- Title the document. Begin your settlement agreement by titling the document in a way that informs the reader about what the agreement is.

- Identify the parties. You should write a paragraph that introduces the parties to the agreement (who is involved in it) and defines their roles.

- Provide a description of the dispute. In this section you will need to describe the "who," "what," "when," "where," and "how" of the dispute.

- Include a statement about what one party is going to receive in return for the release of the other party from any and all legal liability.

- Include a statement regarding the scope of the claims to be settled. ...

- State the conditions clearly. Sometimes, a conditional settlement agreement may be desirable. ...

- Spell out whether the release will include any admissions of fault or liability. ...

- State whether the settlement agreement will be confidential. Making your settlement agreement confidential ensures that neither party can discuss or reveal any of the terms of the settlement to ...

- Include a provision about the dismissal of any ongoing litigation. ...

- Ensure the settlement agreement includes your basic boilerplate provisions. Towards the end of your contract you will include any standard provisions that are usually found in contracts.

- Provide an area for signatures. At the very end of the contract you will make space for all parties to sign the contract.

Full Answer

Who fills out the settlement form?

The form is filled out by the agent who is completing the settlement. The form will itemize all the services and fees related to the process of purchasing or refinancing real estate.

What is a settlement statement or closing sheet?

This form is known as a Settlement Statement or Closing Sheet. It will be used when a party is purchasing or refinancing real estate. The form is filled out by the agent who is completing the settlement.

What is a settlement statement and when is it required?

It is better known as a Settlement Statement. This document is completed when someone is going through the process of buying or refinancing property, such as a home. The real estate agent involved in the sale will complete this document.

How do you write a settlement statement for a house sale?

A standard settlement statement has a column for the seller’s debits and credits on one side, a column for the buyer’s debits and credits on the other, and a description of the charge in the middle. Below we use the ALTA form as an example and break it down, line by line.

What is the most commonly used form for settlement statements?

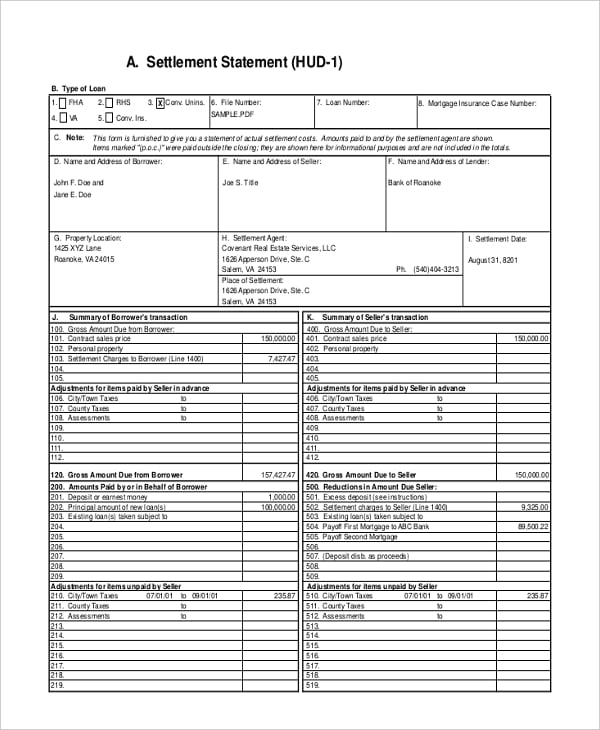

HUD-1 formA HUD-1 form, also called a HUD-1 Settlement Statement, is a standardized mortgage lending document. Creditors or their closing agents use this form to create an itemized list of all charges and credits to the buyer and to the seller in a consumer credit mortgage transaction.

Who fills out a HUD-1?

the settlement agentA HUD-1 or HUD-1A Settlement Statement is prepared by a creditor or, more typically, by the settlement agent who conducts the closing on the creditor's behalf.

How do I fill out a HUD-1?

Check the box for the type of loan. Fill in the property location and the name and address for the borrower, seller and lender. The settlement agent, date and location also are needed. Fill in the appropriate lines in sections J and K, which are summaries of the borrower's and seller's transactions, respectively.

What is the purpose of a settlement statement?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

Who prepares the HUD settlement statement?

A settlement agent, or closing agent, will prepare a HUD-1 settlement statement at the closing of a real estate loan. The final version will explicitly state all costs involved with the real estate loan and to whom the individual charges and fees will be paid to.

What is HUD statement called now?

If you applied for a mortgage after October 3, 2015, for most kinds of mortgage loans you receive a form called the Closing Disclosure instead of a HUD-1.

Is a settlement statement the same as a closing statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

Is closing disclosure same as settlement statement?

Closing Disclosure When you are in the process of closing, you will receive a settlement statement. They arrive three days before closing from your lender. This document is commonly known as the “closing disclosure.” Essentially, this is for buyers to review in advance before closing.

When should I receive the HUD-1 Settlement Statement?

In contrast, lenders must give you a closing disclosure at least three business days before closing. If you are taking out a HELOC, reverse mortgage or manufactured home loan and will be receiving a HUD-1 statement, you should ask your lender for the document at least a day before closing.

What is estimated settlement statement?

The Estimated Settlement Statement lists all of the costs and credits associated with the purchase of a home showing the buyer their total costs to close the transaction and showing sellers their net profit (or loss). Think of it as your detailed receipt that details information from various places on one page.

When can a settlement agreement be used?

A settlement agreement is usually used in connection with ending the employment, but it doesn't have to be. A settlement agreement could also be used where the employment is ongoing, but both parties want to settle a dispute that has arisen between them.

Who prepares the closing statement?

In real estate transactions, a closing agent prepares the closing statement which reflects the cost of the property for both the buyer and the seller. It is important that closing statements reflect the agreement of both buyers and sellers of properties, as well as a mortgage loan that backed up the home purchase.

What is a settlement statement for taxes?

The HUD-1 Settlement Statement is a breakdown of the expenses home sellers and homebuyers incur in a real estate sale. The settlement statement gives both parties a full picture of the expenses attached to the transaction.

What is a settlement statement quizlet?

Uniform Settlement Statement. Under RESPA, a lender must use HUD's Form 1 Uniform Settlement Statement to disclose settlement costs to the buyer. This form covers all costs that the buyer will have to pay at closing, whether to the lender or to other parties.

What is a settlement letter?

A settlement letter is a letter that provides a quote for the amount you need to pay in order to settle your vehicle finance account in full.

What is a settlement statement NZ?

Settlement statement – Your lawyer will check that the rates and any other utilities have been paid by the seller and are up to date. They will then send a settlement statement to your lender, showing the amount required to 'settle' the transaction.

How to resolve a claim in a settlement agreement?

Negotiate the scope of the release. You must negotiate the scope of the release in the agreement to determine which claims will be resolved, and whether any future claims are also resolved by this settlement agreement. You can negotiate a provision stating that the settlement agreement applies to all claims arising out of the dispute, whether they are current or not yet realized, or the settlement may resolve just one aspect of a suit or a single claim. This will depend on your needs.

What should be hammered out before writing a settlement agreement?

For example, payment arrangements and logistics should be hammered out before you write the settlement agreement.

How to settle a dispute between two parties?

1. Decide whether you have the need for a settlement agreement. A settlement agreement is a legally enforceable contract. They can be used in a variety of situations where two parties are in dispute about something and they wish to compromise on how that dispute will be resolved.

What is a settlement agreement?

A settlement agreement is a legally binding contract meant to resolve a dispute between yourself and another party so you do not have to go through the judicial process (or extend the judicial process if you are already in court).

How to settle a dispute with a mediator?

1. Agree on a statement of the dispute. Both parties are likely to have a differing view of the dispute. Before writing your settlement agreement, you must come to an agreement of the factual terms of the dispute. A mediator may be helpful in determining this.

What are the situations where a settlement agreement is used?

Some of the most common situations in which a settlement agreement is utilized include: disputes over damaged property; employment disputes between employers and employees; marriage disputes; and medical malpractice disputes.

What does "unconscionable" mean in a settlement agreement?

A settlement agreement must also not be "unconscionable.". This means that it cannot be illegal, fraudulent, or criminal. For example, you could not agree to settle a lawsuit in exchange for six pounds of cocaine, because the sale of cocaine is illegal in the United States. [11]

How many sections are there in an ALTA settlement statement?

There are a total of 11 sections in the ALTA settlement statement. Each of them highlights a particular type of cost associated with closing. Note that the debit and credit sections are listed against the seller and buyer on their respective sides from the second section which is where the costs are highlighted. Let’s go through all the sections.

What is the ALTA statement sheet?

One of the important documents in this pile is the ALTA statement sheet. The ALTA statement gives an itemized list of prices for the closing process. While the HUD-1 settlement statement used to serve this purpose before, it is now outdated.

How many types of ALTA statements are there?

There are 4 types of ALTA statements made according to their unique recipients. These four types of statements are:

What is the disbursement date?

Disbursement Date. The day when the seller is supposed to receive the payment in their bank account. The disbursement date is the same as the settlement date in most cases. Other Dates: Dates given for recording or anything that relates to transferring the title of the property.

What is flood determination fee?

Flood Determination Fee to. It is paid to get government approval on the property and that it is not located in an area prone to flooding.

Who pays for personal property?

Personal Property. These costs are paid by the buyer provided they want to purchase appliances or any furnishings along with the property. The amount is credited to the seller’s account and debited from the buyer’s.

Where are miscellaneous costs debited?

Miscellaneous costs are debited from the buyer’s account most of the time. However, a lot of time the sellers may agree to pay apart as well, and the costs are debited from the seller’s side. Here is the list of all miscellaneous costs. Pest Inspection Fee.

What do you put next to a statement that is true?

Put a checkmark ( ) next to the statement that is true for your situation. If neither statement is true, you may not use this form or the

How does a court decide spousal support?

Once spousal support is awarded, or reserved the court can change or set the amount or the length of time the spousal support is paid under certain circumstances. The division of property, once approved by the court, is final and can only be changed under limited circumstances.

What is the court order for dividing retirement assets?

If you decide to divide retirement assets , you’ll likely need an additional court order called a “Qualified Domestic Relations Order,” or QDRO, to make the division effective. A QDRO form

Can a settlement agreement be filed if it is not filled out?

If the Settlement Agreement form isn’t filled out completely and signed by both spouses, the form may not be accepted for filing.

Do you include a cover sheet when filing a form?

Don’t include this cover sheet when you file the completed form.

What is a HUD-1 Settlement Statement?

We can define the HUD-1 statement, also known as the HUD-1 form, as a settlement form that itemizes and reconciles all the charges that the buyer and seller pay in purchasing real estate. These charges include a loan origination fee and discount points.

Meet some of our Real Estate Lawyers

Mr. LaRocco's focus is business law, corporate structuring, and contracts. He has a depth of experience working with entrepreneurs and startups, including some small public companies.

How many sections are there in a settlement statement?

The settlement statement lists charges in three sections. The first section shows charges that cannot change. The next section outlines charges that cannot change by more than 10%, while the final section outlines charges that may change.

What is the first page of a HUD settlement statement?

The first page of the settlement statement has a transaction overview, including the amount of cash you need to bring to closing. The sections below are highlighted so you can have an idea of what they look like on the HUD-1 settlement statement you’ll receive.

How long do you have to give a closing disclosure?

In contrast, lenders must give you a closing disclosure three days before closing. Everyone taking out a HELOC, reverse mortgage or manufactured home loan should ask their lender for the HUD-1 document at least a day before closing to allow time to review the contents, fix errors and raise questions with the lender.

What is section 300?

No. 5 (Section 300): Cash at settlement from/to borrower. This section explains if you need to bring cash to the settlement. In most cases, the closing costs for a reverse mortgage refinance or HELOC will be subtracted from the loan, so you don’t need to bring funds to the closing.

How long does it take to pay down a HELOC?

You can borrow as much as you need up to your maximum loan amount, then pay it down to zero as many times as necessary during a set draw period that usually ends after 10 years.

What is a HUD-1 settlement statement?

A HUD-1 settlement statement, also referred to simply as a settlement statement , details every charge associated with your new loan. It also outlines who is responsible for each of those charges — the buyer or the seller — as well as any credits you may receive for things like taxes, insurance or deposits.

Do you need to review a HUD-1 settlement statement before closing?

If you’re getting ready to close on a mortgage, you’ll typically review a closing disclosure. However, if you’re taking out a home equity line of credit (HELOC), a mortgage for a manufactured home that is not attached to real estate or a reverse mortgage, you’ll need to review a HUD-1 settlement statement before you head to the closing table.

What is HUD-1 settlement statement?

The HUD-1 settlement statement is a standard government real estate form that used to be used as the standard real estate settlement form in all transactions in the United States which involve federally related mortgage loans.

What is HUD-1 form?

An HUD-1 Form is used by HUD. It is better known as a Settlement Statement. This document is completed when someone is going through the process of buying or refinancing property, such as a home. The real estate agent involved in the sale will complete this document. Because this document will be sent to HUD, a federal agency, ...

What is a HUD-1 settlement statement?

This form is to be used as a statement of actual charges and adjustments paid by the borrower and the seller, to be given to the parties in connection with the settlement. The instructions for completion of the HUD-1 are primarily for the benefit of the settlement agents who prepare the statements and need not be transmitted to the parties as an integral part of the HUD-1. There is no objection to the use of the HUD-1 in transactions in which its use is not legally required. Refer to the definitions section of the regulations (12 CFR 1024.2) for specific definitions of many of the terms that are used in these instructions.

Which lines and columns in section J are left blank on the copy of the HUD-1?

Lines and columns in section J which relate to the Borrower's transaction may be left blank on the copy of the HUD-1 which will be furnished to the Seller. Lines and columns in section K which relate to the Seller's transaction may be left blank on the copy of the HUD-1 which will be furnished to the Borrower.

Where should the charge be listed on the HUD-1?

However, in order to promote comparability between the charges on the GFE and the charges on the HUD-1, if a seller pays for a charge that was included on the GFE, the charge should be listed in the borrower's column on page 2 of the HUD-1.

Where do you find the charges on HUD-1?

As a general rule, charges that are paid for by the seller must be shown in the seller's column on page 2 of the HUD-1 (unless paid outside closing), and charges that are paid for by the borrower must be shown in the borrower's column (unless paid outside closing).

Who completes HUD-1?

The settlement agent shall complete the HUD-1 to itemize all charges imposed upon the Borrower and the Seller by the loan originator and all sales commissions, whether to be paid at settlement or outside of settlement, and any other charges which either the Borrower or the Seller will pay at settlement.

Which section requires no entry of information?

Section A. This section requires no entry of information.

Do you have to list flood insurance in line 1001?

In addition to the property taxes and insurance listed, some Lenders may require reserves for flood insurance, condominium owners' association assessments, etc. The amount in line 1001 must be listed in the columns, and the itemizations in lines 1002 through 1007 must be listed outside the columns.