Can I deduct alimony payments from my taxes?

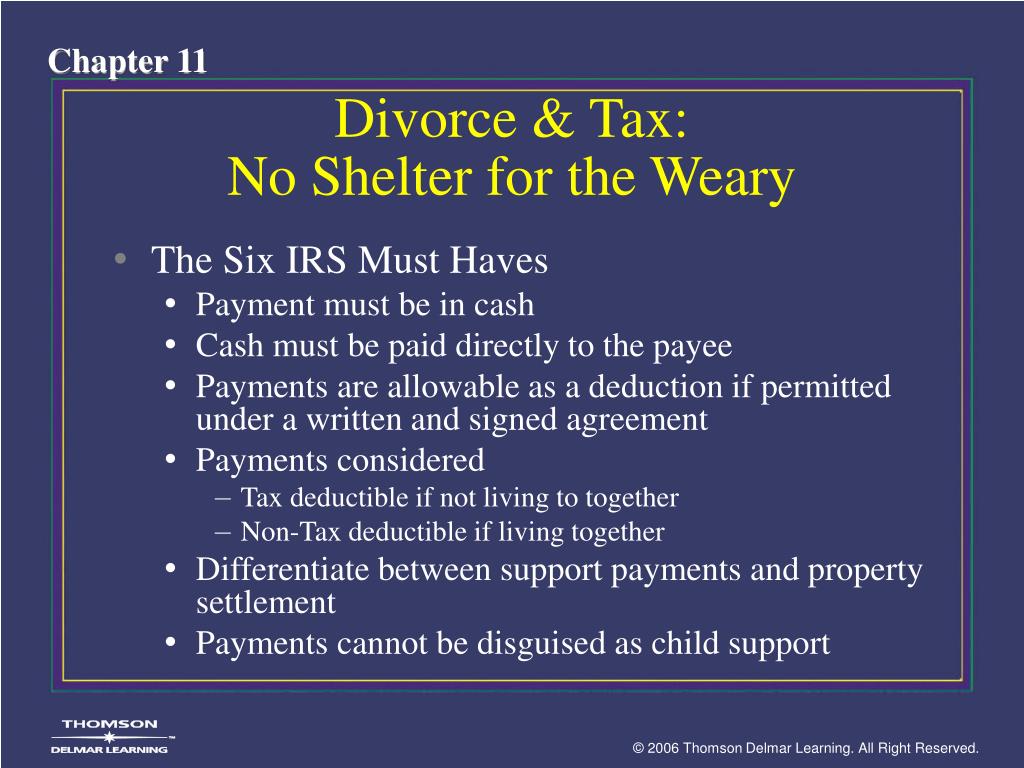

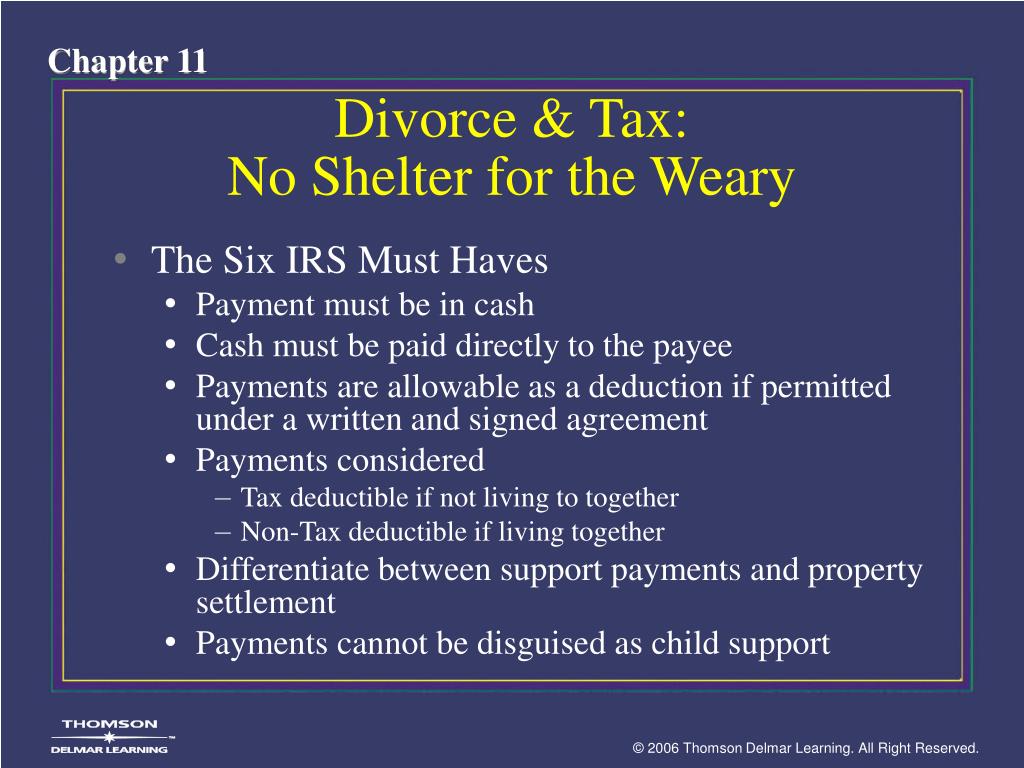

When you make payments under all of these circumstances, you can probably deduct the payments from your income. This is one of the benefits of paying alimony, rather than a property settlement payment. Property transfers incident to divorce are not taxable income to the recipient and, therefore, are not tax deductible to the payor.

Is alimony treated as child support or property settlement?

The payment isn't treated as child support or a property settlement. Not all payments under a divorce or separation instrument are alimony or separate maintenance. Alimony or separate maintenance doesn’t include: Voluntary payments (that is, payments not required by a divorce or separation instrument).

Are all payments under a divorce or separation instrument alimony?

Not all payments under a divorce or separation instrument are alimony. Alimony doesn't include: Child support, Noncash property settlements, whether in a lump-sum or installments, Payments that are your spouse's part of community property income, Payments to keep up the payer's property, Use of the payer's property, or

What is the difference between property distribution and alimony?

A distinction between the two is critical if for no other reason than tax consequences. Alimony payments are different from property distributions, which are generally without tax consequences to either spouse. Failure to properly label alimony can result in drastic tax consequences to the payor.

How to deduct alimony on taxes?

If you paid amounts that are considered taxable alimony or separate maintenance, you may deduct from income the amount of alimony or separate maintenance you paid whether or not you itemize your deductions. Deduct alimony or separate maintenance payments on Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Tax Return for Seniors (attach Schedule 1 (Form 1040), Additional Income and Adjustments to Income PDF ). You must enter the social security number (SSN) or individual taxpayer identification number (ITIN) of the spouse or former spouse receiving the payments or your deduction may be disallowed and you may have to pay a $50 penalty.

What form do you file for alimony?

Report alimony received on Form 1040 or Form 1040-SR (attach Schedule 1 (Form 1040) PDF) or on Form 1040-NR, U.S. Nonresident Alien Income Tax Return (attach Schedule NEC (Form 1040-NR) PDF ). You must provide your SSN or ITIN to the spouse or former spouse making the payments, otherwise you may have to pay a $50 penalty.

What is child support settlement?

Child support, Noncash property settlements, whether in a lump-sum or installments, Payments that are your spouse's part of community property income, Payments to keep up the payer's property, Use of the payer's property, or. Voluntary payments (that is, payments not required by a divorce or separation instrument).

Is there a liability to make a divorce payment?

The payment is to or for a spouse or a former spouse made under a divorce or separation instrument; The spouses aren't members of the same household when the payment is made (This requirement applies only if the spouses are legally separated under a decree of divorce or of separate maintenance.); There's no liability to make ...

Is there a liability for a death payment?

There's no liability to make the payment (in cash or property) after the death of the recipient spouse; and

Is alimony taxable income?

Certain alimony or separate maintenance payments are deductible by the payer spouse, and the recipient spouse must include it in income (taxable alimony or separate maintenance).

Where do the parties reside when payment is made?

The parties reside in separate households when payment is made.

Is the sale of a home tax free?

When the home is sold, the home sale exclusion may be available, permitting $250,000 of gain to be tax free ($500,000 on a joint return). For purposes of the home sale exclusion, which requires the seller to own and use the home as his/her principal residence for two of the five years preceding the date of sale, consider the following in the case of divorce:

Is accrued interest on a savings bond taxable?

Transferred savings bonds. Accrued interest on U.S. savings bonds transferred to the spouse/former spouse is taxable to the spouse who owned the bonds when the interest accrued.

Is a contingency fee taxable?

Shared professional fees. An attorney who earns a contingency fee is taxable on it. However, if the attorney is required to share a portion with a spouse/former spouse, it can be treated as deductible alimony. For example, in a recent case, an attorney earned a $55 million fee and was required by the terms of the marital settlement agreement signed before earning the fee to give his former spouse 10%. The court said this was an alimony payment.

Can a spouse share a home after splitting up?

In the course of a split up, the marital residence may be sold, or one spouse may continue to reside there. He or she may continue to share ownership or receive full ownership under the terms of a property settlement. The transfer of the home between spouses is a tax-free property settlement.

Does alimony have to be included in income?

This means the payer has simply made a nondeductible payment; the recipient does not have to include it in income.

Is alimony taxable in a divorce?

In the course of a marital dissolution, spouses may divvy up their financial assets. Some may take the form of property settlements, which are tax-free events, or alimony, which is taxable to the recipient and deductible by the payer. Unfortunately, it’s not always clear how certain property transfers or payments should be treated.

What are the tax implications of alimony?

This is an area that requires careful planning since the alimony payment and how it is provided directly impacts the tax burden of both spouses. In fact, if the alimony is planned right, both spouses may realize tax savings.

When does alimony stop?

Payments stop upon the recipient’s death . The settlement agreement or judgment must specify that alimony payments terminate when the recipient dies.

Is alimony deductible for child support?

Take care not to classify payments as child support or part of the property settlement. Neither is tax-deductible. If you want alimony to be deductible make sure it is in no way connected to the children or as part of your marital property. Payments are made in cash (this includes checks or money orders). In-kind alimony is not tax-deductible so ...

Does alimony have to be taxed?

Tax deductions for alimony aren’t automatic, though .

Is alimony a contentious issue?

Alimony can be a contentious issue in any divorce case. Careful planning and negotiation is often required to come to an agreement that at least meets the lower-earning spouses needs, if not satisfy both spouses.

Is a spouse's tax payment deductible?

Spouses need to make choices that ensure the payments are tax deductible. In some cases, it may be more favorable from a tax perspective for the payments to be non-deductible and non-taxable. It all depends on the couple’s current financial situation.

Is alimony deductible on taxes?

Payments are made in cash (this includes checks or money orders). In-kind alimony is not tax-deductible so if you want to deduct alimony from taxes, make sure the payer makes payments by cash or check. Payments are received by the current or former spouse and no one else.

What is the difference between alimony and property settlement?

A distinction between the two is critical if for no other reason than tax consequences. Alimony payments are different from property distributions , which are generally without tax consequences to either spouse.

What is alimony pendente lite?

Temporary alimony (alimony pendente lite) is given to one spouse (usually the woman) pending a divorce. Rehabilitative alimony is given to a lesser earning spouse until she (or he) becomes self-sufficient.

What does it mean when a former wife cohabits with a new husband?

A former wife cohabiting with a new love may drive her former husband to distraction , particularly when he is paying her alimony, but payments in support of a property settlement are a distribution of what they had when they were husband and wife.

Can alimony be enforced by the decedent's estate?

Alimony continues only during the lives of the spouses; property settlements are inheritable and can be enforced by the decedent's estate . Spousal support is one of many issues that is often difficult for spouses to agree upon.

Is alimony taxable?

Alimony payments are different from property distributions, which are generally without tax consequences to either spouse. Failure to properly label alimony can result in drastic tax consequences to the payor.

Is it hard to agree on spousal support?

Spousal support is one of many issues that is often difficult for spouses to agree upon. Before negotiating and even signing an agreement regarding spousal support it is very important that you understand your rights and the repercussions of any actions taken.

Is alimony a modification of remarriage?

While the terms and conditions of a property division are negotiated first and set in stone, alimony is often modifiable, and based on changing circumstances, such as changes in employment or retirement. Payments of property division are unaffected by remarriage, whereas alimony often terminates if the recipient makes another trip to the altar. A former wife cohabiting with a new love may drive her former husband to distraction, particularly when he is paying her alimony, but payments in support of a property settlement are a distribution of what they had when they were husband and wife. Alimony continues only during the lives of the spouses; property settlements are inheritable and can be enforced by the decedent's estate.

Tax Treatment of Alimony and Separate Maintenance

- Amounts paid to a spouse or a former spouse under a divorce or separation instrument (including a divorce decree, a separate maintenance decree, or a written separation agreement) may be alimony or separate maintenance payments for federal tax purposes. Certain alimony or separate maintenance payments are deductible by the payer spouse, and the recipient spouse must inclu…

Alimony Or Separate Maintenance – in General

- A payment is alimony or separate maintenance if all the following requirements are met: 1. The spouses don't file a joint return with each other; 2. The payment is in cash (including checks or money orders); 3. The payment is to or for a spouse or a former spouse made under a divorce or separation instrument; 4. The spouses aren't members of the same household when the paymen…

Payments Not Alimony Or Separate Maintenance

- Not all payments under a divorce or separation instrument are alimony or separate maintenance. Alimony or separate maintenance doesn’t include: 1. Child support, 2. Noncash property settlements, whether in a lump-sum or installments, 3. Payments that are your spouse's part of community property income, 4. Payments to keep up the payer's property, 5...

Reporting Taxable Alimony Or Separate Maintenance

- If you paid amounts that are considered taxable alimony or separate maintenance, you may deduct from income the amount of alimony or separate maintenance you paid whether or not you itemize your deductions. Deduct alimony or separate maintenance payments on Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Tax Return for Seniors (attach Schedule 1 (F…

Additional Information

- For more detailed information on the requirements for alimony and separate maintenance and instances in which you may need to recapture an amount that was reported or deducted (recapture of alimony), see Publication 504, Divorced or Separated Individuals. For more information on decrees and agreements executed before 1985, see the 2004 version of Publicati…