You can call AT&T to pay your bill by following these steps: Dial *PAY on your AT&T phone (Spanish speakers should dial *PAGAR). Press 1 to pay with your bank account or press 2 to pay with your card.

Full Answer

How do I Pay my AT&T bill?

Try again. Learn about the convenient ways to pay your AT&T bill. Make payments online, over the phone, in person, and by mail. Online - You can sign in to myAT&T or make a fast payment without signing in. Use your checking or savings account, debit or credit card, and more.

How do I pay my autopay?

AutoPay - Automatically pay your bill each month using your checking or savings account or debit or credit card. Learn about AutoPay By phone - Use your phone to pay your bill on our mobile site, by text message, or by calling us. Learn how to pay by phone In person - We offer many authorized payment locations where you can pay your bill in person.

How do I make a payment on the mobile app?

1 Sign in (or sign up) to the app. 2 Select My Bill. 3 Click on Make a payment. 4 Input the amount of your bill you’d like to pay. 5 Choose your payment method and enter the details. 6 Select Continue. 7 Review and confirm your payment.

Where can I Find my EIP payment information?

Your Online Account: Securely access your individual IRS account online to view the total of your first, second and third Economic Impact Payment amounts under the “Economic Impact Payment Information” section on the Tax Records page. IRS EIP Notices: We mailed these notices to the address we have on file.

Are we getting a gas stimulus check in 2022?

The Gas Rebate Act of 2022 is legislation that would give a $100 monthly rebate (and $100 for each dependent) to help Americans pay for high gas prices. The idea is that payments would continue throughout 2022 during any month when the national average gas price is $4 or more (like right now).

What is the recovery rebate credit 2022?

Are we eligible to claim the credit? (added January 13, 2022) A5. If you file jointly with your spouse and only one individual has a valid SSN, you can claim up to $1,400 for the spouse who has a valid SSN and up to $1,400 for each qualifying dependent claimed on the tax return.

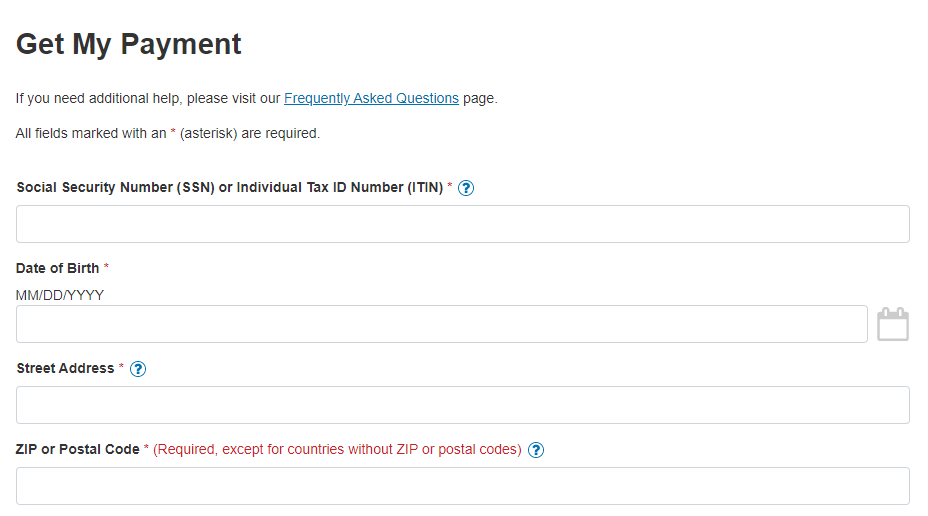

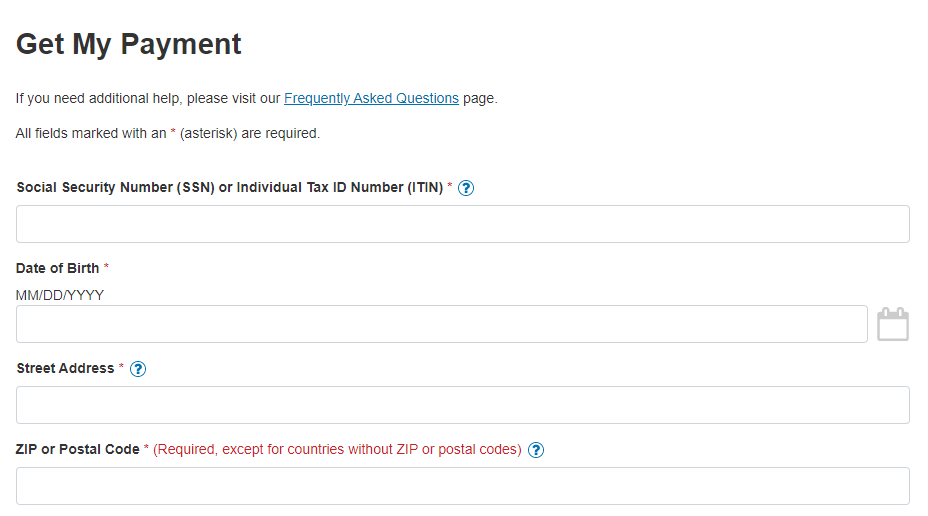

What is get my payment portal?

Stimulus Checks and Direct Deposit. While Get My Payment allows you to give bank direct deposit information to the IRS, you cannot change bank information with the IRS if it already has an account for you on file.

How can I find out if I received a stimulus check in 2021?

To find the amount of Economic Impact Payments issued to you, see your Online Account. The IRS has issued all first, second and third Economic Impact Payments. You can no longer use the Get My Payment application to check your payment status.

How will I receive my recovery rebate credit?

Your Recovery Rebate Credit will reduce the amount of any tax you may owe for 2021 or be included in your tax refund, and can be direct deposited into your financial account. You can use a bank account, prepaid debit card or alternative financial products for your direct deposit.

How do you claim recovery rebate credit?

If you didn't get the full amounts of the first and second Economic Impact Payments, you may be eligible to claim the 2020 Recovery Rebate Credit and must file a 2020 tax return – even if you don't usually file taxes - to claim it.

Is get my payment safe?

How to use Get My Payment. Available only on IRS.gov, the online application is safe and secure to use. Taxpayers only need a few pieces of information to quickly obtain the status of their payment and, where needed, provide their bank account information.

Is get my payment working?

The Get My Payment site is operating smoothly and effectively. As of mid-day today, more than 6.2 million taxpayers have successfully received their payment status and almost 1.1 million taxpayers have successfully provided banking information, ensuring a direct deposit will be quickly sent.

How much is Recovery Rebate credit?

The 2020 Recovery Rebate Credit is part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act that was signed into law in March of 2020. The initial stimulus payment provided up to $1,200 per qualifying adult and up to $500 per qualifying dependent. Most of these payments went out to recipients in mid-2020.

How do I know if I got the 3rd stimulus?

You can track the status of your third stimulus check by using the IRS Get My Payment tool, available in English and Spanish. You can see whether your third stimulus check has been issued and whether your payment type is direct deposit or mail.

How do I know if I received a third stimulus check?

Amount and Status of Your Third Payment You can no longer use the Get My Payment application to check your payment status. To find the amount of the third payment, create or view your online account or refer to IRS Notice 1444-C, which we mailed after sending your payment.

How many times have stimulus checks issued?

COVID-19 Stimulus Checks for Individuals The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible: $1,200 in April 2020. $600 in December 2020/January 2021. $1,400 in March 2021.

What does Amended mean on tax return?

An amended return allows you to correct mistakes on a federal tax return after tax filing. You will need to submit Form 1040-X, Amended U.S. Individual Income Tax Return.

How much is the recovery rebate credit?

They are able to claim a 2020 Recovery Rebate Credit of $2,900 on their 2020 tax returns.

How much was the 3rd stimulus check?

$1,400 per personMost families received $1,400 per person, including all dependents claimed on their tax return. Typically, this means a single person with no dependents received $1,400, while married filers with two dependents received $5,600.

What is the 1400 Recovery rebate credit?

The maximum credit is $1,400 per person, including all qualifying dependents claimed on a tax return. Typically, this means a single person with no dependents will have a maximum credit of $1,400, while married taxpayers who file a joint return that claims two qualifying dependents will have a maximum credit of $5,600.

How to Ask For Payment Politely

The following system only works after one stipulation is fulfilled:If you haven’t fulfilled your obligation to your client and given them great wor...

Step 1: Send Your Client A Payment Request

When you complete the deliverables for your client, it’s time to pull out that email script we gave you up front. What do you notice about the emai...

Step 2: Send A Follow-Up Email

If your client hasn’t responded in two weeks, send them a follow-up email. This message will be more firm and apply a little bit of pressure while...

How to Break Your Client’S Legs Firmly Ask For Payment

In life, though, there are four things that are guaranteed: 1. Death 2. Taxes 3. Frugalistas being wrong 4. Clients not paying you on timeAnd you m...

Step 3: Pick Up The Phone

If your client hasn’t responded to your messages after 3 – 4 weeks since the first email, you’ll want to call them.Calling people takes away the pr...

Step 4: The Nuclear Options

If for some reason your client continues not paying after three emails and a phone conversation, you have three options: 1. Cut ties with the clien...

How Do I Avoid This in The Future?

Remember: Prevention is always better than a cure. So to avoid getting a late-paying client again, you’ll want to make sure you: 1. Did the work. I...

Get The Scripts For Any Situation

As a freelancer, there are a seemingly unending amount of problems you’ll have to deal with over email. That’s why you need proven email scripts th...

View recent payments

Go directly to your bill summary page to see your info, including payments received and balance due.

Check online

Go to Profile and select Billing & payment options. Under Payment options, select Manage payment activity & options to see your scheduled and recent payments. Good to know: We process and post online payments to your account immediately, but they can take up to 2 business days to show online in myAT&T.

What to do if your payment is missing

First, check any other AT&T accounts you may have to see if the payment posted there.

How to pay AT&T bill?

Paying by phone. You can call AT&T to pay your bill by following these steps: Dial *PAY on your AT&T phone (Spanish speakers should dial *PAGAR). Press 1 to pay with your bank account or press 2 to pay with your card. Follow the automated prompts to enter the required information.

How to pay AT&T bill without an account?

If you want to pay your AT&T bill using your internet browser, you’ll have to use a totally different webpage. Enter your AT&T phone number or account number (or select pay a closed account if your account isn’t active). Enter your billing zip code.

Is it hard to pay AT&T phone bill?

Bills are unavoidable. But paying them doesn’t have to be hard. Just follow these simple steps to pay your AT&T phone bill. Paying your cell phone bill is never particularly fun.

How to ask for payment in email?

Ask for the payment simply and be straightforward. Tell them you have included the invoice as part of the email and how you want to be paid.

How to make sure invoice is paid before?

Make sure your invoice includes a clear due date that the client needs to pay you before — lest they incur the wrath of your late fee. Also make sure you didn’t write down the wrong due date or even charged your client for the wrong things. Don’t deliver your service until you are paid.

What to do if client hasn't responded in 2 weeks?

If your client hasn’t responded in two weeks, send them a follow-up email. This message will be more firm and apply a little bit of pressure while making it seem like you’re doing them a favor.

Can clients not pay you on time?

Clients not paying you on time. And you might be at a point where you’re ready to really shake down your client in order to get your payment. That’s okay. Trouble clients happen from time to time. It’s inevitable. What matters most now is that you take action in order to get them to pay you.

Why do professionals avoid discussing payment?

So, many professionals avoid openly discussing payment out of fear of being perceived as rude or embarrassing themselves by asking about something they believe a client finds goes without saying.

Why do you need to send an invoice email before the payment date?

By sending an invoice email before the payment date, you ensure the client has enough time to gather and organize payment documentation. Also, you’ll position yourself as a professional who regularly tracks invoices – and sends reminder emails if the client doesn’t pay on time.

How to achieve full transparency and accountability with clients?

Your best option to achieve full transparency and accountability with your clients, as well as build a better, more trustworthy relationship with them, is to use the timer tracker Clockify. With it, you’ll be able to:

Is PayPal a good payment processor?

PayPal is an efficient, standard choice, but there are also other useful payment processors you can try out, depending on your own preferences, your client’s convenience, as well as the region you live in.

Do you have to make precautions to pay a client?

Most of the time, if you’re unsure a client you’re working with will pay you, making precautions may be a better tactic than chasing after them after you’ve finished and delivered the project.

Can you wait past the agreed point?

More often than not, sadly, you’ll find yourself waiting past the agreed point. At first, you’ll hold good faith that your payment will get processed soon. But, as time passes and your payment doesn’t come, you’ll need to take action yourself and ask for payment directly. Here’s how to ask for payment without being rude, ...

Can you polish out payment details?

You’ll also be able to polish out the details for finalizing that payment in a more brisk manner than you’d be able via email – probably because you won’t have to wait long for the reply.

What happens if a business doesn't offer touchless payment?

If your business doesn't offer touchless payment options, you might experience customers doing some distancing of their own: 57% of consumers say a merchant's digital payment offerings impact their willingness to shop in their stores,1 with 26% saying stores must accept contactless credit card payments for them to feel comfortable going inside for shopping.2

When a shopper is ready to make a purchase, do you want to provide the smoothest checkout experience?

When a shopper is ready to make a purchase, you want to provide the smoothest checkout experience possible–especially when they're in your store with a product in-hand.