Yes, you can use the HUD-1 settlement statement to locate the additional expenses not reported on form 1098. Be careful not to duplicate the expenses. Select Federal Taxes>Deductions & Credits. Enter interest, points, mortgage insurance and property taxes in the Your Home section.

Are Settlement Statement items tax deductible?

Closing on a loan can cost you several thousand dollars. Before you let that prevent you from buying a home or refinancing, learn which settlement statement items are tax deductible. This lowers the overall cost of closing on a loan, by lowering your tax liability at the end of the year.

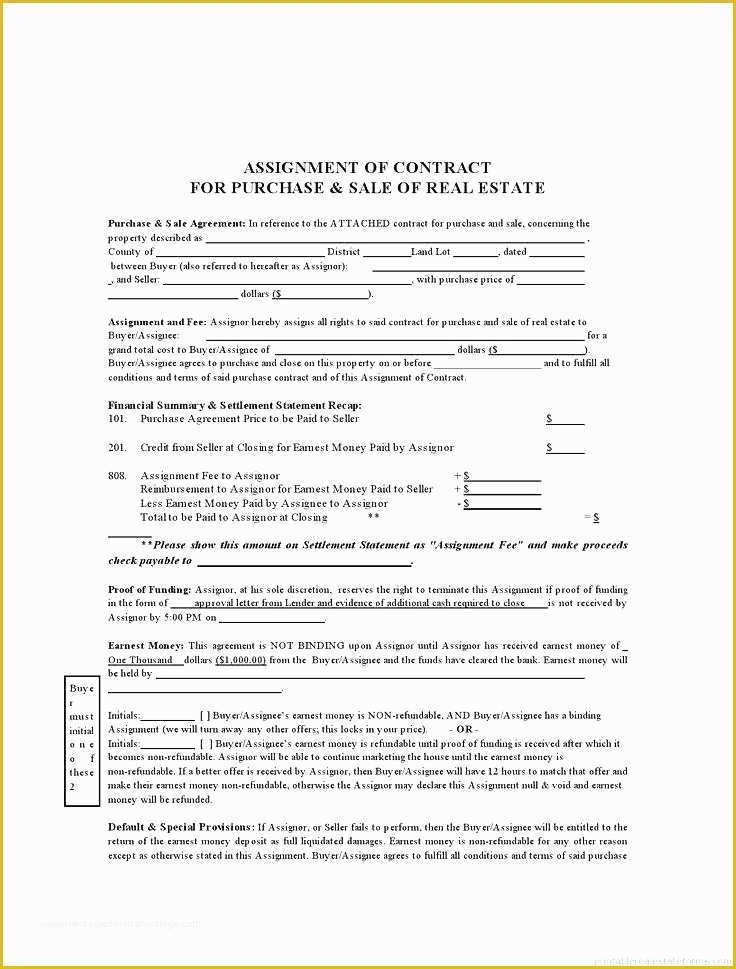

What is a seller’s settlement statement and why is it important?

The Seller’s Settlement Statement will list the purchase price of the property as well as a few other items like the real estate agent commissions, mortgage loan payoffs, prorated taxes, utilities and escrow fees and anything else associated with the home sale.

How do you write a settlement statement for a house sale?

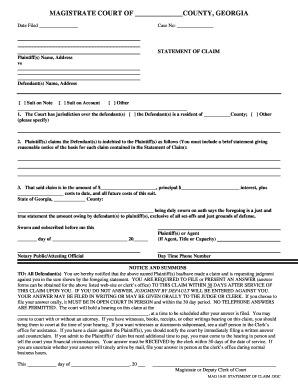

A standard settlement statement has a column for the seller’s debits and credits on one side, a column for the buyer’s debits and credits on the other, and a description of the charge in the middle. Below we use the ALTA form as an example and break it down, line by line.

Do you have to pay taxes on a settlement?

Tax Implications of Settlements and Judgments The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code.

What part of settlement statement is tax deductible?

The only settlement or closing costs you can deduct on your tax return for the year the home was purchased or built are Mortgage Interest and certain Real Estate (property) taxes. These can be deducted in the year you buy your home if you itemize your deductions.

Can I deduct settlement charges on my taxes?

Can you deduct these closing costs on your federal income taxes? In most cases, the answer is “no.” The only mortgage closing costs you can claim on your tax return for the tax year in which you buy a home are any points you pay to reduce your interest rate and the real estate taxes you might pay upfront.

How do you read a settlement statement for taxes?

0:367:31How To Read A Settlement Statement From Your Real Estate ClosingYouTubeStart of suggested clipEnd of suggested clipSo on page one of the closing disclosure you're going to see the parties identified at the top soMoreSo on page one of the closing disclosure you're going to see the parties identified at the top so seller and buyer the property. Address and the loan. Amount.

Why do I need Settlement Statement for taxes?

The settlement statement gives both parties a full picture of the expenses attached to the transaction. Some of the expenses assigned to home sellers and buyers on the HUD-1 form might be tax-deductible, and whether they are depends on the specifics of each transaction.

What closing costs are tax deductible IRS?

Generally, deductible closing costs are those for interest, certain mortgage points and deductible real estate taxes. Many other settlement fees and closing costs for buying the property become additions to your basis in the property and part of your depreciation deduction, including: Abstract fees.

What can I write off when buying a house?

Unfortunately, most of the expenses you paid when buying your home are not deductible in the year of purchase. The only tax deductions on a home purchase you may qualify for is the prepaid mortgage interest (points)....These fees include:Title insurance.Appraisals.Abstract fees.Recording fees.Surveys.

How do you explain a settlement statement?

A settlement statement is a document summarizing all costs owed by or credits due to the homebuyer and seller (or borrower if refinancing). The document also includes the purchase price of the property, loan amount and other details.

What is deductible on a settlement sheet?

Deductible Expenses Interest on your loan paid at closing is tax deductible. Any prorated property taxes allocated as your expenses are also deductible. You can deduct loan origination fees or points, which are the fees a bank charges you for making the loan.

What is the primary purpose of the settlement statement?

A settlement statement is a document that summarizes the terms and conditions of a settlement agreement between parties. Commonly used for loan agreements, a settlement statement details the terms and conditions of the loan and all costs owed by or credits due to the buyer or seller.

Is there a tax credit for buying a house in 2021 IRS?

On April 28, 2021, U.S. lawmakers introduced the First-Time Homebuyer Act of 2021. The bill revises the IRS tax code to grant first-time home buyers up to $15,000 in refundable federal tax credits.

Will I get a 1099 for a lawsuit settlement?

If your legal settlement represents tax-free proceeds, like for physical injury, then you won't get a 1099: that money isn't taxable. There is one exception for taxable settlements too. If all or part of your settlement was for back wages from a W-2 job, then you wouldn't get a 1099-MISC for that portion.

What are the tax benefits of buying a house?

8 Tax Benefits of Buying a Home in 2022Mortgage interest deduction.Mortgage insurance deduction.Mortgage points deduction.SALT deduction.Tax-free profits on your home sale.Residential energy credit.Home office deduction.Standard deduction.

Will I get a 1099 for a lawsuit settlement?

If your legal settlement represents tax-free proceeds, like for physical injury, then you won't get a 1099: that money isn't taxable. There is one exception for taxable settlements too. If all or part of your settlement was for back wages from a W-2 job, then you wouldn't get a 1099-MISC for that portion.

Why is a W 9 required for settlement?

The Form W-9 is a means to ensure that the payee of the settlement is reporting its full income. Attorneys are frequently asked to supply their own Taxpayer Identification Numbers and other information to the liability carrier paying a settlement.

Do I have to report personal injury settlement to IRS?

The compensation you receive for your physical pain and suffering arising from your physical injuries is not considered to be taxable and does not need to be reported to the IRS or the State of California.

Where do you report settlement income on 1040?

Attach to your return a statement showing the entire settlement amount less related medical costs not previously deducted and medical costs deducted for which there was no tax benefit. The net taxable amount should be reported as “Other Income” on line 8z of Form 1040, Schedule 1.

What is a HUD-1 settlement statement?

The HUD-1 Settlement Statement is a breakdown of the expenses home sellers and homebuyers incur in a real estate sale. The settlement statement gives both parties a full picture of the expenses attached to the transaction. Some of the expenses assigned to home sellers and buyers on the HUD-1 form might be tax-deductible, and whether they are depends on the specifics of each transaction. Some of the more common examples of deductible expenses include loan origination fees, mortgage insurance premiums, and real estate tax payments.

What Are Seller Deductions?

Any prorated real estate taxes a home seller pays at closing are tax deductible. However, many of the closing costs listed on a settlement statement are deducted from sale proceeds. Lowered net proceeds reduce the capital gains the home seller may have garnered, thus reducing associated taxes. A capital gain is the improvement between a home's past purchase price and its later sale price, minus sale expenses.

Do home sellers pay closing costs?

Also, home sellers sometimes pay all or a portion of the buyer's closing costs. The closing costs sellers pay for buyers are deductible by buyers only, though the payment of such costs by sellers reduces those sellers' net capital gains and any taxes due.

Can you deduct closing costs on a home sale?

Also, home sellers sometimes pay all or a portion of the buyer's closing costs. The closing costs sellers pay for buyers are deductible by buyers only, though the payment of such costs by sellers reduces those sellers' net capital gains and any taxes due.

Can closing costs be deducted from a sale?

Clarifying Buyer Deductions. Many of the expenses attached to such a sale can be referred to collectively as closing costs. All homebuyers and sellers usually end up paying closing costs, some of which may even be tax deductible. Costs such as home appraisals, inspections, notary fees and others found on a settlement statement may be tax deductible ...

What expenses are capitalized in closing?

When determining whether you owe taxes on the sale of the property, you will subtract the sale price from the property's cost basis to determine the taxable gain from the sale before applicable exclusions are applied. According to the IRS, expenses such as title insurance, transfer taxes, surveys, and legal fees may be capitalized.

Is interest on a loan at closing tax deductible?

Interest on your loan paid at closing is tax deductible. Any prorated property taxes allocated as your expenses are also deductible. You can deduct loan origination fees or points, which are the fees a bank charges you for making the loan.

Is closing expenses tax deductible?

Some expenses you incur at closing are not deductible. The insurance premium for your home insurance is not tax deductible and neither is your title insurance premium. Remember that private mortgage insurance may or may not be deductible, in whole or in part, depending upon your income level.

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

Who is responsible for preparing the settlement statement?

Whoever is facilitating the closing — whether it be a title company, escrow firm, or real estate attorney — will be responsible for preparing the settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.

When are property taxes prorated?

For instance, say you get billed for property taxes in February to cover the previous year. If you’re closing on a sale on April 30, the yearly property tax is “prorated” or calculated for the first four months of the year, and it’s reflected in this section.

Do you have to pay taxes at closing?

A buyer might be required to pay some charges, like homeowners insurance premiums or county taxes, in advance at closing.

What Is a Settlement Statement?

A settlement statement is a document that summarizes the terms and conditions of a settlement, most commonly a loan agreement. A loan settlement statement provides full disclosure of a loan’s terms, but most importantly it details all of the fees and charges that a borrower must pay extraneously from a loan’s interest. Different types of loans can have varying requirements for settlement statement documentation. Generally, loan settlement statements can also be referred to as closing statements .

When are settlement statements created?

Beyond just loans, settlement statements can also be created whenever a large settlement has taken place, such as with a large business transaction or potentially in the legal, insurance, banking, and trading industries.

What is debt settlement?

Debt settlement: A debt settlement statement can provide a summary of debts written off, reduced, or otherwise amended after a debt settlement has completed. Lawyers and debt settlement companies work on behalf of borrowers with overwhelming amounts of debt, in order to help them reduce some or all of their obligations.

What is a settlement statement in stock trading?

Trading: In financial market trading, settlement statements provide proof of a security’s ownership transfer. Typically, stocks are transferred with a T+2 settlement date meaning ownership is achieved two days after the transaction is made.

What is insurance settlement?

Insurance settlement: An insurance settlement is most commonly documentation of the amount an insurer agrees to pay after reviewing an insurance claim. Banking: In the banking industry, settlement statements are produced on a regular basis for internal banking operations.

Does a reverse mortgage require a HUD-1 settlement statement?

RESPA requires a HUD-1 settlement statement for borrowers involved in a reverse mortgage. For all other types of mortgage loans, RESPA requires the mortgage closing disclosure. Both the HUD-1 and mortgage closing disclosure are standardized forms.

What is the tax rule for settlements?

Tax Implications of Settlements and Judgments. The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code. IRC Section 104 provides an exclusion ...

What is employment related lawsuit?

Employment-related lawsuits may arise from wrongful discharge or failure to honor contract obligations. Damages received to compensate for economic loss, for example lost wages, business income and benefits, are not excludable form gross income unless a personal physical injury caused such loss.

What is the purpose of IRC 104?

IRC Section 104 provides an exclusion from taxable income with respect to lawsuits, settlements and awards. However, the facts and circumstances surrounding each settlement payment must be considered to determine the purpose for which the money was received because not all amounts received from a settlement are exempt from taxes.

What is a 1.104-1 C?

Section 1.104-1 (c) defines damages received on account of personal physical injuries or physical sickness to mean an amount received (other than workers' compensation) through prosecution of a legal suit or action, or through a settlement agreement entered into in lieu of prosecution.

What is an interview with a taxpayer?

Interview the taxpayer to determine whether the taxpayer provided any type of settlement payment to any of their employees (past or present).

What is the exception to gross income?

For damages, the two most common exceptions are amounts paid for certain discrimination claims and amounts paid on account of physical injury.

Is emotional distress taxable?

Damages received for non-physical injury such as emotional distress, defamation and humiliation, although generally includable in gross income, are not subject to Federal employment taxes. Emotional distress recovery must be on account of (attributed to) personal physical injuries or sickness unless the amount is for reimbursement ...

Fuck fuck fuck fuck fuck fuck

I really put my heart into this house we bid on. We put in a very strong offer. Very strong. I researched the couple who lived there and died. The last living scientist from the Manhattan Project. An artist from Copenhagen. A couple that donated to arts and museums and social projects. A house with a history and love.

We flipping did it!!

YALLLLL we did it. We beat cash Carl, we beat house flipper skipper (that super bowl commercial had me tilted I’m not going to lie) but we’re officially under contract as of today!!

Can you add interest manually in TurboTax?

You can add the interest manually in TurboTax from the closing disclosure.

Can I use HUD 1 to report 1098?

Can I use Hud-1 Settlement Statement to report taxes, insurance, etc.? Yes, you can use the HUD-1 settlement statement to locate the additional expenses not reported on form 1098. Be careful not to duplicate the expenses.

Is a recording fee deductible?

Other fees, such as commissions, attorney fees, preparation of deed, abstract fees, owner title insurance, recording fees are added to the basis of your home, and not deductible.

Is closing cost deductible on taxes?

The remaining closing costs should be added to the basis of the property. No other closing costs will be deductible on your tax return this year.