Subject: Can you get a copy of your HUD 1 settlement statement if your title company has closed? Go to the land records office and get a copy of the Deed. If you don't want to, pay an attorney a few hundred dollars to get a copy. HUD-1 is irrelevant.

What is HUD 1 settlement statement?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction.

What is a HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a standardized mortgage lending form in use in the United States of America on which creditors or their closing agents itemize all charges imposed on buyers and sellers in consumer credit mortgage transactions.

What is form HUD 1?

A HUD-1 form, also called a HUD-1 Settlement Statement, is a standardized mortgage lending document. Creditors or their closing agents use this form to create an itemized list of all charges and credits to the buyer and to the seller in a consumer credit mortgage transaction.

What is a HUD 1 form?

The HUD-1 form is a three-page mortgage document required in certain cases. This document contains an itemized list of every fee charged for the loan. This form is also commonly referred to as a settlement statement because it’s one of the final pieces of paperwork that comes before the transaction officially closes, or “settles.”

Who provides the HUD settlement statement?

A settlement agent, or closing agent, will prepare a HUD-1 settlement statement at the closing of a real estate loan. The final version will explicitly state all costs involved with the real estate loan and to whom the individual charges and fees will be paid to.

When should I receive the HUD-1 Settlement Statement?

In contrast, lenders must give you a closing disclosure at least three business days before closing. If you are taking out a HELOC, reverse mortgage or manufactured home loan and will be receiving a HUD-1 statement, you should ask your lender for the document at least a day before closing.

What happened to the HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exception: reverse mortgages.

How do I get my HUD payoff statement?

Requests for payoff statements, subordinations, releases, and other documentation specific to these programs can be submitted to:Payoff Requests: [email protected] Requests: [email protected] Requests: [email protected] Partial Claim document submittal: [email protected] items...

Is closing disclosure same as settlement statement?

Closing Disclosure When you are in the process of closing, you will receive a settlement statement. They arrive three days before closing from your lender. This document is commonly known as the “closing disclosure.” Essentially, this is for buyers to review in advance before closing.

Is closing disclosure same as HUD statement?

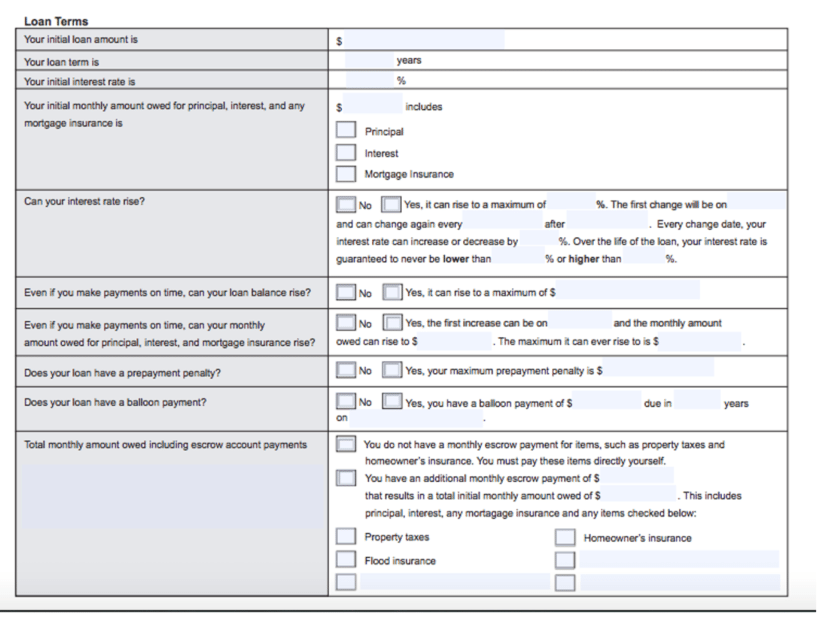

The Closing Disclosure combines and replaces the HUD-1 Settlement Statement and the final Truth-in-Lending (TIL) statement. The form mirrors the information provided on the Loan Estimate.

What is the HUD-1 now called?

Closing DisclosureThe Current Closing Disclosure The Consumer Financial Protection Bureau (CFPB) took over administration from HUD and replaced the HUD-1 with the Closing Disclosure in October of 2015.

What is the purpose of a HUD-1 statement?

A HUD-1 form, also called a HUD-1 Settlement Statement, is a standardized mortgage lending document. Creditors or their closing agents use this form to create an itemized list of all charges and credits to the buyer and to the seller in a consumer credit mortgage transaction.

When did the CD replace the HUD?

Oct. 3, 2015The Closing Disclosure, or CD, replaced the HUD-1 beginning Oct. 3, 2015.

How long does it take to get a payoff letter from HUD?

Under federal law, the servicer is generally required to send you a payoff statement within seven business days of your request, subject to a few exceptions. (12 C.F.R.

Can a HUD loan be forgiven?

A: FHA-insured borrowers are currently eligible for extensive loss mitigation assistance to prevent foreclosure and make mortgage payments more affordable. FHA is currently prohibited by statute from offering explicit principal forgiveness to FHA-insured loans.

How long do heirs have to pay off a reverse mortgage?

Upon the death of the borrower and Eligible Non-Borrowing Spouse, the loan becomes due and payable. Your heirs have 30 days from receiving the due and payable notice from the lender to buy the home, sell the home, or turn the home over to the lender to satisfy the debt.

How can I get a copy of my closing documents?

You can obtain a certified copy of these documents from the closing agent or from your real estate agent if you lose the originals. The closing disclosure contains all the official charges and credits of your home purchase.

What is the purpose of the HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance.

What is the HUD-1 now called?

Closing DisclosureThe Current Closing Disclosure The Consumer Financial Protection Bureau (CFPB) took over administration from HUD and replaced the HUD-1 with the Closing Disclosure in October of 2015.

Did you like how we did? Rate your experience!

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do HUD-1, steer clear of blunders along with furnish it in a timely manner:

How to complete any HUD-1 online

On the site with all the document, click on Begin immediately along with complete for the editor.

Video instructions and help with filling out and completing Hud Form

Hello everyone this is Jim with automatic poker comm and today I'm going to show you how to build a basic HUD from scratch now this HUD would be perfect for somebody just getting started using HUDs or for someone just looking for something very simple that they can use to get a few reads on their opponents at the tables now this HUD can be a starting point for someone and be expanded on later you can actually put pop-ups into this HUD to gain more expanded reads as you face different situations and just use this as a springboard to your play I will be building this HUD using Hold'em manager as you can see on the left hand side here this is the HUD building feature found within hold a manager once we are done the HUD we build will look like the one here on the right-hand side of your screen as you can see we have very few stats but each one of these stats serves a purpose and we will go through that as the video continues and as we build the HUD so hang tight and we'll get started shortly so if you aren't familiar with what a HUD is it is a acronym that means heads-up display but basically what it does is it takes all of the statistics that your tracking software tracks during hands and displays pertinent information as to the playing styles of your opponents and manifests it in a heads-up display on your tables so that you can use that information to make more accurate and better decisions at the poker table whether it be through Reed's or through basic mathematical analysis and frequencies but we're not going to get in all that complicated mumbo-jumbo I'm just going to show you a few stats tell you exactly how you can use those stats and show you how to build it here inside holder manager and then you can get off and start playing with your new HUD now this HUD will also I'm assuming be relevant for use and the other major software out there which is called PokerTracker so by using this tutorial you should be able to also build a HUD within that software as well but this is my favorite software to use so that's the one that I'm going to use to show you how to build your HUD so the first thing that we want to do is choose all of the stats that we want to include in this HUD well the first thing we have is vpip which is shown right here and that can be found to your right here under vpip and pick total vpip and then move it to the left by clicking this button right here and it will show up right here the next step that we want is total preflop raised so we go to the PFR section here and click total PFR and..

What is HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance. If you applied for a mortgage on or before October 3, 2015, or if you are applying for a reverse mortgage, you receive a HUD-1.

What form do you use for a refinance loan?

In transactions that do not include a seller, such as a refinance loan, the settlement agent may use the shortened HUD-1A form.

Who would have your copy of your home purchase?

the real estate attorney who handle d your home purchase would have it if you can not find your copy. I found it was one of those items that kind of got buried in ALL the paperwork.

Do mortgage settlements have to be filed at the recorder of deeds?

Your mortgage lender would have it and also the attorney who handled your settlement should have it. Settlement sheets are not filed documents at the Recorder of Deeds like Deeds, Mortgages, etc.

Do HUD 1 statements have to be recorded?

Otherwise, the lawyer who handled the escrow settlement is the place to go. HUD 1 Statements are not a matter of public record, they are not recorded with the county. Comment.