Debt settlement is much riskier and more harmful to your credit than debt management. It’s a viable option if paying off your debts in full just isn’t a realistic option, but it’s best if you treat it as a last resort. To decide which is right for you, it’s necessary to fully understand how debt management and debt settlement work.

Full Answer

Should you use a debt management plan or a settlement?

Since there is no guarantee that a credit agency will accept a settlement, attempting to settle or withholding payment can backfire and bring on even more credit damage and debt. On the other hand, a debt management plan is typically used when you are looking for a way to simplify multiple debts.

What happens if you don’t settle your debt?

Not only is there no guarantee that the debt settlement company will be able to successfully reach a settlement for all your debts, some creditors won’t negotiate with debt settlement companies at all. 2. You could end up with more debt If you stop making payments on a debt, you can end up paying late fees or interest.

What are the alternatives to debt settlement?

Alternatives to debt settlement 1 Negotiate your own settlement Try negotiating settlements with credit card companies or other creditors on your own. ... 2 Transfer balances If you have credit card debt, consider a balance transfer. ... 3 Seek nonprofit credit counseling

What is debt settlement and how does it work?

Debt settlement is like playing a game of chicken with your creditors, but in the long run your finances always lose. It works like this: You withhold payments until your account is severely delinquent, then ask the creditor to accept a smaller amount as full payment.

What is the difference between a debt management plan and a debt settlement?

Debt management programs (DMPs) are administered by nonprofit credit counseling companies, as opposed to debt settlement companies, which are for-profit. In a DMP, the credit counseling company negotiates with your creditors to reduce your interest rates and fees, or lower monthly payments for you.

Does debt settlement improve credit score?

However, a debt settlement does not mean that your life needs to stop. You can begin rebuilding your credit score little by little. Your credit score will usually take between 6 and 24 months to improve. It depends on how poor your credit score is after debt settlement.

Is debt settlement better than not paying?

It is always better to pay off your debt in full if possible. While settling an account won't damage your credit as much as not paying at all, a status of "settled" on your credit report is still considered negative.

What are the disadvantages of a debt settlement?

Disadvantages of Debt SettlementDebt Settlement Fees. Many debt settlement providers charge high fees, sometimes $500-$3,000, or more. ... Debt Settlement Impact on Credit Score. ... Holding Funds. ... Debt Settlement Tax Implications. ... Creditors Could Refuse to Negotiate Your Debt. ... You May End Up with More Debt Than You Started.

Is it worth it to settle debt?

The short answer: Yes, debt settlement is worth it if all of your debt is with a single creditor, and you're able to offer a lump sum of money to settle your debt. If you're carrying a high credit card balance or a lot of debt, a settlement offer may be the right option for you.

How long does debt settlement affect credit score?

Settled Accounts Remain on Your Credit Report for Seven Years. When you settle, the account will not be removed immediately from your credit report. If you were late on payments, the account will remain on your credit report for seven years from the original delinquency date.

Is it best to settle or pay in full?

Generally speaking, having a debt listed as paid in full on your credit reports sends a more positive signal to lenders than having one or more debts listed as settled. Payment history accounts for 35% of your FICO credit score, so the fewer negative marks you have—such as late payments or settled debts—the better.

How much should you offer to settle a debt?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

Can I get a mortgage after debt settlement?

Most lenders won't want to work with you immediately after a debt settlement. Settlements indicate difficulty with managing financial obligations, and lenders want as little risk as possible. However, you can save enough money and buy a new home in a few years with the right planning.

What are the pros of debt settlement?

Debt settlement pros and consProsConsMight be able to settle for less than what you oweCreditors might not be willing to negotiatePay off debt soonerCould come with feesStop calls from collection agenciesCould hurt your creditCould help you avoid bankruptcyDebt written off might be taxableJan 26, 2022

How do I remove a settled account from my credit report?

Review Your Debt Settlement OptionsDispute Any Inconsistencies to a Credit Bureau.Send a Goodwill Letter to the Lender.Wait for the Settled Account to Drop Off.

How does debt settlement affect taxes?

In general, if you have cancellation of debt income because your debt is canceled, forgiven, or discharged for less than the amount you must pay, the amount of the canceled debt is taxable and you must report the canceled debt on your tax return for the year the cancellation occurs.

How many points does a settlement affect credit score?

Debt settlement practices can knock down your credit score by 100 points or more, according to the National Foundation for Credit Counseling. And that black mark can linger for up to seven years.

How many points will my credit score increase when I pay off collections?

Contrary to what many consumers think, paying off an account that's gone to collections will not improve your credit score.

How do I raise my credit score after a settlement?

How to Improve CIBIL Score After Loan Settlement?Build a Good Credit Repayment History. ... Clear off Pending Dues. ... Manage Credit Cards Better. ... Apply for a Secured Card. ... Credit Utilisation. ... Do Not Raise Frequent Loan Queries. ... Apply for a Secured Credit.

Can I get a mortgage after debt settlement?

Most lenders won't want to work with you immediately after a debt settlement. Settlements indicate difficulty with managing financial obligations, and lenders want as little risk as possible. However, you can save enough money and buy a new home in a few years with the right planning.

Can I negotiate a credit card debt settlement myself?

Yes, you can do DIY debt settlement, but it can be complicated, risky and damaging to your credit score. In addition, debt settlement requires you...

What percentage of a debt is typically accepted in a settlement?

Successful debt settlement typically results in your having to pay 50 to 80% of the original balance. But this is not guaranteed; creditors will no...

How do I negotiate with debt collectors for a lower settlement?

If you are already behind on your debt payments by 90 days or more, you may be able to negotiate a debt settlement. Talk to your creditor about you...

How can I find a credit counseling agency to get help and sign up for a debt management program?

You can find accredited credit counseling agencies and certified credit counselors via the National Foundation for Credit Counseling (NFCC) or the...

What Is a Debt Management Plan?

Debt management plans (DMPs) are offered by credit counseling organizations. They’re designed to help you repay the outstanding principal balances on your unsecured debts faster.

What Is a Debt Settlement Program?

Debt settlement programs are available through for-profit companies. The main goal of these programs is to help you resolve unsecured debts by only paying a fraction of what you owe.

Debt Management vs. Debt Settlement Comparison

The primary difference between debt management and debt settlement is the amount of debt you pay off. With a DMP, you’ll pay off all the unsecured debt enrolled in the program. But with debt settlement, the idea is to get out of debt faster by convincing your creditors to accept less than what’s owed.

How to Enroll in a Debt Management Program

Have you weighed your options and decided a DMP is best? Then, consider an experienced credit counseling agency, like Consolidated Credit, to get started.

How long does debt settlement affect credit?

This negative effect can stay on your credit report for seven years. This is one reason why debt settlement is typically considered a last resort.

What is debt settlement?

Debt settlement is a form of debt relief where people try to renegotiate the amount of debt they owe, and ask their creditors to accept a lower repayment. This can be done by the individual creditor or by using the services of a debt settlement company.

How to save money on debt?

Credit counseling agencies can work with your creditors to negotiate lower interest rates, get fees waived and otherwise help you save money on your debt payments. As a result, the new monthly payment you make as part of your debt management plan may be less than you were paying before. This can free up space in your budget to help you build emergency savings or work toward other financial goals while getting out of debt.

What is debt management plan?

Debt management programs, also called debt management plans or DMPs, are a service offered by consumer credit counseling agencies. Credit counseling agencies are nonprofit organizations that help people who are having trouble managing their debts but want to avoid declaring bankruptcy. Most of their services are provided at low or no cost to you as the customer. Credit counseling agencies are funded in part by creditors.

How does debt consolidation help?

Debt consolidation can help you get out of debt faster by reducing your interest rate. But not everyone may be able to qualify for a lower-APR debt consolidation loan. If your credit is poor and you are having trouble making payments, you may need to consider what is seen by many as a last resort, debt settlement.

What does credit counseling do?

When you sign up to work with a credit counseling agency—along with your debt management program—you’ll receive personal finance coaching and advice on setting a budget, managing your money and credit more responsibly, and building a better financial future.

How long does it take to pay off debt?

In exchange, you agree to repay the full amount of your debt over a period of months or years. Most people on a debt management plan are able to pay off their debt within three to five years.

What is considered debt settlement?

Another factor is the status of your debt. Debt settlement is typically only considered when you are severely delinquent in payments or already facing collections. Since there is no guarantee that a credit agency will accept a settlement, attempting to settle or withholding payment can backfire and bring on even more credit damage and debt.

What is a Debt Management Plan?

A Debt Management Plan, or DMP, is a debt relief program that involves working with a financial coach to create a personalized budget. Your coach may work with you and your creditors by:

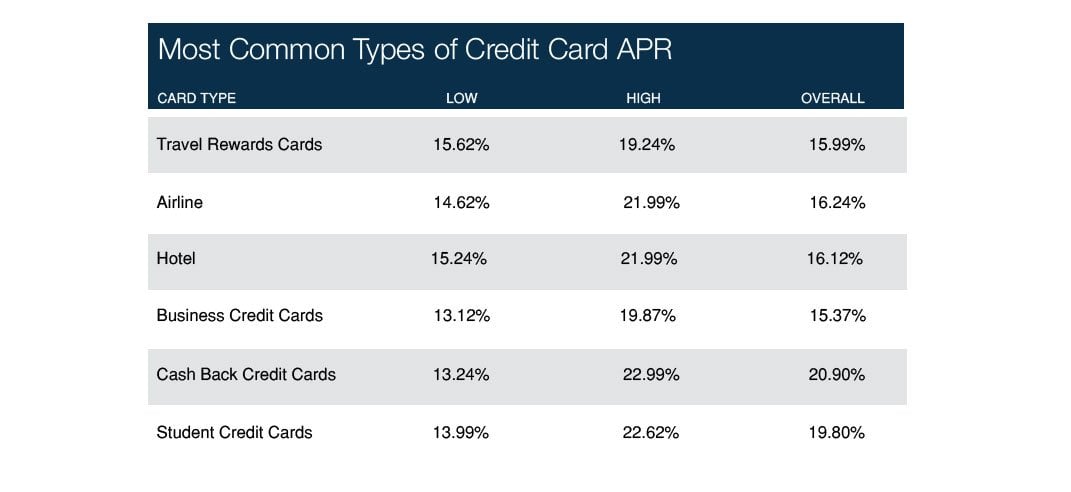

Why is it so hard to pay off credit cards?

And thanks to late fees and high annual percentage rates (APRs), it’s easy to fall into a debt hole.

Does FICO use your credit history?

However, you should be aware that lenders and credit agencies like FICO use your credit history to generate a credit score. A temporary decrease in your available credit may have a negative effect on your score. And if you stop making your monthly payment on time, a dip in your credit score is possible.

Can creditors negotiate a settlement?

Debt settlement does require some expertise and finesse to get right, though. Your creditors may not agree to negotiate a singular sum, or you may end up paying more than your original debt amount in fees. If you’re not careful, you may end up with even more debt than you started with.

Is it better to pay off debt or settle?

If you’re close to declaring bankruptcy, debt settlement may be your best choice.

Do you have to deposit money into a savings account for debt settlement?

The company uses this account to make settlement payments, so you can expect to have to deposit a significant amount initially.

What does it mean to settle a debt?

Settling your debt means you'll reach an agreement with creditors where they accept less than the full amont owed as the payoff amount. Settlement is the only repayment method where you pay less than what is owed, so you'll save money in the sense that you won't have to repay your full debt amount.

What happens if you miss a payment?

If you begin missing payments, you will very likely start getting phone calls and letters from various collection departments. The fact that you're attempting to settle your debt won't change this. They'll continue attempting to collect the debt until it's been paid or settled.

How long does it take to get paid for a DMP?

Over the course of your DMP, your included credit accounts will be paid in full - usually in around 36 to 48 months.

Do creditors reage your account after DMP?

As an extra bonus, many creditors will actually re-age your account after a certain number of DMP payments - which essentially means they'll consider the account current even if you never made up those missed payments.

Do creditors have to agree to a DMP?

Creditors don’t have to agree to the terms of a DMP, but chances are very good that they will. Remember - a DMP means you'll be paying your debt in full, which is preferable for creditors than having you file for bankruptcy or choose debt settlement.

Do you have to deal with each creditor individually?

Unless you use the services of a professional debt settlement company, you'll need to deal with each creditor individually.

Can a credit counselor suggest a DMP?

In other words, a credit counselor cannot suggest a DMP if the payments aren't affordable for you. While counselors strive hard to create a budget that supports your debt-repayment goals, it may be that your income is not enough to sustain your living expenses and a debt management plan.

What is debt settlement?

Debt settlement is a strategy in which you stop making payments to your creditors, typically for a few months or longer. You’ll then request that the creditor take a portion of the amount you owe as full payment, and to forgive the rest, the hope being that the creditor will reason that some payment is better than no payment.

What is debt management?

A debt management plan can help you eliminate credit card debt by consolidating multiple debts into one payment that you’ll pay off monthly. You’ll work with and make your payments to a nonprofit credit counseling agency who will help you set up a 3-5 year repayment strategy.

Which should you choose?

When deciding whether to go with debt settlement or debt management, you should consider your ability to pay off debt you have.

What is debt settlement?

Debt settlement is a practice that allows you to pay a lump sum that’s typically less than the amount you owe to resolve, or “settle,” your debt. It’s a service that’s typically offered by third-party companies that claim to reduce your debt by negotiating a settlement with your creditor. Paying off a debt for less than you owe may sound great at first, but debt settlement can be risky, potentially impacting your credit scores or even costing you more money.

How does debt settlement work?

The companies generally offer to contact your creditors on your behalf, so they can negotiate a better payment plan or settle or reduce your debt.

How many payments do you have to make to a debt collector?

Once the debt settlement company and your creditors reach an agreement — at a minimum, changing the terms of at least one of your debts — you must agree to the agreement and make at least one payment to the creditor or debt collector for the settled amount.

What happens if you stop paying debt?

If you stop making payments on a debt, you can end up paying late fees or interest. You could even face collection efforts or a lawsuit filed by a creditor or debt collector. Also, if the company negotiates a successful debt settlement, the portion of your debt that’s forgiven could be considered taxable income on your federal income taxes — which means you may have to pay taxes on it.

How much debt has Freedom Financial resolved?

Why Freedom Financial stands out: Freedom Financial says it has resolved over $12 billion in debt since 2002. The company offers a free, “no-risk” debt relief consultation to help you decide if its program might work for you.

Can a company make a lump sum payment?

The company may try to negotiate with your creditor for a lump-sum payment that’s less than the amount that you owe. While they’re negotiating, they may require you to make regular deposits into an account that’s under your control but is administered by an independent third-party. You use this account to save money toward that lump payment.

Who can check if a debt settlement company is licensed?

The state attorney general’s office can also check if the company is required to be licensed and whether it meets your state’s requirements. The Better Business Bureau has consumer reviews of businesses that could help you as you research a debt settlement service provider.

What is debt settlement?

Now, let’s talk about debt settlement. Debt settlement is a negotiated reduction of your owed balance. Creditors typically won’t consider accepting a settlement until you are a few months past due for payment. That means you must first do damage to your credit report. One of the biggest drawbacks of a debt settlement plan is the impact on credit. Regardless of whether your settlement arrangement is successful or not, your credit rating will be severely damaged for several years.#N#Keep in mind that your creditors are under no obligation to settle your debt for less than what you owe. And because debt settlement involves not paying your bills for a number of months, you may end up with additional penalties and interest, legal bills, and calls from collection agencies. In addition, it can be expensive, too. You may pay as much as 25% of the money you save to the settlement company. Additionally, the portion of debt that is “settled” can count as income, and you may be taxed on it.

How does a debt management plan work?

First, let’s quickly outline a debt management plan. A DMP consolidates your bills without borrowing more money. You do not take out any more debt to pay for existing debts. You make one monthly payment to the agency you have chosen to work with. Your money is then distributed on your behave to your creditors.#N# A credit counselor at a non-profit credit counseling agency, like ACCC, will review your financials over the phone. There are several possible outcomes to improve your finances and reach your goals. Creating a new budget, entering into a DMP, and filing for bankruptcy are a few examples. Let’s focus on the debt management program.#N#A DMP is only available to those who complete a credit counseling session. Even then, the counselor must determine if this is an appropriate option. Not everyone qualifies. In this plan, the agency will secure lower minimum monthly payments or lower interest rates from your creditors, making repayment more feasible and affordable for the debtor. Any accounts entered into a debt management program must be closed. Your payments will be consolidated into one that is paid to the agency, and they disburse to each credit account.

What is credit counseling?

Credit counseling is a process where a certified personal finance counselor reviews your financial situation. They provide education and advice on how to better manage your finances. There is a complete budget analysis to determine all your income and expenses. The cause of the debt is determined and possible repayment solutions are examined. An accredited credit counseling agency can help an individual determine the best repayment option. They also offer educational resources to help you better manage your personal finances and avoid problems in the future. Agencies typically offer free counseling, only charging fees if you opt to enter a debt management plan.