Move money from your bank account to your Vanguard account through an electronic bank transfer (EBT) or wire. Make an electronic deposit Add a bank to your Vanguard account Send scheduled automatic deposits from your bank account to your Vanguard account.

Full Answer

How do I transfer my Vanguard funds to a new brokerage?

only have Vanguard mutual fund accounts. For each registration, you’ll open a newbrokerage account with a new account number and move your Vanguard fund assets into it. Your new brokerage account will also have a money market settlement fund (which will be opened with a zero balance) to pay for and receive proceeds from any trades you make.

What can I do with MY vanguard settlement fund?

The role of your settlement fund You should consider keeping some money in your settlement fund so you're ready to trade. You can use your settlement fund to buy mutual funds and ETFs (exchange-traded funds) from Vanguard and other companies, as well as stocks, CDs (certificates of deposit), and bonds.

How do I add additional funds to MY vanguard account?

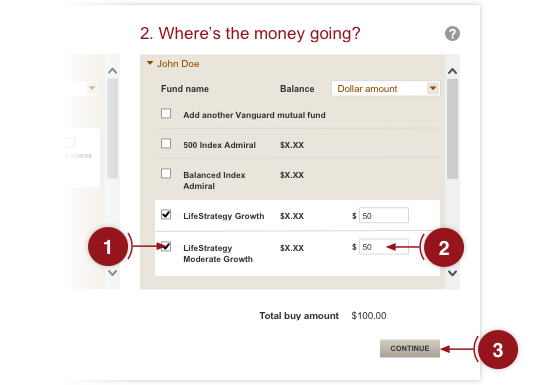

Click CONTINUE. In Where’s the money going?, select the fund (s) from your existing holdings that you’d like to exchange into or select Add another Vanguard mutual fund. If you are adding a Vanguard fund you don’t currently hold, you can select from our list of available funds or you can search funds by name, symbol, or number.

What is the vanguard vmfxx fund?

The fund is the Vanguard Federal Money Market Fund, Investor Class (ticker symbol VMFXX). Other mutual funds could be sold, and the proceeds sent directly to a bank account, bypassing the account’s core position.

How do I transfer money from bank to Vanguard settlement?

How do I send money from my bank to Vanguard?From the Vanguard homepage, search "Buy funds" or go to the Buy funds page. ... Select the checkbox next to an existing fund. ... Once you select a checkbox, a textbox will appear below it. ... When you enter fund information in the text box, fund choices will appear.More items...

How long does it take to transfer money to Vanguard settlement fund?

How long will it take to transfer my account to Vanguard? Completion times vary depending on the type of transfer, your account details, and the company holding your account. Some transfers can take 4 to 6 weeks, but your wait could be shorter. You'll get a more accurate estimate when you start your transfer online.

What is a settlement fund in Vanguard?

Your settlement fund is used to pay for and receive proceeds from brokerage transactions, including Vanguard ETFs®, in your Vanguard Brokerage Account.

How do I transfer money between Vanguard accounts?

How do I exchange a Vanguard mutual fund for another Vanguard mutual fund online?From the Vanguard homepage, search "Exchange funds" or go to the exchange funds page. ... Select the checkbox next to the fund name you want to exchange from.Enter the dollar amount you want to exchange into the textbox.More items...

Can Vanguard settlement fund lose money?

An investment in the fund could lose money over short or even long periods. You should expect the fund's share price and total return to fluctuate within a wide range, like the fluctuations of the overall stock market.

What if Vanguard goes out of business?

What happens if my fund company fails? Your money is safe. Under the Investment Company Act of 1940, which governs the industry, each fund is set up as an individual corporate entity, with its own board of directors. Essentially, your fund hires the fund company to manage its assets.

What is the interest rate on Vanguard settlement fund?

The expense ratio is 0.16% ($16 annually for every $10,000 invested) and the seven-day SEC yield, which reflects the interest earned after deducting fund expenses for the most recent seven-day period, is 0.01%. The one-year return as of March 31 was 0.14%.

Which Vanguard fund has the highest return?

Fastest growing Vanguard funds worldwide in May 2022, by one year return. The fastest growing investment fund managed by U.S. asset management company Vanguard is the Vanguard Energy Index Fund. Over the year to May 1, 2022, the mutual fund generated an annual return of 60.64 percent.

Can I withdraw all my money from Vanguard?

While you can withdraw up to $100,000 (or 100% of your balance), you may not want to take out so much. Check your plan whether you can request additional withdrawals or loans. If you have a loan, suspend the payments.

Why can't I withdraw my money from Vanguard?

When you sell funds you'll need to wait for the trade to settle before you can withdraw the cash. This normally happens 2 business days after the trade completes.

Does Vanguard charge to exchange funds?

Vanguard Brokerage doesn't charge additional fees for a purchase, a sale, or an exchange of any load mutual fund offered through our program.

Who is better Vanguard or Fidelity?

Fidelity and Vanguard both do a good job keeping costs fairly low, but Fidelity has a slight edge overall. Both brokers charge zero commission for stock and ETF trades, but Fidelity charges $0.65 per contract on options trades, while Vanguard charges $1 per contract for customers with less than $1 million in assets.

How long does Vanguard take to clear?

Please allow up to 48 hours for your assets to reflect in your account.

How long does a Vanguard withdrawal take?

Unlike some deposit options, withdrawal is rarely instant. It usually takes at least 1 business day, but often several business days for your money to arrive. We tested withdrawal at Vanguard and it took us 2 business days, which is considered fairly average.

How long do Vanguard sales take?

Like all mutual funds, Vanguard funds trade once a day at the close of the market. The net asset value NAV is recalculated, and this is when shares are bought and sold. Unlike stocks that can trade almost instantaneously, mutual funds have a slight delay, but they are still one of the most liquid types of investments.

How do I add money to my Vanguard money market account?

Move money from your bank account to your Vanguard account through an electronic bank transfer (EBT) or wire. Send scheduled automatic deposits from your bank account to your Vanguard account.

Make an electronic deposit

Move money from your bank account to your Vanguard account through an electronic bank transfer (EBT) or wire.

Send money through a direct deposit

Send income directly from your employer, the government (including tax refunds), or other sources electronically to your Vanguard account.

Use an online bill paying service

Use your bank's bill pay service to send money to your Vanguard account on a recurring basis.

Invest by sending a check

You can also buy Vanguard fund shares by mailing us a check. Use our online process to generate a printable customized form. The Vanguard mailing address will appear on the form. Note: If you have a brokerage account, you must select your settlement fund in the 1. Where's the money going? section in order to see the option to purchase by check.

How long does it take to transfer money to Vanguard?

A transfer from your bank to your Vanguard account can take a few days before the money is cleared and ready to use. So having that money ready is crucial.

What Is A Settlement Fund?

A settlement fund is a fund where your money sits after you sell your investments or receive dividends. You can withdraw that money and transfer it to your regular checking account.

How much investment is required for Vanguard Total Stock Market Index fund?

The minimum investment requirement for that fund is $3,000.

Where do dividends go?

Dividends you receive from your stocks or other securities go directly to your settlement fund. So if you want to grow your investments, set your account to “reinvest” so that the dividends can automatically be used to buy more shares.

Does a settlement fund earn interest?

Your settlement fund will earn you some interest on the money it contains , but not a lot. To learn more about the interest, visit Vanguard.

How to add another Vanguard mutual fund?

If you are buying a new fund, check the box next to Add another Vanguard mutual fund. Then type in the fund name, symbol, or number. If you aren’t sure which fund, you can view a list of Vanguard mutual funds by clicking the Select from a list of our fundslink.

Who holds Vanguard assets?

All investing is subject to risk, including the possible loss of the money you invest. Brokerage assets are held by Vanguard Brokerage Services, a division of Vanguard Marketing Corporation, member FINRA and SIPC.

Do you need to move money into settlement fund?

Note:If you’re buying a brokerage product like a stock or ETF, you’ll need to move money into your settlement fund to cover the trade.

Does Vanguard have a contribution?

Vanguard.com defaults to a contribution. If this isn’t a contribution select Yesin the question that states Is this a rollover from an employer-sponsored plan or IRA? Then continue with the transaction.

Is Vanguard a brokerage?

Vanguard funds not held in a brokerage account are held by The Vanguard Group, Inc., and are not protected by SIPC. Brokerage assets are held by Vanguard Brokerage Services, a division of Vanguard Marketing Corporation, member FINRA

If you have a car lease ending soon, Please look into buying it and then reselling it

With the used car shortages, the residual value is much lower than the actual value. Look into into for your own good.

Very worried that my financial advisor isn't legit

Edit: this has blown up so I am removing any identifying information at this point. Thanks for all of the advice everyone.

Insurance Denied My Inpatient Hospital Stay Because They Deemed It Not Medically Necessary

About a week ago I went to my local ER because I woke up with a swollen uvula. I was unable to speak, breathe through my mouth, and it constantly initiated a gag reflex. At first, they thought it was anaphylaxis but then realized it was probably an infection.

I'm 30 and dying, how can I use my 401k without penalty?

I'm looking for someone who may be able to help me. There are some free services online for people in my position that so far I have been a little intimidated about using.

Dealer wanted to charge me more then I went to local Credit Union and this is what happened

Update....... I just get a call from BECU and they said they will give me the loan directly without the middle man, the dealer. They acknowledged that the Dealer was wrong so they will cancel that application and they will also remove the credit inquiry from my credit report. This is a win for all of you.

Fidelity "Declines to do business with me"

Last week I opened a Roth IRA account with Fidelity and linked my bank account to transfer funds. Fidelity sent a couple deposits to my savings account, which I verified, and then moved $6k over.

How to sell Vanguard funds?

To do this, first tap on the menu icon (three horizontal bars) in the upper-left of the app. Next, scroll down to ‘My Transactions’ and choose ‘Buy, sell, & exchange.’ Here, you will have the option to choose ‘Sell Vanguard funds.’ Tapping on this link produces the next menu where you can specify a cash amount and the receiving bank account. The option ‘Sell Vanguard funds’ must be chosen because a free cash balance will be in a Vanguard fund.

Does Vanguard charge for wire transfers?

Vanguard Wire Transfer Withdrawal. Vanguard offers wire transfers, too, and it doesn’t charge for them, either. Most brokers do charge something to send a wire. Vanguard clients can send a wire of funds to either a domestic or foreign bank.

Does Vanguard offer free cash balance?

A free cash balance will be in a money market mutual fund, because Vanguard does not offer any other core account option. The fund is the Vanguard Federal Money Market Fund, Investor Class (ticker symbol VMFXX). Other mutual funds could be sold, and the proceeds sent directly to a bank account, bypassing the account’s core position.

Does Vanguard charge for ACAT?

Amazingly, Vanguard doesn’t charge anything for outgoing full or partial transfers. Most companies do charge for this service.

Trade Settlement Times at Vanguard

While trading at Vanguard, you have likely come across T+1, or T+2 settlement dates assigned to the securities you invest in. While these codes can be a bit confusing at first, understanding how to read them and what they mean is actually quite simple, and very important.

What Exactly is Settlement?

In short, trade settlement days, also known as T+1, T+2, T+3, etc., depict the amount of time that it will take for funds to ‘settle’ into an account.

Why Does the Settlement Date Exist?

Trade settlement stems from the early days of the stock market, when trade confirmation and the transfer of funds was a manual process. Considering that the NYSE has been facilitating stock trades since the late 1700s, it makes sense that the processes involved with moving money was very different that the systems we use today.

Trade Settlement Terminology

The fastest way to see how trade settlement will affect transactions in the stock market is to learn the terminology. Luckily, the terms are not complicated.

Foreign Markets and Trade Settlements

At Vanguard, investors have access to several foreign securities. Vanguard has a global reach and investors can take advantage of that in numerous ways.

Getting Around Settlement Restrictions

In cash accounts, the money received from selling securities lands directly into the account. However, that money is ‘unsettled’ for the allotted period (i.e., T+3, or four days). For investors, this is important to keep track of because using unsettled funds to purchase more securities can result in account violations.

Who owns Vanguard Brokerage Services?

Brokerage assets are held by Vanguard Brokerage Services, a division of Vanguard Marketing Corporation, member FINRA and SIPC.

Is investing subject to risk?

All investing is subject to risk, including the possible loss of the money you invest.

When to move Vanguard funds?

If you consent to move your Vanguard mutual fund assets before the market closes (typically 4 p.m., Eastern time), the move will generally be complete as soon as the next business day. If you consent to move your Vanguard mutual fund assets after the market closes, those assets will generally appear in your brokerage account as soon as the second business day.

Can you reinvest Vanguard funds?

If you sell a stock or bond, you can reinvest the proceeds in Vanguard funds the same day. As always, you won’t pay commissions to buy or sell Vanguard mutual funds and ETFs in a Vanguard Brokerage Account.**