5 steps to rebuild credit after debt settlement.

- 1. Monitor your credit report. As you begin to settle your debts, keep an eye on your credit report. Check your report about 30 days after a debt ...

- 2. Apply for new credit.

- 3. Become an authorized user.

- 4. Pay your bills on time and in full.

- 5. Get a small loan.

- Check Your Credit Report Regularly.

- Dispute Errors on Your Credit Report.

- Make On-Time and Full Payments on Your Bills.

- Get a Secured Credit Card.

- Sign Up for a Credit-Building Program.

- Keep a Low Credit Utilization Ratio.

- Diversify Your Credit.

- Maintain Old Accounts Open.

How to settle your debts on your own?

How to do a DIY debt settlement: Step by step

- Determine if you’re a good candidate. Have you considered bankruptcy or credit counseling? ...

- Know your terms. You need to negotiate two things: how much you can pay and how it’ll be reported on your credit reports.

- Make the call. Dealing with your creditor will require persistence and persuasion. ...

- Finalize the deal. ...

How to negotiate credit card debt settlement by yourself?

How to negotiate credit card debt settlement yourself step-by-step Step 1: Define your goals. All debt settlement negotiations start with an offer – either a collector reaches out to you or you reach out to a creditor. It’s important when trying to negotiate a settlement that you have realistic goals.

What is the best way to settle debt?

Part 1 of 3: Negotiating the Debt Amount Download Article

- Read the judgment. Debtors and creditors should review the court order (judgment) to determine the total amount due and any specific payment instructions ordered by the court.

- Evaluate your financial situation. Whether you are the creditor or the debtor, you should review your finances before negotiating the amount of the debt.

- Contact the other party. ...

How to negotiate debt with creditors and debt reduction tips?

If you want to make a proposal to repay this debt, here are some considerations:

- Be honest with yourself about how much you can pay each month. ...

- Write down a summary of your monthly take-home pay and all your monthly expenses (including the amount you want to repay each month and other debt payments). ...

- Decide on the total amount you are willing to pay to settle the entire debt. This could be a lump sum or a number of payments. ...

How long does it take your credit to recover after debt settlement?

However, a debt settlement does not mean that your life needs to stop. You can begin rebuilding your credit score little by little. Your credit score will usually take between 6 and 24 months to improve. It depends on how poor your credit score is after debt settlement.

How many points will my credit score drop if I settle a debt?

100 pointsDebt settlement practices can knock down your credit score by 100 points or more, according to the National Foundation for Credit Counseling. And that black mark can linger for up to seven years.

Does debt settlement stay on credit?

How Long Do Settled Accounts Stay on a Credit Report? Settling an account will cause the status to show that you no longer owe the debt, but the account will stay on your credit report for seven years from the original delinquency date.

Does settled in full hurt your credit?

While settling an account won't damage your credit as much as not paying at all, a status of "settled" on your credit report is still considered negative. Settling a debt means you have negotiated with the lender and they have agreed to accept less than the full amount owed as final payment on the account.

Can I get loan after settlement?

The bank or lender takes a look at the borrower's CIBIL score before offering him a loan and if the past record shows any settlement or non-payment, his loan is likely to get rejected.

How many points will my credit score increase when I pay off collections?

Contrary to what many consumers think, paying off an account that's gone to collections will not improve your credit score.

Is it better to settle or pay in full?

Settling for Less Can Relieve Stress And it's important to know that paying your debt in full is the better option when it comes to your credit. If you can't pay in full, settling is better than defaulting on your debt and may relieve some stress for you.

Can you have a 700 credit score with collections?

Yes, it is possible to have a credit score of at least 700 with a collections remark on your credit report, however it is not a common situation. It depends on several contributing factors such as: differences in the scoring models being used.

Will settling a collection account raise my credit score?

When you pay or settle a collection and it is updated to reflect the zero balance on your credit reports, your FICO® 9 and VantageScore 3.0 and 4.0 scores may improve. However, because older scoring models do not ignore paid collections, scores generated by these older models will not improve.

How many points does removing a collection raise your credit score?

How much your credit score will increase after a collection is deleted from your credit report varies depending on how old the collection is, the scoring model used, and the overall state of your credit. Depending on these factors, your score could increase by 100+ points or much less.

How many points do you get for paying off collections?

Your overall credit profile As you might expect, this means that the higher your score was before having the debt sent to collections, the more you stand to gain by paying it off. This is responsible for the wide range (45–125 points) that we gave above.

Will settling a charge-off raise credit score?

Paying a closed or charged off account will not typically result in immediate improvement to your credit scores, but can help improve your scores over time.

How to rebuild credit after settling debt?

As you start settling your debts, there are five steps you can take to rebuild credit: 1. Monitor your credit report. As you begin to settle your debts, keep an eye on your credit report. Check your report about 30 days after a debt should have been settled to make sure the account status has been updated, Bovee says.

How long does settled debt stay on credit report?

Settled debt stays on your credit report for up to seven years from the time the account went delinquent (the date you missed your first payment). The older the debt gets, the less negative impact it will have, especially if you’ve started adding positive credit history back to your report. As you start settling your debts, there are five steps you ...

How badly has my credit been hurt?

How badly your credit has been hurt depends on factors like how behind you were on paying your bills and the age and number of the accounts you’ve settled. That’s especially true if you stopped making payments to your creditors to save up a lump sum settlement, which is something debt settlement companies will often ask you to do.

What to do if your credit report is not updated?

If your accounts aren’t being updated in a timely manner, or at all, contact the credit bureaus and get in touch with your debt settlement company if you’re using one. It’s important not to just assume that your credit report is being accurately updated. 2. Apply for new credit.

What is the biggest factor in your credit score?

The biggest factor, 35% in fact, for what determines your credit score is how you pay your bills. Paying your bills on time, and especially in full, will not only potentially help stop you from getting in credit debt trouble again, but also will keep your credit balances low, which accounts for 30% of your score. 5.

Does paying past due debt help your credit score?

If the past-due debts you settled were somewhat unusual for you and you otherwise have a history of successfully paying your debt, that will help your credit score rebound. The same is true if you still have open credit accounts, a mortgage or other loans that you are making timely payments toward.

Can you settle debts and rebuild your credit?

Once you’ve settled your debts, the best way to rebuild your credit is to open a couple of new credit accounts and then use them responsibly.

How long does it take to improve your credit score after debt settlement?

That shows lenders you are capable of paying your debts on time. Having other debt you’re still paying and are current on, such as a mortgage, car loan or other credit accounts will help, too. People with a fairly robust and positive credit history might be able to start improving their credit score in six months or possibly as little as half that time.

How long does it take for a debt to be settled before it is charged off?

If possible, it’s best to settle your debts before they are charged off. A charge-off is when a lender “writes off” a debt after 180 days of not receiving a minimum payment from you on the debt. However, you still owe the debt and it will still appear on your credit report. This is also the point where a lender might sell the debt to a third-party debt collector.

How is my credit score calculated?

When considering how debt settlement affects your credit score, first it’s helpful to understand the factors involved, and how each is weighed. There are three main consumer credit reporting bureaus — Experian, Equifax and TransUnion — and each have their own credit scoring methodology similar to the original FICO credit scoring model created in the 1950s. Here we’ll focus on the traditional scoring model, which is made up of five different categories, each weighing differently on your final credit score:

What happens when a lender writes off a credit card?

When a lender writes off your debt, they close your account and list it as a charge off, which hurts your credit score. For many people, though, it can be tough to both negotiate and come up with the money to settle several debts within a six-month time frame. So you might want to settle one card and target one that you can take care of before a charge off happens.

What is credit utilization?

Credit utilization measures how much of your available credit you’re actually using. For example, if you have a credit card with a $12,000 line of credit and you’ve charged $9,000 in purchases recently, that means your credit utilization on that one card is 75%.

Why is debt settlement negative?

The reason debt settlement is considered a negative mark on your credit report is because settled debts are those that you’ve paid off for less than what you owed. Which means you didn’t pay the debt in full or as agreed. In most cases, it’s better to settle a debt than to continue to miss payments, but it will still ding your score.

How long does a late payment stay on your credit report?

If you have no history of late payments, aka “delinquencies,” the account will remain on your credit report for seven years from the date the account was settled. Or if you did fall behind on your payments, the account will stay on your credit report seven years from when it first became delinquent and was never current again. But you can start improving your credit score before those debts disappear from your report. And the older those debts get, the less they’ll hurt your score.

How long does it take to settle a debt?

Debt settlement programs usually take 12 to 48 months to complete. During that time clients have a lot of practice making regular payments and the opportunity to learn about good financial habits. This financial reset can be a big confidence boost for clients who didn’t believe in their ability to have a good credit score or be “good with money.”

What percentage of clients enroll in a debt settlement program with poor credit?

Our survey found that 67.1% of clients who enroll begin with poor or fair credit scores, which may be symptomatic of their financial difficulties that led to pursuing debt settlement.

How to find out if debt relief is right for you?

Contact a Certified Debt Specialist to find out if debt relief is right for you.

What did Client 1 start with?

Client 1 started with a poor credit score which dropped slightly during the program but improved after they paid off their enrolled debt.

What percentage of clients with good scores graduate with a good score?

42.85% of clients who enrolled with good scores (670 to 739) graduated with scores that stayed the same or improved.

What percentage of clients with fair credit score graduated with a credit score that stayed the same?

For example, in our recent survey, 100% of clients who enrolled with fair scores (580-669) graduated with scores that stayed the same or improved. 88.46% who enrolled with poor scores (300-579) graduated with scores that improved or stayed the same. Clients with higher scores still saw credit score recovery and improvement but at a slower rate.

How to increase credit score after enrolled debt?

After your enrolled debts are settled and paid your score may continue to increase if you practice good habits. Paying your bills on time, keeping your balances low, and limiting new credit to essentials like one credit card and a car loan.

How long does a debt settlement stay on your credit report?

A debt settlement remains on your credit report for seven years. 3 . As with all debts, larger balances have a proportionately larger impact on your credit score. If you are settling small accounts—particularly if you are current on other, bigger loans —then the impact of a debt settlement may be negligible.

How to negotiate a debt settlement?

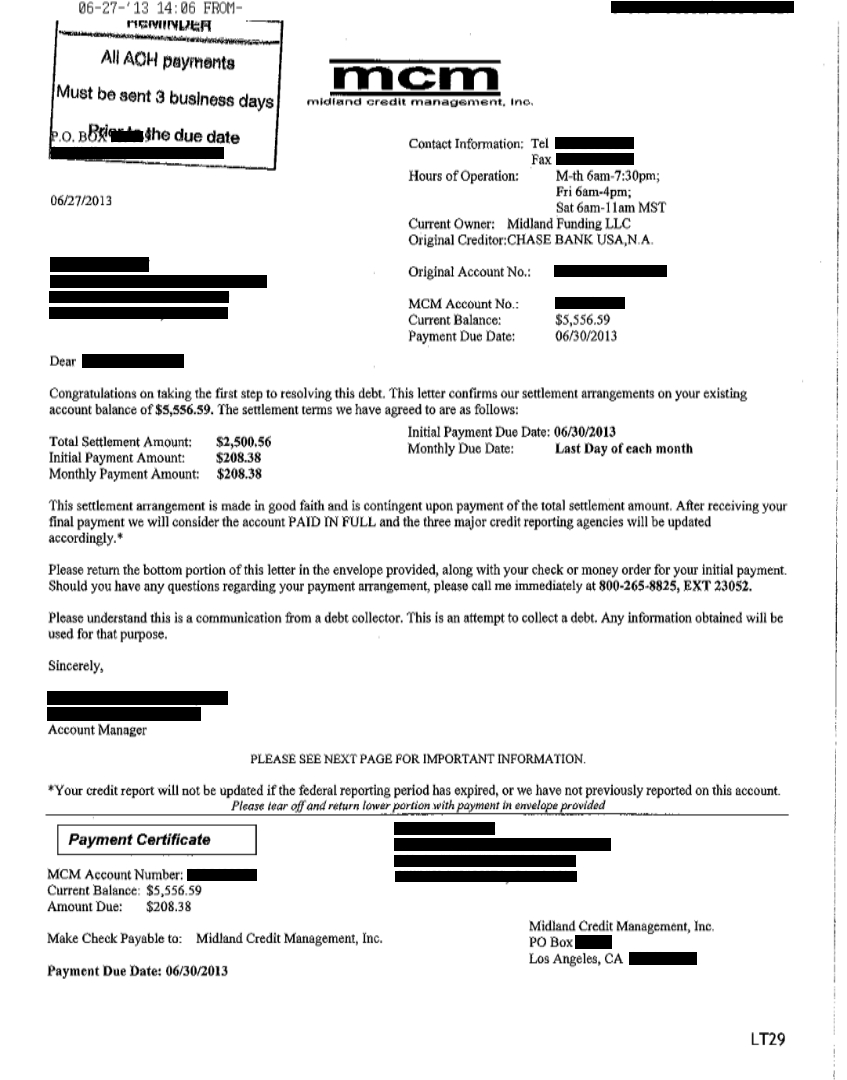

You can negotiate a debt settlement arrangement directly with your lender or seek the help of a debt settlement company. Through either route, you make an agreement to pay back just a portion of the outstanding debt. If the lender agrees, your debt is reported to the credit bureaus as "paid-settled.".

What Sort of Debt Should I Settle?

Since most creditors are unwilling to settle debts that are current and serviced with timely payments, you're better off trying to work out a deal for older, seriously past-due debt, perhaps something that's already been turned over to a collections department. It sounds counter-intuitive, but generally, your credit score drops less as you become more delinquent in your payments .

What is a debt settlement plan?

A debt settlement plan—in which you agree to pay back a portion of your outstanding debt —modifies or negates the original credit agreement. 1 When the lender closes the account due to a modification to the original contract (as it often does, after the settlement's complete), your score gets dinged.

What is a credit report?

As you know, your credit report is a snapshot of your financial past and present. It displays the history of each of your accounts and loans, including the original terms of the loan agreement, the size of your outstanding balance compared with your credit limit, and whether payments were timely or skipped.

Is a forgiven debt taxable income?

Think about taxes. The IRS usually considers canceled or forgiven debt as taxable income. 7 Check with your tax advisor about any possible tax implications of making a debt settlement.

Is debt settlement good for credit?

Facing past due debt can be scary, and you may feel like doing anything you can to get out of it. In this situation, a debt settlement arrangement seems like an attractive option. From the lender’s perspective, arranging for payment of some, but not all, of the outstanding debt can be better than receiving none. For you, a debt settlement packs a punch against your credit report, but it can let you resolve things and rebuild.

How long does it take to rebuild credit after debt settlement?

Your overall credit history will play a role in how fast your credit bounces back after settling a debt. If you otherwise have a solid credit history and have successfully paid off loans or are in good standing with other lending institutions, you could rebuild your credit more quickly than if you have a larger history of late payments, for example.

What is the purpose of settling debt?

Settling debt is essentially coming to an agreement with your creditors to pay back part of what you owe and be forgiven for the rest. If you’re at the stage of considering settling debt, then you’ve already missed several payments, probably months worth, which takes a toll on your credit. So how can you settle debt and minimize ...

How to get a debt collector to delete your credit report?

As part of your debt settlement negotiation, you may be able to get the creditor or debt collector to agree to report your account as paid in full or have them request to have it deleted from your report. You can suggest this in exchange for paying some of your debt or upping the amount you’re offering to pay. This is not all that likely to work with credit card banks and other lenders, but can be effective with medical and utility collections, and is also now part of the credit reporting policies at three of the largest debt buyers in the nation: Midland Credit Management (MCM), Portfolio Recovery Associates (PRA) and Cavalry Portfolio. You can learn more about each of these companies’ pay for delete policies here .

What percentage of credit score is based on unpaid debt?

If you have unpaid debt, then your credit score has already been affected. According to FICO, 30% of your credit score is based on the amount you owe on existing accounts. Late payments get reported to credit bureaus by lenders and then the delinquency is reflected in the credit score.

How to avoid a lawsuit?

To avoid a lawsuit, try to settle your debts before a charge-off occurs. Call the creditor or the debt collector and see if you can negotiate a settlement. If you have more than one debt, try to target one or two accounts to settle first, prioritizing those that are most likely to sue you.

What to do if you sell your debt to a third party?

If your debt has been sold to a third-party debt collector, you’ll have to contact the new debt owner, or the collection agency they’re using, in order to resolve the debt. Be clear about your financial situation. If they know you can’t afford to pay much, that could make them more willing to accept a lower settlement offer. Before you send them any money, get your agreement in writing.

What happens if you pay your credit card balance in full?

Keep in mind however, that if you pay your balances in full each month — meaning, you aren’t paying interest charges — your credit utilization will remain low no matter how much you borrow month to month. 3. Don’t close credit card accounts, even if you don’t use them.

How long does it take credit to recover after a debt settlement program?

Consumers usually begin to start new, unsecured credit within a year of completing a good program. Since you aren’t paying your full balance as agreed, debt settlement will have a negative impact on your credit score. A “Settled” status is much better than an “Unpaid” status, but any payment status other than “Paid as agreed” or “Paid in full” can hurt your credit.

What to do before trusting a debt settlement company?

Before trusting any company to shoulder the settlement tasks, make sure you find a legitimate debt settlement company which offers a clear path to debt recovery.

Why is lump sum payment more successful?

The lump-sum payment option is usually more successful because most creditors feel if you can commit to paying something over a period of time, you should be able to pay back what you owe even on a defaulted debt. Typically the only circumstance where a creditor will accept payments over a period is when it makes sense to break the payments up over a short time span. For instance, a $10k debt can be settled for $5k, then split into three payments of $1667.

How long does it take to rebuild your credit?

While the repair process may only take somewhere between 3-6 months, the time it takes to completely rebuild your credit can take longer. Generally 1 to 2 years is a reasonable amount of time to expect your credit to fully recover. Bearing in mind, this doesn’t take into account continued spending on new credit cards or loans after entering a relief program.

How to rebuild credit?

While starting to rebuild your credit, try and maintain different types of credit accounts. Manage the mix of your credit types effectively to get a quick and steady boost to your score . Lenders like to see a mix of types of credit to show your ability to pay under varying circumstances.

What is settlement in credit?

Settlement offers a way to pay your debt, without the interest or added fees. In addition, the amount you pay is less than what you owe. It sounds great, and it certainly can be, but consumer should be informed that their credit will take a hit.

Is it good to settle debt to improve credit score?

Going through a debt settlement plan eliminates your unsecured debts. Because of this, the debt-to-income ratio is immediately improved. This is a good thing for your credit score, and will continue to improve as your accounts are settled.