To get free credit monitoring or a cash payment (or both), you must submit a claim: online at EquifaxBreachSettlement.com, or through the mail. (Send your claim to Equifax Data Breach Settlement Administrator, c/o JND Legal Administration, P.O. Box 91318, Seattle, WA 98111-9418). You can opt to get payment in the form of a check or prepaid card.

Full Answer

What is the settlement with Equifax?

The company has agreed to a global settlement with the Federal Trade Commission, the Consumer Financial Protection Bureau, and 50 U.S. states and territories. The settlement includes up to $425 million to help people affected by the data breach. The initial deadline to file a claim in the Equifax settlement was January 22, 2020.

How much will Equifax pay you?

Equifax Might Owe You $125. Here's How to Get It A settlement with the FTC means Equifax will pay victims of its breach $125 or more. Make sure it pay ups. Save this story for later.

How much did Equifax pay out for the data breach?

As part of its $700 million settlement with the commission, Equifax set aside more than $500 million to compensate the millions of victims of the data breach.

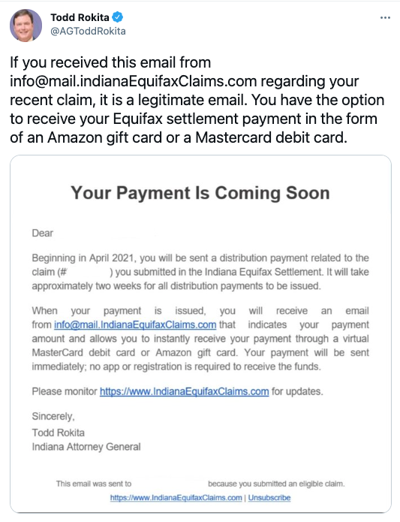

Did you get an email about free credit monitoring through Equifax?

Lots of people recently got an email or letter about free credit monitoring through the Equifax settlement. That’s because the settlement with Equifax was just approved by a court. So now, if you signed up for credit monitoring as part of that settlement, you can take a few steps to switch it on. The email or letter tells you how.

See more

Will I get money from Equifax settlement?

Status of financial reimbursement If you were affected by the Equifax data breach, you can still claim financial reimbursement for costs you incurred, or time you spent dealing with fraud or identity theft, after January 22, 2022. Claims are due by January 22, 2024. For more details, visit EquifaxBreachSettlement.com .

How do I get money from Equifax?

File a claim for Out-of-Pocket Losses or Time Spent Submit a claim to receive reimbursement for Out-of-Pocket Losses and/or Time Spent. You may claim Out-of-Pocket Losses, Time Spent, and Credit Monitoring Services under the Settlement depending on whether you file claim(s) during the Initial or Extended Claims Period.

How much will each person get from Equifax settlement?

Under the settlement terms, Equifax agreed to set up a fund to provide free credit monitoring and identity theft protection to consumers, as well as provide cash payments to people affected by the breach—up to $20,000 per person.

Will I get $125 from Equifax?

If you asked for money If you requested compensation of up to $125 or reimbursement for time spent recovering from fraud or ID theft, a check or debit card will be mailed to the address you used when submitting your claim. Be prepared for compensation that is much less than you requested.

How much can you get from a data breach settlement?

The settlement includes up to $425 million to help people affected by the data breach. The initial deadline to file a claim in the Equifax settlement was January 22, 2020.

How much was the Equifax settlement?

$425 millionEquifax data breach class action lawsuit settlement updates: On June 3, 2021, the 11th Circuit Court of Appeals upheld the $425 million Equifax data breach settlement.

How do I check my Equifax claim?

You can also log into your myEquifax account and view your status by clicking the “check status of a dispute” button. If you are checking your status by mail or phone, please make sure you have the confirmation number that was provided to you when you submitted your dispute.

Who qualifies for Equifax settlement?

You are a Settlement Class Member if you are among the approximately 147 million U.S. consumers identified by Equifax whose personal information was impacted by the Equifax Data Breach.

Where is my Bank of America settlement check?

Class members can expect settlement awards to be received by April 30, 2022. To view your check status, click here. Questions? Contact the Settlement Administrator at 1-855-654-0890.

Which banks use Equifax?

Banks that typically use Equifax dataDiscover it Cash Bank.Discover it Balance Transfer.Discover it Miles.Chase Freedom Flex.Chase Unlimited Freedom.Chase Slate Edge.Citi Double Cash Card.Citi Premier Card.

How does Equifax work?

1. We compile your credit history based on your credit accounts, using your Social Security number or other identification information. 2. We provide your credit information, in the form of credit reports, to lenders and creditors to help them determine your creditworthiness.

What kind of company is Equifax?

multinational consumer credit reporting agencyEquifax Inc. is an American multinational consumer credit reporting agency headquartered in Atlanta, Georgia and is one of the three largest consumer credit reporting agencies, along with Experian and TransUnion (together known as the "Big Three").

What is Equifax revenue?

4.92 billion USD (2021)Equifax / Revenue

What does it mean when Equifax settles with the FTC?

A settlement with the FTC means Equifax will pay victims of its breach $125 or more. Make sure it pay ups. Save this story for later.

How long does Equifax monitor credit report?

The settlement specifically allows for "at least four years of free monitoring of your credit report at all three credit bureaus (Equifax, Experian, and TransUnion)" and then "up to six more years of free monitoring of your Equifax credit report.". That's not as comprehensive as it sounds at first. At least, though, during the four years ...

How much compensation can you get for identity theft?

People who have already suffered identity theft or other damages as a result of the breach and have documentation to back it up are potentially eligible for up to $20,000 in compensation.

How much did Equifax pay for hacking?

An Equifax hack settlement promises a $125 payout. The truth is more complicated. Authorities announced that Equifax, the credit reporting company plagued by a massive 2017 data breach, will have to pay up to $700 million in their settlement. (Reuters)

What happens if you do nothing with Equifax?

Moreover, it means you will forfeit your right to sue Equifax for harm caused by the breach or continuing pursue separate claims you’ve filed.

How long do you have to file a claim for identity theft?

If you claim fewer than 10 hours, you only need to detail what actions you took and how much time was spent. You do not have to prove your identity was stolen directly as a result of the 2017 breach, but it has to have to occurred after the breach. You must file a claim by Jan. 22, 2020.

When do you have to opt out of Equifax?

If you don’t want to settle, and you want to keep the option to take legal action against Equifax as an individual, you must opt out of the settlement by mailing a written “request for exclusion,” postmarked by Nov. 19, 2019, to the settlement administrator.

Can you take legal action against Equifax if you do nothing?

Given all that, the biggest loophole you should be aware of is that if you do nothing, you will automatically waive your right to take legal action against Equifax in the future.

Is $125 enough for a hacker?

If you have spent or lost money as a result of the hack (legal or accounting fees, or the money you lost because someone stole your identity and charged a large amount of money on accounts in your name, the money you spent freezing and unfreezing your credit, postage, etc.) then $125 isn’t going to be enough.

Does Equifax cover $125?

Second, even if you file for reimbursement , there’s a good chance you won’t actually get the full $125 that Equifax and the FTC are talking about. Things are worded carefully in the agreement, but the bottom line is there’s a limited amount of money in the payout pool, and it won’t cover $125 checks for 147 million people.

How much can you claim for time spent on Equifax?

The Equifax settlement has a provision through which victims can claim a cash payment for "time spent.". This means that you can claim a rate of $25 per hour for up to 20 hours of the time you wasted dealing with the fallout of the breach.

How much can you claim for a credit freeze?

If you spent hours researching what to do about the breach, setting up credit freezes, hopping on the phone with your bank, or doing anything else remotely relevant, you can claim up to $250 for that time without needing to show any specific evidence.

Can you still get your money from Equifax?

The Equifax settlement process has been absurd, but don't worry. You can still get your money. Photograph: David Muir/Getty Images

Does Equifax have free credit monitoring?

The free credit monitoring Equifax offered after its breach has now expired, but many states offer a list of disclosed breaches that you can check. Many of those companies have given out free credit monitoring as recompense.

What happens if you are impacted by Equifax?

If you were impacted by the Equifax data breach, you may seek reimbursement for valid Out of Pocket losses or Time Spent (excluding losses of money and time associated with freezing or unfreezing credit reports or purchasing credit monitoring or identity theft protection) incurred during the Extended Claims Period if you have not received reimbursement for the claimed loss through other means.

When is the deadline to file a claim against Equifax?

The deadline to file a claim for Out-of-Pocket Losses or Time Spent that occurred through January 22, 2020 has passed.

When is the deadline for Equifax?

If you are a class member, the deadline to file Initial Claims Period claim (s) for free credit monitoring or up to $125 cash payment and other cash reimbursement passed on January 22, 2020.

When is the deadline for credit monitoring in 2024?

January 22, 20 24 (For future losses and time) File a claim for Credit Monitoring Services or Alternative Reimbursement Compensation. The deadline to submit a claim to receive the Free Credit Monitoring Services offered under the Settlement, or Alternative Reimbursement Compensation has passed.

When is the extended claim period for credit monitoring?

You may seek reimbursement for valid Out-of-Pocket Losses or Time Spent (excluding losses of money and time associated with freezing or unfreezing credit reports or purchasing credit monitoring or identity theft protection) incurred during the Extended Claims Period (between January 23, 2020 and January 22, 2024) if you have not received reimbursement for the claimed loss through other means.

Is the Equifax settlement final?

By order of the Court, the Settlement cannot become final until the appeals of the remaining objectors are resolved. In September of 2017, Equifax announced it experienced a data breach, which impacted the personal information of approximately 147 million people.

When is the extended claim period for out of pocket loss?

To be eligible, your claim for Out-of-Pocket Losses or Time Spent must occur between January 23, 2020 and January 22, 20 24(the “Extended Claims Period”).