How to Settle Taxes Owed

- File Back Taxes —The IRS only accepts settlement offers if you have filed all your required tax returns. If you have...

- Amend Ghost Returns — In some cases, if you have unfiled back taxes, the IRS creates a substitute for return (SFR) for...

- Apply for a Settlement — Once you are in tax compliance, you can start to apply for a settlement. A tax...

How to file a tax settlement offer with the IRS?

1 File Back Taxes —The IRS only accepts settlement offers if you have filed all your required tax returns. ... 2 Amend Ghost Returns — In some cases, if you have unfiled back taxes, the IRS creates a substitute for return (SFR) for you. ... 3 Apply for a Settlement — Once you are in tax compliance, you can start to apply for a settlement. ...

What are my options for IRS debt settlement?

There are a few options for IRS debt settlement that range from creating a payment plan to an offer in compromise. All of them have varying levels of difficulty to obtain, and you may wind up paying the full amount of fees and penalties the IRS adds to your tax debt.

What happens if you dont have enough money to settle taxes?

If you don’t have enough money to pay in full or make payments, the IRS may let you settle. The IRS also reverses penalties for qualifying taxpayers. How Does a Tax Settlement Work? You determine which type of settlement you want and submit the application forms to the IRS.

Where can I find the best tax settlement method?

Our Tax Team (Tax Attorneys, Tax Lawyers, CPA’s, IRS Agents) can find the best tax settlement method for your situation. Find out how our tax settlement service works.

See more

How much will the IRS usually settle for?

Each year, the Internal Revenue Service (IRS) approves countless Offers in Compromise with taxpayers regarding their past-due tax payments. Basically, the IRS decreases the tax obligation debt owed by a taxpayer in exchange for a lump-sum settlement. The average Offer in Compromise the IRS approved in 2020 was $16,176.

Will the IRS take a settlement offer?

Yes – If Your Circumstances Fit. The IRS does have the authority to write off all or some of your tax debt and settle with you for less than you owe. This is called an offer in compromise, or OIC.

Can you negotiate with the IRS without a lawyer?

You don't have to hire a law firm or other tax professional to make an OIC. If your offer is rejected, you can appeal within 30 days using Request for Appeal of Offer in Compromise, Form 13711 (PDF).

Who qualifies for IRS Fresh Start?

People who qualify for the program Having IRS debt of fifty thousand dollars or less, or the ability to repay most of the amount. Being able to repay the debt over a span of 5 years or less. Not having fallen behind on IRS tax payments before. Being ready to pay as per the direct payment structure.

How long does it take to settle with IRS?

Processing times vary, but you can expect the IRS to take at least six months to decide whether to accept or reject your Offer in Compromise (OIC).

How likely is the IRS to accept an offer in compromise?

A rarity: IRS OIC applications and acceptances for 2010-2019 In 2019, the IRS accepted 33% of all OICs. There are two main reasons that the IRS may not accept your doubt as to collectibility OIC: You don't qualify. You can't pay the calculated offer amount.

Is the IRS really forgive tax debt?

The IRS rarely forgives tax debts. Form 656 is the application for an “offer in compromise” to settle your tax liability for less than what you owe. Such deals are only given to people experiencing true financial hardship.

What to do if you owe the IRS a lot of money?

Here are some of the most common options for people who owe and can't pay.Set up an installment agreement with the IRS. ... Request a short-term extension to pay the full balance. ... Apply for a hardship extension to pay taxes. ... Get a personal loan. ... Borrow from your 401(k). ... Use a debit/credit card.

How likely is the IRS to accept an offer in compromise?

A rarity: IRS OIC applications and acceptances for 2010-2019 In 2019, the IRS accepted 33% of all OICs. There are two main reasons that the IRS may not accept your doubt as to collectibility OIC: You don't qualify. You can't pay the calculated offer amount.

How does an offer in compromise work with the IRS?

An offer in compromise is an agreement between a taxpayer and the IRS that settles a tax debt for less than the full amount owed. An offer in compromise is an option when a taxpayer can't pay their full tax liability. It is also an option when paying the entire tax bill would cause the taxpayer a financial hardship.

How do I write an offer in compromise letter to the IRS?

You must provide a written statement explaining why the tax debt or portion of the tax debt is incorrect. In addition, you must provide supporting documentation or evidence that will help the IRS identify the reason(s) you doubt the accuracy of the tax debt.

Can you negotiate with IRS to remove penalties and interest?

First, you should know that it is possible to negotiate for an abatement of penalties and interest, but it is at the discretion of the IRS agent with whom you are working. Second, it takes time, sometimes a year or two, to negotiate with the IRS for a reduction of interest or penalties.

How Does a Tax Settlement Work?

You determine which type of settlement you want and submit the application forms to the IRS. The IRS reviews your application and requests more information if needed. If the IRS does not accept your settlement offer, you need to make alternative arrangements. Otherwise, collection activity will resume.

How to Settle Taxes Owed

These are the basic steps you need to follow if you want to settle taxes owed.

Ways to Settle Taxes for Less

Here is an overview of the main ways that you can settle your tax liability for less than you owe:

Settling State Owed Taxes

If you owe federal and state taxes, you must resolve those taxes separately. Each state has its settlement programs. Some states have settlement programs that are very close to the IRS settlement methods, and others have drastically different programs. Review the state you owe taxes in to find what resolutions are offered by the state.

Important Tax Settlement Notes

If you want the IRS to stop collection activities, you need to make arrangements. If you don’t set something up, the IRS will continue to try to get the money in other ways. A lot of the process is automated, and if you don’t prove your situation to the IRS, the IRS will have no idea that you are experiencing financial hardship.

Request a Free Tax Analysis & Consult Get Started

If you have heard the term settling for pennies on the dollar, this is how it is done. Don’t expect this to be easy though, the IRS is very picky about who will qualify.

How to Negotiate a Tax Settlement with the IRS

Tax debt is a serious issue. The government reserves special abilities when it comes to leveraging payment from indebted taxpayers, as their collection actions supersede those of most other creditors. When negotiating a tax settlement with the IRS, it’s important to create an offer the IRS is likely to accept sooner rather than later.

Negotiating a Tax Settlement with the IRS

When you owe back taxes to the IRS, you’re indebted to the government itself – and there are very few ways out of that debt. In some cases, taxpayers can argue that the debt they’re facing isn’t valid and argue doubt as to their own liability.

Getting an Offer in Compromise Accepted

Knowing your own RCP or having a good idea of what it might be lies at the heart of drafting a good offer in compromise. Your RCP is based on your monthly disposable income (any income after taxes and basic living expenses), and the quick sale value of any non-exempt assets and properties.

Be Up to Date with Your Tax Returns

Drafting an effective offer in compromise is still just one part of negotiating a tax settlement with the IRS, albeit a crucial one.

Alternatives to an Offer in Compromise

An offer in compromise can be an effective way to reduce what you owe, and help you get back into good standing with the IRS. But offers in compromise are not always necessary, when there are other, potentially easier alternatives.

Setting Up a Payment Plan

If you cannot pay your debt off in one go, and if your debt is less than $100,000 in combined tax, penalties, and interest, then consider a short-term payment plan. Short-term payment plans consist of multiple lump sum payments made within a total of 120 days, extendable to at most 180 days via phone or mail.

Requesting Currently Not Collectible Status

When neither a payment plan nor an offer in compromise is in the cards, your best bet might be to just focus on fighting back against the IRS’s collection actions, until you can get back on your feet.

Preparation of Decision Documents

As a general rule, the decision document will be prepared by Appeals, executed by the petitioner, and then transmitted by Appeals to Field Counsel. Exceptions exist where the case involves complexities that require unusual considerations in the drafting of the decision document or related documents. Examples are cases involving:

Claim for Increased Deficiency or Alternative Penalty

Unless a claim for increased deficiency is made, the stipulated amount of deficiency in tax or penalty for each year cannot be in excess of the tax deficiency or addition to tax determined in the statutory notice of deficiency. It is preferable that a claim for the increased deficiency be made in an answer or an amended answer.

Waiver Paragraph

In every case in which a deficiency or a liability (including the proper amount of employment tax in section 7436 cases) is stipulated, the separate stipulation document or the stipulation part of the combined stipulation and decision document should contain a paragraph waiving the restrictions on the assessment and/or collection of the deficiency or liability, plus interest.

Interest Paragraphs in Stipulated Decision Documents

The Service does not settle Tax Court cases by waiving statutory interest assessments.

Settlement Documents for "S" Cases

The instructions in CCDM 35.8 addressing Decisions and Rule 155 computations are applicable to "S" cases, except that any language directed toward preserving the rights to appeal should be omitted from the computation for entry of decision and the decision.

Review and Processing Settlement Documents

If documents to be filed with the Tax Court on behalf of both the petitioner and the respondent are not executed by the petitioner, they must be executed by an attorney or other representative admitted to practice before the court who has duly entered an appearance on behalf of the petitioner in the case.

Settlement Conferences

Settlement conferences between Associate Chief Counsel attorneys and DOJ attorneys are infrequent. They are held in Washington, D.C. when a case has been referred to an Associate Chief Counsel office for review. Taxpayer’s counsel may also be present at these conferences.

Recommendation on Offer

When Recommendation Furnished. When DOJ submits a settlement offer to Field Counsel or an Associate Chief Counsel office for the Service’s recommendation, the best settlement letter possible should be prepared within the prescribed time limits.

Settlement Letters Content

The objective of Counsel in providing a recommendation to DOJ with respect to a settlement offer or a proposed concession by DOJ should be to produce the best possible letter within the applicable time limits.

Form and Contents

The form of a settlement letter is very similar to that of a suit or referral letter. The most significant differences between a settlement letter and a referral letter are that the settlement letter does not have a discussion of jurisdiction as that aspect of the case was disposed of at the referral letter stage.

Application of Executive Order 12988 on Civil Justice Reform

Pursuant to the Civil Justice Reform guidelines, litigation counsel are required to evaluate each case to determine whether Alternative Dispute Resolution (ADR) would assist to expedite the matter.

Conflicting Recommendations

On occasion the Tax Division will not agree with the Service’s recommendation. If the Review Section of the Tax Division wishes to accept an offer and the Service recommends rejection, the offer must be considered at a higher level.

Joint Committee Cases

Objective. Pursuant to section 6405, a refund in excess of $2,000,000 must be referred to the Joint Committee on Taxation. Congress, in instituting this requirement, intended to create a means whereby it could monitor the effectiveness of the Internal Revenue Code by examining the reasons for large refunds.

Offer in Compromise

An offer in compromise is when you settle taxes for less than you owe. It’s not for everyone. The process is difficult, and there are strict qualification requirements.

Penalty Abatement

Penalty abatement is when the IRS forgives penalties. This is a very common method for settling taxes for less than you owe. In fact, about a third of all IRS penalties are removed at a later date.

Partial Payment Installment Agreement

A Partial Payment Installment Agreement is when you make payments based on what you can afford rather than the monthly amount required to satisfy the taxes in full before the CSEDs expire. The balance gets reduced as the statute of collections comes into effect.

Innocent Spouse Relief

Innocent spouse relief is available to taxpayers who have filed jointly with their spouse or former spouse. Normally, both spouses are liable for all tax, penalties, and interest, but there are some rare situations where it’s unfair to hold both spouses liable. If you qualify, the IRS still holds the spouse liable, but you aren’t responsible.

IRS Tax Bankruptcy

Bankruptcy can sometimes eliminate taxes owed. You can eliminate certain taxes through Chapter 7, but it depends on the age of the taxes and several other factors. Bankruptcy is not always the best option if you solely looking at it to discharge taxes. Consequently, it generally negatively impacts your credit and forces you to liquidate assets.

Tax Settlement Services

If you are looking for tax settlement either for IRS or state taxes, call to have a tax professional analyze your financial situation. They can help you figure out which option is best for your situation. There are many different types of tax settlements. It helps to consult with a licensed tax professional.

Apply With the New Form 656

If you apply for an offer in compromise April 26 or later, use the April 2021 version of Form 656-B, Offer in Compromise Booklet PDF.

Make Sure You Are Eligible

The IRS will return any newly filed Offer in Compromise (OIC) application if you have not filed all required tax returns and have not made any required estimated payments. Any application fee included with the OIC will also be returned. Any initial payment required with the returned application will be applied to reduce your balance due.

Submit Your Application

Find forms for submitting an application and step-by-step instructions in Form 656-B, Offer in Compromise Booklet PDF. Your completed offer package will include:

Select A Payment Option

Your initial payment will vary based on your offer and the payment option you choose:

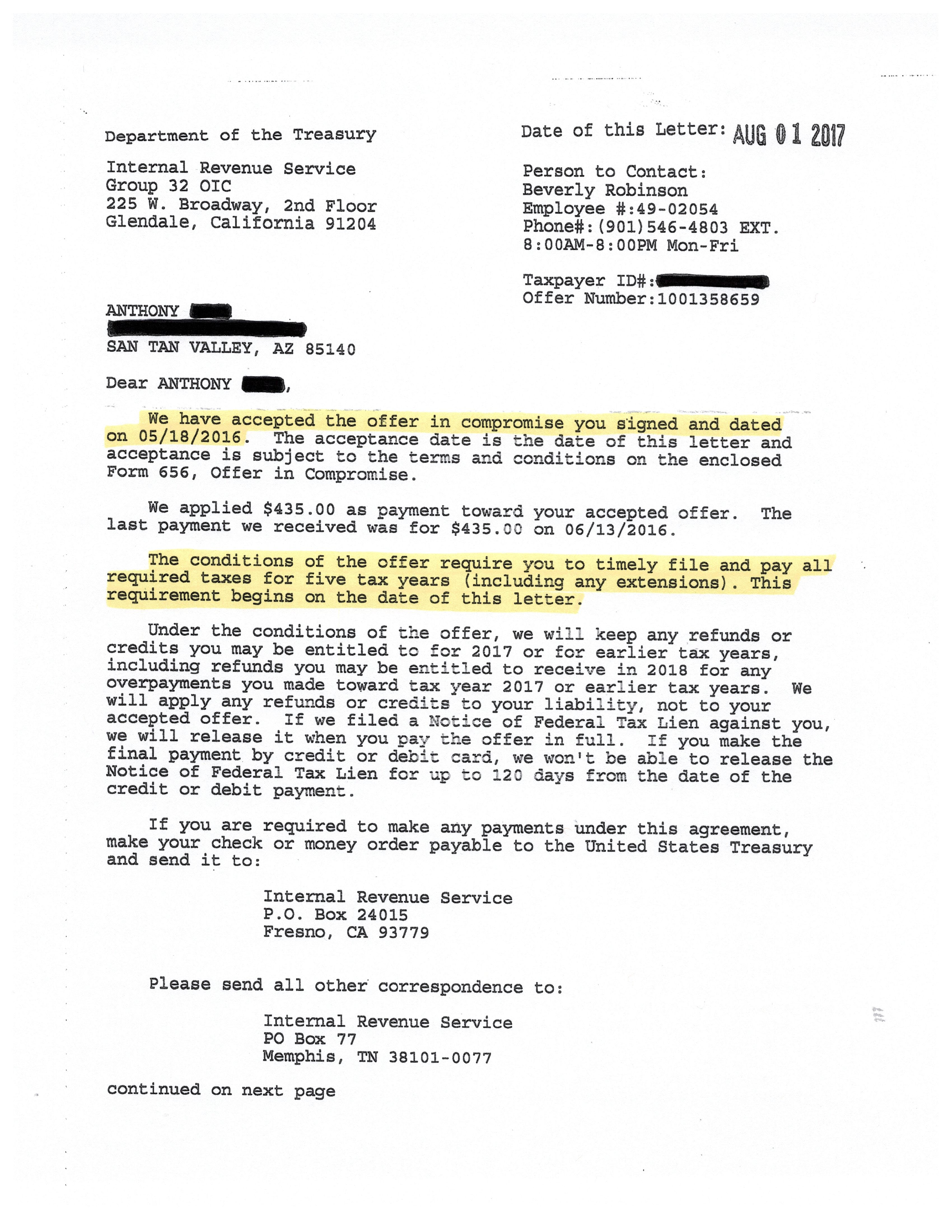

If Your Offer Is Accepted

You must meet all the Offer Terms listed in Section 7 of Form 656, including filing all required tax returns and making all payments;

IRC Section and Treas. Regulation

IRC Section 61 explains that all amounts from any source are included in gross income unless a specific exception exists. For damages, the two most common exceptions are amounts paid for certain discrimination claims and amounts paid on account of physical injury.

Resources (Court Cases, Chief Counsel Advice, Revenue Rulings, Internal Resources)

CC PMTA 2009-035 – October 22, 2008 PDF Income and Employment Tax Consequences and Proper Reporting of Employment-Related Judgments and Settlements

Analysis

Awards and settlements can be divided into two distinct groups to determine whether the payments are taxable or non-taxable. The first group includes claims relating to physical injuries, and the second group is for claims relating to non-physical injuries. Within these two groups, the claims usually fall into three categories:

Issue Indicators or Audit Tips

Research public sources that would indicate that the taxpayer has been party to suits or claims.