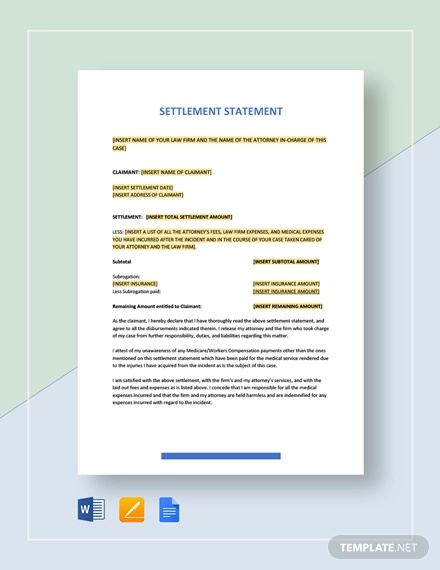

- Know your purpose in writing the settlement statement. You should have a goal in mind as to why you are writing a settlement statement. ...

- Review all the details of your transaction. Make sure you remember what both parties have agreed upon.

- Carefully lay down the points needed to be discussed in the settlement statement. This includes all terms, conditions, standards, and all important details regarding your transaction.

- Write in an understandable manner. You need to write clearly. Use simple words, phrases, and language. Specify all the things that need to be specified.

- Be honest. You need the other party to trust you until the last moment, so be honest in writing all the contents of your settlement statement.

- Make it short. Do not include unnecessary information which would make your settlement statement unnecessarily long.

- Go over your settlement statement many times before sending it to the other party. You first need to check if all the information you included are accurate. ...

What is settlement and examples of settlement?

Settlement statement defines the document which discloses the summary writing of the transaction between the service provider and the client. For example, a seller sends the buyer a settlement statement containing the summed up costs with regards to the buyer’s purchase. Or a lender sends a settlement statement to a borrower containing all ...

What is a HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a standardized mortgage lending form in use in the United States of America on which creditors or their closing agents itemize all charges imposed on buyers and sellers in consumer credit mortgage transactions.

How do you write a letter of settlement?

Settlement Agreement Letter Writing Tips. The letter should specify the important details. The letter should also specify how the settlement can be tackled. The letter should specify the amount. The letter should be clear and simple. The letter should express the terms & conditions from the standpoint of both the parties.

What is a HUD settlement statement?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction.

What is the most commonly used form for settlement statements?

A HUD-1 form, also called a HUD-1 Settlement Statement, is a standardized mortgage lending document. Creditors or their closing agents use this form to create an itemized list of all charges and credits to the buyer and to the seller in a consumer credit mortgage transaction.

How do you record a settlement statement?

How to Record a HUD Settlement StatementCredits – will list the gross amount owed to the seller at the time of settlement closing:Debits – will list the charges of the seller at the time of settlement closing:Debits – will list the gross amount owed by the buyer at the time of statement closing:More items...•

What is final settlement statement?

A settlement statement is a document summarizing all costs owed by or credits due to the homebuyer and seller (or borrower if refinancing). The document also includes the purchase price of the property, loan amount and other details.

Is a settlement statement the same as a closing statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

How do I record a purchase of a property?

Add a home's purchase price to the closing costs, such as commissions, to determine the home's total cost. Write “Property” in the account column on the first line of a journal entry in your accounting journal. Write the total cost in the debit column. A debit increases the property account, which is an asset account.

Where does the purchase price appear on a Settlement Statement?

Where does the purchase price appear on the settlement statement? debit for the buyer credit for the seller. Where does the buyers new loan appear on the settlement statement? Credit buyer- The buyers debit column lists all the charges to the buyer; the credit column shows how the buyer is going to pay the charges.

Who prepares the closing statement?

Typically, closing agents are real estate attorneys, title companies or escrow officers. Unlike the HUD-1, which closing agents generally provided to buyers and sellers on the day of a real estate closing, closing statements must be issued at least three business days before closing.

What is estimated settlement statement?

The Estimated Settlement Statement lists all of the costs and credits associated with the purchase of a home showing the buyer their total costs to close the transaction and showing sellers their net profit (or loss). Think of it as your detailed receipt that details information from various places on one page.

How can I get a copy of my closing documents?

You can obtain a certified copy of these documents from the closing agent or from your real estate agent if you lose the originals. The closing disclosure contains all the official charges and credits of your home purchase.

How do you write a closing statement example?

An example of a closing argument is the lawyer opening with a statement, "How can my client be in two places at once?". The lawyer could then incorporate the theme of an alibi, arguing that the defendant could not have possibly committed a crime because they weren't even in the country when the crime took place.

What a closing statement looks like?

A mortgage closing statement lists all of the costs and fees associated with the loan, as well as the total amount and payment schedule. A closing statement or credit agreement is provided with any type of loan, often with the application itself.

When can a settlement agreement be used?

A settlement agreement is usually used in connection with ending the employment, but it doesn't have to be. A settlement agreement could also be used where the employment is ongoing, but both parties want to settle a dispute that has arisen between them.

How do I record a settlement statement in Quickbooks?

3:4822:25How to Use QuickBooks Online to Record a HUD 1 Final ... - YouTubeYouTubeStart of suggested clipEnd of suggested clipSo let's go to the quick create plus sign. And we'll go over to journal entry. And we're going toMoreSo let's go to the quick create plus sign. And we'll go over to journal entry. And we're going to enter a bunch of debits and credits. So the purchase price on the surface looks like 43,000.

How do I record a settlement payment in Quickbooks?

First, we have to record the exact amount you've received from your client and apply it to the invoice.Open the affected invoice and click Receive payment.Enter the payment date and where to deposit the amount.Mark the invoice and enter the exact amount you've received ($3k).Click Save and close.

What is a settlement statement for taxes?

The HUD-1 Settlement Statement is a breakdown of the expenses home sellers and homebuyers incur in a real estate sale. The settlement statement gives both parties a full picture of the expenses attached to the transaction.

How do you record the sale of land in accounting?

How do you record the sale of land?Credit to its Land account for its cost of $200,000.Debit to its Cash account for the $500,000 it received.Credit to the income statement account Gain on Sale of Real Estate for $300,000.

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

Who is responsible for preparing the settlement statement?

Whoever is facilitating the closing — whether it be a title company, escrow firm, or real estate attorney — will be responsible for preparing the settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.

How long before closing do you have to give closing disclosure?

In the wake of the subprime crisis, the Consumer Financial Protection Bureau requires that buyers receive the Closing Disclosure, outlining loan costs among other fees and information pertinent to the borrower, no later than 3 days before closing for review.

When are property taxes prorated?

For instance, say you get billed for property taxes in February to cover the previous year. If you’re closing on a sale on April 30, the yearly property tax is “prorated” or calculated for the first four months of the year, and it’s reflected in this section.

What Is a Settlement Statement?

A settlement statement is a document that summarizes the terms and conditions of a settlement, most commonly a loan agreement. A loan settlement statement provides full disclosure of a loan’s terms, but most importantly it details all of the fees and charges that a borrower must pay extraneously from a loan’s interest. Different types of loans can have varying requirements for settlement statement documentation. Generally, loan settlement statements can also be referred to as closing statements .

When are settlement statements created?

Beyond just loans, settlement statements can also be created whenever a large settlement has taken place, such as with a large business transaction or potentially in the legal, insurance, banking, and trading industries.

What is debt settlement?

Debt settlement: A debt settlement statement can provide a summary of debts written off, reduced, or otherwise amended after a debt settlement has completed. Lawyers and debt settlement companies work on behalf of borrowers with overwhelming amounts of debt, in order to help them reduce some or all of their obligations.

What is a settlement statement in stock trading?

Trading: In financial market trading, settlement statements provide proof of a security’s ownership transfer. Typically, stocks are transferred with a T+2 settlement date meaning ownership is achieved two days after the transaction is made.

What is insurance settlement?

Insurance settlement: An insurance settlement is most commonly documentation of the amount an insurer agrees to pay after reviewing an insurance claim. Banking: In the banking industry, settlement statements are produced on a regular basis for internal banking operations.

Does a reverse mortgage require a HUD-1 settlement statement?

RESPA requires a HUD-1 settlement statement for borrowers involved in a reverse mortgage. For all other types of mortgage loans, RESPA requires the mortgage closing disclosure. Both the HUD-1 and mortgage closing disclosure are standardized forms.

What does a well-researched and cogent statement tell the judge?

A well-researched and cogent statement tells the judge you’ve thought about—and care about—your case. Your thought and care promotes theirs

What did panelists draw on their experiences and observations from the bench and practice on enhancing pre-settlement?

Panelists drew on their experiences and observations from the bench and practice on enhancing pre-settlement conference position papers, as well as tips and suggestions for more successful settlement conferences.

Should you talk to a settlement conference judge?

With notice to the other side, talk with the settlement conference judge beforehand about aspects of your case that you’re uncomfortable disclosing ( e. g., difficult client) or intricate details the judge to may need to delve into beforehand to get perspective they’ll need. Oftentimes judges aren’t prepared to “rule” on the case, and if a litigant wants the judge to understand a particular aspect, they should tell the judge in advance. This technique often proves especially useful for nuances, awkward facets, and explaining why a defendant really can’t go above a maximum they’ve set

Is it too early to file a settlement?

Judge Finnegan replied that yes, sometimes it’s too early for a settlement conference, but she generally encourages litigants to prepare for a conference before filing a motion for summary judgment.

Can you attack a discharge decision maker?

For employment discharge cases: don’t attack the discharge decisionmaker. That makes it more difficult to “sell” a settlement to the settlement decisionmakers

Should litigants jointly memorialize their principal settlement terms?

If the litigants successfully reach a settlement, to avoid later confusion and dispute, they should jointly memorialize their principal settlement terms in detail before anyone leaves

What are the situations where a settlement agreement is used?

Some of the most common situations in which a settlement agreement is utilized include: disputes over damaged property; employment disputes between employers and employees; marriage disputes; and medical malpractice disputes.

What should be hammered out before writing a settlement agreement?

For example, payment arrangements and logistics should be hammered out before you write the settlement agreement.

How to resolve a claim in a settlement agreement?

Negotiate the scope of the release. You must negotiate the scope of the release in the agreement to determine which claims will be resolved, and whether any future claims are also resolved by this settlement agreement. You can negotiate a provision stating that the settlement agreement applies to all claims arising out of the dispute, whether they are current or not yet realized, or the settlement may resolve just one aspect of a suit or a single claim. This will depend on your needs.

How to settle a dispute between two parties?

1. Decide whether you have the need for a settlement agreement. A settlement agreement is a legally enforceable contract. They can be used in a variety of situations where two parties are in dispute about something and they wish to compromise on how that dispute will be resolved.

What is a settlement agreement?

A settlement agreement is a legally binding contract meant to resolve a dispute between yourself and another party so you do not have to go through the judicial process (or extend the judicial process if you are already in court).

How to settle a dispute with a mediator?

1. Agree on a statement of the dispute. Both parties are likely to have a differing view of the dispute. Before writing your settlement agreement, you must come to an agreement of the factual terms of the dispute. A mediator may be helpful in determining this.

What does "unconscionable" mean in a settlement agreement?

A settlement agreement must also not be "unconscionable.". This means that it cannot be illegal, fraudulent, or criminal. For example, you could not agree to settle a lawsuit in exchange for six pounds of cocaine, because the sale of cocaine is illegal in the United States. [11]

How to find an attorney for a settlement?

You can find an attorney by contacting your local or state bar association and asking for a referral.

What to do if a settlement fails?

If settlement fails, then you’ll probably have to go to court. You should analyze whether you’re likely to win at court. If so, then you can be aggressive at the settlement conference. If your case is weak, then you probably should seek resolution during the settlement conference.

What do you need to know in a divorce?

In a divorce dispute, for example, you’ll need to determine child custody, visitation, child support, and spousal maintenance (alimony). You should figure out what you want in all areas. In a personal injury dispute, you’ll need to decide how much money you are willing to pay or accept.

What is it called when you reach an impasse?

This is called “caucusing, ” and the mediator might use it if you reach an impasse. Caucusing allows you to speak honestly to the mediator without the other side hearing what you say. You can also ask the mediator for their honest assessment of how they think the settlement conference is going.

What is the role of a mediator in a settlement?

A mediator’s job is to guide the discussion and to get the two sides listening to each other. Even if a judge runs the conference, realize that they will not be deciding anything during it.

How to get a time limit on a divorce?

You will need to obtain the consent of the other party and prepare a written stipulation to a new, agreed upon date. Then you will need to call the court to clear that date with their calendar. If you can't get an agreement from the other side, you will have to file a motion to have the judge step in and schedule a mutually agreeable settlement conference.

What is settlement conference?

Settlement conferences are used in all kinds of lawsuits, but they are very common in divorce and personal injury cases. The purpose of the conference is to resolve the dispute in a way that satisfies all parties to the lawsuit. Settlement conferences may be mandatory (required by the court) or voluntary. Regardless of the type of settlement conference, you should prepare by thinking about what you want and the minimum amount you are willing to settle for. Talk about the case with a lawyer and then submit all required paperwork.

How many sections are there in an ALTA settlement statement?

There are a total of 11 sections in the ALTA settlement statement. Each of them highlights a particular type of cost associated with closing. Note that the debit and credit sections are listed against the seller and buyer on their respective sides from the second section which is where the costs are highlighted. Let’s go through all the sections.

What is the ALTA statement sheet?

One of the important documents in this pile is the ALTA statement sheet. The ALTA statement gives an itemized list of prices for the closing process. While the HUD-1 settlement statement used to serve this purpose before, it is now outdated.

How many types of ALTA statements are there?

There are 4 types of ALTA statements made according to their unique recipients. These four types of statements are:

What is flood determination fee?

Flood Determination Fee to. It is paid to get government approval on the property and that it is not located in an area prone to flooding.

Who pays for personal property?

Personal Property. These costs are paid by the buyer provided they want to purchase appliances or any furnishings along with the property. The amount is credited to the seller’s account and debited from the buyer’s.

What is the disbursement date?

Disbursement Date. The day when the seller is supposed to receive the payment in their bank account. The disbursement date is the same as the settlement date in most cases. Other Dates: Dates given for recording or anything that relates to transferring the title of the property.