- Firstly you need to work out how much to offer your creditors and then send your offer to them in writing.

- Always ask your creditors to confirm they accept your offer in writing before you send them any money.

- Keep any letters your creditors send to you about the settlement offer just in case you need to refer to them again in the future. ...

- You may find not all your creditors are willing to accept your offer of settlement and you’ll have to negotiate with each one individually. ...

- If your offers are accepted, make sure you send payment to each creditor by the date they give you. Keep proof of payment.

Should I write a debt settlement offer letter?

What Your Settlement Letter Should Include

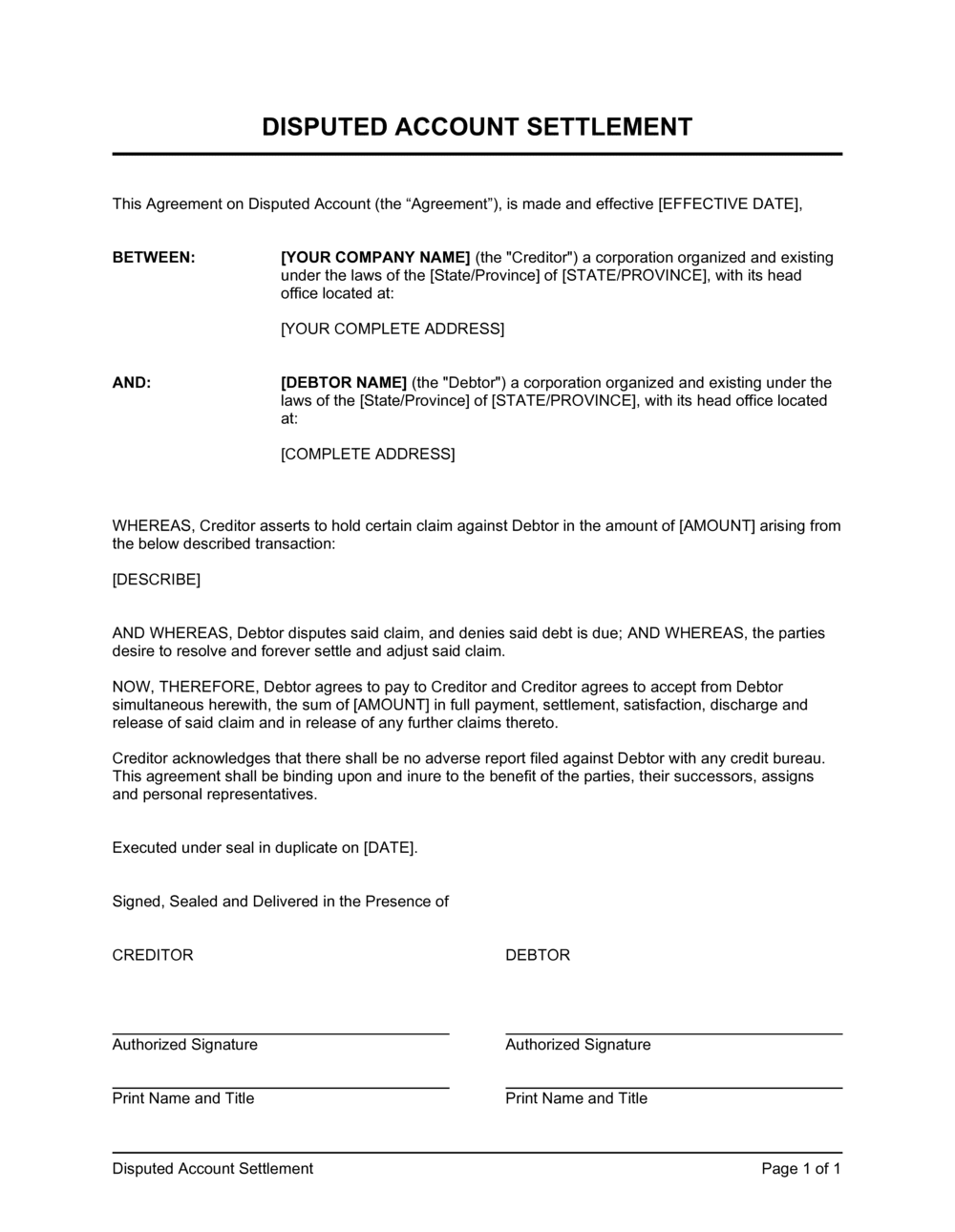

- The letter should be on company letterhead, regardless of whether you’re dealing with a collection agency or the original creditor. ...

- The letter should include a date so you know when the settlement offer was made.

- Make sure the correct account number is listed on the debt settlement letter. ...

How much should I offer to settle a debt?

When entering negotiations, make sure to:

- Know your rights. You can’t be harassed, lied to, threatened, or even spoken to out of business hours.

- Consider your debt. What type of debt do you owe? This will help in understanding what you could ask for.

- Speak calmly and logically.

- Make your offer. Debt collectors may settle for around 50% of your debt. ...

What percentage should I offer to settle debt?

- Credit Cards, Department Store Cards 40%

- Citibank Accounts 65%

- Discover Accounts 65%

- Cell Phones (Collections over $750) 50%

- Apartment Lease Re-letting Fees 40%

- Medical Debts, Collections 50%

- Judgments/Garnishments, Repossessions 80%

- Pay Day Loans, Signature Loans 40%

- Collection Balance Greater than $750 Settlements 40%

How to negotiate a debt settlement?

If you want to make a proposal to repay this debt, here are some considerations:

- Be honest with yourself about how much you can pay each month. ...

- Write down a summary of your monthly take-home pay and all your monthly expenses (including the amount you want to repay each month and other debt payments). ...

- Decide on the total amount you are willing to pay to settle the entire debt. This could be a lump sum or a number of payments. ...

What percentage should I offer to settle debt?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

How do you negotiate with a debt buyer?

Negotiate with the debt collector using your proposed repayment planExplain your plan. When you talk to the debt collector, explain your financial situation. ... Record your agreement. Sometimes, debt collectors and consumers don't remember their conversations the same way.

How much less will a creditor settle for?

If you decide to try to settle your unsecured debts, aim to pay 50% or less. It might take some time to get to this point, but most unsecured creditors will agree to take around 30% to 50% of the debt. So, start with a lower offer—about 15%—and negotiate from there.

Is it smart to settle with a debt collector?

It is always better to pay off your debt in full if possible. While settling an account won't damage your credit as much as not paying at all, a status of "settled" on your credit report is still considered negative.

What is the 11 word phrase to stop debt collectors?

If you need to take a break, you can use this 11 word phrase to stop debt collectors: “Please cease and desist all calls and contact with me, immediately.” Here is what you should do if you are being contacted by a debt collector.

Is it better to settle or pay in full?

Settling for Less Can Relieve Stress And it's important to know that paying your debt in full is the better option when it comes to your credit. If you can't pay in full, settling is better than defaulting on your debt and may relieve some stress for you.

What should you not say to debt collectors?

9 Things You Should (And Shouldn't) Say to a Debt CollectorDo — Ask to see the collector's credentials. ... Don't — Volunteer information. ... Do — Make a preemptive offer. ... Don't — Make your bank account accessible. ... Maybe — Ask for a payment-for-deletion deal. ... Do — Explain your predicament. ... Don't — Provide ammunition.More items...

What is a reasonable full and final settlement offer?

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

What happens if a debt collector won't negotiate?

If the collection agency refuses to settle the debt with you, or if the agency or creditor agrees to settle, but you renig on your end of the agreement, the collection agency or creditor may decide to pursue more aggressive collection efforts against you, which may include a lawsuit.

How can I get a collection removed without paying?

There are 3 ways to remove collections without paying: 1) Write and mail a Goodwill letter asking for forgiveness, 2) study the FCRA and FDCPA and craft dispute letters to challenge the collection, and 3) Have a collections removal expert delete it for you.

Can I pay original creditor instead of collection agency?

Working with the original creditor, rather than dealing with debt collectors, can be beneficial. Often, the original creditor will offer a more reasonable payment option, reduce the balance on your original loan or even stop interest from accruing on the loan balance altogether.

Should I pay a 5 year old collection?

If you have a collection account that's less than seven years old, you should still pay it off if it's within the statute of limitations. First, a creditor can bring legal action against you, including garnishing your salary or your bank account, at least until the statute of limitations expires.

What happens when someone buys your debt?

When a debt has been purchased in full by a collection agency, the new account owner (the collector) will usually notify the debtor by phone or in writing. Selling or transferring debt from one creditor or collector to another can happen without your permission.

How do debt buyers make money?

Debt buyers make money by acquiring debts cheaply and then trying to collect from the debtors. Even if the debt buyer collects only a fraction of the amount owed on a debt it buys—say, two or three times what it paid for the debt—it still makes a significant profit.

How Much Do debt settlement companies charge?

a 15% to 25%Debt settlement companies typically charge a 15% to 25% fee to tackle your debt; this could be a percentage of the original amount of your debt or a percentage of the amount you've agreed to pay.

Do I have to pay a debt that has been sold?

Unpaid debt doesn't go away. Until the debt is either paid or forgiven, you still owe the money. This is true even if it's a credit card debt that is sold to a collection agency. Even if you think it's unfair.

Do debt settlement programs work?

Yes! Just like any debt solution, this is not a silver bullet; it won’t fix every debt situation for every consumer. But when it’s used in the righ...

Do I need to work with a professional to settle my debt?

It’s possible to DIY debt settlement, but not always advisable. Plus, a professional debt settlement program will roll all of your monthly payments...

How bad does debt settlement hurt your credit?

This varies based on your credit profile. If you have perfect credit, then a settlement can affect you significantly; it’s likely you’ll lose your...

How does debt settlement affect your taxes?

This is an important question. The IRS counts forgiven debt as income. Essentially, the IRS expects you to pay taxes on the discharged balance. If...

How long does debt settlement take?

Making a single settlement offer and setting up an agreement can take as little as a month. If you enroll in a debt settlement program, then it gen...

How much does debt settlement cost?

When you work with a debt settlement company, you will pay fees. The fee amount varies by company. Usually, it’s a percentage of what you pay each...

Is debt settlement bad?

This depends on your goals. If you have an excellent credit score and don’t want to hurt it, then settlement is extremely bad. But if your score ha...

What is better: debt consolidation or debt settlement?

Again, this depends on your financial situation and goals. When Debt Consolidation is Better When Debt Settlement is Better Most of your debts ar...

What happens if you settle a debt with a debt buyer?

If you enter into a new payment arrangement with the debt buyer, you could damage your credit score and make it easier for the debt buyer to sue you.

What to do before a debt buyer files a lawsuit?

What to Do Before a Debt Buyer Files Suit. If you're receiving demand letters and phone calls from a debt buyer about a legitimate debt—and the debt buyer hasn't filed a lawsuit against you—the first decision you should make is whether you should ignore the debt or deal with the debt buyer.

How to find out if a debt buyer has purchased your debt?

The easiest way to find out if a debt buyer has purchased your debt is to read your mail. You will probably receive a letter from the debt buyer stating it bought the debt. You can also check your credit reports. If you see a debt with your original creditor marked as "charged off" or something similar, and then see another company with a debt in the same amount but with a more recent date, that company is likely a debt buyer.

How do debt buyers make money?

Debt buyers make money by acquiring debts cheaply and then trying to collect from the debtors. Even if the debt buyer collects only a fraction of the amount owed on a debt it buys—say, two or three times what it paid for the debt—it still makes a significant profit.

What happens if a debt buyer files a lawsuit against you?

If the debt buyer files a lawsuit against you, you might have a defense that could prevent it from getting a judgment against you. For all of these reasons, you have a great deal of leverage when negotiating with a debt buyer, much more than you might think.

How to tell if a debt buyer bought your debt?

How You Can Tell If a Debt Buyer Bought Your Debt. The easiest way to find out if a debt buyer has purchased your debt is to read your mail. You will probably receive a letter from the debt buyer stating it bought the debt. You can also check your credit reports.

What does a debt buyer do?

Debt buyers purchase debts in bulk and then try to collect them. Learn how to deal with a debt buyer.

What is debt settlement?

Key Takeaways. Debt settlement is an agreement between a lender and a borrower to pay back a portion of a loan balance, while the remainder of the debt is forgiven. You may need a significant amount of cash at one time to settle your debt. Be careful of debt professionals who claim to be able to negotiate a better deal than you.

What are the downsides of debt settlement?

The Downsides of Debt Settlement. Although a debt settlement has some serious advantages, such as shrinking your current debt load , there are a few downsides to consider. Failing to take these into account can potentially put you in a more stressful situation than before.

Why do credit cards keep putting you on a debt?

It is usually because the lender is either strapped for cash or is fearful of your eventual inability to pay off the entire balance. In both situations, the credit card issuer is trying to protect its financial bottom line—a key fact to remember as you begin negotiating.

How to negotiate a credit card?

Start by calling the main phone number for your credit card’s customer service department and asking to speak to someone, preferably a manager, in the “debt settlements department.”. Explain how dire your situation is.

Is debt settlement good for you?

Although a debt settlement has some serious advantages, such as shrinking your current debt load, there are a few downsides to consider. Failing to take these into account can potentially put you in a more stressful situation than before.

Can a credit card company seize a debt?

Credit cards are unsecured loans, which means that there is no collateral your credit card company—or a debt collector —can seize to repay an unpaid balance. While negotiating with a credit card company to settle a balance may sound too good to be true, it’s not.

What is debt settlement?

Debt settlementis a debt relief option that focuses on getting you out of debt for a percentage of what you owe. It’s also commonly called debt negotiationbecause you negotiate to only pay back a portion of the outstanding balance. In exchange, the creditor or collector discharges whatever is left.

What is the advantage of debt settlement?

Cost savings is the other big advantage of debt settlement. While other debt reliefsolutions focus on reducing the interest rate applied to your debt, debt settlement makes APR a complete non-issue. With debt settlement, you only pay back a percentage of principal – that’s the actual debt you owe.

How to settle a medical bill?

With this method, you contact a company first and make a settlement offer. You offer a certain percentage of what you owe and request for the remaining balance to be discharged. You can use this method with debt collectors, medical service providers for unpaid medical bills, or with a credit card company if your account is behind but still with the original creditor.

How long does it take to get out of debt?

Unless you file for Chapter 7 bankruptcy, which can take as little as six months to complete, debt settlement is typically the fastest way to get out of credit card debt. Debt settlement programs can be completed in as little as 12 months, depending on your financial situation. Even if you have limited funds for generating settlement offers, a good debt settlement company may be able to help you set up a plan that would have you out of debt less than 48 months. That’s equal to the average term you’d face with a debt consolidation loan, and you’ll likely eliminate your debt for half the cost!

How long does a settlement stay on your credit report?

The settlement remains on your credit report seven years from when the account first became delinquent.

How much does it cost to file Chapter 7?

The filing fee for Chapter 7 is $335, then you’ll also have fees for your attorney. This is why it’s important to have the right filing expectationsbefore you take your case to the courts. Let a certified debt relief specialist help you weigh the pros and cons of debt settlement based on your needs, credit, and budget.

How much does it cost to file for bankruptcy?

Keep in mind that bankruptcy isn’t free. The filing fee for Chapter 7 is $335, then you’ll also have fees for your attorney. This is why it’s important to have the right filing expectations before you take your case to the courts.

What to do if you agree to a settlement?

If you agree to a repayment or settlement plan, record the plan and the debt collector’s promises. Those promises may include stopping collection efforts and ending or forgiving the debt once you have completed these payments. Get it in writing before you make a payment.

How long does a debt have to be paid before it can be sued?

The statute of limitations is the period when you can be sued. Most statutes of limitations fall in the three to six years range, although in some jurisdictions they may extend for longer.

How to contact a debt collector?

Any debt collector who contacts you to collect a debt must give you certain information when it first contacts you, or in writing within 5 days after contacting you, including: 1 The name of the creditor 2 The amount owed 3 That you can dispute the debt or request the name and address of the original creditor, if different from the current creditor.

How to talk to a debt collector about your debt?

Explain your plan. When you talk to the debt collector, explain your financial situation. You may have more room to negotiate with a debt collector than you did with the original creditor. It can also help to work through a credit counselor or attorney.

How long does it take for a debt collector to contact you?

Any debt collector who contacts you to collect a debt must give you certain information when it first contacts you, or in writing within 5 days after contacting you, including: The name of the creditor. The amount owed. That you can dispute the debt or request the name and address of the original creditor, if different from the current creditor.

What to do if you don't recognize the creditor?

If you don’t recognize the name of the creditor, you can ask what the original debt was for (credit card, mortgage foreclosure deficiency, etc.) and request the name of the original creditor. After you receive the debt collector’s response, compare it to your own records.

When will debt collectors have to give notice of eviction moratorium?

All debt collectors must follow the Fair Debt Collection Practices Act (FDCPA). This can include lawyers who collect rent for landlords. Starting on May 3, 2021, a debt collector may be required to give you notice about the federal CDC eviction moratorium.

What is do it yourself debt settlement?

With do-it-yourself debt settlement, you negotiate directly with your creditors in an effort to settle your debt for less than you originally owed.

How much does a debt settlement company charge?

With a debt settlement company, you’ll likely pay a fee of 20% to 25% of the enrolled debt once you agree to a negotiated settlement and make at least one payment to the creditor from an account set up for this purpose, according to the Center for Responsible Lending.

What company did the CFPB take legal action against?

In 2013, the CFPB took legal action against one company, American Debt Settlement Solutions, saying it failed to settle any debt for 89% of its clients. The Florida-based company agreed to effectively shut down its operations, according to a court order.

What is the difference between debt settlement through a company and doing it yourself?

Time and cost are the main distinctions between debt settlement through a company and doing it yourself.

What does "settled" mean on credit report?

Settled debts are generally marked as “Settled” or “Paid Settled,” which doesn’t look great on credit reports. Instead, you'll try to get your creditor to mark the settled account “Paid as Agreed” to minimize the damage.

How long can you be behind on a debt settlement?

Debt settlement is an option if your payments are at least 90 days late, but it’s more feasible when you're five or more months behind. But because you must continue to miss payments while negotiating, damage to your credit stacks up, and there is no guarantee that you’ll end up with a deal.

How long does it take to settle a debt?

While completing a plan through a company can take two and a half years or more, you may be able to settle your debts on your own within six months of going delinquent, according to debt settlement coach Michael Bovee.

Why do creditors accept settlement offers?

Creditors can either send your accounts to collections, sue you for nonpayment, or sell the debt to a third-party debt buyer or collector.

How to settle debt for less than what you owe?

While many creditors might agree to settle your debt for less than what you owe, there’s no guarantee that debt settlement will work. If you’re considering trying it on your own, here’s a rough guide to the steps you may want to take: 1. Assess your situation. Create a list of your past-due accounts with the creditors’ names, how much you owe, ...

What to do if a creditor doesn't settle?

If the creditor doesn't agree to settle, you may want to wait until it sells the debt and try again with the debt buyer or collection agency.

How long do you have to be late to settle a credit card?

For example, you may need to be at least 90 days late on an account before a creditor considers settling. Or, some creditors might not settle at all, and you’ll have to wait until the debt is sold to another company. Some creditors might also be more likely to sue you to collect an unpaid debt than others.

What to do if you feel like you're drowning in debt?

If you feel like you’re drowning in debt, the idea of settling for less money than you owe can be appealing. You could hire a debt settlement company that will work on your behalf to negotiate settlements with your creditors.

What to do if you think you have enough money to settle an account?

Once you think you have enough money saved up to settle an account, you can call your creditor and make an offer. In some cases, the creditor may have already sent you a settlement offer. You could accept the offer, or respond with a lower counteroffer.

How long do you have to be behind on credit card payments to settle?

Creditors generally don’t agree to settle an account if you’re only a few days late. You may need to be at least 90 or more days behind on your payments before a credit card company will even consider a settlement. By that point, your late payments have likely been reported to the credit bureaus.

But How?

The key to making a settlement negotiation work at 25 to 50 percent is preparedness. You need the right amount of cash on hand, as well as a few tools in your box to ensure the debt collectors don’t dissuade or discourage you.

Tricks to Avoid

Debt negotiations can be tense. But you can settle your debt by approaching the call with these tricks in mind.

Settling Debt

Debt settlement negotiations can be intimidating, but most agencies will take 25 to 50 cents on the dollar to settle your debt. Be sure to get it in writing and offer the money right then. The key is to fight fire with fire.

How long does it take for a debt collector to send out a settlement offer?

Some creditors and debt collectors automatically send out settlement offers on accounts. Creditors may do this when the account reaches 90 days past due. Collection agencies may make the offer as soon as they assume responsibility for collecting on the debt. A letter including the offer may not specifically use the word settlement, but there could be some language to indicate that you can pay a lump-sum amount that’s less than the full balance due and the creditor will cancel the rest of the debt. Once you receive the offer, you have to decide if it’s worth taking.

What to do if you reach an acceptable settlement?

If you and the creditor reach an acceptable settlement amount, then make the payment and keep a copy for your records. Making a counteroffer or just negotiating could be intimidating so you could always hire a debt settlement company to help you through the process.

How to write a counter offer letter?

You could say that you only have a certain amount of money that you’re able to use to settle the account. Ask the creditor to sign and return a copy of the agreement if they accept. You should send your letter via certified mail with return receipt requested and wait for an answer. If you have a fax machine, include the fax number so the creditor can send the agreement back faster if the creditor accepts.

What is the biggest part of debt settlement?

The biggest part of debt settlement is probably negotiation. You want to pay the smallest amount possible to satisfy your debt (or nothing at all!) and the creditor would prefer if you paid the full balance of the account. Somewhere in the middle there’s an amount that could work well for both of you. Sometimes you could be the one making the initial offer and your creditor will respond with an acceptance or a counteroffer. But, there may be times when you’re on the receiving end of the initial offer and you’re faced with a choice to accept or reject the offer.

Can you settle a lump sum?

A letter including the offer may not specifically use the word settlement, but there could be some language to indicate that you can pay a lump-sum amount that’s less than the full balance due and the creditor will cancel the rest of the debt. Once you receive the offer, you have to decide if it’s worth taking.

How to deal with a debt settlement?

You can accept the settlement offer and pay the settlement account in full. This is the easiest and fastest way to deal with the debt, assuming you’ve received a legitimate settlement offer. Read the settlement offer carefully or have an attorney review the offer to be sure it’s legally binding – that the creditor or collector can’t come after you for the remaining balance at some point in the future.

What percentage of a debt is typically accepted in a settlement?

Debt settlement agreements often range between 30% and 60% of the total amount owed, but there will also be substantial fees on top of that amount.

How long does debt settlement stay on your credit report?

Generally, settled accounts stay on your credit report for seven years after the original date of delinquency. A debt settlement will negatively affect your credit, but not as much as failing to pay the debt will. 6

How to stop a third party debt collector from collecting my credit report?

You can stop communication from a third-party debt collector by sending a written cease and desist letter. 4

What is a settlement letter?

A settlement letter could be a debt collector ploy to get you to make one or more partial payments on a time-barred debt, that is one whose statute of limitations has expired. The payment would restart the statute of limitations giving the collector more time to sue you for the debt 1 .

Can a creditor accept a lower settlement?

Your creditor may be willing to accept a lower settlement than the one offered in the letter. Because the door for settling the debt is already opened, you can use this opportunity to see if the creditor is willing to accept a lower payment.

Do you have to convince a creditor to settle?

Plus, you don't have to convince creditor to settle because they’ve already made that decision. Don’t get too excited about the prospect of finally being rid of this debt. Before you pay or even speak to anyone about the settlement (particularly a debt collector), you need to be sure the settlement offer is legitimate.

The Basics of Debt Settlement

The Downsides of Debt Settlement

Should You Do It Yourself?

Appearances Matter

The Negotiating Process

- Start by calling the main phone number for your credit card’s customer service department and asking to speak to someone, preferably a manager, in the “debt settlements department.” Explain how dire your situation is. Highlight the fact that you’ve scraped a little bit of cash together and are hoping to settle one of your accounts before the money ...

The Bottom Line