- Define your goals. All debt settlement negotiations start with an offer – either a collector reaches out to you or you reach out to a creditor.

- Know who holds the debt. First, make sure you know who you’re talking to. ...

- Reach an agreement. When you start your actual negotiation, start low. ...

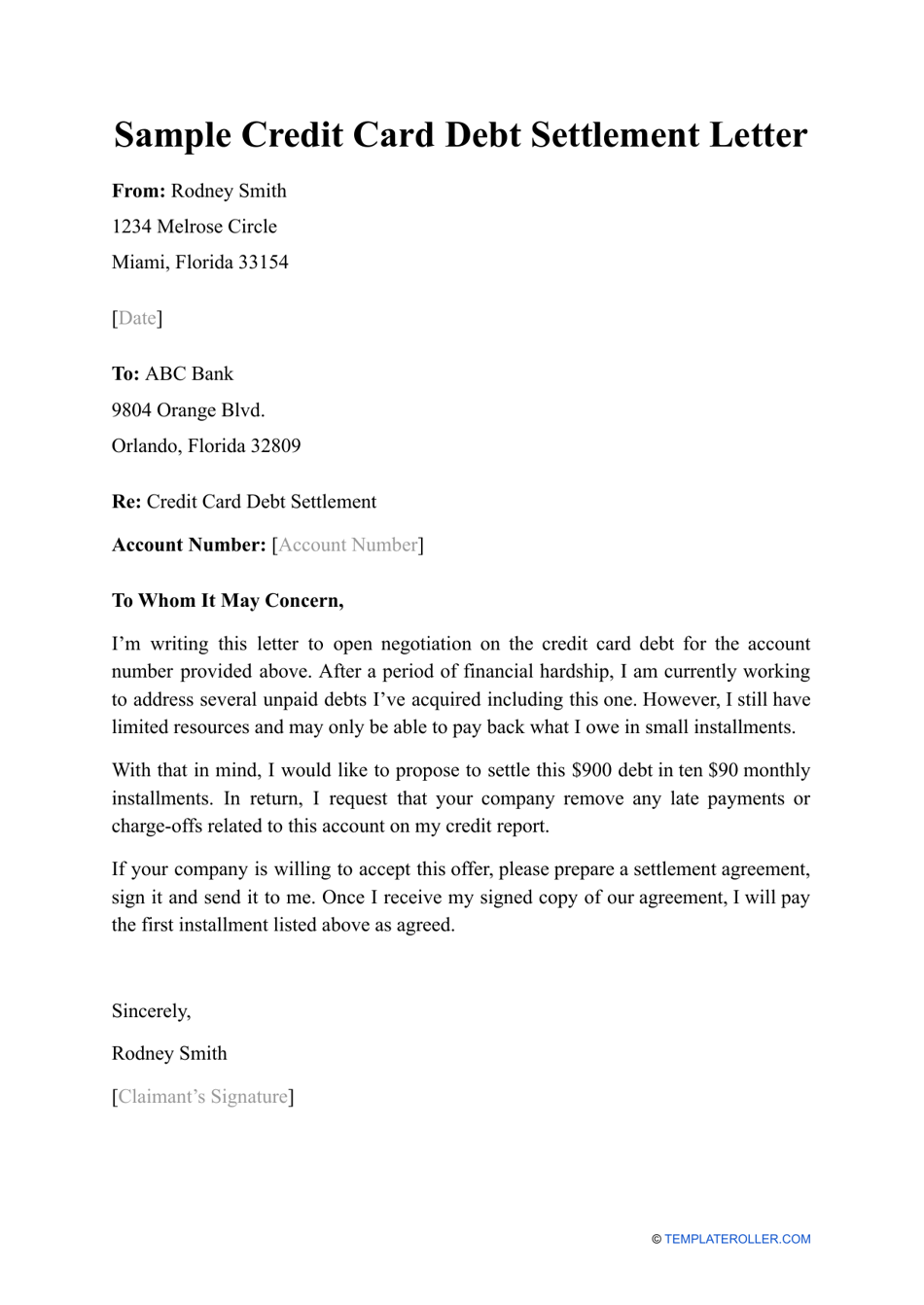

- Sign the formal document. Once that agreement is reached, the terms of the settlement are laid out in writing and both parties sign the formal debt settlement agreement.

- Pay the settlement amount. You pay the amount agreed to, usually in a single lump sum settlement.

- Make sure the creditor reports the final status of the account to the credit bureaus. The new status of your account should show up on your credit report. ...

Full Answer

How to write a successful debt settlement agreement?

Prepare Your Debt Settlement Offer

- Assess your budget – how much are expenses and income? Put what is left in an account to pay off the settlement.

- Consider taxes – The IRS considers the difference between what you owe and settle for income

- Consider credit reporting – You don’t want your creditor to report settled or paid settled

Do it yourself debt settlementgotiate a debt settlement?

With do-it-yourself debt settlement, you negotiate directly with your creditors in an effort to settle your debt for less than you originally owed. The strategy works best for debts that are already delinquent. Creditors, seeing missed payments stacking up, may be open to a settlement because partial payment is better than no payment at all.

What is the best way to negotiate a settlement?

What is the best way to negotiate a divorce settlement?

- Focus On Interests Not Positions. ...

- Be Careful Of “Hard Bargaining” ...

- Be Careful Not To Destroy The Relationship With The Other Side. ...

- Recognize The Other Side's Perceptions & Emotions. ...

- Take Control Of Your Own Emotions.

Will I get sued if I do debt settlement?

Yes, they can—it is possible to be sued while in a debt settlement program. A debt settlement program is nothing more than negotiation with a creditor. If while during those negotiations, you are in default on a debt (haven't been making payments, or have been paying late or less than the full amounts due), the creditor can sue you to recover what you owe them.

What percentage should I offer to settle debt?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

How much less will debt collectors settle for?

Offer a Lump-Sum Settlement Some want 75%–80% of what you owe. Others will take 50%, while others might settle for one-third or less. Proposing a lump-sum settlement is generally the best option—and the one most collectors will readily agree to—if you can afford it.

Will a debt collector settle for 30%?

Lenders typically agree to a debt settlement of between 30% and 80%. Several factors may influence this amount, such as the debt holder's financial situation and available cash on hand.

Will a debt collector settle for 10%?

Depending on the situation, debt settlement offers might range from 10% to 50% of what you owe. 3 The creditor then has to decide which offer, if any, to accept. Consumers can settle their debts or hire a debt settlement firm to do it for them.

Is it better to settle or pay in full?

Generally speaking, having a debt listed as paid in full on your credit reports sends a more positive signal to lenders than having one or more debts listed as settled. Payment history accounts for 35% of your FICO credit score, so the fewer negative marks you have—such as late payments or settled debts—the better.

What should you not say to debt collectors?

9 Things You Should (And Shouldn't) Say to a Debt CollectorDo — Ask to see the collector's credentials. ... Don't — Volunteer information. ... Do — Make a preemptive offer. ... Don't — Make your bank account accessible. ... Maybe — Ask for a payment-for-deletion deal. ... Do — Explain your predicament. ... Don't — Provide ammunition.More items...

What happens if a debt collector won't negotiate?

If the collection agency refuses to settle the debt with you, or if the agency or creditor agrees to settle, but you renig on your end of the agreement, the collection agency or creditor may decide to pursue more aggressive collection efforts against you, which may include a lawsuit.

Is it worth it to settle debt?

In general, paying off the total amount of debt you owe is a better option for your credit. An account that appears as "paid in full" on your credit report shows potential lenders that you have fulfilled your obligations as agreed, and that you paid the creditor the full amount due.

Does Debt Settlement hurt your credit?

Debt settlement can negatively impact your credit score, but it won't hurt you as much as not paying at all. You can rebuild your credit by making all payments on time going forward and limiting balances on revolving accounts.

How long before a debt is uncollectible?

four yearsIn California, the statute of limitations for consumer debt is four years. This means a creditor can't prevail in court after four years have passed, making the debt essentially uncollectable.

What is a reasonable full and final settlement offer?

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

Can I pay original creditor instead of collection agency?

Working with the original creditor, rather than dealing with debt collectors, can be beneficial. Often, the original creditor will offer a more reasonable payment option, reduce the balance on your original loan or even stop interest from accruing on the loan balance altogether.

What is a reasonable full and final settlement offer?

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

Can you negotiate with debt collectors?

You may have more room to negotiate with a debt collector than you did with the original creditor. It can also help to work through a credit counselor or attorney. Record your agreement. Sometimes, debt collectors and consumers don't remember their conversations the same way.

Why do debt collectors offer discounts?

Why is that? Because the collection agency bought the original debt from your creditor, most likely for a substantial discount. That means they don't have to recover the entire amount to make a profit. By proposing a settlement, you can pay off the debt quickly, usually for less than the original amount.

Can I pay my original creditor instead of collection agency?

Working with the original creditor, rather than dealing with debt collectors, can be beneficial. Often, the original creditor will offer a more reasonable payment option, reduce the balance on your original loan or even stop interest from accruing on the loan balance altogether.

What percentage of a debt is typically accepted in a settlement?

A creditor may agree to accept anywhere from 40% to 50% of the debt you owe, but it could go as high as 80%. The original creditor is likely to be...

How does debt settlement affect your credit?

Debt settlement may hurt your credit score by more than 100 points and the settlement will stay on your credit report for seven years. Add this to...

Why is debt settlement considered a last resort?

Debt settlement is considered a last resort strategy because of the damage it does to your credit. Other options that require you to pay back the f...

What is do it yourself debt settlement?

With do-it-yourself debt settlement, you negotiate directly with your creditors in an effort to settle your debt for less than you originally owed.

What is the difference between debt settlement through a company and doing it yourself?

Time and cost are the main distinctions between debt settlement through a company and doing it yourself.

How much does a debt settlement company charge?

With a debt settlement company, you’ll likely pay a fee of 20% to 25% of the enrolled debt once you agree to a negotiated settlement and make at least one payment to the creditor from an account set up for this purpose, according to the Center for Responsible Lending.

What company did the CFPB take legal action against?

In 2013, the CFPB took legal action against one company, American Debt Settlement Solutions, saying it failed to settle any debt for 89% of its clients. The Florida-based company agreed to effectively shut down its operations, according to a court order.

What does "settled" mean on credit report?

Settled debts are generally marked as “Settled” or “Paid Settled,” which doesn’t look great on credit reports. Instead, you'll try to get your creditor to mark the settled account “Paid as Agreed” to minimize the damage.

How long can you be behind on a debt settlement?

Debt settlement is an option if your payments are at least 90 days late, but it’s more feasible when you're five or more months behind. But because you must continue to miss payments while negotiating, damage to your credit stacks up, and there is no guarantee that you’ll end up with a deal.

How long does it take to settle a debt?

While completing a plan through a company can take two and a half years or more, you may be able to settle your debts on your own within six months of going delinquent, according to debt settlement coach Michael Bovee.

What are the downsides of DIY debt settlement?

Downsides of DIY Debt Settlement. Regardless of whether you take on the task yourself or reach out to a debt settlement company, you may face a tax burden if you do reach a settlement. If at least $600 in debt is forgiven, you’ll likely pay income taxes on the forgiven amount. Another downside to either DIY or professional debt settlement is ...

What to ask when entering a payment plan?

If you do enter a payment plan, ask whether the creditor will lower the interest rate on the debt to ease your financial burden. During your negotiations, maintain a written record of all your communication with a creditor. Last but not least, keep your cool and be honest.

Why do you do it yourself debt settlement?

A DIY settlement avoids the fees you might pay to a professional debt settlement company .

How many steps to take when you head down the DIY road of debt settlement?

Here are seven steps you can take when you head down the DIY road of debt settlement.

How do debt collectors make money?

Debt collectors make money by collecting past-due debts that originated with a creditor, such as a credit card company. When dealing with debt collectors, be patient. It may take several attempts to get the type of settlement you’re comfortable with.

Why is debt settlement considered a last resort?

Debt settlement is considered a last resort strategy because of the damage it does to your credit. Other options that require you to pay back the full principal debt amount—and thus do not negatively affect your credit score—include debt consolidation and debt management plans.

Is DIY debt settlement worth it?

DIY debt settlement negotiations almost certainly will consume a fair amount of your time and energy, and it could take a while to reach an agreement. In the end, though, all of your work may be worth it—especially if you’ re able to position yourself for a better financial future.

Was this answer helpful to you?

Please do not share any personally identifiable information (PII), including, but not limited to: your name, address, phone number, email address, Social Security number, account information, or any other information of a sensitive nature.

What happens if the statute of limitations is passed?

If the statute of limitations has passed, then your defense to the lawsuit could stop the creditor or debt collector from obtaining a judgment. You may want to find an attorney in your state to ask about the statute of limitations on your debt. Low income consumers may qualify for free legal help.

How to contact a debt collector?

Any debt collector who contacts you to collect a debt must give you certain information when it first contacts you, or in writing within 5 days after contacting you, including: 1 The name of the creditor 2 The amount owed 3 That you can dispute the debt or request the name and address of the original creditor, if different from the current creditor.

What is CFPB sample letter?

The CFPB has prepared sample letters that you can use to respond to a debt collector who is trying to collect a debt. The letters include tips on how to use them. The sample letters may help you to get information, set limits or stop any further communication, or exercise some of your rights.

How to talk to a debt collector about your debt?

Explain your plan. When you talk to the debt collector, explain your financial situation. You may have more room to negotiate with a debt collector than you did with the original creditor. It can also help to work through a credit counselor or attorney.

How long does it take for a debt collector to contact you?

Any debt collector who contacts you to collect a debt must give you certain information when it first contacts you, or in writing within 5 days after contacting you, including: The name of the creditor. The amount owed. That you can dispute the debt or request the name and address of the original creditor, if different from the current creditor.

How long does a debt have to be paid before it can be sued?

The statute of limitations is the period when you can be sued. Most statutes of limitations fall in the three to six years range, although in some jurisdictions they may extend for longer.

Why is debt validation important?

Debt validation is a crucial step because it may halt the collection process if the collector is unable to obtain verification on your debt. However, in most cases adequate verification is obtained and the collection process continues. Once the amount of your debt has been validated, an experienced debt settlement attorney at McCarthy Law will ...

How does a debt settlement work?

As mentioned above, you will have time during the negotiations to save up for a settlement. Unlike debt management plans where you make a monthly payment that is disbursed to your creditors , in a debt settlement your money is deposited into an account to be accumulated until the negotiated amount is reached and your creditors receive a lump sum settlement.

How long does it take to settle a debt?

During the negotiations, which can take anywhere from 6 months to 36 months, depending on the amount of debt and creditors you owe, you will have time to save up money to use towards settlement.

How long does it take to get a debt validated?

The amount of your debt. Your right to dispute the debt within thirty days.

Why is it important to have a lawyer negotiate and review the actual settlement agreement?

It is important to have a lawyer negotiate and review the actual settlement agreement to make sure you are fully protected and the creditor can’t come after you later.

How to stop a collection call?

First, you can write a cease and desist letter to the collection agency stating either your request for the calls to stop or your refusal to pay the debt. The second option is to obtain attorney representation.

How long does it take to dispute a creditor's name?

Your creditor’s name. The amount of your debt. Your right to dispute the debt within thirty days. Notification of your ability to send a written request for verification of the debt and/or the name and address of the original creditor.

How to avoid credit damage?

However, there are several solutions you can negotiate which may allow you to avoid credit damage, including: Negotiating to list a credit account status as paid in full. Negotiating to re-age an account to remove delinquent payments. Using pay for delete to remove a debt collection account from your credit report.

Why is it important to negotiate a settlement?

It’s important when trying to negotiate a settlement that you have realistic goals. You’re not going to get out of debt for nothing – you’ll need to pay something to get your balances discharged. How much you end up paying depends on what you want to accomplish and who you’re negotiating with.

What is the original creditor?

The original creditor – i.e. the credit card company that you have the account through. An in-house collections department, who may be trying to collect on a debt that’s past-due but not charged off yet. A third-party debt collector that’s attempting to collect on a charged off debt on behalf of the original creditor.

What is debt buyer?

A debt buyer, who purchased a portfolio of bad debts from the credit card company for a small percentage of each amount owed. A debt buyer is much more likely to settle for a lower amount. They paid pennies on the dollar to purchase your debt from the credit card company.

How much does a debt settlement pay?

The average debt settlement pays out roughly 48% of the original amount owed.

What to do if your debt is not matching your records?

Ask for the agency’s name, the name of the representative that you’re speaking with , and a contact call-back number. Then ask that they send you a written notice about the debt immediately.

What happens when you settle your debt?

When you settle your debt, you agree to pay less than what you owe. Depending on your situation, this may be the right form of debt relief for you. Unlike some other methods, you don’t always have to use a professional service to settle. The following steps will teach you how to negotiate debt settlement on your own.

What happens after a debt settlement is paid?

After completing successful negotiations, a debt settlement lawyer will review the entire settlement agreement to make certain that the debtor is fully protected once the settlement has been paid and that creditors will have no recourse to pursue additional collections later.

What is debt settlement?

Debt settlement occurs when a debtor successfully negotiates a payoff amount for less than the full balance owed on a debt. This lower negotiated amount is agreed to by the creditor or collection agency and must be fully documented in writing. The debt settlement is often paid off in one lump sum, although it can also be paid off over time.

What happens to credit card debt settlement?

In a debt settlement scenario, delinquent credit card accounts continue to accrue interest expense and late fees while causing damage to a credit score and profile that will need to be repaired later.

How long does it take to settle a debt?

Negotiations can take up to three years, and this provides the debtor with significant time to save for an eventual settlement.

How to contact United Debt Settlement?

Contact United Debt Settlement to learn more about debt settlement. Give us a call at ( 888-574-5454) or fill out our online contact form and get a free savings estimate.

Can a debt settlement lawyer defend a debtor?

A debt settlement lawyer can also prove useful in the event that a creditor does file a lawsuit against the debtor, taking swift and appropriate action to defend a debtor. However, lawsuits are not especially common, and it is important to know that a reputable debt settlement firm can also get the job done – and often less expensively with a similar or better outcome.

Can creditors accept debt settlement offers?

Although creditors are under no legal obligation to accept debt settlement offers, negotiating and paying lower amounts to settle debts is far more common than many people realize. The process of debt settlement focuses primarily on unsecured debt, such as debt associated with high-interest rate credit cards, medical debt and private student loans.

How to finalize a settlement?

Release the settlement funds. To finalize the settlement, you need to deliver the settlement funds on or before the expiration date. Most settlement funds are remitted via ACH bank draft (aka "check by phone"). Make sure you write down who you spoke with that processed your payment. Every once in a blue moon a creditor or collection agency might require you to overnight a cashier's check to finalize a settlement. But the vast majority of settlements are finalized via ACH bank draft.

How many credit card accounts are delinquent?

Whether we're in a good economy or not, a certain percentage (approx. 2-5%) of credit card accounts are delinquent. For credit card companies, it's just the cost of doing business — and they know it.

How long does it take to settle a debt?

In fact, some may lose patience and sue you. Certain debt settlement companies advertise "debt settlement plans", implying you can take several years to get through the process. In my opinion, that's a recipe for disaster. Generally speaking, I recommend completing the debt settlement process in 12 months or less (18 months tops).

What is the biggest determinant of successfully negotiating settlements for less than full balance?

Perhaps the biggest determinant of successfully negotiating settlements for less than full balance is making sure you meet the minimum criteria.

Is credit card debt unsecured?

Remember, credit card debt is unsecured debt. If a credit card account becomes delinquent there's no property to repossess or put a lien on.

Can you send a cease and desist letter to a creditor?

With certain credit card companies, a cease and desist letter is an automatic trigger to fast-track your account for litigation. Besides, if your goal is to negotiate a settlement with a creditor, you need to keep an open line of communication. For these reasons, I never recommend sending a cease and desist letter.

Is debt settlement a viable alternative to bankruptcy?

Although the debt settlement process can be a viable alternative to bankruptcy, it isn't perfect.

What to do if you can't get a debt collector to accept a lower payment?

Even if you can't get the collector to agree to accept a lower payment, you may be able to work out an arrangement to pay off the debt in installments. Knowing how to negotiate with debt collectors will help you work out a payment solution that helps you take care of the debt collection account for good. 1.

How to contact debt collectors?

Here are a few things you should know: 4 1 Debt collectors can only call you between 8 a.m. and 9 p.m. 2 They can't harass you or use profane language when speaking to you. 3 They can't threaten to take action that's illegal or that they don't intend to follow through with. 4 Debt collectors can only contact your employer, family members, and friends to contact information about you.

What to do if a credit collector doesn't send proof?

Otherwise, if the collector doesn't send sufficient proof, send the collector a cease and desist letter asking they stop contacting you and dispute the debt with the credit bureaus. 8

How long does it take for a debt collector to send you a notice?

5 Approach all debt collections with a healthy dose of skepticism. Within five days of contacting you, the collectors must send you a debt validation notice.

How do debt collectors work?

Debt collections can happen to even the most financially responsible consumers. A bill may slip your mind, you may have a dispute with the creditor over how much you really owe, or billing statements can get lost in the mail before you ever know the debt exists.

How long does it take for a debt validation notice to be sent?

Within five days of contacting you, the collectors must send you a debt validation notice. This notice lists how much money you owe, names the entity to which you owe it, and details steps you can take if you believe there's been a mistake. 6

How do junk debt buyers make money?

Or, junk debt buyers earn profits on debts they've purchased for just pennies on the dollar. 2 . Collectors only make money when consumers pay the debt. They can't seize property or take money from consumer bank accounts unless they sue and obtain a court judgment and permission to garnish the consumer's wages. 3 . 2.

How long does it take to settle a debt?

Pursuing debt settlement is a last resort because it involves stopping payments and working with a firm that holds that money in escrow while negotiating with your creditors to reach a settlement, which can take up to four years.

How to negotiate with credit card companies?

Be Persistent and Document Everything. If you want to negotiate with a credit card company, the process usually begins with a phone call. However, it may require long conversations with multiple people over days or weeks.

What Happens to Credit Card Debt When You Die?

Credit card debt is paid off by your estate after you die. In other words, the debt will be subtracted from anything you intend to pass onto heirs. Your estate executor will use estate assets to pay down the debt. After your debts are settled, your remaining assets will be passed onto your heirs.

How Do You Consolidate Credit Card Debt?

There are many ways you can consolidate credit card debt. The key is to get a single debt instrument that you can transfer all of your existing debt into. It could be a personal loan, a home equity loan, or even another credit card known as a " balance transfer card ."

What is the worst scenario for a credit card company?

Absent some sort of unique set of circumstances, a bankruptcy filing would be the worst-case scenario for the credit card company because it stands to lose everything it has extended you. It means that they may be willing to forgive a large portion of the debt balance in hopes of getting back something rather than nothing.

Why do credit card companies have priorities?

Credit card companies, many of which are owned by banks, have several priorities. The first is to generate profit for the parent company and its shareholders. When it becomes evident that someone may be unable to pay his or her balance, a shift in the credit card company's priorities happens that can work to your advantage.

What to know before calling a bank?

Before you call, make sure you know exactly how much you owe, what your interest rate is, and any other important account details.

The Basics of Debt Settlement

The Downsides of Debt Settlement

- Although a debt settlement has some serious advantages, such as shrinking your current debt load, there are a few downsides to consider. Failing to take these into account can potentially put you in a more stressful situation than before. First, debt settlement generally requires you to come up with a substantial amount of cashat one time. This is what makes the debt settlement attracti…

Should You Do It Yourself?

- If you decide that a debt settlement is the right move, the next step is to choose between doing it yourself or hiring a professional debt negotiator. Keep in mind that your credit card company is obligated to deal with you and that a debt professional may not be able to negotiate a better deal than you can. Furthermore, the debt settlement industry has its fair share of con artists, ripoffs, a…

Appearances Matter

- Whether you use a professional or not, one of the key points in negotiations is to make it clear that you’re in a bad position financially. If your lender firmly believes that you’re between a rock and a hard place, the fear of losing out will make it less likely that they reject your offer. If your last few months of card statementsshow numerous trips to five-star restaurants or designer-boutique sho…

The Bottom Line

- While the possibility of negotiating a settlement should encourage everyone to try, there’s a good chance you’ll hear a “no” somewhere along the way. If so, don’t just hang up the phone and walk away. Instead, ask your credit card company if it can lower your card’s annual percentage rate(APR), reduce your monthly payment, or provide an alternative payment plan. Often your cre…