Here are the tips for writing the best demand letter to an insurance company for settlement: 1) Provide a detailed account of the physical facts of the case 2) Give details on what injuries you incurred

Full Answer

How to write a settlement letter for a car accident settlement?

Discuss any other losses or damages that occurred as a result of the accident. Next, the letter should include the settlement amount you are demanding, although it should be 25-100% higher than your minimum as the insurance company will most likely offer you less than what you demand.

How to settle a car insurance claim?

Tips for Settling a Car Insurance Claim 1 Be Prepared. Have everything you need when you submit your claim. ... 2 Understand How Car Insurance Companies View Claims. Auto insurance companies typically offer low settlements on claims. ... 3 Negotiate Your Settlement. ... 4 Consider an Attorney. ...

How do you write an insurance claim for a car accident?

Describe the car accident, your injuries, the medical treatment you received, any ongoing health issues you have, how badly your vehicle was damaged, and any other losses you incurred as a result of the car accident. Then, tell the insurance company how much money you demand as a result of the circumstances.

What should be included in a claim settlement letter?

In case you decide to embark on this mission alone, include the following in your claim settlement letter: You can find various sample letters on the internet, so make sure to use the one suitable for your claim. A claim for a car accident or a medical issue should consist of different parts and information.

What should you consider when calculating a fair settlement?

How to negotiate with insurance company?

Why do drivers get entangled with insurance companies?

What to do when an adjuster comes in near your minimum?

What happens when you get involved in a car accident?

How much do personal injury attorneys take?

How to describe a car accident?

See 4 more

About this website

How do I write a letter to insurance settlement?

7 Tips for Writing a Demand Letter To the Insurance CompanyOrganize your expenses. ... Establish the facts. ... Share your perspective. ... Detail your road to recovery. ... Acknowledge and emphasize your pain and suffering. ... Request a reasonable settlement amount. ... Review your letter and send it!

How do I write a demand settlement letter for car insurance?

The purpose of this article is to help you maximize the effectiveness of your demand letter.Request Your Medical Records. ... Document Your injury. ... Establish the Extent of Property Damage. ... Document Your Expenses. ... Be Organized. ... Do Not Exaggerate and Do Not Be Greedy. ... Calculating "Pain and Suffering" ... Seek Professional Legal Advice.

How do insurance companies negotiate cash settlements?

Let's look at how to best position your claim for success.Have a Settlement Amount in Mind. ... Do Not Jump at a First Offer. ... Get the Adjuster to Justify a Low Offer. ... Emphasize Emotional Points. ... Put the Settlement in Writing. ... More Information About Negotiating Your Personal Injury Claim.

How do I get the most out of my car insurance claim?

Contact your insurance provider as soon as possible: The first thing you should do is contact your insurance right away. This will present a more accurate recollection of the events that took place. The more accurate and the better you're able to recall the incident, the stronger your claim will be.

How do you write a good settlement offer?

Writing the Settlement Offer Letter Include your personal contact information, full name, mailing address, and account number. Specify the amount that you can pay, as well as what you expect from the creditor in return. A good starting point for negotiation could be offering around 30% of the amount that you owe.

How do you explain pain and suffering?

Pain and suffering refers to the physical discomfort and emotional distress that are compensable as noneconomic damages. It refers to the pain, discomfort, anguish, inconvenience, and emotional trauma that accompanies an injury.

How do you respond to a low ball settlement offer?

Steps to Respond to a Low Settlement OfferRemain Calm and Analyze Your Offer. Just like anything in life, it's never a good idea to respond emotionally after receiving a low offer. ... Ask Questions. ... Present the Facts. ... Develop a Counteroffer. ... Respond in Writing.

What should you not say to an insurance adjuster?

Never say that you are sorry or admit any kind of fault. Remember that a claims adjuster is looking for reasons to reduce the liability of an insurance company, and any admission of negligence can seriously compromise a claim.

How do you ask for more money in a settlement?

Send a Detailed Demand Letter to the Insurance Company Because the insurance company will likely reply with an offer for an amount lower than what you've asked for in the demand letter, you should ask for between 25 and 100 percent more than what you would be willing to settle for.

What happens if insurance doesn't pay enough?

If your insurance claim check is not enough, take a second (or third, or fourth) look through your insurance policy to see if you can find anything that might help you win your case against your insurance company to get them to give you a higher settlement.

Do insurance companies try to get out of paying?

Insurance companies will seek to decrease or eliminate payments for injuries caused by an insured person's actions. After becoming injured, victims of accidents want nothing more than to move on from the traumatizing experience.

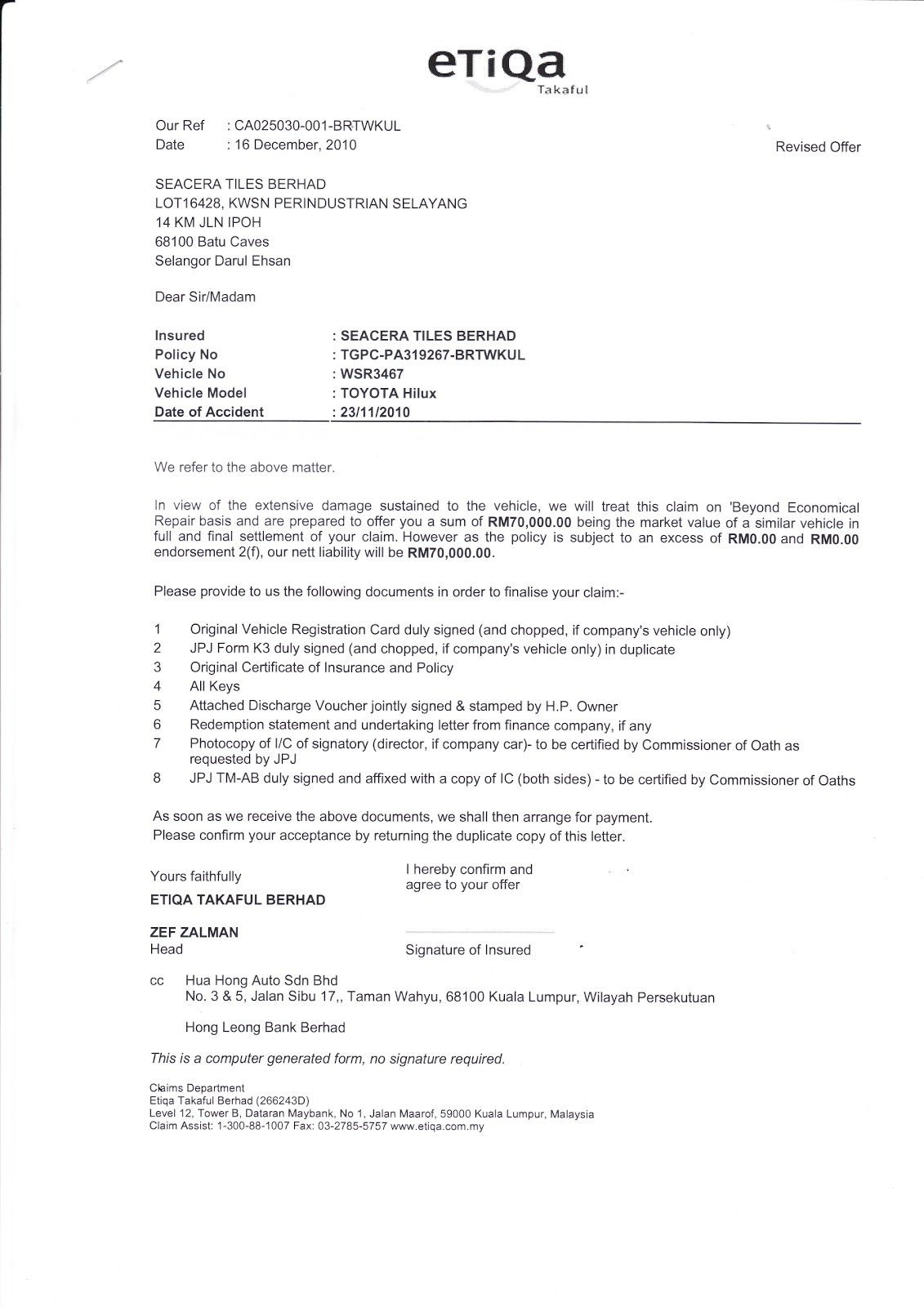

What do insurance companies use to value a totaled car?

The insurer will use the actual cash value of your car immediately before the damage to decide whether to declare your vehicle a total loss. You can get an estimate of your car's fair market value from tools like Kelley Blue Book or by checking to see what similar cars are selling for in your area.

How do you write a good demand letter?

Ten Tips for Writing an Effective Demand LetterBe Organized. ... Submit the Letter in a Timely Manner. ... Reference Pertinent Claim Information on All Communication. ... Use Appropriate Professional Language and Tone. ... Use Subheadings. ... Be Specific. ... Set Forth Demand Amount Clearly. ... Provide Deadline for Response.More items...•

How do you request a settlement for demand?

How To Write A Demand Letter To Settle Your ClaimOutline The Incident. You will need to start by outlining the details of the accident. ... Detail Your Injuries. ... Explain All Of Your Damages. ... Calculate Your Settlement Demand. ... Attach Relevant Documents. ... Get Help From An Attorney.

What is an insurance demand letter?

Writing a “demand letter” is one of the initial steps taken in the personal injury claims process. The demand letter is a document sent to the at-fault party's insurance company, explaining your side of the story, the losses you have incurred, and the total amount you are requesting as a settlement.

What is an insurance settlement letter?

Settlement letters should summarize the purpose of the claim and communicate to the insurance company a fair value for the claim. Insurance companies generally try to settle claims for as little money as possible, making it difficult to reach a satisfactory outcome.

Why should I settle my claim? Shouldn’t I file a personal injury lawsuit?

Most personal injury claims settle out of court because it’s faster, less expensive, and not as risky. Trials are stressful, and it can take months...

How does the insurance decide to offer a settlement?

Claims adjusters will divide damages into two categories: physical damages, such as medical bills and property damage, and emotional damage, such a...

Can I reject a settlement offer?

Claims adjusters will divide damages into two categories: physical damages, such as medical bills and property damage, and emotional damage, such a...

How is my lawyer paid?

Most personal injury attorneys are paid on a contingency basis. If your claim is successful, they will take a percentage of the final settlement. T...

Writing a Strong Insurance Negotiation Letter (with Sample)

When a person submits a claim letter to an insurance company, whether it’s for a car accident, medical malpractice, personal injury or other reason, the insurance company will respond with a first offer. At this point, the claimant has the right to make a counter offer, and in most cases, this is the best thing to do. They can write an insurance negotiation letter where they express their ...

Tips on negotiating with your car insurance company after an incident

After you notify your car insurance company that your vehicle has been involved in an accident, they will send out a claim adjuster to take care of your insurance claim.

How Do You Fight an Insurance Company on a Totaled Car? - WalletHub

To negotiate a settlement with an insurance claims adjuster: Start by filing a claim and sending a completed proof-of-loss form to your insurer as soon as possible, if you haven’t already done so.; Wait to receive the insurance adjuster’s settlement offer (exact timeframes vary by state).; Make a counteroffer if you are not satisfied with the adjuster’s offer. …

How to negotiate an insurance settlement for your car

Whether you feel you were properly compensated during the claims process or you and the insurance company have different ideas about what constitutes a fair settlement, there are steps you need to take so the process is as quick and painless as possible.

1. Make sure you have all the documents related to your accident

A police report is the most important document you can have after an accident. It provides you with the official documentation of the accident, so work with the police officer on the scene to make sure the report is accurate.

2. Keep track of accident-related expenses

Keep track of all of your expenses to make sure you know exactly how much you should be paid by the insurance company after an accident. This includes:

3. Work with your insurer if at all possible

One of the best things you can do when buying insurance is to make sure you purchase coverage designed to protect you even if the other driver is at fault in an accident.

4. Hire an attorney if necessary

If you are just negotiating for the value of your totaled vehicle, an attorney may not be necessary. However, if you have a newer, more expensive vehicle and the insurance company isn’t giving you enough to properly repair or replace your car, it might be worth your time to hire a lawyer.

5. Get it in writing

Once you and your insurance company have agreed to a settlement, make sure you get it in writing. Confirming everything in a written document is the best way to make sure everyone is on the same page and there is no confusion regarding the claim.

1. Know What To Include

Your demand letter needs to answer some important questions.

2. Watch the Tone

Many people believe they can appeal to the humanity in an insurance company to get a better payout. This is rarely, if ever true. Insurance companies are focused primarily on reducing risk.

3. Attach the Necessary Documents

When you send a demand letter to an insurance company, it does not arrive in isolation. Also included are all the documents that back up your arguments. The more documentation you have to prove that your claim is legitimate, the higher the chances of the insurance company negotiating a reasonable settlement.

4. Decide on the Recipient (s)

Some attorneys recommend sending at least two demand letters. Why? By the time you decide on what to include in your demand letter, you may receive information from the insurance companies explaining who will handle full or partial damages. Sometimes this is one or both companies.

What to do if you can't settle a car accident?

If you cannot arrive at a fair settlement agreement after negotiating with an insurance company, you may need to hire a car accident lawyer. An experienced accident attorney can help you evaluate your situation and determine whether a personal injury lawsuit is necessary.

What do you need to know before sending a demand letter to your insurance company?

Before you send a demand letter to your insurance company, you must determine what you believe your claim is worth. When arriving at a figure, you should take into account all of the following:

What to do if your insurance company refuses to pay you?

If the prospect of negotiating with your insurance company or that of the other driver is overwhelming, or an insurance company has refused to pay you a fair settlement, an experienced car accident lawyer may be able to help you navigate the claim negotiation and settlement process. We strongly suggest that you speak to a qualified car accident attorney if you feel that your insurance company is not offering fair compensation. Most car accident lawyers, like us, offer free auto accident case reviews.

How to hire an attorney for a car accident?

1. Initiate a Claim as Soon as Possible after an Auto Accident. After a car accident, you should contact your insurance company right away. It is important to initiate a claim as soon as possible after a car accident so that you can recall details about your accident accurately.

How to communicate with insurance company?

When communicating with the insurance company, emphasize the strongest points in your favor. Do not waste time going over undisputed facts; focus on what’s most important to you. If you suffered an injury that will require lifelong medical care, discuss how this will affect your quality of life and finances over time. If you missed a significant amount of work, reiterate the total amount of wages you lost and how missing work impacted your family. Make it clear to the insurance company that you must be compensated fairly for your injuries and other losses.

How to write a demand letter for medical insurance?

Before you send a demand letter to your insurance company, you must determine what you believe your claim is worth. When arriving at a figure, you should take into account all of the following: 1 The cost of your medical care and related expenses, 2 The amount of income you lost as a result of your injuries if you were unable to work, 3 Whether you are permanently disabled or will require long-term medical care, 4 Any pain and suffering you endured after the accident, and 5 The cost of repairing or replacing your vehicle and any other property that was damaged in the accident.

Why do people settle out of court?

Most personal injury claims settle out of court because it’s faster, less expensive, and not as risky. Trials are stressful, and it can take months for a jury to reach a verdict. After reviewing your case and settlement offers, your attorney will guide whether you should accept the offer or take the case to court.

What to ask for when filing a claim for auto insurance?

As you submit documentation for your claim, you will ask the auto insurance company for the amount of money that you feel is fair based on the property damage or personal injury suffered in the car accident.

What to do if you are in a car accident that is not your fault?

When you are in a car accident that is not your fault, you may need to file a personal injury or property damage claim. The car insurance company may offer you a settlement, but its initial offer may be lower than the amount you feel you are entitled to receive. Continue reading for tips on getting a fair deal when settling your claim.

Why is my insurance offer so low?

The first offer may be very low because the insurance adjuster is hoping you will not negotiate. Don’t rush to accept an offer that feels too low. Request explanations. Ask the insurance adjuster to identify reasons why you were given a lower offer than you had asked for in your initial claim.

Why do you need a lawyer for car insurance?

These are some reasons why you might want to consider hiring a lawyer, including: The insurance adjuster is putting pressure on you to settle quickly. You don’t think the car insurance company is offering you a fair settlement.

What happens if you can't prove your injuries were accident related?

For example, if you can’t prove your injuries were accident-related with documentation, your insurer might argue that they cannot be reimbursed. Negotiating a settlement is often necessary to receive a fair settlement if the insurance company’s first offer is low.

Do auto insurance companies offer low settlements?

Auto insurance companies typically offer low settlements on claims. Their goal is to save money by paying out the minimum that you will accept. They may make the following arguments: You were at fault (fully or partially), so they cannot compensate you to the extent you feel you deserve.

Can a statute of limitations come before a fair settlement?

Your case is dragging on and your state’s statute of limitations may come before you reach a fair settlement.

What is the background of an insurance claim?

Background – The background is only a more descriptive summary of the incident that occurred. Describe where you were and what you were doing immediately before the accident, then how the accident occurred. Keep in mind, that your information must stay factual! If it didn’t happen, is irrelevant to the incident, or there is no proof to verify, then leave it out of the background. Your summary is the meat and potatoes of settlement. Anything you ask the insurance company is based on the description of the events that is listed in the demand letter. Any contradictory or wrong information could hurt your settlement.

What information should be included in an insurance claim?

Insurance Company’s Information – Make sure to include the name of the insurance company, name of the adjuster/or medical examiner, their title, and the company’s address.

What You Should Consider Before Drafting Your Letter?

Before drafting the demand letter, there are certain questions you must be able to answer; as they will help you compel a strong argument.

When Should You Send Your Demand Letter?

You may want to know when is the best time to send a demand letter. A lot of people send their demands right after the accident/incident occurs, which usually results badly. Here is the reason why. If a demand letter is sent too prematurely, then you won’t be able to list all your damages and expenses. Always wait to give your letter to the insurance company after your medical condition is stable and your doctor has given you a long-term outlook on what your health will look like in the future. After doing this, you will have exact estimations of your present damages and future ones.

What to Expect After Sending the Letter?

The waiting game is always the worst! You never know how the insurance company is going to respond. Here are three practical realities to look forward to after your demand letter has been sent. One, the insurance company accepts your offer and decided to go ahead and settle the claim. Truthfully, most insurance companies want to get done with your settlement as soon as possible. The longer the claim drags out, the more resources are extended to it; while they also have other claims to tend to. Two, they may decide to refuse your demand and counter offer another settlement. It may sound daunting, but all hope is not lost in this scenario. That is the importance of setting your total demand higher than the exact amount to prepare for counter offers. Three, the insurance company may not respond at all to your letter. Yes, even though you clearly listed your expected response time they may just ignore your letter. Why? Because legally there are no laws to enforce them to respond to it. In this case, don’t worry! Consider you can at this point file a lawsuit. The demand letter will still help to speed up the lawsuit, because everything has been clearly listed and documented with supporting evidence.

What is a demand letter for insurance?

A demand letter is a factual summary of your claim, which includes all injuries (major or minor), loss of wages, emotional trauma (if applicable), and property damage.

What is insurance editorial guidelines?

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

What Should a Claim Settlement Letter Include?

Insurance companies deal with hundreds, even thousands of claims daily. That is why your letter to an insurance company should stand out.

How to send a letter to insurance company?

Send your letter by certified mail with a requested return receipt since you will need to document the date your insurance company received it.

What is DoNotPay insurance?

DoNotPay assists in appealing denied insurance claims from any provider, including 21st Century, Allianz, Fred Loya, or Shelter.

What to do if your insurance company rejects your claim?

In case your insurance company rejects your claim, send them an appeal letter and try to make them reconsider the decision. DoNotPay can help with this issue, too!

How long does it take to file a claim with your insurance provider?

Should you have insurance for your property, car, health, or any other, you might be in a position to file a claim with your insurance provider one day.

What to include in an accident letter?

Photographs and videos of the accident, all the damage, and your injuries. You should include any additional documentation supporting your case. Both you and the insurance provider should have copies of all the evidence.

Does DoNotPay speed up the process of filing insurance claims?

DoNotPay also speeds up the process of filing insurance claims, claiming warranties, reducing property tax, and drafting various legal docs.

What is a letter to insurance company for claim settlement?

A letter to insurance company for claim settlement is a document that represents a factual summary of your compensation claim, including the cause and value of your loss, and the settlement you are seeking. It is usually sent to an insurance company, which can be yours or that of the liable party, to report an accident or event for which you are insured.

What is a statement of fact?

Statements of fact – These are detailed descriptions of the circumstances leading to, during, and after the accident.

What happens when you submit a claim letter to an insurance company?

When a person submits a claim letter to an insurance company, whether it’s for a car accident, medical malpractice, personal injury or other reason, the insurance company will respond with a first offer. At this point, the claimant has the right to make a counter offer, and in most cases, this is the best thing to do.

Who does a letter go to when a claimant is at fault?

In most cases, the letter goes to the at-fault party’s insurance company to make it clear that the claimant suffered injuries because of the fault of the company’s insured person.

Why do insurance companies make low offers?

The first offer given by the insurance company will most likely be very low and not be their last offer. They may purposefully make a low offer to see if the claimant knows what he or she is doing. This is why it is recommended to negotiate for a higher offer.

What should an insurance adjuster do if the first offer is very close to the claimant's minimum amount?

If the insurance adjuster’s first offer is very close to the claimant’s minimum amount, the claimant should adjust their expectations upward.

What to do if a claimant wants to lower the amount?

If the claimant wants, they can enter into negotiations and send several letters that gradually lower the amount they will accept. It is also important for the claimant to mention any emotional suffering. This will not have a dollar value, but it is strong support of a higher settlement.

Should the claimant decide on the lowest amount they have calculated is fair for their claim?

The claimant should decide on the lowest amount they have calculated is fair for their claim and keep it in mind during negotiations, but not reveal it to the insurance company. If the insurance adjuster’s first offer is very close to the claimant’s minimum amount, the claimant should adjust their expectations upward.

Is an insurance company required to give a fair settlement?

The insurance company is not required by law to give a claimant a fair settlement. There are some adjusters who want to treat claimants fairly and some who take advantage of the claimant’s naiveté to offer a less than fair amount.

What should you consider when calculating a fair settlement?

When calculating the fair settlement amount, be sure to consider: Any suffering and pain caused by the accident. The cost of any required medical care and other related expenses.

How to negotiate with insurance company?

As you prepare for your negotiation with the insurance company, it's helpful to follow a few tips. The first is to avoid taking the first offer made. According to Nolo, Sutliff & Stout, and Findlaw.com, an insurance adjuster will often make an extremely low first offer to determine whether you know how to negotiate or understand the value of your car. Even if the offer seems reasonable at first glance, you should always negotiate.

Why do drivers get entangled with insurance companies?

In many cases, drivers find themselves entangled with insurance companies to get claims paid in a timely fashion. Dealing with the aftermath of a car accident can be a stressful situation. In many cases, drivers find themselves entangled with insurance companies to get claims paid in a timely fashion. If you're wondering how to negotiate an ...

What to do when an adjuster comes in near your minimum?

Additionally, if the first offer from an adjuster comes in near your minimum amount, you may want to consider increasing that amount .

What happens when you get involved in a car accident?

When you are involved in a car accident that causes significant damage to your vehicle, the next step is getting compensated by the insurance company that provides the policy on the car. However, getting a fair price for the damage is often a challenge, as an insurance company loses money when it has to pay out following an accident.

How much do personal injury attorneys take?

Most personal injury attorneys take a cut of one-third of the settlement amount, so it has to be a high amount to make it worthwhile to hire an attorney. If you're negotiating a settlement, use these tips to increase your chances of a positive outcome.

How to describe a car accident?

Outline any injuries you sustained as a result as well as any medical treatment that was required for the injuries and ongoing health issues. Describe the extent of damage caused to your vehicle. Discuss any other losses or damages that occurred as a result of the accident.