customer can't use this credit card for this transaction.

What does pick up card error mean?

What does pick up card mean? The error message “Pick up card” means that the customer's bank has declined the transaction as the issuer wants to retrieve the card. If you can do it safely, you are advised to keep the card.

What is pick up card?

“Pick Up Card” is an electronic payment code from the card's issuer declining the transaction and instructing the merchant to retain the card. The main reasons why a bank might refuse to authorize a transaction are: The card was reported lost. The card was reported stolen. The transaction was flagged as fraudulent.

What is do not honor code 201?

What does 'Do Not Honour' mean? In a nutshell, a 'Do Not Honour' error code comes up when the customer's card issuer is refusing to send an authorisation token back to your payment system. It's not necessarily anyone's fault; the issuer simply didn't validate the transaction.

What is NMI in Excel?

NMI provides a Batch Upload interface for merchants who store their customer details in formats such as Excel spreadsheets or CSV files and wish to upload these transactions into the gate way. The formats accepted are .csv (comma-separated value), .xls (Microsoft Excel) or .txt (text).

Where to find batch response file?

- To see the response file for you batch upload you will need to go to "View Batch History". This can be found near the top of the batch upload menu and you can download a response file for your upload.

How long does it take for a batch settlement to happen?

Here are the steps involved in a batch settlement. Several transactions, usually within a 24-hour time frame , are aggregated (batched) together and transaction information is sent to the acquiring bank from the processor.

What is a batch of credit card transactions?

When a transaction is approved, it is added to your batch. A batch is a group of transactions that have been processed but have yet to be settled. When a batch hasn’t been settled yet, it is called an open batch, and transactions in the batch can still be voided and reversed if needed.

What happens when a batch is closed?

Once a batch is closed, the settlement occurs when the processor receives the processed funds from each issuing bank whose credit cards were part of the batch. The total batch amount will then be transferred via bank-transfer to your bank account.

Can you close a batch and trigger a settlement?

Once you’re ready, you can close a batch and trigger a settlement. For most merchants, this is typically done automatically at a set time each day. However, some merchants, like retailers and restaurants, prefer to manually settle their batches during their end of day cash-out.

What do you need to know about batch settlements?

What You Need to Know About Batches and Settlements. If you’re a merchant accepting credit and debit payments for your business, then batches and settlements are an important part of your day-to-day. Settling the day’s transactions is what gets the money you earned from your customers into your business’s bank account.

How long does it take for a closed batch to settle?

Without holds, funds should appear in your bank account within 1-2 business days. Some processors have longer wait times and might make you wait 7-10 business days to receive your funds, while others might offer same-day deposits, but for a higher fee.

What is a Batch?

A batch is a group of transactions that have been processed but have yet to be settled. When a transaction is approved, it is added to your batch. When a batch hasn’t been settled yet, it is called an open batch, and transactions in the batch can still be voided and reversed if needed. This is important to know because voiding a transaction is less costly and time-consuming than refunding a transaction.

What is a Settlement?

Once a batch is closed and submitted, the business’s credit card processor receives the processed funds from each issuing bank whose credit cards were part of the batch (in other words, retrieving the money from every customer’s account). The total batch amount will then be transferred via bank-transfer to the merchant’s bank account.

Why is it important to settle a business?

If you’re a merchant accepting credit and debit payments for your business, then batches and settlements are an important part of your day-to-day. Settling the day’s transactions is what gets the money you earned from your customers into your business’s bank account.

How long does it take to settle a batch of cash?

If batches are left open for too long (typically 48 hours to 6 days), some processors will choose to automatically close and settle the batch, while others will let the unsettled transactions expire.

How long does it take for a transaction to be aggregated?

Several transactions, usually within a 24-hour time frame , are aggregated together into a batch and all the transaction information is sent to the payment processor.

Processors & Devices

NMI offers more payment processor and device options than anyone else in the industry.

SDKs & APIs

Build whatever you need with less time and effort, from integrating payments into your software to developing terminal devices pre-equipped with NMI payment processing.

Gateway Solutions

Select just the features you need for your merchants, from standard payment acceptance to advanced solutions that drive revenue.

One platform, all channels

NMI’s full commerce enablement platform powers payments in all the channels your merchants need: in-store, mobile, online or unattended.

A consolidated customer view

Our unified token vault uses a single token for each buyer’s payment credential, offering a consolidated view of customers with deep insights into behaviors and trends.

Make it your own

Our white-labeling capabilities let you present your brand to your customers, while our customization options empower you to fully control onboarding, pricing and services offered.

Why is it important to settle your batches?

It is important to settle your batches regularly to avoid expired transactions, and to make sure you're receiving your deposits in the fastest possible time. Most Virtual Terminals can be configured for automatic settlement every night.

Can you manually settle a batch in Virtual Terminal?

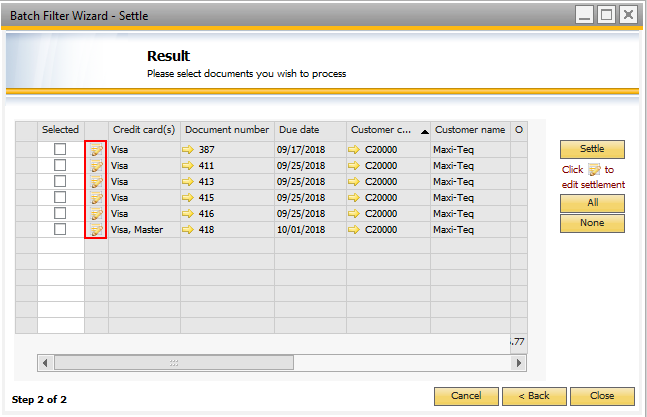

Even if automatic settlement is enabled, your batch can still be manually settled in the Virtual Terminal at any time. After signing in, move to the Batch Management menu. If you have both Credit Card and Virtual Check service, select the batch you wish to settle; otherwise, select whichever option is present: ...

What Is A Batch?

How Batch Credit Card Processing Works

Why Batch Credit Card Processing Is Used

- You will have to build out the document using the correct headers. Attached to this article are documents that outline the headers for batch upload. Once you have the file ready log into the merchant's account and go to "Other Services>Batch Upload". You have an option here between the Auto Detect File Format and to use a selected format. /// Auto-...

What Is A Settlement?

How Does The Settlement Process Work?

- Once a batch is closed, the settlement occurs when the processor receives the processed funds from each issuing bank whose credit cards were part of the batch. The total batch amount will then be transferred via bank-transfer to your bank account. How fast you receive a closed batch is up to your processor, as processors will sometimes place hold t...

Batches and Settlements History

Understanding Gross Settlements vs. Net Settlements