How to Respond to an Insurance Company's Settlement Offer

- Check Your Policy. Before you hear from the insurance company, check your policy terms. ...

- Compare Figures. Calculate your own estimate of a fair settlement. ...

- Ask Questions. If an insurance company's settlement seems very low, ask why. ...

- Work With a Professional. ...

- Remain Calm and Analyze Your Offer. Just like anything in life, it's never a good idea to respond emotionally after receiving a low offer. ...

- Ask Questions. ...

- Present the Facts. ...

- Develop a Counteroffer. ...

- Respond in Writing.

How to reject a settlement offer from an insurance company?

In a written letter, you should reject the initial offer of the insurance company by emphasizing the following points: Clearly state that you do not find the initial settlement offer acceptable; Lists the specific reasons why the initial settlement offer is not acceptable; and Include a demand for a higher settlement offer.

What should I do if I receive a settlement offer letter?

Once you have the settlement offer letter, you have the right to make a counter demand if you find the offer unacceptable. Compare what the insurance company has offered to your record of costs and losses, and the maximum payment provided by the insurance policy.

How do I counter a low insurance settlement offer?

Countering a Low Insurance Settlement Offer You may receive a settlement offer in a phone call or email, which will be followed by a letter. Once you have the settlement offer letter, you have the right to make a counter demand if you find the offer unacceptable.

Do I have to settle for what an adjuster offers?

You do not have to settle for whatever paltry sum an adjustor thinks he or she can get away with offering you. You have the right to reject any settlement offer and respond with a counter demand for the payment you deserve. But you have to wait until a settlement offer is made to reject it and submit a counter demand.

How do you respond to an insurance offer?

Countering a Low Insurance Settlement OfferState that the offer you received is unacceptable.Refute any statements in the adjustor's letter that are inaccurate and damaging to your claim.Re-state an acceptable figure.Explain why your counteroffer is appropriate, including the reasons behind your general damages demands.More items...•

What happens if you decline an insurance offer?

When you reject a settlement offer from the insurance company, that offer is “dead,” meaning you can't later change your mind and accept it. Instead, you'll submit a counteroffer, which means that you are now the party submitting an offer, and it's up to the insurance company to accept or reject it.

How do I decline an insurance settlement?

Always reject a settlement offer in writing. Type a letter to your contact at the insurance company listing the reasons you think that their offer is too low. Back up these reasons with concrete evidence attached to the letter. Finally, provide a counteroffer of a sum you think is more reasonable.

Can you negotiate a settlement offer?

If the offer is reasonable, you can immediately make a counteroffer that is a little bit lower than your demand letter amount. This shows the adjuster that you, too, are being reasonable and are willing to compromise. A little more bargaining should quickly get you to a final settlement amount you both think is fair.

Should you accept the first offer of compensation?

Unless you have taken independent legal advice on the whole value of your claim, you should not accept a first offer from an insurance company.

Should you accept first offer insurance claim?

Once the offer is made, you have 21 days to decide whether or not to accept it. You should always take legal advice before accepting a Part 36 offer, especially if you have a conditional fee agreement or are using an insurance policy to cover your legal expenses, as you may find you invalidate your contract.

Can you negotiate the total loss value?

A vehicle is legally considered a total loss if the cost of repairs and supplemental claims equal or exceed 75% of the fair market value – which, again, can typically be negotiated. If your car is a total loss, and the insurance carrier accepts liability, they are required to pay fair market value for the vehicle.

How do you negotiate a settlement with an insurance claims adjuster?

Begin the Settlement Negotiation Process (5 Steps)Step 1: File An Insurance Claim. ... Step 2: Consolidate Your Records. ... Step 3: Calculate Your Minimum Settlement Amount. ... Step 4: Reject the Claims Adjuster's First Settlement Offer. ... Step 5: Emphasize The Strongest Points in Your Favor.

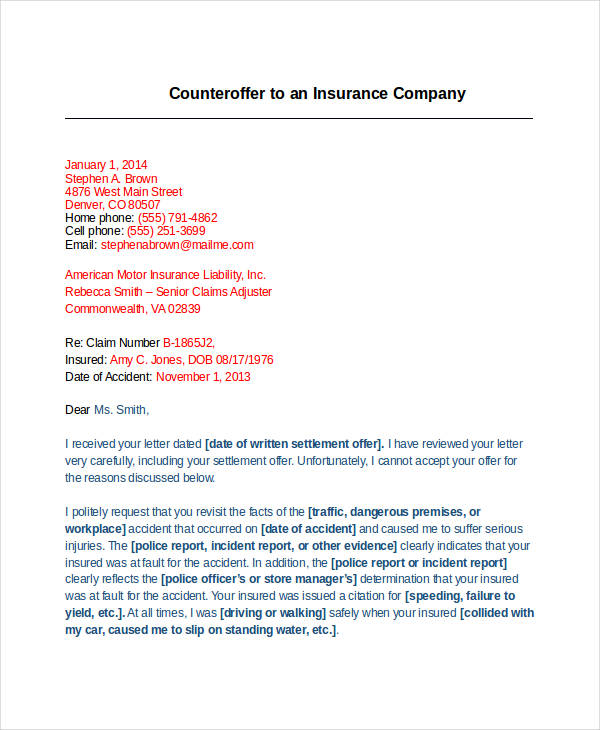

How do I write a counter offer letter for an insurance settlement?

What To Include In Counter Offer. In the letter, you will need to refer to the offer made by the insurance company and when it was made. You will then need to reiterate why you think you are owed damages from the other party and why you think that offer was low.

What is a reasonable full and final settlement offer?

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

How much should I offer in a settlement agreement?

The rough 'rule of thumb' that is generally used to determine the value of a settlement agreement (in respect of compensation for termination of employment) is two to three months' gross salary.

How do I maximize my insurance settlement?

15 Ways to Maximize Compensation for your Car Accident SettlementWRITE DOWN EVERYTHING FROM YOUR ACCIDENT. ... TAKE PHOTOGRAPHS OF YOUR ACCIDENT. ... JOURNAL ALL OF YOUR PAIN AND SUFFERING. ... SEEK IMMEDIATE MEDICAL ATTENTION. ... TELL YOUR DOCTOR EVERYTHING THAT HURTS. ... DO WHAT THE DOCTOR ORDERS. ... TURN TREATMENT INTO TESTIMONY.More items...•

Do you have to accept first offer on totaled car?

When your car is declared as a total loss by your insurer, you have a few options. You don't have to take the first offer you receive, and you can negotiate with your insurer until you're happy with what they offer.

What does decline coverage mean?

Employees who choose to decline one or more lines of coverage offered by a company for themselves or their dependents must sign a waiver and provide a reason for declining.

How do you write a letter to reject a settlement offer?

This letter should state:That you will not accept the initial settlement offer;The reasons why you feel you deserve a higher settlement amount;Each of their low-offer reasons, and your responses;The higher settlement amount that you will accept.

How do you negotiate with car insurance adjusters about total loss?

If you are wondering how to negotiate with an insurance adjuster during an auto total loss claim, there are some steps you can follow.Determine what the vehicle is worth. ... Decide if the initial offer is too low. ... Negotiate with your insurance adjuster. ... Hire an attorney. ... Obtain a written settlement agreement.More items...•

What happens if a plaintiff refuses a settlement offer?

In some states, if a defendant makes a settlement offer that the plaintiff refuses, and the plaintiff's damages award at trial are equal to or less than the settlement offer, the plaintiff will be required to pay the defendant's attorney fees and court costs. Depending on how complicated the case was, even though the plaintiff "won," he or she may have to pay more to the defendant than the defendant is required to pay in damages! Therefore, a plaintiff should be wary about automatically refusing a reasonable first settlement offer.

Who makes settlement offer in a lawsuit?

Once a complaint has been filed, a settlement offer, if any, will be made by either the defendant or the defendant's insurance company.

What happens if a plaintiff is unrepresented by an attorney?

If a plaintiff is unrepresented by an attorney and hasn't developed the case by gathering facts (or worse, doesn't even know how to do so), an insurance company or represented defendant will most likely give a settlement offer that is low relative to the potential damages.

What happens if the insurance company knows that the plaintiff is desperate for cash and/or new to the litigation process?

If the insurance company or defendant knows that the plaintiff is desperate for cash and/or new to the litigation process, the offer will be even lower.

What happens if a defendant has little cash?

If a defendant has little cash and few assets, a plaintiff is not going to get much out of a trial, no matter how big the damage award. If a settlement offer from a broke defendant isn't much less than what a plaintiff could hope to collect after a trial, settling and avoiding the hassle could be the best course.

What is the key consideration in a lawsuit?

The key consideration is what the defendant's insurance policy limits are. A defendant will have to pay out of pocket for any damage awards that go beyond the policy limit, so if the policy limit is low and the defendant is broke, a seemingly low settlement offer might be as good as it gets. If the policy limit is high, the plaintiff will not need to consider how much money is available to pay a potential damage award, and can focus on other factors.

Can a plaintiff get stung by a settlement?

However, the unwary plaintiff could get stung by litigation settlement rules, depending on the state.

Check Your Policy

Before you hear from the insurance company, check your policy terms. Determine the amount of your deductible, which the insurance company will subtract from the value it assigns to your loss. Make sure that the specific type of incident you're seeking a settlement for is covered in your policy.

Compare Figures

Calculate your own estimate of a fair settlement. Account for the dollar value of the damage, as well as who was at fault. Add in auxiliary costs, such as emergency response to an accident and rental fees if you need a car while yours is in the shop or a hotel while your home is being repaired.

Ask Questions

If an insurance company's settlement seems very low, ask why. You'll learn whether the figure is based on facts of the incident and may discover that the insurance company is missing crucial information. Ask how the insurance company arrived at a dollar value of your property.

Work With a Professional

Contact a lawyer who specializes in insurance law if you don't make any progress getting an insurance company to raise its settlement offer, or if your case is especially complex. Some insurance cases, such as medical malpractice or wrongful death cases, rely on precedents and insurance laws that you might not be aware of.

What happens when you sign off on a settlement?

It’s a cheap buy-off to your right to sue. Once you sign off on a settlement offer, you effectively sign away your right to pursue further damages – even if you realize later your actual damages were much higher than what you settled for.

Why do insurers pay off lowball settlements?

It pays off for insurers to issue lowball settlement offers because many of those injured in crashes simply accept them, no questions asked. Often this is simply because they don’t know better. It can also be the allure of a quick payment. It’s a cheap buy-off to your right to sue. Once you sign off on a settlement offer, ...

What to do if an adjuster is not fair?

Stay polite and professional. We understand it’s a frustrating and emotional process. But even if you think the adjuster isn’t being fair with you, yelling or cursing isn’t going to help your case. In fact, it could hurt your reliability as a witness. (This is one reason we recommend working with a lawyer who can handle all the negotiations.)

What is the legal duty of insurance companies to act in good faith?

Insurers have a legal duty to act in good faith to resolve claims. If they do not, O.C.G.A. § 33-4-6 allows for a bad faith insurance claim in which you could be awarded your original damages plus more than 50 percent of the liability or $5,000 (whichever is greater) plus attorney’s fees.

What to do if an auto accident is bad faith?

An experienced auto accident attorney can help you determine if the insurer has acted in bad faith and how to pursue that claim – but the time to do it is before you sign any settlement. The foregoing answers are not legal advice and are merely a general overview.

How to make a case for fair compensation?

Offer the facts. Keep records of everything. Your injuries, damage to your car, medical bills, proof that you’ve lost time off work, witness contact information – anything that will help you make a case for fair payment of reasonable damages.

Do adjusters have all the facts?

They don’t have all the facts. Adjusters are human. They might overlook critical facts. Those facts might be missing. Sometimes there is evidence about which you yourself aren’t aware.

What is initial settlement offer?

The initial settlement offer is the insurance company's way of feeling you out. Do not lose your cool over something you can not control. You are, most likely, going to get low-balled on the initial offer. The insurance company's priority is maximizing profit, not looking out for your well-being.

What happens if you hold on to your settlement money?

By holding on to your settlement money for a longer period of time, the insurance company is essentially earning income off the money that is rightfully yours and in essence they are mitigating their own payout. You need to take a proactive role in bringing your claim to a close and securing a favorable settlement offer!

How long does it take for an insurance company to offer an insurance policy?

The amount of time it takes to receive an initial offer from the insurance company can widely vary. In more minor accidents, the insurance company may fling an initial offer at you with a few days or a week or two of the accident. Generally, the more complex or severe the accident, the more time it will take for the insurance company ...

Why do insurance companies throw out a single figure?

It is common for the insurance company to throw out a single figure in hopes that the one amount will be enough to fool you into a cheap settlement. By having the adjuster break down the offer, you can identify where the insurance company may be shorting your claim.

What is the phone number for McMillian Law Firm?

The McMillian Law Firm is known for compassionate and effective legal representation. Call us now at (843) 900-1306 or use the online form to schedule your free no-obligation case evaluation today.

How often should I call a claims adjuster?

You should call the claims adjuster regularly, I would say at least once a week, until an initial offer is given! If the claims adjuster contacts you and gives an offer over the phone, please tell them to reduce the offer to writing and sent to you certified mail. Any offer that is received from the insurance company should be broken down into its component parts (medical bills, lost wages, future treatments, pain and suffering, etc.). It is common for the insurance company to throw out a single figure in hopes that the one amount will be enough to fool you into a cheap settlement. By having the adjuster break down the offer, you can identify where the insurance company may be shorting your claim.

What does a claims adjuster do after receiving a claim?

Upon receiving the claim and / or the demand letter and making an initial offer, the claims adjuster will conduct an investigation that in a lot of ways will mirror the investigation done by your personal injury attorney. The claim adjuster will interview witnesses, review police reports, review your medical records, and read the demand letter. In cases that involve more severe injuries and claimed damages, the claims adjuster will visit the scene of your accident. Upon completion of this investigation, the claims adjuster at that point will usually make the initial settlement offer.

What to Do After a Serious Car Accident

You should fully expect that the insurance company will low ball you with their first offer. You can start preparing for that possibility immediately after your accident by:

Economic vs Non-Economic Damages

The damage from a car accident can affect multiple aspects of your daily life. Economic damages relate to a specific monetary harm such as medical expenses or lost wages. Non economic damages are more intangible losses, and as such, are much more difficult to assign a value to.

How to Respond to a Low Settlement Offer

Once you have received a settlement offer by phone or email, take the time to compare it to your records to determine if you feel the offer is fair and will properly cover your costs. Remember, you have the legal right to reject any settlement offer from an insurance company, and to present a counteroffer with the payment you believe you deserve.

How a Personal Injury Lawyer Can Help You Reject a Lowball Settlement Offer

The mere presence of a lawyer’s letterhead on a letter rejecting a lowball settlement offer can alter the way that insurance agencies handle your claim. And in the case that you wish to proceed with a lawsuit, you will have already been working with a lawyer who understands the particulars of your case.