You can reverse your AUC settlement by using transaction code AIST or following path; SAP menu > Accounting > Financial Accounting > Posting > Reverse Document > AIST – Capitalize Asset u. Const. From the reversal of settlement of AUC: initial screen you need to enter followings;

Full Answer

How do I reverse AUC settlement?

Thanks in Advance. You have to use transaction AIST in order to reverse AUC settlement. Settlement can be reversed simply by using the settlement program. Click on the top, left-hand screen option to reveal option to Reverse Settlement. Input the settlement period of the settlement you wish to reverse.

How to settle an asset under construction in SAP?

3.1) To settle an asset under construction go to Navigation: SAP Easy Access -> SAP Menu -> Accounting -> Financial accounting -> Fixed Asset -> Posting -> Capitalize Asset u. Const. ->Settle.

When will my expenses be settled to the linked AUC?

Once the first project postings are done, 100% of the expenses are automatically settled to the linked AuC. For instance, we have posted a supplier invoice to capitalize the AuC for the project cost

What happens to AUC – 82 after the settlement run?

After the settlement run you can see that in AuC – 82, the settlement run transfer postings appear Also, since the settlement is done completely, the AuC net book value shows 0,00 but with the capitalized status

How do you reverse AUC?

You have to use transaction AIST in order to reverse AUC settlement.

How do you reverse a settlement in SAP?

ProcedureOn the SAP Easy Access screen, choose Agricultural Contract Management Contract Settlement Settlement Workcenter .Choose Settlement Reversal.Enter the required details and choose .In the Settlement Units group box, choose the document.Choose . ... In the Settlement Group box, choose the document.Choose .

How do you get rid of AUC in SAP?

1) Reverse the settlement and post back to internal order and then write off . 2) settle to Final asset and change Dep key to 0000 and then scrap.

What is reversal settlement?

When you reverse a settlement, all transaction distributions that were involved in settling an invoice with a payment are reversed, such as general ledger postings, exchange rate gains or losses, penny differences, and cash discount transactions.

How do I run KO88 in SAP?

Settlement of Internal Orders Tutorial: KO02 & KO88 in SAPIn the Category Column enter 'CTR' for cost center.In the Settlement receiver Column enter the Cost Center in which the Order is to be settled.In the percent column , Enter the percentage amount which is to be settled.More items...•

How do I change the settlement rule in SAP?

ProcedureChoose Settlement rule in the master data maintenance for the relevant sender object. ... You maintain settlement rules in Customizing under Controlling Internal Orders Actual Postings Settlement Maintain Settlement Profiles .Choose Edit New rule or enter the value directly.

How do you settle AUC to fixed assets?

Settlement Run- AUC to Fixed Assets using Tcode AIAB Go to the transaction code AIAB , enter the company code, AUC number and press on execute button. Now select the enter button to maintain settlement rules. Enter the category 'FXA', the receiver asset number and the percent allocation.

How do I transfer AUC to asset in SAP?

First steps such as PO creation and MIGO will be the same as the previous process i.e. settlement after MIGO.Step 1: Create AUC.Step 2: Create Main Asset.Step 3: Create PR & PO.Step 4: Post MIGO.

How do you write off an asset under construction in SAP?

As a result, the transfer from the asset under construction to completed fixed assets can be handled in one of two ways:Summary transfer from a normal asset master record to the receiver assets (transaction type 348/349)As an asset master record with line item management, which you settle by line item to the receivers.

How do you reverse a transaction?

Transactions can be reversed by authorization reversal, by refund, or by chargeback. Meanwhile, merchants can only counteract a reversal through deflection or representment.

What is the difference between reversal and refund?

General rule to keep in mind: If the payment in question was deposited into the account, it would be a Refund. If it was not deposited, it would be a Reversal.

How long does a reversal transaction take?

1-3 daysHow Long Does a Transaction Reversal Take? A transaction reversal takes 1-3 days, depending on the issuing bank.

What does reversal payment mean?

A payment reversal is any situation where a merchant reverses a transaction, returning the funds to the account of the cardholder who made the payment. Payment reversals are not all created alike. Some have minimal impact on the merchant's bottom line, and others can be quite costly.

What does reversal mean in a bank account?

What does payment reversal mean? Payment reversal (also "credit card reversal or "reversal payment") is when the funds a cardholder used in a transaction are returned to the cardholder's bank. This can be initiated by the cardholder, merchant, issuing bank, acquiring bank, or card association.

What does reversal transaction mean?

Reversal transaction refers to situations where a client has sent the money but it is yet to be received by the merchant's account. While it is still being processed, the transaction can be reversed.

Why did my payment get reversed?

They can occur for the following reasons: Item sold out before it could be delivered. The purchase was made fraudulently. The customer changed their mind about the purchase after paying.

What happens when you post a project to AuC?

Once the first project postings are done, 100% of the expenses are automatically settled to the linked AuC.

What asset class is used for AuC?

You can either mark the standard available fixed asset class 4000 as the default class to create asset under construction or create a custom fixed asset class.

What is settlement factor?

Settlement Factor, Enter the quote for each receiver as an absolute value. Taken as a whole, the settlement factor represents the settlement ratio (such as for instance 60:40) for which costs are allocated. The system automatically calculates the percentage for each unit.

Is 4000 asset class an AuC class?

So, here marked 4000 Asset Class as AuC class and also the depreciation method should always be 0000 – No automatic depreciation

Is AuC a fixed asset?

A : So, When posting the initial expenses/cost the AuC asset is changing its status to Capitalized – Yes this is right AuC is nothing but a fixed asset with a special fixed asset class (with the AuC Indicator set to true).So there is no difference in the status handling between AuCs and FXAs.

Symptom

In settlement, one can settle a sender with a different period as of Release 4.0. The prerequisite for this is that the posting period is after the settlement period and that the settlement period and posting period are in the SAME fiscal year. This means that a cross-year settlement is NOT possible. Example: Current period is 1/2017.

Product

SAP ERP Central Component all versions ; SAP ERP all versions ; SAP R/3 Enterprise all versions ; SAP R/3 all versions ; SAP S/4HANA Finance all versions ; SAP S/4HANA all versions ; SAP enhancement package for SAP ERP all versions ; SAP enhancement package for SAP ERP, version for SAP HANA all versions

Keywords

KBA, KO88, CO88, KO8G, CJ88, CJ8G, RKO7KO8G, RKO7CJ8G, period end closing, year end closing, unsettled costs, posting period, settlement period, fiscal year, jahresübergreifend, periodenfremd, cross year settlement. , KBA , CO-PC-OBJ , Cost Object Controlling , CO-OM-OPA-F , Period-end Closing , How To

About this page

This is a preview of a SAP Knowledge Base Article. Click more to access the full version on SAP ONE Support launchpad (Login required).

Purpose

The purpose of this page is to clarify the understanding of the system logic and requirements in relation to the settlement of asset under construction through transaction codes AIAB and AIBU.

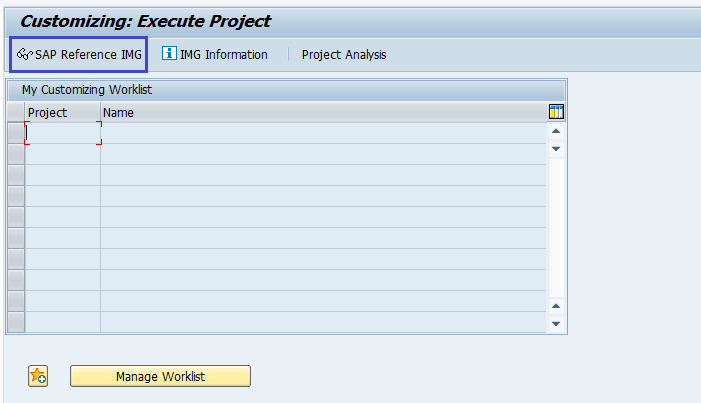

Overview

The following paragraphs and screen shots will describe an EXAMPLE in steps of a settlement of asset under construction using transaction codes AIAB and AIBU and provide an explanation of the functionality of the main fields and buttons.

Preparing scenario

1.1) Create an asset under construction using asset class that refers to AUC. and post two acquisitions to this asset with different posting date, please refer to the following link how to post acquisitions: Asset acquistion.

S etting distribution rules through transaction code AIAB

2.1) To set distribution rules to an asset under construction go to Navigation: SAP Easy Access -> SAP Menu -> Accounting -> Financial accounting -> Fixed Asset -> Posting -> Capitalize Asset u. Const. -> Distribute.

Settlement AUC through transaction code AIBU

3.1) To settle an asset under construction go to Navigation: SAP Easy Access -> SAP Menu -> Accounting -> Financial accounting -> Fixed Asset -> Posting -> Capitalize Asset u. Const. ->Settle.