To enter vendor credits in QuickBooks

QuickBooks

QuickBooks is an accounting software package developed and marketed by Intuit. QuickBooks products are geared mainly toward small and medium-sized businesses and offer on-premises accounting applications as well as cloud-based versions that accept business payments, manag…

Full Answer

How do I get a vendor to accept payments through QuickBooks?

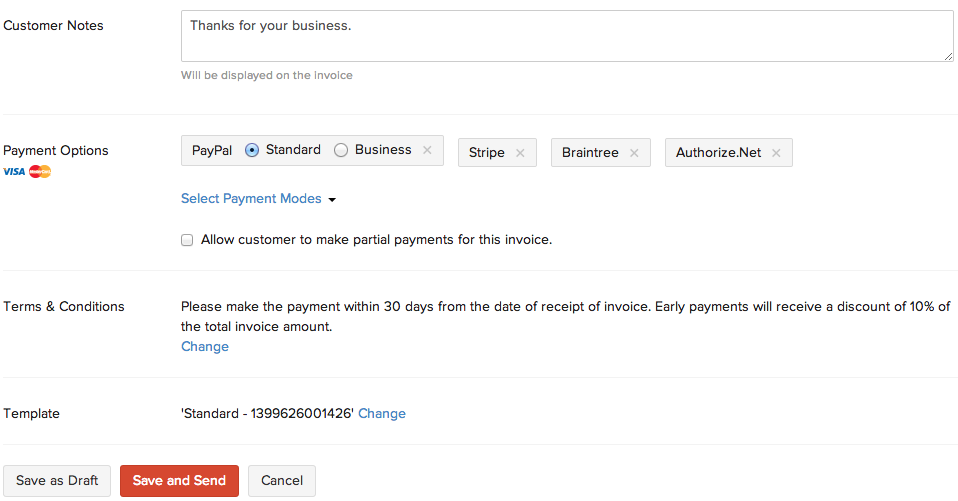

The vendor accepting payments through QuickBooks Online after the customer makes their bill payments. First, get the vendor bill into the QuickBooks Online system, either automatically or by manually entering it. When you receive a bill from a vendor, you can record it and pay it when it’s due. Select + New. Select Bill.

How do I record a QuickBooks Online early payment discount?

To record a QuickBooks Online early payment discount, begin by entering and creating the vendor credit, as described in QuickBooks Support: Create a Vendor Credit. Select + New. Select Vendor credit or Receive vendor credit. In the Vendor dropdown, select your vendor.

How do I record a vendor bill in QuickBooks?

Tell QuickBooks where you want vendor bill transactions to be recorded. Choose an expense account from the chart of accounts drop-down menu. Use the drop-down menu to note where this customer came from. Vendor types include: You can create a custom field for your vendor.

How do I enter a discount on a vendor Bill?

The U.S. QuickBooks Community on Intuit QuickBooks provides step-by-step instructions for the customer to enter a discount on a vendor bill when they pay the invoice with QuickBooks Desktop. The steps are: Go to Vendors menu. Select Pay Bills. Select the vendor bill. Click Set Discount. Enter the Amount of Discount. Select the Discount Account.

How do I record a settlement payment in QuickBooks?

How to record Settlement check with commission deductedOpen the affected invoice and click Receive payment.Enter the payment date and where to deposit the amount.Mark the invoice and enter the exact amount you've received ($3k).Click Save and close.

How do I record advanced payment to vendor in QuickBooks?

Advance payment to supplierGo to the Expenses, then select Supplier/Vendors.Click the supplier's name, and find the bill.Under the Action column, click the Pay Bills or Make payment link.From the Bill Payment page, put a checkmark on the check you've recorded under Credits.Hit Save and close or Save and new.

How do I record a prepayment to a supplier?

Option 1: Use Accounts Payable to record prepayment You can write a check to the vendor and record it to your Accounts Payable (A/P) account, decreasing the balance until you are ready to enter the final bill. Create a check for the vendor.

How do I enter a retainer payment and an invoice in QuickBooks?

Option 2. Invoice customers for deposits or retainersSelect + New.Select Invoice.Select the Customer name from the dropdown list.In the Product/Service column, select the Retainer or Deposit item you set up.Enter the amount received for the retainer or deposit in the Rate or Amount column.Select Save and close.

What is the journal entry for advance payment to vendor?

The entry now is to debit the proper Fixed asset account which is Leasehold improvement, close the Advances to supplier account by crediting it, and record the cash payment for the balance which is by crediting the Cash account.

What is the journal entry for advance payment?

Whenever an advance payment is made, the accounting entry is expressed as a debit to the asset Cash for the amount received. A credit also needs to be made to the liability account – something along the lines of Advance Payments, Unearned Revenue, or Customer Advances.

What is the difference between prepayment and advance payment?

Pre-paid is an amount more often paid for the expenses, the benefits from such payments will flow to the entity in the following financial years however the advance payment is the payment made for goods/services without the receipt of goods/services.

What is a vendor prepayment?

A vendor prepayment is a posting transaction that impacts the general ledger without offsetting the Accounts Payable account. When the vendor prepayment is applied, the Accounts Payable account is offset. Vendor prepayment transactions support the Multi-Book Accounting feature.

How do you record advance payments in accounting?

Advance payments are recorded as a prepaid expense in accrual accounting for the entity issuing the advance. Advanced payments are recorded as assets on the balance sheet. As these assets are used they are expended and recorded on the income statement for the period in which they are incurred.

How do you account for a retainer?

How should the legal retainer be booked in your accounting system?Book the Retainer in Prepaid Expenses.As future invoices come in, there are two options: Debit against the Retainer. ... TIP: Get solid invoices from your Law Firm, including hours, work completed.

How do I bill against a retainer in QuickBooks?

When you receive an upfront deposit or retainer from a customer, you need to record it.From the Customers menu, select Enter Sales Receipts.From the Customer:Job drop-down list, select the customer or job.If the Deposit To field appears, select the account into which to deposit the funds. ... Select the Payment method.More items...•

How do you invoice against a retainer?

How to draw from a retainerGo to Invoices > Overview and click New invoice.Select the client and choose to create an invoice for tracked time, expenses, or fixed fees, then click Choose projects.At the bottom of the New invoice page, you'll be asked if you want this invoice to draw from the relevant retainer.More items...

How do you record advance payments in accounting?

Advance payments are recorded as a prepaid expense in accrual accounting for the entity issuing the advance. Advanced payments are recorded as assets on the balance sheet. As these assets are used they are expended and recorded on the income statement for the period in which they are incurred.

How do I record an advance in QuickBooks?

QuickBooks Desktop PayrollGo to Lists, then Payroll Item List.Select Payroll Item ▼ dropdown, then New.Select Custom Setup, then Next.Select Addition, then Next.Enter the name of the item, such as Employee advance.Select the expense account where you want to track the item. ... Set the tax tracking type to None.More items...

What is the difference between advance and prepaid?

Pre-paid is more related to amount paid for expenses incurred/services rendered but the benifits of which will continue to flow in next financial years. This is normaly arises in case of services. Here the Chances of getting the amount back is very less or remote. Advance is payment without receipts of Goods/Services.

Where does Advances to suppliers go on the balance sheet?

Therefore, it makes sense to classify Advance Payments to Supplier as a Current Asset. They are categorized under the same heading on the company's Balance Sheet. It must also be noted that Advance to Suppliers is only recorded as a Current Asset if the order delivery date is less than 12 months.

Step 1: Enter a vendor credit

This makes sure the credit hits the expense account you use for this vendor.

Step 3: Use Pay Bills to connect the bank deposit to the vendor credit

Even though you aren’t paying a bill, this is the right thing to do. This last step is to keep your vendor expenses accurate.

Sign in for the best experience

Ask questions, get answers, and join our large community of QuickBooks users.

How to add a vendor in QuickBooks Pro?

Create A Vendor. To add a vendor in QuickBooks Pro, begin by going to Vendors>Vendor Center>New Vendor. Vendor Information is divided into five sections: Address Info, Payment Settings, Tax Settings, Account Settings, and Additional Info. The only required field is Address Information, but we’ll go over the others as well.

How to create a custom field in QuickBooks?

You can create a custom field for your vendor. Click the “Define Fields” button in the bottom right-hand corner of the screen. Then write a label for your custom field and select whether that custom field applies to contact, vendors, or employees.

Can you add billing rate levels in QuickBooks?

Much like customer pricing levels , it’s possible to create billing rate levels in QuickBooks. You can add one now or click the blue question mark to learn more about this feature.

What does QuickBooks want to know?

The first thing that QuickBooks wants to know is this a bill or did your vendor issue you a credit. The next thing it asks you is who is your vendor.

What does it mean when you check if an invoice is billable?

The other thing I want you to notice, there is a little checkbox. If this is checked, that means this is billable. What that means is, if you remember when we looked at invoices there was an option there to pull in any expenses that we wanted to pull into the invoice and turn around and invoice the customer for.

What module do you work with purchase orders?

We’re going to be working with purchase orders over in module six and this would be a way that you could go in and actually select a purchase order or a different one if you had pulled one in originally, you can enter the time.

Can you run a report on who owes you in QuickBooks?

That’s not wrong as far as QuickBooks is concerned. But the ideal way to handle this is to go ahead and put all of your bills that you know you’re going to owe in QuickBooks. That way you can run reports and see who you owe. How much are over 30 days, and so forth.

Why should a vendor record invoices in QuickBooks Online?

That’s because the customer has a choice of taking or not receiving the payment discount. The vendor doesn’t know which outcome will happen when invoicing the customer and for open invoices not yet paid.

How to receive payment in QuickBooks?

From the QuickBooks Home page or the Customers menu, select Receive Payment.

What is the subtotal on a vendor invoice?

In QuickBooks, the subtotal on the vendor invoice is before any sales tax. Ask your CPA about proper discount account coding for your business if you’re unsure. For example, QuickBooks may automatically code a customer’s early payment discount as a credit to other income.

What is the payment term on a vendor invoice?

Each vendor invoice includes the payment terms. This is to indicate any early payment discounts. These are usually given as a percentage of the total invoice amount before any sales tax.

What is invoice payment?

A customer making invoice payments after the receipt of goods or services .

Can you apply early payment discounts in QuickBooks?

Applying early payment discounts in Intuit QuickBooks Online and QuickBooks Desktop is easy. Coding bill payment discounts properly is part of the accounting process. Here’s a breakdown of how it all works:

Can early discount be credited to purchases account?

Your accountant may think that early discounts on inventory purchases should be credited to the purchases account instead, which reduces the cost of goods sold (COGS). Bookkeeping for early payment discounts is handled differently in QuickBooks Online and QuickBooks Desktop.