How to Negotiate and Settle a Car Accident Claim Without a Lawyer.

- 1. Start Building Your Claim at the Scene. Gathering evidence to support your accident claim starts at the scene of the crash.

- 2. Notify Both Insurance Companies.

- 3. Organize the Evidence You’ll Need to Win.

- 4. Prepare Yourself for Claim Negotiations.

- 5. Make Your Demand for Settlement.

- Speak to the insurance adjuster. Before you can start working toward a settlement, you need to speak with the insurance adjuster to find out what they're willing to cover after you file your claim. ...

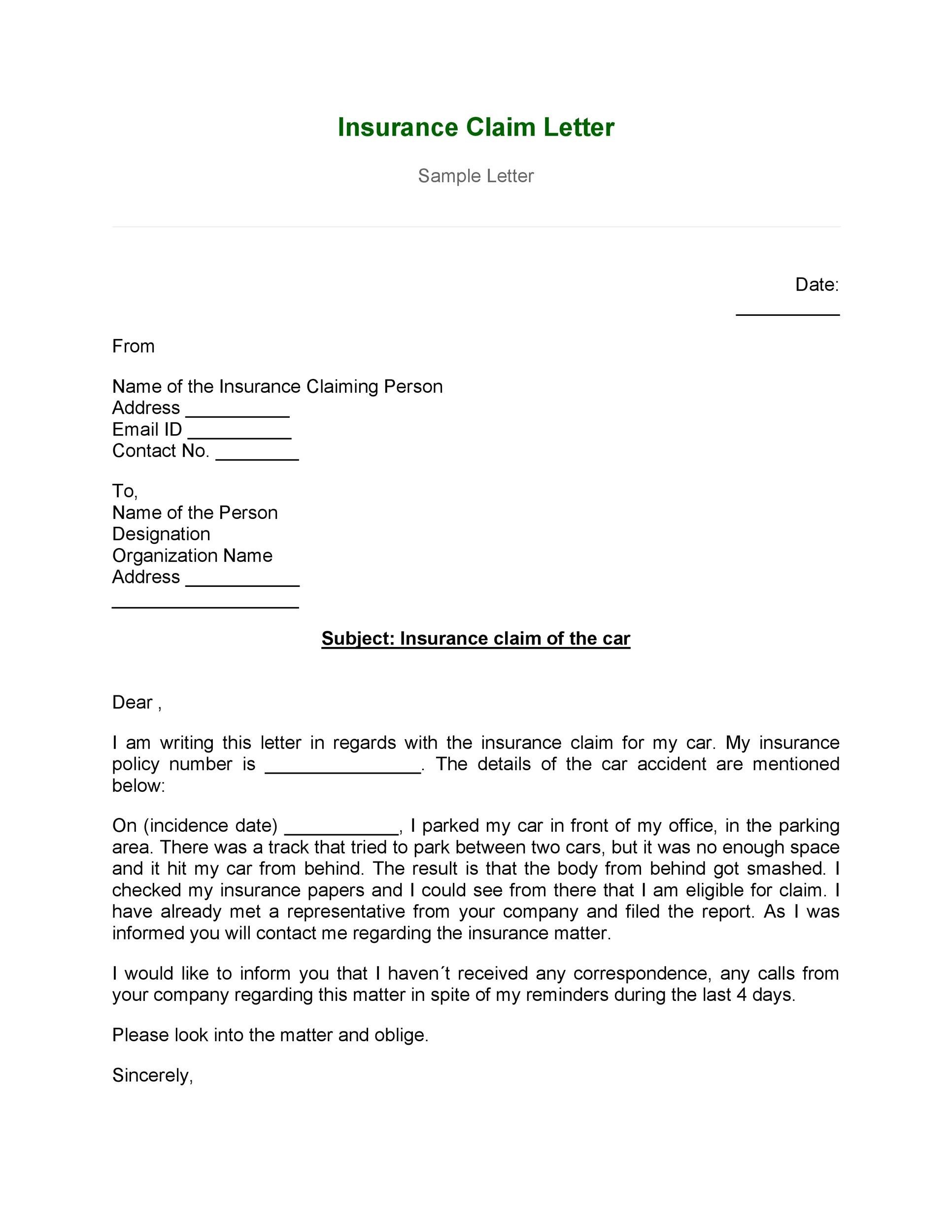

- Craft your demand letter. ...

- Do your due diligence before going to court.

How to settle a car accident the right way?

- There are around 4.2 million fender-benders (no injuries or fatalities) reported to police in the United States each year.

- You are not required to file an insurance claim after an accident, but should file a police report.

- other driver instead of filing a claim.

Should I accept a car accident settlement?

Things to consider before accepting a settlement from the insurance company. Should I Accept a Settlement Offer? Following a car accident, accepting a settlement offer may seem like the easiest way to resolve your case. While this may be true, it is not always to your advantage. For one thing, once you accept a settlement, there is no turning back.

Do you need a lawyer for a car accident settlement?

Need a Car Accident Lawyer for a Settlement? The truly honest answer here, without a doubt, is “no.”. Having said that, the truly smart answer to this question is “yes,” especially if you have suffered a serious injury. The more complicated the case, the more of a need there is to have an attorney by your side to ensure you get the proper justice.

How long does a car accident claim take to settle?

Shortly following a car accident (usually within 24 hours), an injured party should file a car accident claim with the insurance company of the at-fault driver/ negligent driver. Once a claim is filed, it usually takes a few months for the injury victim and the insurance adjuster to agree on a settlement offer.

How do I ask for more pain and suffering?

How to Negotiate Pain and Suffering in a Car Accident ClaimPrepare well. ... Learn about pain and suffering. ... Keep your tone with the adjuster professional. ... Explain how the injury affected your life. ... Do not be shy. ... Tell the insurance adjuster how painful the whole experience was. ... Explain how painful the treatment was.More items...

How do I negotiate more money from a car accident claim?

8 Auto Accident Settlement Negotiation TipsInitiate a Claim as Soon as Possible After an Auto Accident.Keep Accurate Records About the Accident.Calculate a Fair Settlement.Send a Detailed Demand Letter to the Insurance Company.Do Not Accept the First Offer.Emphasize the Points in Your Favor.Get Everything in Writing.More items...

How do you respond to a low settlement offer?

Steps to Respond to a Low Settlement OfferRemain Calm and Analyze Your Offer. Just like anything in life, it's never a good idea to respond emotionally after receiving a low offer. ... Ask Questions. ... Present the Facts. ... Develop a Counteroffer. ... Respond in Writing.

How do insurance companies negotiate cash settlements?

Let's look at how to best position your claim for success.Have a Settlement Amount in Mind. ... Do Not Jump at a First Offer. ... Get the Adjuster to Justify a Low Offer. ... Emphasize Emotional Points. ... Put the Settlement in Writing. ... More Information About Negotiating Your Personal Injury Claim.

What should you not say to an insurance adjuster?

Never say that you are sorry or admit any kind of fault. Remember that a claims adjuster is looking for reasons to reduce the liability of an insurance company, and any admission of negligence can seriously compromise a claim.

What happens if insurance doesn't pay enough?

If your insurance claim check is not enough, take a second (or third, or fourth) look through your insurance policy to see if you can find anything that might help you win your case against your insurance company to get them to give you a higher settlement.

What is a reasonable settlement agreement?

By Ben Power 8 April 2022. A settlement agreement is a contract between two parties, usually (but not always) an employer and an employee, which settles the employee's claims against their employer.

Should you accept the first offer of compensation?

Unless you have taken independent legal advice on the whole value of your claim, you should not accept a first offer from an insurance company.

How do I write a counter offer for a car accident?

From the standpoint of procedure, you will need to make a counter-offer in writing. Be sure you send your letter to the appropriate person, whether that be an insurance adjuster or an attorney. Make it clear that you are rejecting their initial offer and include your reasons for doing so.

Do insurance companies want to settle quickly?

Insurance companies want to settle cases right away, because they don't want you to have an opportunity to speak to a personal injury lawyer. If an insurance company is offering you any money, it is always advisable that you at least have a consultation with an attorney.

Do insurance companies try to get out of paying?

Insurance companies will seek to decrease or eliminate payments for injuries caused by an insured person's actions. After becoming injured, victims of accidents want nothing more than to move on from the traumatizing experience.

Can you argue with an insurance claims adjuster?

After considering their argument, you can form a counter-argument. An adjuster can bring up a few things, however, that you should prepare for. When you enter negotiations with the insurance company and/or claims adjuster you should have a desired settlement in mind, as well as a minimum settlement you will accept.

Can you negotiate a car settlement figure?

Even if the offer seems reasonable at first glance, you should always negotiate. After you research the value of your car, come up with a number that you feel is fair for a settlement. It should be the absolute minimum you are willing to accept.

Can you argue with an insurance claims adjuster?

After considering their argument, you can form a counter-argument. An adjuster can bring up a few things, however, that you should prepare for. When you enter negotiations with the insurance company and/or claims adjuster you should have a desired settlement in mind, as well as a minimum settlement you will accept.

Should I accept first offer of compensation?

Unless you have taken independent legal advice on the whole value of your claim, you should not accept a first offer from an insurance company.

How do insurance adjusters determine the value of a car?

To conduct an appraisal, the adjuster will assess the car's damage and then estimate how much it would cost to repair it. The adjuster is trying to determine how much your car would have been worth before the accident. Once they finish their investigation, the claims adjuster will decide if the car is worth fixing.

How long do you have to file a claim after an accident?

However, there is a time limit on filing claims related to the accident that you should be aware of. All states have a statute of limitations which imposes a strict deadline on how long you can wait before filing claims. Under Maryland’s statute of limitations, you have to file your claims within 3 years after the accident.

What to do if you are seriously injured?

If you have been seriously injured and are looking for a quick settlement, you are almost invariably going to get less than the value of your accident case. To give the insurance company a reason to make something approaching a reasonable offer, you need all of your medical bills and records and often a written analysis of your case from a doctor – either a treating doctor or “independent” medical expert – as to the extent and scope of your injuries. If you settle a case before you have all of the documentation you need for your claim, you have little chance of receiving fair value. Our law firm will not even consider taking a case if the client is trying to settle the case before her doctors understand the full scope of her injuries.

What do insurance adjusters do?

Insurance adjusters use anything you say to knock down your settlement offer, or they pass along the information to the insurance company’s lawyers to give cross-examination fodder against you at trial.

What do you need to make an insurance offer?

To give the insurance company a reason to make something approaching a reasonable offer, you need all of your medical bills and records and often a written analysis of your case from a doctor – either a treating doctor or “independent” medical expert – as to the extent and scope of your injuries.

What happens if you demand more than the value of a claim?

By demanding more than the value, you telegraph to the insurance company that you don’t know the value of your claim. When your case does settle, there will be a good chance you left a lot of money on the table. Because an insurance company’s response to a ridiculous demand is not to make a real settlement offer.

What does "controlled conditions" mean in a lawyer?

When our attorneys do allow for these statements, we set them up under controlled conditions to limit any damage the client can do to the case.

What to do if you are going to take the risk and delay?

If you are going to take the risk and delay, do not talk to anyone about how the incident happened or the extent and scope of the injuries.

How to settle a car accident without a lawyer?

Here’s how to settle a car accident claim without a lawyer so you can make the best decision for your needs and your finances. Evaluate the extent of your damages. Before you can start working toward a settlement, you need to make sure you have a clear idea of the damages you suffered. This goes beyond the physical damages done to your vehicle ...

What happens if you meet with another car accident attorney?

You’ll meet with the other driver’s car accident attorney and come to an agreement on an appropriate settlement. This will save you time, money, and spares you the expense of having to hire an auto accident attorney to represent your case.

What do you need to know before you settle a car accident?

Before you can start working toward a settlement, you need to speak with the insurance adjuster to find out what they’re willing to cover after you file your claim. They’ll look at the damage done to your car and any medical expenses you have relating to the accident.

What happens after a car accident case is heard?

After hearing your case, the judge will make a decision on how much of a settlement you deserve. If you represented yourself well, that amount will be higher than what the insurance company initially offered. However, if you weren’t able to make a solid case, the judge may declare that the insurance company’s original settlement was enough. Once you accept the settlement, you’ll be able to close out your car accident claim and move on with your life.

How many people get injured in car accidents?

Car accidents happen every day and more than three million people get injured in those crashes every year. An astounding two million of those car accident victims suffer permanent injuries that will pain them for the rest of their lives. The sooner you can settle your car accident claim, the sooner you can start focusing on your recovery.

What do attorneys do to help clients get money?

Attorneys have extensive experience helping clients get the money they deserve. Even better, they can streamline the settlement process so you get your money more quickly. If you do end up going to court, they’ll be able to mount your case and argue on your behalf against the insurance company’s experienced legal team. ...

What happens if you accept a settlement?

If you accept the settlement, you’re done and you can focus on getting your life back to normal.

What is a Car Accident Settlement?

A car accident settlement is an agreement between you and the other driver (or their insurance company) to resolve your claim. The settlement will typically involve a monetary payment from the other driver or their insurance company to you.

Why Would I Want to Negotiate a Settlement Without a Lawyer?

There are a few reasons you might want to negotiate a settlement without a lawyer. First, it can save you time and money. Hiring a lawyer can be expensive, and if you can reach an agreement without one, it will likely save you money in the long run.

What Should I Keep in Mind When Negotiating a Settlement Without a Lawyer?

There are a few things to keep in mind when negotiating a car accident settlement without a lawyer:

How to Negotiate a Car Accident Settlement Without a Lawyer?

The first step in negotiating a car accident settlement without a lawyer is to contact the other driver’s insurance company. You will need to provide them with your contact information and the details of the accident.

What to do if you don't accept a counter offer?

Consider the counter-offer, and then decide if you want to accept it or not. If you do, fine. Take the money, and sign a release. If you don't, get ready to file a personal injury lawsuit in court.

Why do the stakes increase when you lose a case?

When losses ("damages" in legalese) are significant, the stakes increase for everyone—for you because you want fair compensation for your injuries, and for the defendant (usually an insurance company) because they don't want to pay a large amount to resolve the case.

What is a multiplier in personal injury?

Lawyers and writers have often talked about a "multiplier" in personal injury cases, used by insurance companies to calculate pain and suffering as being worth some multiple of your special damages. But that is only true up to a point.

Can an insurance adjuster negotiate a low settlement?

Remember, the insurance adjuster will probably low-ball you but then you can start to negotiate. It's okay if your demand is on the high side - this will give you room to negotiate later. Learn more about responding to a low personal injury settlement offer.

Can you negotiate a personal injury settlement?

And in cases where your injuries are relatively minor and the other side's fault is pretty clear, it may be more economical to negotiate your own personal injury settlement, rather than handing over one-third of your award to a lawyer (which is common practice under personal injury lawyer fee agreements ).

Is it clear that the other party was at fault?

Is it clear that the other party was at fault? If it's obvious that the defendant or one of its employees is to blame for your accident—you've got witnesses who will testify on your behalf, for example—you may find it easier to prove fault, and to get a satisfactory settlement on your own.

Can you represent yourself in an accident?

When To Consider Self-Representation. It's certainly possible to represent yourself in a personal injury claim after an accident come away with a satisfactory result. This is especially true if you have experience handling your own legal matters in the past, and you're able and willing to stand up for yourself and your case.

What Type of Accident Cases Should You NOT Try to Settle on Your Own?

Before we go any further, we need to discuss what types of auto accident cases you should not attempt to settle without help from a lawyer. The reasoning for each varies some but the common theme is that you will almost certainly receive more money for your car accident if you have an experienced attorney handling the case.

What Are Your Options for Settling a Minor Car Accident Claim?

If you're involved in a car wreck and you decide to handle the negotiations with the insurance company yourself, what are your options? Well, the first option is to just accept what the insurance companies are offering - I NEVER recommend that. They are going to offer the lowest amount that they think you are willing to accept and they have ZERO obligation to pay what your claim may actually be worth.

What Must You Prove to Get the Most Money From a Car Accident?

You must prove that someone else was negligent or careless and that it was their negligence or carelessness that caused your injury. If you fail to do this, you lose. If you sue the wrong person, you lose. If you wait too long to sue, you lose. If you had an injury BEFORE the accident, then you are only entitled to be compensated to the extent your injury is now worse.

How Do You Write a Demand Letter for an Auto Insurance Claim?

This is an opportunity to explain why your case demands additional compensation and why the settlement they have offered is too low. Take the time to properly explain all the details and use hard numbers to prove your point where you can.

What If I Decide I Need an Attorney to Help With My Claim?

There's nothing to prevent you from hiring an attorney before you reach a signed agreement with the insurance companies. There's also no shame in starting off on your own and deciding the process is too much to handle alone. As I've detailed above, the insurance companies do not play fair and they see those without legal representation as easy targets. If you've run into a wall, or you're just tired of dealing with process, you can call me at the Stephens Law Firm and I'll be glad to let you know how I can help.

What to do if you are hit by a drunk driver?

If you were hit by a drunk driver you should hire an attorney to settle your case. In most instances you will be entitled to more compensation than an insurance company will offer without a skilled attorney handling your case. Additionally, you may want to sue the intoxicated driver personally for their actions.

How long do you have to file a personal injury claim in Texas?

In Texas, the statute of limitations on car accidents is two years from the date of the accident. This also means that you only have two years to settle a claim with the insurance companies - after that, they can simply deny your claim, pay you nothing, and you can no longer file a lawsuit. Keep that in mind when negotiating with insurance adjusters, they may be stalling to run the clock out on your claim.

Mistake 1: Trusting the Insurance Adjuster

The adjuster is not your friend. Insurance claims adjusters are trained to engage claimants in informal discussions. They try to get you to relax, so you let your guard down. Being too relaxed makes it much easier for the adjuster to get you to say things they can use against you. Be on your guard at all times.

Mistake 2: Speaking Without Thinking

Your chance to negotiate a fair settlement can be ruined with just a first few words of introduction with the adjuster. Take this common exchange, for example:

Mistake 3: Giving a Recorded Statement

Don’t agree to give your recorded statement. It’s not a good idea to give a recorded statement without an attorney to represent you. Once you give a recorded statement, your claim will be limited to the specifics of that statement. The only one who can benefit is the insurance company.

Mistake 4: Signing a Blanket Medical Release

Don’t sign any medical releases right away. Standard insurance company release forms allow the company to gather all your medical information for the past five to ten years. Protect your medical privacy. The adjuster doesn’t need that information at the start, and should never need your entire health history to settle a minor injury claim.

Mistake 6: Overlooking Important Evidence

You’ll need solid car accident evidence to prove the other driver’s liability (responsibility) for the crash and to prove the extent of your injuries.

Mistake 8: Ignoring Your Medical Records

The adjuster will go over your medical records with a fine-toothed comb. It’s a lot to read, but make sure you read and understand everything that’s in your doctor’s notes and treatment records. You need to be able to defend the nature of your injuries, why your doctor prescribed treatments, and why you needed to be off work.

Mistake 9: Discussing Prior Injuries

Don’t discuss any pre-existing injuries. You can set back your claim by admitting you have a prior injury too soon in the claims process. If you tell the adjuster about it, they’ll be quick to say your latest injury is just an exacerbation of your previous one. You need a doctor to evaluate how one injury is related to the other.

How to negotiate with insurance company?

As you prepare for your negotiation with the insurance company, it's helpful to follow a few tips. The first is to avoid taking the first offer made. According to Nolo, Sutliff & Stout, and Findlaw.com, an insurance adjuster will often make an extremely low first offer to determine whether you know how to negotiate or understand the value of your car. Even if the offer seems reasonable at first glance, you should always negotiate.

What happens when you get involved in a car accident?

When you are involved in a car accident that causes significant damage to your vehicle, the next step is getting compensated by the insurance company that provides the policy on the car. However, getting a fair price for the damage is often a challenge, as an insurance company loses money when it has to pay out following an accident.

Why do drivers get entangled with insurance companies?

In many cases, drivers find themselves entangled with insurance companies to get claims paid in a timely fashion. Dealing with the aftermath of a car accident can be a stressful situation. In many cases, drivers find themselves entangled with insurance companies to get claims paid in a timely fashion. If you're wondering how to negotiate an ...

What to do when an adjuster comes in near your minimum?

Additionally, if the first offer from an adjuster comes in near your minimum amount, you may want to consider increasing that amount .

What does a claims adjuster do?

A claims adjuster will make a determination of what it will cost to perform repairs to your vehicle but knowing its value can assist you in your negotiation. The two main types of claims in this situation are first-party and third-party and which type depends on who is found to be at fault in the accident.

How much do personal injury attorneys take?

Most personal injury attorneys take a cut of one-third of the settlement amount, so it has to be a high amount to make it worthwhile to hire an attorney. If you're negotiating a settlement, use these tips to increase your chances of a positive outcome.

What should you consider when calculating a fair settlement?

When calculating the fair settlement amount, be sure to consider: Any suffering and pain caused by the accident. The cost of any required medical care and other related expenses.