Full Answer

Can I preserve my Medicaid benefits after a personal injury settlement?

As a Medicaid beneficiary, we have advised you of the need to take action to preserve your benefits (e.g. creating a special needs trust, spending down in the same calendar month funds are received, etc…). As the recipient of a personal-injury settlement, you are putting your Medicaid benefits at risk of being cancelled by the government.

What happens when a Medicaid recipient receives an inheritance or settlement?

This article will explain what happens when a Medicaid recipient receives an inheritance or personal injury settlement and what the person about to receive an inheritance can do to preserve their Medicaid benefits. Some action must be taken in the same calendar month funds are available to a Medicaid beneficiary.

Will my injury settlement make my client eligible for Medicaid?

But again, as an injury lawyer, unless your settlement is being annuitized, you are likely handing your client a check that will make your client ineligible for Medicaid because that check will cause them to fail the Medicaid asset test. The asset test just says that a Medicaid recipient cannot have more than $2,000.00 in combined countable assets.

Does the IRS count a personal injury settlement for tax purposes?

So, even though the IRS doesn’t count a personal injury settlement for tax purposes, Medicaid most certainly does when they are evaluating eligibility. Does the Personal Injury Client Still Want their Medicaid? The answer may very well be “no.”

What is Medicaid insurance?

Medicaid is the means-dependent insurance program operated jointly by the US government and the respective state Medicaid agencies. Medicaid exists to provide lower-income individuals with access to basic medical care at little to no cost to them.

What happens if you are injured in an accident?

If you or somebody you care about has been injured in an accident or as a result of the negligence of somebody else, you will have the right to pursue compensation through a personal injury claim or lawsuit. You may be able to recover compensation through a personal injury settlement, and this could help pay your medical expenses, lost wages, ...

How does medicaid differ from Medicare?

Medicaid differs from Medicare and other government benefit programs in that Medicaid recipients are subject to stricter eligibility requirements. Some of these requirements are retroactive.

Is Medicaid eligibility for assets?

In general, most assets are not exempt from Medicaid eligibility calculations. There are a few exemptions for things that are considered “core items” that individuals or couples could not reasonably be expected to live without. This could include:

When did people get SSI and Social Security?

People who have gotten both an SSI check and a Social Security check in the same month at least once since April 1977 AND who still get a Social Security check

Do structured settlements push Medicaid recipients over their income limits?

Structured personal injury settlements often do not push a recipient over the Medicaid income limits.

Can you get medical compensation for a personal injury?

You may be able to recover compensation through a personal injury settlement, and this could help pay your medical expenses, lost wages, out-of-pocket costs, and other losses that have arisen due to the injury. However, personal injury settlements could complicate a recipient’s efforts to obtain Medicaid benefits in the future.

What was the settlement in Sams vs Department of Public Welfare?

He sustained a brain injury from the accident, and sued the negligent driver, reaching a settlement of $380,000. After paying his legal fees and a Medicaid Lien, he had $232,474 left, to which he agreed to a structured settlement annuity paying $967.23 monthly, with an annual interest rate of 3% for 360 months to continue for the rest of his life.

What Factors Go Into How Medicaid Benefits are Determined?

Pennsylvania Medicaid, also known as “Medical Assistance”, determines eligi bility based on income/resources— computed using the Modified Adjusted Gross Income—and household size in comparison to income/resource limits. They also factor in age and disability in order to determine which income/resource limits apply. Under Federal Law, recipients of Supplemental Security Income are automatically eligible to receive Medicaid coverage in Pennsylvania.

How to avoid the tragic result of Sams case?

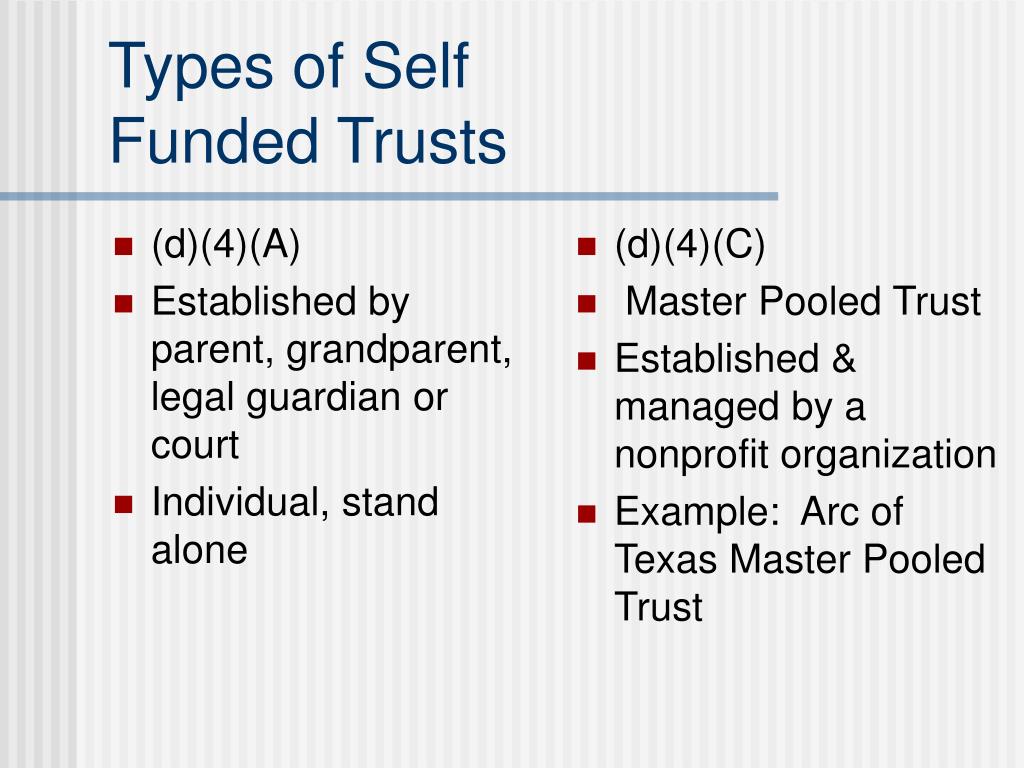

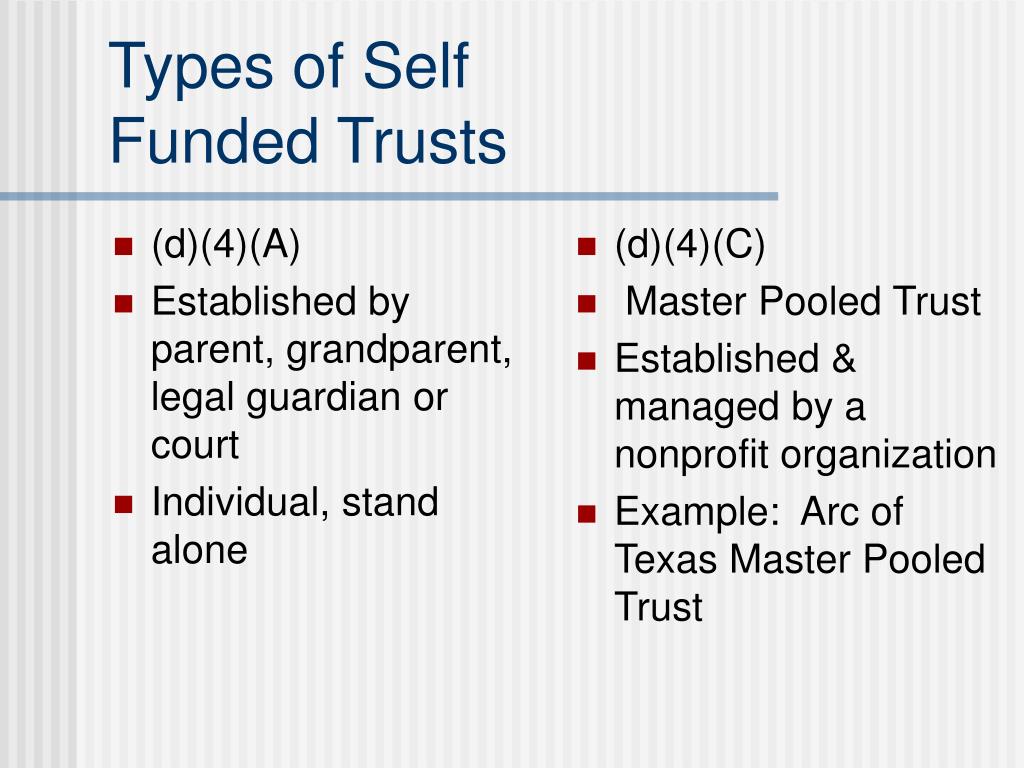

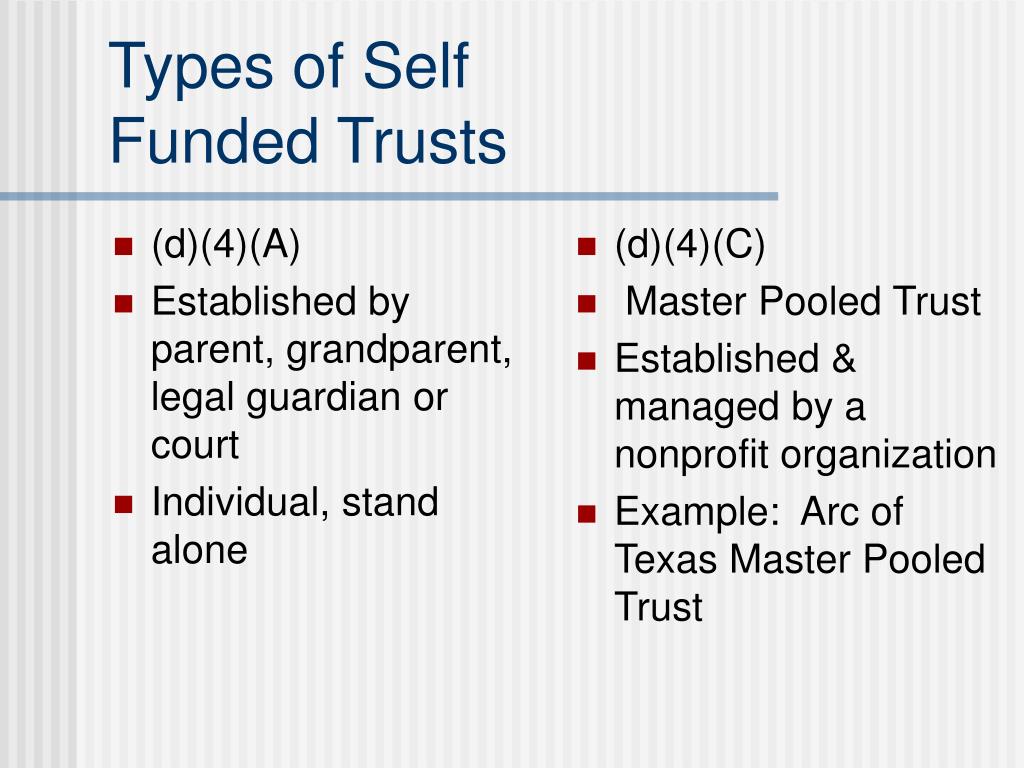

The first option involves spending down the settlement proceeds—as the name suggests, you would spend the lump-sum money received to maintain eligibility for SSI or Medicaid benefits. The second option is establishing a special needs trust, in which the Government does not take into consideration when determining eligibility for Medicaid. The final option is setting up a pooled trust, a shared trust that is also disregarded when determining Medicaid eligibility.

Why do you need to spend down money on a special needs trust?

There are several reasons that you may want to consider the spend down option. It may be wise if you received a relatively small settlement amount to avoid the set-up and ongoing costs that will accompany a special needs trust. Other reasons that you may want to spend down the money is if you have debts to pay, or are in the market for a home, vehicle or other high-priced items. The downside of this option is that you will sacrifice money in the future that could help pay for special needs. It is important to consider both alternatives in detail in order to make an informed decision that will best improve your quality of life.

Can you put money into a special needs trust?

Special need trusts, also known as supplementary need trusts, are ignored when determining asset limits for eligibility for Medicaid or SSI. You are able to open this kind of trust if you are under 65 and disabled under the Social Security Administration Standard. Special need trusts will provide security for permanently disabled individuals beyond what Medicaid and SSI can provide and will last as long as needed, or until funds are spent.

Can a third party file a lien on a lawsuit?

A third-party may file a request for a lien during your lawsuit, in which they may have the legal right to a portion of your settlement. In personal injury cases, liens are filed by any entity that paid any healthcare bills of the injured party. If you have Medicaid and you suffered an injury, Medicaid may be entitled to a lien on your settlement for any medical expenses that Medicaid covered as a result of the injury.

Can you pull Medicaid benefits?

Since Medicaid is need-based, they may pull benefits if additional income or resources determine an individual ineligible. Examples of such resources include checking or savings accounts, stocks and bonds, some trust funds, and life insurance. Small to medium settlement amounts may not affect access to Medicaid benefits, but receiving larger settlements may result in your loss of benefits if the settlement brings you above a particular percentage of the federal poverty level. Thus, it is important to have legal counsel advising you on how to avoid the loss of Medicaid benefits.

Can you take Medicaid in the same month?

Some action must be taken in the same calendar month funds are available to a Medicaid beneficiary. The timing of this is very important (which is why it makes sense for you to talk to a Medicaid-planning lawyer ASAP, and not just when you receive a large check!

Can you get Medicaid if you have $2,000?

If their assets ever exceed $2,000 at the end of any calendar month, they will no longer be Medicaid-eligible. Those on medicaid may not be sure of what to do when receiving an inheritance from a recently-deceased family member or from a personal injury settlement.

Can you gift Medicaid to IRS?

It will not. This line of thinking often gets those who want Medicaid in trouble. Medicaid gifting rules have nothing to do with IRS gifting rules.

What to do after a personal injury settlement?

After you receive a personal injury settlement, a trained attorney can help you keep your Medicaid benefits or remain eligible for future benefits. A “special needs trust” that keeps the bulk of your settlement in safekeeping is exempt from Medicaid’s strict means testing. With a special needs trust at your disposal, you can use your settlement’s funds to pay for necessary goods and services without worrying about triggering a Medicaid penalty. Since special needs trusts need to be set up properly to avoid unintended consequences, it’s best to work closely with an attorney during the settlement process.

What is Medicaid Basics?

Medicaid Basics. Medicaid is a means-dependent insurance program that’s jointly administered by the federal government and the various state Medicaid agencies. It exists to provide low-income individuals with access to basic medical care at little or no out-of-pocket cost.

Is Medicaid exempt from assets?

Most assets are not exempt from Medicaid eligibility calculations. There are a few exceptions for “core items” that solvent individuals or couples can’t reasonably expect to live without. These may include:

Can you settle a personal injury case?

While you may want to settle your personal injury case, there are things to keep in mind if you hope to secure medicaid benefits going forward. If you’ve been injured in an accident or as a result of a third party’s negligence, you have every right to pursue a personal injury case.

Can a special needs trust be set up?

Since special needs trusts need to be set up properly to avoid unintended consequences, it’s best to work closely with an attorney during the settlement process. If you want to settle your personal injury case but worry that it could complicate your eligibility for Medicaid benefits, talk to a seasoned attorney about your options.

Can you get disqualified from Medicaid if you have a personal injury settlement?

In order to remain eligible, those who haven’t yet applied for Medicaid eligibility often attempt to dispose of the post-cap portion of their settlements or siphon the cash into exempt assets. However, these maneuvers can be time-consuming and problematic.

What is medicaid insurance?

Medicaid is an insurance program that is determined by and contingent on an individual's financial needs. Medicaid provides low-income individuals with basic medical care with minimal or no cost. Medicaid recipients do have strict eligibility requirements.

What are the Medicaid eligibility limits?

The Affordable Care Act created a new way to determine Medicaid income eligibility based on Modified Adjusted Gross Income (MAGI). Medicaid eligibility is extremely complex, and as you can see can become even more complex when you factor in a personal injury settlement. Medicaid eligibility can also vary by state. As such, you should consult an experienced attorney that specializes in Medicaid.

What is a Special Needs Trust?

Individuals using a Special Needs Trust must meet certain criteria including:

What happens if you are injured due to negligence?

If you were injured due to another person's negligence, you may be entitled to compensation from a personal injury case. If you have been injured, you will need to show that the other person owed you a duty of care that a reasonable person in similar circumstances would have been required to show. Then you would need to show that you did sustain an injury, and it was the other person's negligence that caused your injury. But what if you are also trying to qualify (or stay qualified) for Medicaid? Any personal injury settlements you may receive could possibly impact your Medicaid benefits.

Can you spend down assets for medicaid?

However, some assets may be exempt, or not "counted" toward your asset limit. If you have assets that are not counted toward the amount to qualify for Medicaid, you can " spend down" those assets to meet the Medicaid asset limit. We recommend calculating this amount with a qualified attorney that is experienced in Medicaid spend-down. One reason is Medicaid has a look-back period to review these transfers. So, for example, if you have gifted assets or sold assets below fair market value, you may become ineligible for Medicaid.

Is a personal injury settlement countable?

When it comes to your personal injury claims, personal injury settlements are considered "countable assets." What this means is if you have received a personal injury settlement during your Medicaid eligibility period, you are prohibited from receiving future Medicaid benefits.

Are there any Remedies to receive Medicaid after a Personal Injury Settlement?

If you still want to be eligible for Medicaid, you may want to consider moving some of your assets into exempt asset categories. Our team of attorneys can help set up a trust that will help you remain eligible for your benefits. A Special Needs Trust can help in keeping your settlement exempt from Medicaid's financial requirements. A special needs trust can allow you to use your personal injury settlement funds to pay for necessary goods and services.

How Can You Protect Your Medicaid Benefits?

If you expect a small to moderate settlement amount, you can decide to spend down your proceeds. How you do this will depend on your state laws. Some states require that you spend down the settlement the same month as you receive it. You will also need to purchase items that are not considered countable assets.

What Is Medicaid?

Medicaid is a need-based insurance program that is jointly provided by state agencies and the federal government. It is designed to provide subsidized healthcare coverage to low-income individuals. Typically, people who benefit from the program include children, pregnant women, low-income adults, and people with disabilities.

Is Medicaid a poverty line?

Unlike Medicare, Medicaid beneficiaries are subject to strict eligibility requirements. Your income and assets should be below the federal poverty line to receive benefits. People who receive SSI, however, are exempt from these income requirements.

Does a personal injury settlement affect Medicaid?

Does a personal injury settlement affect Medicaid? Yes. In fact, a good number of accident victims are forced to choose between their personal injury settlement and Medicaid benefits. However, you can skip this choice if you plan ahead and consult with an expert Hudson County Personal Injury Attorney.

Does financial compensation affect Medicaid?

While financial compensation can help promote your recovery, it can also affect your eligibility for Medicaid benefits. Therefore, it is important to learn the impact of your settlement on your benefits and how you can protect yourself in such situations.

Is a personal injury settlement countable?

Personal Injury Settlements and Medicaid Eligibility. A personal injury settlement is considered a countable asset. This means that receiving one can affect your eligibility for Medicaid benefits. Generally, small to medium settlement amounts have little or no effect on Medicaid.

What is the recovery right of medicaid?

When an action or claim is brought against a third party by a medical assistance recipient, any payment, settlement or compromise of the action or claim, or any court award or judgment, is subject to the recovery right of the department of medicaid or county department .

What is the right of recovery for medical assistance?

A medical assistance recipient’s enrollment in a medical assistance program gives an automatic right of recovery to the department of medicaid and a county department of job and family services against the liability of a third party for the cost of medical assistance paid on behalf of the recipient. When an action or claim is brought against a third party by a medical assistance recipient, any payment, settlement or compromise of the action or claim, or any court award or judgment, is subject to the recovery right of the department of medicaid or county department. Except in the case of a medical assistance recipient who receives medical assistance through a medicaid managed care organization, the department’s or county department’s claim shall not exceed the amount of medical assistance paid by the department or county department on behalf of the recipient. A payment, settlement, compromise, judgment, or award that excludes the cost of medical assistance paid for by the department or county department shall not preclude a department from enforcing its rights under this section.

Can a medicaid claim exceed the amount of medical assistance paid by the department or county department?

Except in the case of a medical assistance recipient who receives medical assistance through a medicaid managed care organization, the department’s or county department’s claim shall not exceed the amount of medical assistance paid by the department or county department on behalf of the recipient.

Does Medicaid take money from settlements?

It is also true that Medicaid will demand rei mbursement from any settlement or jury award you receive. The program will only take an amount equal to what it spent in covering your care, though. In most cases, you will hold onto some or all of the compensation you received for lost wages, loss of future earnings, pain and suffering, and, when they exist, punitive damages.

Does Medicaid affect personal injury settlements?

Yes, Medicaid does affect personal injury settlements. No, this should not discourage anyone who has Medicaid coverage in Ohio from attempting to hold the person or company that caused their injuries accountable through insurance claims or a lawsuit.

Can a personal injury attorney fight for Medicaid?

While no outcome can be guaranteed, a personal injury attorney who represents a client who is covered by Medicaid will fight to ensure that a settlement or jury award accounts for all of Medicaid’s previous and projected spending.

Does Medicaid cover car accident?

Medicaid Covers Now and Seeks Reimbursement Later. First, know that Ohio Medicaid will cover emergency and follow-up care for injuries suffered in a car crash, truck accident, slip and fall, dog attack, or other accident that would give you grounds for filing a personal injury claim. You do not need to worry about paying all ...

Medicaid Basics

Eligibility Limits

- Individuals who wish to obtain Medicaid benefits can’t earn more than about $2,200 per month. This exact figure is subject to change and typically rises by 1% to 5% at the beginning of each calendar year. Additionally, recipients can’t have more than $2,000 to $3,000 in “countable assets.” The exact “countable asset” limit is dependent on the recipient’s long-term care needs and certai…

Exempt Assets

- Most assets are not exempt from Medicaid eligibility calculations. There are a few exceptions for “core items” that solvent individuals or couples can’t reasonably expect to live without. These may include: • A primary residence worth up to $500,000 • An automobile • Wedding and engagement rings • Funeral contracts • Certain types of life insurance Unfortunately, personal injury settleme…

How This Affects Medicaid Eligibility

- Unstructured personal injury settlements that push potential Medicaid recipients over the “asset cap” will result in disqualification. Individuals who receive settlements during a period of Medicaid eligibility are prohibited from receiving future benefits. In order to remain eligible, those who haven’t yet applied for Medicaid eligibility often attempt to dispose of the post-cap portion of the…

Potential Remedies

- After you receive a personal injury settlement, a trained attorney can help you keep your Medicaid benefits or remain eligible for future benefits. A “special needs trust” that keeps the bulk of your settlement in safekeeping is exempt from Medicaid’s strict means testing. With a special needs trust at your disposal, you can use your settlement’s f...