Contact your creditor. If the debt is legitimate – but you think the collector may not be – contact your creditor about the calls. Share the information you have about the suspicious calls and find out who, if anyone, the creditor has authorized to collect the debt.

- Robocalls. ...

- Exaggerated promises. ...

- Upfront fees. ...

- Questionable contact information. ...

- Nothing in writing. ...

- “Government” debt relief programs. ...

- Dictate to stop communicating with creditors.

Is it worth it to use a debt settlement company?

Don't believe this. The truth is, paying off debt is long and painful. There's no way around it. A proper debt settlement company will have professionals helping you through the arduous process of repairing your credit, but don't expect to crack open a cold one and relax in your chair while it happens.

How can I verify whether a debt collector is legitimate?

How can I verify whether or not a debt collector is legitimate? Ask the caller for their name, company, street address, telephone number, and if your state licenses debt collectors, a professional license number. You can also refuse to discuss any debt until you get a written "validation notice."

Is your debt help company legit?

There are actually organizations in the financial industry that serve as watchdogs over debt help companies. It's true! If a company has accreditations from one or more of these organizations, you can feel confident that they're more than likely legitimate.

What are the warning signs of a debt collection scam?

Here are a few warning signs that could signal a debt collection scam: The debt collector threatens you with criminal charges. Legitimate debt collectors should not claim that they'll have you arrested. The debt collector refuses to give you information about your debt or is trying to collect a debt you do not recognize.

How do I know if a debt settlement company is legitimate?

Ask the caller for a name, company, street address, telephone number, and professional license number. Many states require debt collectors to be licensed. Check the information the caller provides you with your state attorney general . Your state regulator may be of assistance if your state licenses debt collectors.

How do I know if a debt is real?

Track the source of the debt by reaching out to your creditor to see if it has any information about the debt in question. If the company that contacted you matches what your creditor has on file, you'll know it's a legit debt collector. Always ask for a validation letter or confirmation about the debt.

Is there really a debt relief program?

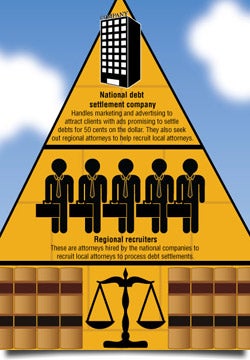

National Debt Relief is a debt settlement company that negotiates on behalf of consumers to lower their debt amounts with creditors. Consumers who complete its debt settlement program reduce their enrolled debt by 30% after its fees, according to the company.

What is a reasonable debt settlement amount?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

What is the 11 word phrase to stop debt collectors?

If you need to take a break, you can use this 11 word phrase to stop debt collectors: “Please cease and desist all calls and contact with me, immediately.” Here is what you should do if you are being contacted by a debt collector.

What proof do debt collectors have to provide?

This usually means producing proof that the debt was assigned to it. Often such proof will be a bill of sale, an "assignment", or a receipt between the last creditor holding the debt and the entity suing you.

Why is debt relief bad?

Debt settlement will negatively affect your credit score for up to seven years. That's because, to pressure your creditors to accept a settlement offer, you must stop paying your bills for a number of months.

Does debt settlement hurt your credit?

Debt settlement can negatively impact your credit score, but it won't hurt you as much as not paying at all. You can rebuild your credit by making all payments on time going forward and limiting balances on revolving accounts.

How long does it take to improve credit score after debt settlement?

between 6 and 24 monthsHowever, a debt settlement does not mean that your life needs to stop. You can begin rebuilding your credit score little by little. Your credit score will usually take between 6 and 24 months to improve. It depends on how poor your credit score is after debt settlement.

Is it better to settle a debt or pay in full?

It is always better to pay off your debt in full if possible. While settling an account won't damage your credit as much as not paying at all, a status of "settled" on your credit report is still considered negative.

Can I pay original creditor instead of collection agency?

Working with the original creditor, rather than dealing with debt collectors, can be beneficial. Often, the original creditor will offer a more reasonable payment option, reduce the balance on your original loan or even stop interest from accruing on the loan balance altogether.

Can I be chased for debt after 10 years?

Can I Be Chased for Debt After 10 Years? In most cases, the statute of limitations for a debt will have passed after 10 years. This means that a debt collector may still attempt to pursue it, but they can't typically take legal action against you.

How do you prove a debt is not yours?

How to Prove a Debt Is Not Yours With a Verification LetterDocumentation that you owed the debt at some point, such as a contract you signed.How much you owe and the last outstanding action on the debt, which can be shown by documents such as the last statement or bill.More items...•

Can someone take a loan out in your name?

If someone does manage to steal your identity they could open bank accounts, obtain credit cards or loans, take out mobile phone contracts or buy things in your name. They could even apply for passports or driving licences, potentially doing even more damage to your finances and your credit rating.

How can you identify a scammer?

Four Signs That It's a ScamScammers PRETEND to be from an organization you know. Scammers often pretend to be contacting you on behalf of the government. ... Scammers say there's a PROBLEM or a PRIZE. ... Scammers PRESSURE you to act immediately. ... Scammers tell you to PAY in a specific way.

Can debt be sent to collections without notice?

Generally, the creditor does not have to tell you before it sends your debt to a debt collector, but a creditor usually will try to collect the debt from you before sending it to a collector.

How to report a debt collector?

Contact your creditor. If the debt is legitimate – but you think the collector may not be – contact your creditor about the calls. Share the information you have about the suspicious calls and find out who, if anyone, the creditor has authorized to collect the debt. Report the call.

How to refuse to discuss debt with debt collector?

Ask the caller for their name, company, street address, telephone number, and if your state licenses debt collectors, a professional license number. You can also refuse to discuss any debt until you get a written "validation notice." Do not give personal or financial information to the caller until you have confirmed it is a legitimate debt collector.

How to file a complaint with the CFPB?

If you're having trouble with debt collection, you can submit a complaint with the CFPB online or by calling (855) 411-CFPB (2372).

How to report suspicious caller?

Report the call. Submit a complaint with the CFPB or get in touch with your state Attorney General's office with information about suspicious callers.

When will debt collectors have to give notice of eviction moratorium?

All debt collectors must follow the Fair Debt Collection Practices Act (FDCPA). This can include lawyers who collect rent for landlords. Starting on May 3, 2021, a debt collector may be required to give you notice about the federal CDC eviction moratorium.

Can a debt collector threaten you?

The debt collector threatens you with criminal charges. Legitimate debt collectors should not claim that they'll have you arrested.

Can a debt collector give you a mailing address?

Ask for an explanation in writing before you pay. The debt collector refuses to give you a mailing address or phone number. The debt collector asks you for sensitive personal financial information. You should never provide anyone with your personal financial information unless you are sure they're legitimate.

What to do if you don't owe a debt?

If you believe you do not owe the debt or that it's not even your debt, tell the caller that you will send a written request to the debt collector and ”dispute” the debt. You can also send a written request to the debt collector to receive more information about the debt.

What does it mean when a debt is not on your credit report?

If the debt is not on your credit report, that does not necessarily mean the debt is not valid.

What is the Fair Debt Collection Practices Act?

The Fair Debt Collection Practices Act prohibits debt collectors from engaging in a variety of practices, such as misrepresenting the debt, falsely claiming to be a lawyer, or using obscene or profane language when trying to collect a debt.

What to do if you suspect a scammer?

If you suspect you are dealing with a scammer, contact the creditor the debt collector claims to be working for and find out who has been assigned to collect the debt.

What time do debt collectors call you?

You might be dealing with a scammer if you are called before 8 a.m. or after 9 p.m.

How long does it take for a debt collector to send a notice?

If the debt collector does not provide this information during the initial contact with you, they are required to send you a written notice within five days of that initial contact.

Why do scammers like to use payment methods?

Scammers like these payment methods because they may be untraceable, and it can be hard for you to get your money back.

How Debt Relief and Debt Settlement Work?

Debt Relief and Debt Settlement is a negotiated agreement by which a creditor accepts less than the total amount owed to legally satisfy a debt.

Schedule Your Free Debt Analysis

Potential clients speak with a certified debt specialist regarding their financial situation.

Enroll Into Our Debt Relief Program

Signed enrollment documents are processed and the new client receives a call from our team of dedicated account managers to welcome them to the program.

Negotiations & Settlement

Our talented negotiations team begins working on client accounts immediately.

Debts Resolved!

Your debts will be resolved in a few short years or even months so you can have a new beginning financially.