Here is how you can raise a dispute with CIBIL for removing your name from CIBIL settlement:

- Visit the official CIBIL website and create an account. If you already have an account on CIBIL, enter your credentials...

- Click on “Credit Reports” and go to “Dispute Centre” and then select the “Dispute an Item” option.

- Fill in all the details in the CIBIL dispute form online.

How can I remove a loan settled record from my CIBIL?

How can I remove a loan settled record from my CIBIL report? Pay no interest until 2023. Freeze interest payments until 2023 with a 0% intro APR credit card. A written-off status stays for seven years on your CIBIL report, affecting your chances of getting loans in the future.

What does “settled” mean on a CIBIL report?

If the borrower has been granted a concession on the dues that they owe to the lender, their CIBIL report will include the term “Settled” once the settlement is done. It will remain on their report as a semi-permanent stain that they will only be able to get rid of after 7 years.

What happens to your CIBIL report if a lawsuit is dropped?

If you have received a concession in payment of your dues, your CIBIL report will reflect a ‘settled account’, even if the lawsuit is dropped. It will remain on your report for 7 years. This can cause issues for you in the future, as potential lenders will refrain from approving your loan or credit applications.

What to do if your CIBIL account has been written off?

A “written off” or a “settled” account can be viewed negatively by the lender. Check if there is any account which has been tagged incorrectly. If yes, raise a dispute via CIBIL’s Dispute Resolution Process. Go through the Days Past Due section carefully. If you notice anything apart from a “000” or an “XXX” then this can be viewed negatively.

When did RBI request banks to send defaulter data to CIBIL?

In 2002 , RBI requested banks, financial institutions, and state financial corporations to send defaulter data directly to the TransUnion CIBIL. This data would include suit-filed accounts of Rs.25 lakh and above, as well as Rs.1 crore and above.

How long does a CIBIL report stay on your credit report?

It will remain on your report for 7 years. This can cause issues for you in the future, as potential lenders will refrain from approving your loan or credit applications.

What are wilful defaulters?

For instance, a wilful defaulter is someone who: 1 Deliberately makes no payments, despite having a good net worth and cash flow 2 Siphons funds 3 Misuses the finances borrowed for reasons not stated 4 Falsifies information 5 Removes securities without the bank’s knowledge 6 Conducts fraudulent transactions

What happens if you default on a loan?

Once your missed payments start reflecting in your credit history, it will drastically bring down your credit score.

When did RBI start collecting defaulters?

It started with borrowers who have failed to pay Rs.1 crore and above. Then, in 1999, RBI started collecting and disseminating information of defaulters who crossed Rs.25 lakh and above.

What to do if you can't clear your dues?

If you think you may not be able to clear your dues, there are certain steps you need to take to avoid a suit-filed account tagged against your name. One of the first things you can consider is extending your loan’s tenure. Approach your bank, justify why you require an extension, and ask them to increase it.

Can you withdraw a loan if you have settled it?

However, the case will be withdrawn only once you’ve settled your loan . Your bank is also required to report this to CIBIL so they can update their records.

What is CIBIL Defaulter List?

CIBIL or any credit bureau does not maintain any list of loan defaulters. However, as mentioned above, a list of wilful defaulters who owe ₹25 lakhs or more to any of the financial institutions (banks/NBFCs) in the country is maintained by the RBI.

Wilful Defaulter Meaning

Makes very little to no payments deliberately in spite of having a good net worth and a healthy cash flow

How to Remove a Suit-Filed Account From Your CIBIL Report

If an individual has defaulted on their loan, their bank and/or financial institutions will most probably file a lawsuit against them in a court. If the borrower has crossed the ₹25 Lakhs threshold wilfully, the information will be made available on the public database as well.

How to remove a written off account from CIBIL?

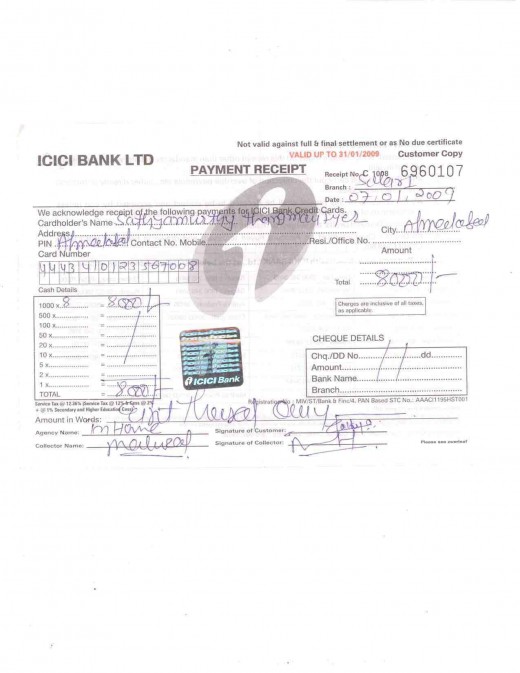

Once you have paid the total outstanding amount, get a NOC from the lender stating that you don’t owe anything to them. Request your lender to submit the NOC to CIBIL, asking them to remove the ‘Written-off” account status.

How to remove settled status from bank?

In order to remove the settled status from the bank, you must pay back all the dues and close the loan. I would suggest you approach the bank and offer to fully pay the accrued dues and penalties if any and close the loan. Once the dues are paid, the lending institution shall send the status on. Continue Reading.

What happens if a loan is settled on a credit report?

And if the borrower has the settlement in his credit report, the banks and lenders will reject the loan. When the CIBIL mentions the loan as being settled, the lenders and banks will be vary of you and will not provide you loan.

How long does a CIBIL hold a record?

The CIBIL holds this record for over 7 years. So, if the borrower will take a loan during that period, it is likely that the lenders will be vary of the borrower and try and stay away from giving the. Continue Reading. When a bank or the lender is writing off a loan, they will report it to CIBIL. Though the relationship between the bank or ...

What happens when a bank writes off a loan?

When a bank or the lender is writing off a loan, they will report it to CIBIL. Though the relationship between the bank or the lender and the borrower has terminated, CIBIL doesn’t take that into consideration. Instead of closing the transaction, they term it as settled.

What happens when a loan is settled?

Instead of closing the transaction, they term it as settled. When a loan is termed settled, it is viewed as a negative credit behavior and the borrower’s credit score drops by 75-100 points. The CIBIL holds this record for over 7 years.

How long does a written off loan stay on CIBIL?

A written-off status stays for seven years on your CIBIL report, affecting your chances of getting loans in the future. You can get it removed by doing the following:

How to Raise a Dispute via CIBIL Dispute Resolution Process?

Go to www.cibil.com, and create an account. If you already have one, simply sign in.

How to Improve CIBIL Score After Loan Settlement?

Although the settlement of your loan account will tend to ease your EMI woes, a poor credit score would still haunt you for some time, making it difficult to secure a loan anytime soon. Hence, you must take charge of your financial situation and take some rightful steps in order to improve your CIBIL score.

How Would Lenders Treat You After a Debt Settlement?

Post debt settlement, lenders might be hesitant to offer you unsecured loans as you were unable to pay your previous dues in full. However, there are chances of availing a secured loan by pledging an asset as security with the lender. Also, note that a secured loan can raise your CIBIL score faster if you make timely repayments.

Parameters That Determine Your CIBIL Score Post Debt Settlement

There are certain parameters that CIBIL uses to assign credit scores. These parameters are crucial in rebuilding your credit history in the most desired way. They are as follows:

FAQs on Written-Off Status

You can start paying off the settlement amount to remove the written-off status on your report and obtain an NOC (No Objection Certificate) from the lender, stating that you don’t owe anything to them. Ask the lender to submit the NOC to CIBIL, on updation of the report the written-off status will be removed.

How long does it take to hear back from CIBIL?

Once you have identified the inaccurate information, initiate the dispute resolution process by clicking here. You should hear back from CIBIL in 30 days. If the respective bank or financial institution re-confirms that the information that was reflecting in your CIR is correct then we will not be in a position to make any changes. It is advisable to get in touch with the concerned Bank directly to expedite the process.

Is non payment due to non receipt of statement a valid reason for missing payments?

Non-payment due to non-receipt of statement may not be considered a valid reason for missing payments (If this has been covered in the cardholder agreement). If you have not paid the outstanding due to this then the late payment fees, service charges etc would be accumulating.

Is CIBIL a credit repair company?

Going to a “credit repair” company and paying a large sum of money may not be the best solution. CIBIL is not associated with any credit repair company.