A standard settlement statement has a column for the seller’s debits and credits on one side, a column for the buyer’s debits and credits on the other, and a description of the charge in the middle. Below we use the ALTA form as an example and break it down, line by line. Source: (American Land and Title Association)

Full Answer

Is the settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry. What’s the difference between a Closing Disclosure and settlement statement?

Is settlement statement same as Closing Disclosure?

You may also see the settlement statement come into play in along with the “Closing Disclosure” form. This is among the fairly common closing documents for seller. If you find at a later time you need a copy of your closing statement, contact the settlement agent for the home purchase.

How to generate a daily settlement report?

Settlement occurs for all batches submitted within the 24-hour "settlement day". For example, for a particular processor, all transactions from 9 PM Monday night through 9 PM Tuesday night occur during that "day". Generating a Settlement Report. To access the Settlement Report page, navigate to Reports-> Standard-> Settlement.

What is a HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a standardized mortgage lending form in use in the United States of America on which creditors or their closing agents itemize all charges imposed on buyers and sellers in consumer credit mortgage transactions.

How do you read a home settlement statement?

4:3813:06How To Read A Closing Statement - YouTubeYouTubeStart of suggested clipEnd of suggested clipSo it starts with the agreed upon sale price. And then debits and credits are applied to both buyerMoreSo it starts with the agreed upon sale price. And then debits and credits are applied to both buyer and seller. And then all of the numbers are added and subtracted at the very bottom.

How do you read a settlement?

0:367:31How To Read A Settlement Statement From Your Real Estate ClosingYouTubeStart of suggested clipEnd of suggested clipSo on page one of the closing disclosure you're going to see the parties identified at the top soMoreSo on page one of the closing disclosure you're going to see the parties identified at the top so seller and buyer the property. Address and the loan. Amount.

What are points on a settlement statement?

Points are calculated in relation to the loan amount. Each point equals one percent of the loan amount. For example, one point on a $100,000 loan would be one percent of the loan amount, or $1,000. Two points would be two percent of the loan amount, or $2,000.

What is final settlement statement?

A settlement statement is a document summarizing all costs owed by or credits due to the homebuyer and seller (or borrower if refinancing). The document also includes the purchase price of the property, loan amount and other details.

What is the difference between a closing disclosure and a settlement statement?

While closing disclosures provide information about a borrower's loan, settlement statements do not include loan information. Settlement statements are used for commercial transactions and cash closings.

Where does the purchase price appear on a settlement statement?

Where does the purchase price appear on the settlement statement? debit for the buyer credit for the seller. Where does the buyers new loan appear on the settlement statement? Credit buyer- The buyers debit column lists all the charges to the buyer; the credit column shows how the buyer is going to pay the charges.

How do you calculate points?

One point is 1% of the loan value or $1,000. To calculate that amount, multiply 1% by $100,000. For that payment to make sense, you need to benefit by more than $1,000. Points aren't always in round numbers, and your lender might offer several options.

Are closing costs and points tax deductible?

Can you deduct these closing costs on your federal income taxes? In most cases, the answer is “no.” The only mortgage closing costs you can claim on your tax return for the tax year in which you buy a home are any points you pay to reduce your interest rate and the real estate taxes you might pay upfront.

How do I know if I paid my mortgage points?

Your lender will send you a Form 1098. Look in Box 2 to find the points paid for your loan. If you don't get a Form 1098, look on the settlement disclosure you received at closing. The points will show up on that form in the sections detailing your costs or the sellers' costs, depending on who paid the points.

What is a Good Faith Estimate in real estate?

A Good Faith Estimate, also called a GFE, is a form that a lender must give you when you apply for a reverse mortgage. The GFE lists basic information about the terms of the mortgage loan offer. The GFE includes the estimated costs for the mortgage loan.

Which two items will appear on a closing disclosure?

Closing disclosure form sectionsLoan information. This section should match your loan estimate regarding the loan term, loan purpose and loan program (conventional, FHA, VA or USDA).Loan terms. ... Projected payments. ... Costs at closing. ... Late payment fee. ... Escrow account.

Is settlement date the same as closing date?

"Settlement date" and "closing date" are synonymous terms referring to the date when a property's seller and buyer meet to finalize the deal. At this time, the deed to the property is transferred from the seller to the buyer and all pertinent paperwork is completed.

What is settlement in real estate?

What is settlement? Property settlement is a legal process that is facilitated by your legal and financial representatives and those of the seller. It's when ownership passes from the seller to you, and you pay the balance of the sale price. The seller sets the settlement date in the contract of sale.

What's the term for a charge that either party has to pay at closing?

Closing costs are fees due at the closing of a real estate transaction in addition to the property's purchase price. Both buyers and sellers may be subject to closing costs.

What is a closing statement?

A closing statement is a form used in a real estate transaction that includes an itemized list of all the buying or selling costs associated with that transaction. It's a standard element of home sales, especially those that involve mortgages, and refinancings.

Which two items will appear on a closing disclosure?

Closing disclosure form sectionsLoan information. This section should match your loan estimate regarding the loan term, loan purpose and loan program (conventional, FHA, VA or USDA).Loan terms. ... Projected payments. ... Costs at closing. ... Late payment fee. ... Escrow account.

What is a HUD-1 settlement statement?

The real estate closing statement was called the HUD-1 Settlement Statement until a few years ago. Today, it’s known as the Closing Disclosure. It’s one of the important documents you will sign at the closing. Understanding what to look for and what everything means will help you understand its importance.

What should the closing statement include?

It should contain information pertaining to your loan including the loan amount, loan term, and interest rate. It should also tell you of any odd terms about the loan, ...

What to read on the fourth page of a mortgage?

On the fourth page, however, you’ll want to read about any special features of your loan . For example, is the loan assumable? If so, the appropriate box will be checked. You’ll also learn if your lender accepts partial payments or if it has an escrow account.

What is the third page of a loan estimate?

On the third page, you’ll likely see the information you are after – the cash you need to close the loan. However, it does show you a comparison between what you saw on the Loan Estimate and the final closing costs at the closing.

Where is the closing cost breakdown on a loan?

The second page of the clo sing statement is where you’ll see the breakdown of the closing costs. If you have closed on a loan prior to 2015, this will look similar to the HUD-1 Settlement Statement. You’ll see a breakdown of the following categories:

Can you skim through disclosures?

As you move further down the disclosure, you’ll see various information that further calculates the totals above. As long as you know the above totals are correct, you can skim through these sections just to make sure you understand them, but they are all reflect ed in the first few pages.

Can you see escrow deposit on down payment?

You’ll also see the down payment amount; again make sure the amount is correct. If you put down an escrow deposit, that amount should be subtracted from the amount of the down payment . Finally, you’ll see any seller or lender credits subtracted from the amount as well.

What Is a Settlement Statement?

A settlement statement is a document that summarizes the terms and conditions of a settlement, most commonly a loan agreement. A loan settlement statement provides full disclosure of a loan’s terms, but most importantly it details all of the fees and charges that a borrower must pay extraneously from a loan’s interest. Different types of loans can have varying requirements for settlement statement documentation. Generally, loan settlement statements can also be referred to as closing statements .

When are settlement statements created?

Beyond just loans, settlement statements can also be created whenever a large settlement has taken place, such as with a large business transaction or potentially in the legal, insurance, banking, and trading industries.

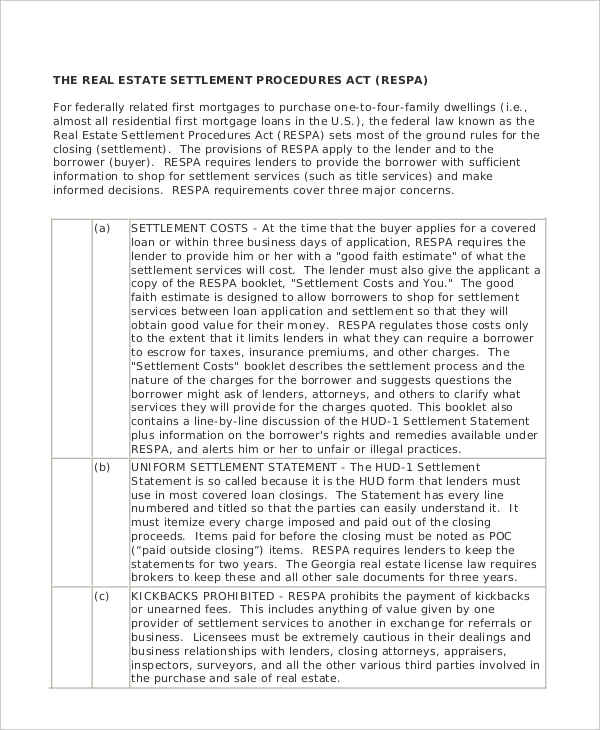

What is a RESPA?

The Real Estate Settlement Procedures Act (RESPA) govern s the formulation of both closing disclosures and HUD-1 statements for the mortgage lending market. RESPA has been revised and updated throughout history to help manage mortgage lending disclosures and protect borrowers. RESPA requires a HUD-1 settlement statement for borrowers involved in a reverse mortgage. For all other types of mortgage loans, RESPA requires the mortgage closing disclosure.

What is debt settlement?

Debt settlement: A debt settlement statement can provide a summary of debts written off, reduced, or otherwise amended after a debt settlement has completed. Lawyers and debt settlement companies work on behalf of borrowers with overwhelming amounts of debt, in order to help them reduce some or all of their obligations.

What is a settlement statement in stock trading?

Trading: In financial market trading, settlement statements provide proof of a security’s ownership transfer. Typically, stocks are transferred with a T+2 settlement date meaning ownership is achieved two days after the transaction is made.

What is insurance settlement?

Insurance settlement: An insurance settlement is most commonly documentation of the amount an insurer agrees to pay after reviewing an insurance claim. Banking: In the banking industry, settlement statements are produced on a regular basis for internal banking operations.

Does a reverse mortgage require a HUD-1 settlement statement?

RESPA requires a HUD-1 settlement statement for borrowers involved in a reverse mortgage. For all other types of mortgage loans, RESPA requires the mortgage closing disclosure. Both the HUD-1 and mortgage closing disclosure are standardized forms.

How many sections are there in an ALTA settlement statement?

There are a total of 11 sections in the ALTA settlement statement. Each of them highlights a particular type of cost associated with closing. Note that the debit and credit sections are listed against the seller and buyer on their respective sides from the second section which is where the costs are highlighted. Let’s go through all the sections.

What is the ALTA statement sheet?

One of the important documents in this pile is the ALTA statement sheet. The ALTA statement gives an itemized list of prices for the closing process. While the HUD-1 settlement statement used to serve this purpose before, it is now outdated.

What are points in a mortgage?

Points. Mortgage points are given to the lender for which they reduce the interest rate for the buyers. This amount is paid upfront during closing.

How many types of ALTA statements are there?

There are 4 types of ALTA statements made according to their unique recipients. These four types of statements are:

What is the disbursement date?

Disbursement Date. The day when the seller is supposed to receive the payment in their bank account. The disbursement date is the same as the settlement date in most cases. Other Dates: Dates given for recording or anything that relates to transferring the title of the property.

What is flood determination fee?

Flood Determination Fee to. It is paid to get government approval on the property and that it is not located in an area prone to flooding.

Who pays for personal property?

Personal Property. These costs are paid by the buyer provided they want to purchase appliances or any furnishings along with the property. The amount is credited to the seller’s account and debited from the buyer’s.

What is settlement statement?

A settlement statement is the statement that summarizes all the fees and charges that both the home-buyer and seller face during the settlement process of a housing transaction. The table below gives further explanation as to what these fees and charges are for both buyer and seller.

When are sellers charged for taxes?

Seller is charged their portion of the current year taxes from January 1st to the closing date. Based on either prior year taxes or most recent mill levy and assessed value. This determines pursuant to the contact.