Click on the orange Get Form button to begin editing and enhancing. Turn on the Wizard mode on the top toolbar to have extra pieces of advice. Complete each fillable field. Ensure that the information you add to the Your Settlement And HUD-1 - Hud is updated and accurate. Add the date to the form using the Date feature.

Full Answer

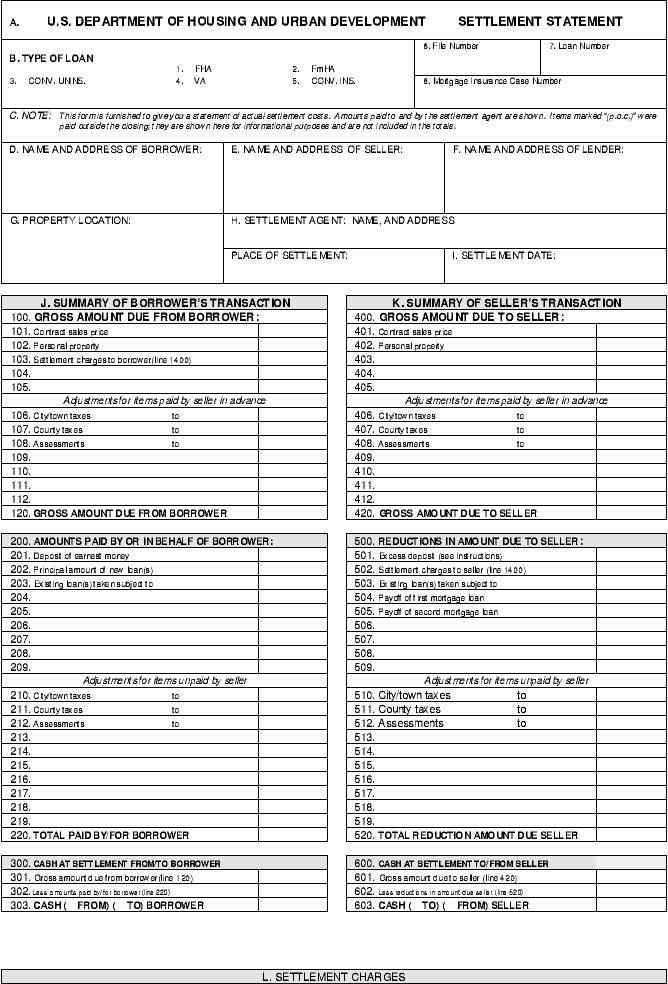

What does A HUD-1 Settlement Statement look like?

The first page of the settlement statement has a transaction overview, including the amount of cash you need to bring to closing. The sections below are highlighted so you can have an idea of what they look like on the HUD-1 settlement statement you’ll receive.

What are the instructions for completion of the HUD-1?

The instructions for completion of the HUD-1 are primarily for the benefit of the settlement agents who prepare the statements and need not be transmitted to the parties as an integral part of the HUD-1. There is no objection to the use of the HUD-1 in transactions in which its use is not legally required.

Is the HUD-1 required for a line of credit?

The use of either the HUD-1 or HUD-1A is not mandatory for open-end lines of credit (home-equity plans), as long as the provisions of Regulation Z are followed. The HUD-1A settlement statement is to be used as a statement of actual charges and adjustments to be given to the borrower at settlement, as defined in this part.

What is a HUD-1 form used for in real estate?

The Real Estate Settlement Procedures Act (RESPA) required that the HUD-1 form be used as the standard real estate settlement form in all transactions in the United States that involved federal mortgage loans. 2 It was formerly used for nearly all transactions that involved a buyer and seller, including cash closings .

When must a lender use HUD's Form 1 Uniform settlement statement?

(a) Use by settlement agent. The settlement agent shall use the HUD-1 settlement statement in every settlement involving a federally related mortgage loan in which there is a borrower and a seller.

What is a HUD-1 form used for?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance. If you applied for a mortgage on or before October 3, 2015, or if you are applying for a reverse mortgage, you receive a HUD-1.

What is the difference between HUD-1 and settlement statement?

A HUD-1 form, also called a HUD-1 Settlement Statement, is a standardized mortgage lending document. Creditors or their closing agents use this form to create an itemized list of all charges and credits to the buyer and to the seller in a consumer credit mortgage transaction.

Is a HUD-1 Settlement Statement required for a cash sale?

A: The answer is no. For my readers, a HUD-1 is the settlement statement that is used for most residential closings. HUD stands for the Department of Housing and Urban Development.

Are HUD-1 forms still used?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exception: reverse mortgages.

How do you read a settlement statement for taxes?

0:367:31How To Read A Settlement Statement From Your Real Estate ClosingYouTubeStart of suggested clipEnd of suggested clipSo on page one of the closing disclosure you're going to see the parties identified at the top soMoreSo on page one of the closing disclosure you're going to see the parties identified at the top so seller and buyer the property. Address and the loan. Amount.

What replaced the HUD-1 Settlement?

The Closing Disclosure combines and replaces the HUD-1 Settlement Statement and the final Truth-in-Lending (TIL) statement. The form mirrors the information provided on the Loan Estimate.

Is closing disclosure same as settlement statement?

Closing Disclosure When you are in the process of closing, you will receive a settlement statement. They arrive three days before closing from your lender. This document is commonly known as the “closing disclosure.” Essentially, this is for buyers to review in advance before closing.

Is a settlement statement the same as a closing statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

What is the primary purpose of the settlement statement?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

How do I read a HUD statement?

Look at the first page of the HUD statement. Look over the basic details in Part B, such as your name, the seller's name and the property address. Read sections J and K, which give a summary of the total amounts owed from or due to the borrower or seller.

What is the difference between a closing disclosure and a HUD?

Another big distinction between the Closing Disclosure and the HUD-1 is where the HUD-1 listed all terms, charges and credits for both the buyer and the seller, the Closing Disclosure has a separate form for the buyer as it does for the seller. This provides for more consumer protection at the closing table.

Who prepares a HUD-1 statement?

A settlement agent, or closing agent, will prepare a HUD-1 settlement statement at the closing of a real estate loan. The final version will explicitly state all costs involved with the real estate loan and to whom the individual charges and fees will be paid to.

What is the new HUD-1 called?

The Closing Disclosure, or CD, replaced the HUD-1 beginning Oct. 3, 2015.

What is a HUD-1 settlement statement?

This form is to be used as a statement of actual charges and adjustments paid by the borrower and the seller, to be given to the parties in connection with the settlement. The instructions for completion of the HUD-1 are primarily for the benefit of the settlement agents who prepare the statements and need not be transmitted to the parties as an integral part of the HUD-1. There is no objection to the use of the HUD-1 in transactions in which its use is not legally required. Refer to the definitions section of the regulations (12 CFR 1024.2) for specific definitions of many of the terms that are used in these instructions.

Who completes HUD-1?

The settlement agent shall complete the HUD-1 to itemize all charges imposed upon the Borrower and the Seller by the loan originator and all sales commissions, whether to be paid at settlement or outside of settlement, and any other charges which either the Borrower or the Seller will pay at settlement.

What is line 101 in a mortgage?

Line 101 is for the contract sales price of the property being sold, excluding the price of any items of tangible personal property if Borrower and Seller have agreed to a separate price for such items.

What is the principal limit on a reverse mortgage?

For reverse mortgage transactions, the amount disclosed on Line 202 is the initial principal limit. Line 203 is used for cases in which the Borrower is assuming or taking title subject to an existing loan or lien on the property. Lines 204-209 are used for other items paid by or on behalf of the Borrower.

What is P.O.C. on HUD?

Charges paid outside of settlement by the borrower, seller, loan originator, real estate agent, or any other person, must be included on the HUD-1 but marked “P.O.C.” for “Paid Outside of Closing” (settlement) and must not be included in computing totals.

Where should the charge be listed on the HUD-1?

However, in order to promote comparability between the charges on the GFE and the charges on the HUD-1, if a seller pays for a charge that was included on the GFE, the charge should be listed in the borrower's column on page 2 of the HUD-1.

Where do you find the charges on HUD-1?

As a general rule, charges that are paid for by the seller must be shown in the seller's column on page 2 of the HUD-1 (unless paid outside closing), and charges that are paid for by the borrower must be shown in the borrower's column (unless paid outside closing).

What is a HUD-1 settlement statement?

A HUD-1 settlement statement, also referred to simply as a settlement statement , details every charge associated with your new loan. It also outlines who is responsible for each of those charges — the buyer or the seller — as well as any credits you may receive for things like taxes, insurance or deposits.

What is the first page of a HUD settlement statement?

The first page of the settlement statement has a transaction overview, including the amount of cash you need to bring to closing. The sections below are highlighted so you can have an idea of what they look like on the HUD-1 settlement statement you’ll receive.

How long do you have to give a closing disclosure?

In contrast, lenders must give you a closing disclosure three days before closing. Everyone taking out a HELOC, reverse mortgage or manufactured home loan should ask their lender for the HUD-1 document at least a day before closing to allow time to review the contents, fix errors and raise questions with the lender.

What is section 300?

No. 5 (Section 300): Cash at settlement from/to borrower. This section explains if you need to bring cash to the settlement. In most cases, the closing costs for a reverse mortgage refinance or HELOC will be subtracted from the loan, so you don’t need to bring funds to the closing.

How long does it take to pay down a HELOC?

You can borrow as much as you need up to your maximum loan amount, then pay it down to zero as many times as necessary during a set draw period that usually ends after 10 years.

What is section 200 in mortgage?

No. 4 (Section 200): Amount paid by or on behalf of borrower. This section details any credits you receive toward costs you’ve already paid or that the seller is paying. Line 201 shows the money you’ve already paid, such as an earnest money deposit, while Line 202 reflects the principal amount of the new loan.

How many sections are there in a settlement statement?

The settlement statement lists charges in three sections. The first section shows charges that cannot change. The next section outlines charges that cannot change by more than 10%, while the final section outlines charges that may change.

What is HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance. If you applied for a mortgage on or before October 3, 2015, or if you are applying for a reverse mortgage, you receive a HUD-1.

What form do you use for a refinance loan?

In transactions that do not include a seller, such as a refinance loan, the settlement agent may use the shortened HUD-1A form.

Can I share my PII?

Please do not share any personally identifiable information (PII), including, but not limited to: your name, address, phone number, email address, Social Security number, account information, or any other information of a sensitive nature.

What is HUD-1 settlement statement?

The HUD-1 settlement statement is a standard government real estate form that used to be used as the standard real estate settlement form in all transactions in the United States which involve federally related mortgage loans.

What is HUD-1 form?

An HUD-1 Form is used by HUD. It is better known as a Settlement Statement. This document is completed when someone is going through the process of buying or refinancing property, such as a home. The real estate agent involved in the sale will complete this document. Because this document will be sent to HUD, a federal agency, ...

What is included in HUD-1?

The HUD-1 form contains the following components: Type of loan. Settlement charges. Agency commissions. Items payable in connection with a loan. Items required by lender to be paid in advance. Reserves deposited with lender. Title charges. Government recording and transfer charges.

When to use a refinance form?

It will be used when a party is purchasing or refinancing real estate. The form is filled out by the agent who is completing the settlement. The form will itemize all the services and fees related to the process of purchasing or refinancing real estate.

Is HUD-1 still used today?

After October 2015, borrowers began receiving a Closing Disclosure instead of a HUD-1 for most mortgage loans. The HUD-1 settlement statement is still used today for reverse mortgages.

What is the line 901. interest?

interest paid at the time of purchase (the charge at closing would normally be done for interest up to the date of first payment). Line 901.

Can I use HUD 1 to report 1098?

Can I use Hud-1 Settlement Statement to report taxes, insurance, etc.? Yes, you can use the HUD-1 settlement statement to locate the additional expenses not reported on form 1098. Be careful not to duplicate the expenses.