- Invalidate the lien. If the lien is invalid or was obtained in a manner that doesn't follow the procedural requirements under the law, an attorney may be able to strip the lien from the property. ...

- Satisfy the debt. ...

- Negotiate a lower payoff. ...

- File for bankruptcy.

How do I remove an invalid lien in California?

Step 1: Contact the Lien Claimant and Request.Step 2: Obtain a Certified Copy of the Claim of Lien. ... Step 3: Prepare the Required Court Pleadings. ... Step 4: Copy and Assemble the Documents. ... Step 5: File Documents in Court, Pay Filing Fee, and Ask Clerk for a Hearing Date. ... Step 6: Have the Petition and Other Documents Served.More items...•

How do I get rid of a lien on my property in Florida?

If you want to remove a lien from your property, you need to do one of two things: 1) have the contractor record a release of the lien or 2) file an appeal to have the lien released.

How long does a lien stay on your property in New Jersey?

20 yearsHow long does a judgment lien last in New Jersey? A judgment lien in New Jersey will remain attached to the debtor's property (even if the property changes hands) for 20 years.

How do I contest a lien in Georgia?

If they refuse to cancel the lien, and you still believe the lien was filed in error, you can file a Notice of Contest with the county real estate records. A Notice of Contest requires the person who filed the lien to file a lawsuit against the party that owes them money within 60 days.

Do liens expire in Florida?

Liens are valid for five years from the original filing date. Florida law allows judgment liens to be filed a second time to extend the lien's validity five more years. (See s. 55.201-55.209, F.S.)

How do I dispute a lien against my property in Florida?

Contesting A Lien An owner has a right to file a Notice of Contest of Lien during the one-year period. Upon the filing of a Notice of Contest of Lien, a lienor must file a lawsuit to enforce the lien within 60 days. Failure of the lienor to timely file a lawsuit renders the lien invalid.

What happens when a lien expires?

While an expired lien will no longer be valid and enforceable (and thus has lost its effectiveness as a tool to help remedy a payment issue), it still may remain attached to the underlying property. This is due to the fact that a mechanics lien claim is filed with the clerk of court or the county recorder.

Does a lien affect your credit?

Statutory and judgment liens have a negative impact on your credit score and report, and they impact your ability to obtain financing in the future. Consensual liens (that are repaid) do not adversely affect your credit, while statutory and judgment liens have a negative impact on your credit score and report.

How do I find out if there is a lien on my property in NJ?

In New Jersey, liens are public record....To search for liens on a property, a person may:Search the county clerk's website, using the property owner's name and address of the property. ... Visit the county recorder or clerk's office physically and conduct the inquiries in person.More items...

How long is a lien valid in Georgia?

How long does a judgment lien last in Georgia? A judgment lien in Georgia will remain attached to the debtor's property (even if the property changes hands) for seven years (whether the lien is attached to real estate or to personal property).

How do I get rid of a lien on my property in Georgia?

You'll have to get a release-of-lien form, fill it correctly, and have it signed and stamped by your lien-holder (or creditor) in front of an authorized notary. Submit that form to your county recorder's office for a small fee.

How long do you have to file a lien in Georgia?

within 365 daysIn Georgia, claimants must file a mechanics lien within 90 days from last date of furnishing labor or materials to the project. In Georgia, all lien claimants must initiate the enforcement of the lien within 365 days from the date on which the lien was filed.

How do I get a Judgement lien removed from my house in Florida?

Florida statutes provide a procedure to remove judgment liens from homestead in advance of a sale or refinance. Florida Statute 222.01(2) provides a procedure to send a form notice to the judgment creditors claiming homestead exemption. The creditor 45 days after notice to contest the claim of homestead.

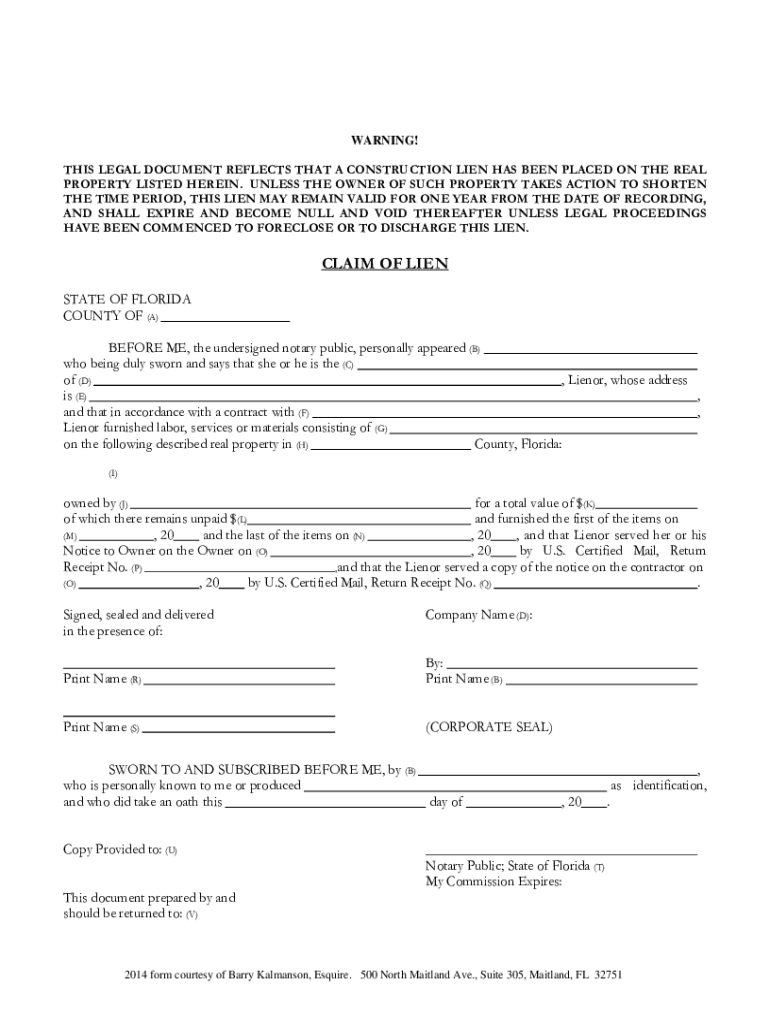

How do property liens work in Florida?

FLORIDA'S CONSTRUCTION LIEN LAW ALLOWS SOME UNPAID CONTRACTORS, SUBCONTRACTORS, AND MATERIAL SUPPLIERS TO FILE LIENS AGAINST YOUR PROPERTY EVEN IF YOU HAVE MADE PAYMENT IN FULL. UNDER FLORIDA LAW, YOUR FAILURE TO MAKE SURE THAT WE ARE PAID MAY RESULT IN A LIEN AGAINST YOUR PROPERTY AND YOUR PAYING TWICE.

Can a lien be placed on a homestead property in Florida?

Article X, Section 4 of the Florida Constitution exempts homestead property from levy and execution by most judgment creditors. This means that a creditor cannot place a lien against or force the sale of your homestead to satisfy an obligation or monetary judgment.

What happens when a lien expires?

While an expired lien will no longer be valid and enforceable (and thus has lost its effectiveness as a tool to help remedy a payment issue), it still may remain attached to the underlying property. This is due to the fact that a mechanics lien claim is filed with the clerk of court or the county recorder.

What does the court do when a lien is not valid?

If there is a question of fact related to the determination of whether the lien is or is not valid, the court may take evidence to assist in the determination (like a deposition of interested parties or other evidence).

What are the requirements for a lien in Pennsylvania?

These requirements include: a debt of more than $500, notice requirements (for parties that did not contract directly with the property owner), timing requirements, and filing and service requirements ...

Can you file objections to lien enforcement?

The objections may be filed prior to the lien claimant initiat ing an enforcement action, and likely should be, to avoid the requirement to file a regular answer to the enforcement action. This is an action in court, and while an individual may represent him/herself, it is rarely a good idea, and it may be worth while to enlist the services ...

Can a lien be disallowed in Pennsylvania?

In such situations, liens are disallowed by law. If a lien is filed in that instance, the owner can petition the court for an immediate discharge of the lien. While these exact procedures are specific to Pennsylvania, there are many states with similar options to get a fraudulent or facially insufficient lien removed.

Can a lien be removed quickly?

Another Option, But Only on Some Residential Projects. There is potentially another option to have a lien removed quickly (that also requires a court action). But, this option is only available if the project was on a single or double residential project, and the owner has paid the GC the full contract amount.

Can a property owner file preliminary objections?

A property owner who has been made defendant in a procedurally or substantively defective lien can file these “preliminary objections” in an attempt to have the invalid lien removed in a quick and relatively inexpensive manner. To best position themselves for the removal of the insufficient lien, the owner should set forth all bases for belief that the lien is improper in the preliminary objections. The objections may be filed prior to the lien claimant initiating an enforcement action, and likely should be, to avoid the requirement to file a regular answer to the enforcement action.

What happens when a tenant files a lien?

For general contractors, when a subcontractor or material supplier files a lien, it will typically place the contractor in breach of its contract and suspend future payments.

When is intent to lien served?

On residential properties, the intent to lien must be served on the property owner and the general contractor by no later than the 15th day of the second month, from each and every month, the lien claimant provided unpaid labor/materials to the property.

How long does it take to file a lawsuit to foreclose a property?

Failure to File a Lawsuit to Foreclose: Recording and serving the lien affidavit is not the last step. A lien claimant must file a lawsuit to foreclose the lien; meaning prove up it is actually entitled to the money claimed owed and that it followed all applicable lien laws. For residential properties, the lawsuit must be filed within 1 year from the last date that the lien affidavit could be filed and on commercial properties, 2 years from the last date the lien affidavit could be filed. Generally speaking, this deadline tends to run approximately 1 or 2 years from when the lien was recorded since most lien claimants wait until the last date to record the lien. If a lawsuit is not filed within these deadlines, the lien becomes invalid even if all other lien laws have been satisfied.

How long do you have to serve a lien on a contract?

On commercial projects, the 1st tier lien claimant (anyone hired by the general contractor) has an additional month to serve the notice, or the 15th day of the third month from each and every month that the lien claimant provided unpaid labor/materials to the project. To make it more complicated, on commercial projects, anyone hired by a subcontractor (as opposed to the general contractor) has an additional intent to lien notice requirement, wherein they must serve the general contractor only, with notice of the unpaid amount by no later than the 15th day of the second month from each and every month work was performed but not paid. Taking the above example, the second-tier lien claimant would be required to notify the general contractor of the unpaid work performed in January, by no later than March 15. A second-tier lien claimant can combine the two notices into one, but only if the notice is sent by the earlier of the two dates.

What are mechanics liens in Texas?

Texas mechanic’s liens laws are among the most complex lien laws in the Nation. To compound the complexity, Texas courts require the lien claimant to strictly follow the lien laws in order to perfect a valid lien against a property. Despite that, the county clerk’s office (the location where liens are filed) will not review the lien affidavit prior to recording it to determine whether the lien claimant is entitled to a lien or has satisfied all of the lien laws. As a result, thousands of invalid liens are recorded on a monthly basis.

How long does it take to serve a lien affidavit?

Failure to Timely Serve the Lien Affidavit: After the lien has been recorded, the lien claimant must serve the property owner with the lien affidavit by certified mail, or its equivalent, within 5 business days from recording the lien. Failure to do so will invalidate the lien.

What is a Constitutional Lien?

To be entitled to a Constitutional lien, the direct contractor must have provided labor or materials to improve the actual structure and the property must not have been sold to a good faith purchaser (someone who was not aware of the debt) before the lien is recorded.

How to remove a lien from a property?

Removing a lien from your property can be a complex and drawn out process. However, you do have a few options: Satisfy Your Debt: This is the most straightforward option. Once you have paid off the balance of your debt, in full, you can file a Release of Lien form. This acts as evidence that the debt has been paid and will effectively remove ...

What is a court order to remove a lien?

Each jurisdiction has its own specific requirements regarding the process, so be sure to check with your jurisdiction to ensure you follow the proper protocol; Obtain a Court Order Removing the Lien: This is an option if the lien was obtained through fraud, coercion, bad faith, or any other illegal means.

What happens when you take out a lien on your car?

Once again, there are many different ways in which a creditor may place a lien on your property. For example, when a person takes out an auto loan a lien is created which gives the lender the right to possession of the vehicle until the loan is repaid in full. Additionally, since the car loan is secured by the vehicle itself, most lenders will require the borrower to also take out full insurance coverage on the vehicle. Although the information that appears on car titles varies from state to state, in general a vehicle’s title will reveal all current and past liens and lienholders.

How do liens arise?

Most liens arise from a contract between the creditor and debtor. In general, before a lien can be placed on a property, the creditor must go to court and present evidence of the unpaid debt. A judgment is then received, and if it is granted, the creditor may proceed with filing a lien on the property. This is done by registering the judgment ...

What is a lien on a property?

The legal term “ lien ” refers to the right to keep possession of a property that belongs to another person, until that person has paid off a debt that they owe. A lender may take the lien and then sell it in specific circumstances, such as those in which the borrower is unable to make their scheduled loan payment.

What is a statutory lien?

This means that the lien is authorized by some statute for delinquent payments , such as tax liens. Under a statutory lien, the debtor does not consent to the lien.

What is a judicial lien?

Judgment, or judicial liens are typically obtained in connection to the final judgment issued in a lawsuit between a debtor and a creditor. Once the judicial lien has been certified by the court, the debtor is required to forfeit their property.

Is mechanic's lien available in California?

The Mechanic’s Lien remedy is not available on California state and local public works projects. The Stop Notice or Notice to Withhold combined with an action against the Payment Bond, or for breach of contract against the prime contractor, are the usual remedies available to subcontractors, laborers and materialmen on state and local public works.

Can a mechanic's lien be recorded?

The recording of an invalid mechanic’s lien or filing of a stop notice sometimes has the effect of denying a party funds to which it is entitled throughout the course of a lengthy litigation, or alternatively, forcing such a party to agree to an unfavorable settlement to obtain funds sooner. However, by being aware of the summary methods for removing invalid mechanic’s liens and stop notices, a party may be able to gain access to disputed funds during the course of a litigation without waiting months or even years, and without giving in to the other party’s demands to settle the dispute.

Why is a lien invalid?

Depending on state law, a lien may be invalid for a variety of reasons, including the failure to file the lien within the required timeframe, the lien amount is under dispute, inadequate description of the property, improper procedures were followed ( i.e. failure to provide you , the property owner, with a preliminary notice of your lien rights) or the lien holder engaged in fraud when filing the lien.

How to remove a lien in Louisiana?

In Louisiana, for instance, you must give the claimant 10 days to remove the lien after you send the demand letter before you can file a lawsuit for the removal of the lien. In the motion you submit to the court, you will state the facts of the case, the reason the lien is invalid and the relief you are requesting.

How to dispute a lien?

Step 1. Write a demand letter. If a lien is invalid or illegal, you can dispute its validity by sending the lien holder a demand letter. In the demand letter --- which may or may not be required by state law --- you will explain the reason why the lien is invalid and you will demand its removal.

What is a mechanic's lien?

A mechanic's lien is a claim a person can file against an owner's property for unpaid labor, supplies or services provided to the property owner. A person can dispute an illegal lien if the lien holder does not have a valid claim.

How long does it take to get a lien hearing in Washington?

State law will mandate when the hearing must take place. In the state of Washington, for example, the hearing date must occur between six and 15 days from the date the motion was served on the lien holder.

Can you serve a lien holder by certified mail?

This notifies the lien holder that you have filed a lawsuit to remove the lien. Depending on state law, besides serving the lien holder via in-person delivery, it may be acceptable to serve the lien holder via certified or registered mail instead.

How to remove a lien in Texas?

Section 53.160 prescribes the approved procedure for filing a “motion to remove a claim or lien.” Although the statute references a motion, the best practice would be to file a lawsuit to remove the lien and then assert the motion ancillary thereto. A 21-day period must elapse between notice and hearing, although the lien claimant is not required to answer the motion. At the hearing, the lien claimant bears the burden of proving that notice was properly given and the lien affidavit duly filed. The movant seeking removal of the lien bears the burden on any remaining issues. There is no appeal from this, but the lien claimant does have the option of posting a bond in order to keep the lien in the real property records.

How are judgment lien claims discovered?

The existence of a judgment lien or other type of lien is usually discovered when a title company checks the property records and produces a title commitment in anticipation of a sale or refinance.

How to get a child support lien released in Texas?

Texas Family Code Section 157.3171 establishes a process by which an obligor may obtain the release of a child support lien against the obligor’s homestead. The procedure involves the filing of an affidavit and is identical to that contained in Section 52.0012 (discussed above). The law states that “the obligor is considered to be a judgment debtor under that section and the claimant under the child support lien is considered to be a judgment creditor under that section.” The person claiming the lien may file a contradicting affidavit: “If the claimant files a contradicting affidavit as described by Subsection (d), the issue of whether the real property is subject to the lien must be resolved in an action brought for that purpose in the district court of the county in which the real property is located and the lien was filed.” If the property is in the same county in which a divorce or action for child support was had, then the court that heard the case would likely have jurisdiction over the lien issue as well.

What is a bona fide homestead in Texas?

Assertion of a bona fide homestead is therefore an absolute defense in the event a creditor seeks to execute on a judgment by forcing the sale of the homestead. The creditor may seek to discover other non-exempt assets of the debtor and attempt execution on those, but not on the homestead. Moreover, if the homestead is sold, Property Code Section 41.001 (5) (c) provides that the proceeds are not subject to seizure for a creditor’s claim for six months after the date of sale. Having said all of that, it is not uncommon to encounter a title company that demands that liens be released prior to closing—even if it is the homestead which is being sold—so lien release (or at least a partial release as to the homestead) can become an issue.

What is an abstract of judgment?

When properly recorded and indexed [in the county clerk’s real property records], an abstract of judgment creates a judgment lien on non-exempt real property that is superior to the rights of subsequent purchasers and lienholders.

What is a fraudulent lien in Texas?

. a fraudulent lien or claim filed against real or personal property.” A person who knowingly and intentionally files a fraudulent lien may be held liable in civil district court for the greater of $10,000 or actual damages, exemplary damages, and recovery of attorney’s fees and costs. It is also a criminal offense. Tex. Penal Code § 37.01. If applicable, a cause of action under Civil Practice & Remedies Code Section 12.002 should be included in any suit against the lien claimant.

What is a subcontractor lien?

. . A person who provides labor or materials to construct a building or improvement under a contract with the property owner, the owner’s agent, or an original contractor is entitled to a lien against that property. . . . A subcontractor is considered a derivative claimant and must rely on his statutory lien remedies. . . . A subcontractor may seek recovery from ‘trapped’ funds held by the property owner or funds ‘retained’ by the owner. . . . ‘Trapped’ funds are funds not yet paid to the original contractor at the time the property owner receives notice that a subcontractor has not been paid; on receiving such notice, the owner may withhold those funds from the original contractor until the claim is paid or settled or until the time during which a subcontractor may file a lien affidavit has passed.” Pham v. Harris County Rentals, L.L.C., 455 S.W.3d 702 (Tex.App.— [1st Dist.] 2014, no pet.). A subcontractor or supplier “is a derivative claimant and, unlike a general contractor, has no constitutional, common law, or contractual lien on the owner’s property. . . . As a result, a subcontractor’s lien rights are totally dependent on compliance with the statutes authorizing the lien.” Moore v. Brenham Ready Mix, Inc ., 463 S.W.3d 109 (Tex.App.—Houston [1st Dist.] 2015, no pet.).