What is an executor’s agreement?

Let’s look at a few common types of executory agreements to get a better sense of the concept. According to the International Accounting Standards (IAS), an executory contract is a contract where neither party has fulfilled any executory obligations or have partially performed their obligations to a relatively equal proportion.

What happens to an executory agreement when someone goes bankrupt?

An executory agreement is handled differently than general unsecured claims when someone goes bankrupt. A debtor has the option to accept the contract and perform the remaining obligations (assumption of contract) or refuse to perform the obligations (rejection of contract)

What kind of lease is an executory contract?

This type of agreement is an executory contract since both parties are agreeing to do their part to care for and pay for the property during the time laid out in the lease. Car or equipment leases. Be sure to manage the rental of smaller items, like cars and equipment, with executory contracts.

When does an executory contract have to be executed?

December 19, 2014. An executory contract is a contract made by two parties in which the terms are set to be fulfilled at a later date. The contract stipulates that both sides still have duties to perform before it becomes fully executed. The contract is often in place between a debtor or borrower and another party.

What is an example of an executory contract?

An example of an executory contract is an apartment lease. The lessee is expected to continue to pay and the lessor is expected to continue to care for the property until the end date in the contract.

Which of the following contracts is an executory contract?

Executory Contract Real Estate Any contract in which the terms are set to be fully performed at a later date is an executory contract. Some examples of executory contracts include real estate deeds, development contracts, car lease, rental lease and more.

What makes a contract executory?

An executory contract is a contract that has not yet been fully performed or fully executed. It is a contract in which both sides still have important performance remaining. However, an obligation to pay money, even if such obligation is material, does not usually make a contract executory.

Is a franchise agreement an executory contract?

A franchise agreement which is in effect at the time a bankruptcy case is filed is an executory contract.

What is meant by executory agreement?

Something (generally a contract) that has not yet been fully performed or completed and is therefore considered imperfect or unassured until its full execution. Anything executory is started and not yet finished or is in the process of being completed in order to take full effect at a future time.

What is the difference between executed and executory contract?

(a) An executed contract is one in which all the parties thereto have performed all the obligations which they have originally assumed. (b) An executory contract is one in which something remains to be done by one or more parties.

Is a promissory note an executory contract?

A promissory note, a completed sale or assignment, an expired agreement, an agreement effectively and completely terminated prior to the bankruptcy filing, or a single purchase order would typically not be an executory contract.

How many days until the agreement will be executory?

The decision of the Commission shall be executory after the lapse of seven (7) days from receipts thereof by the losing party.

Are insurance policies executory contracts?

Unexpired insurance policies, where the insurer has a continuing obligation to provide coverage and the debtor has a continuing obligation to pay stan- dard premiums, are executory contracts. 36 In other words, if the debtor does not pay its premiums, the insurer can cancel the policy.

What is executed contract with example?

Alex goes to the local coffee shop and buys a cup of coffee. The barista sells her the coffee in exchange for the cash payment. So it can be said that this is an executed contract. Both parties have done their part of what the contract stipulates.

What is an executory contract quizlet?

An executory contract is a contract that has not yet been fully performed, that is to say, fully executed. Put another way, it's a contract under which both sides still have important performance remaining.

What are types of contract?

Types of contractsFixed-price contract. ... Cost-reimbursement contract. ... Cost-plus contract. ... Time and materials contract. ... Unit price contract. ... Bilateral contract. ... Unilateral contract. ... Implied contract.More items...•

What is an executory contract quizlet?

An executory contract is a contract that has not yet been fully performed, that is to say, fully executed. Put another way, it's a contract under which both sides still have important performance remaining.

What is executed contract with example?

Alex goes to the local coffee shop and buys a cup of coffee. The barista sells her the coffee in exchange for the cash payment. So it can be said that this is an executed contract. Both parties have done their part of what the contract stipulates.

What is executory contract in commercial law?

A contract under which unperformed obligations remain on both sides, or where both parties have continuing obligations to perform. For example, most leases or contracts for the sale of goods where the goods have not been delivered by the seller and the buyer has not paid, are executory contracts.

What are types of contract?

Types of contractsFixed-price contract. ... Cost-reimbursement contract. ... Cost-plus contract. ... Time and materials contract. ... Unit price contract. ... Bilateral contract. ... Unilateral contract. ... Implied contract.More items...•

Why is an executory agreement called an executory agreement?

The reason why it is called an executory agreement is due to the fact that the parties to the contract still have significant and material contractual obligations left to perform. In a nutshell, the parties have not yet benefited from the full execution of the obligations expected under the contract.

What is the purpose of a real estate executory contract?

In a real estate executory contract, the renter or tenant must pay rent in exchange for the landlord or property owner to provide use and access to the property , such as:

How long does it take for a bankruptcy trustee to accept executory contracts?

Code relating to “Bankruptcy”, Section 365 ( 11 U.S.C. § 365) In Chapter 7 bankruptcy cases, the bankruptcy trustee must assume executory contracts within 60 days of the bankruptcy filing date without which the contract will be deemed as rejected.

What is executory contract accounting?

According to the International Accounting Standards (IAS), an executory contract is a contract where neither party has fulfilled any executory obligations or have partially performed their obligations to a relatively equal proportion.

What is the meaning of "reject the executory contract"?

Reject the executory contract (resulting in a breach of contract) The law enables a debtor or trustee to make such an election so they can better determine which contracts are best to keep and which ones are better to terminate in the context of a successful reorganization.

What is the option of a debtor to accept a contract?

A debtor has the option to accept the contract and perform the remaining obligations (assumption of contract) or refuse to perform the obligations (rejection of contract) In the meantime, the other party to the contract (non-debtor) must continue performing the obligations of the contract.

Who gets special treatment under the law as the debtor in possession (the bankrupt) or the trustee has the ability?

Executory agreements will get special treatment under the law as the debtor-in-possession (the bankrupt) or the trustee has the ability to: Assume the executory contract (allowing for the continuation of the contract) Reject the executory contract (resulting in a breach of contract)

What is executory contract?

An executory contract holds people to duties they've been assigned to a specific date laid out in the contract. It goes into effect when someone files for bankruptcy and stipulates that the two people that signed still have an obligation to meet. If the obligations are not met, it's a breach of contract. These types of contract are usually between ...

What do you need to know before signing an executory contract?

Before anyone signs an executory contract, they need to read and thoroughly understand all terms and obligations contained in the contract. The terms and other legal jargon in such a contract can be confusing. You should talk to an experienced attorney in cases where you're having trouble understanding the intent of the contract.

What is an ongoing agreement with a debtor?

Businesses that have an ongoing agreement with a debtor could deal with issues pertaining to prepetition executory contracts with the debtor. The Bankruptcy Code authorizes debtors to assume or reject contracts for bankruptcy, meaning they have the ability to retain contracts that are beneficial and abandon contracts that are burdensome.

What is a trustee in a bankruptcy agreement?

The debtor, otherwise known as a bankruptcy trustee, in the agreement is the person who decides whether they “assume” (agree) or “reject” (refuse) to fulfill the obligations set out in an executory contract. The non-debtor party of the contract has to continue on as though bankruptcy has not been filed. If the debtor assumes the contract, then they ...

How long do you have to reject a lease in bankruptcy?

The buyer then has to prove that they can perform the obligations of the contract in the future. With the exception of leases for commercial real estate, you have 60 days from the filing of bankruptcy to reject ...

What happens if a debtor assumes a contract?

If the debtor assumes the contract, then they have to pay their payments and other defaults in full and show that they can pay in the future. If they choose, the debtor can assume the contract but assign it to someone else. That someone else is typically a buyer of the debtor's assets.

What is a real estate lease?

Real estate leases are executory contracts, as tenants have to pay rent and, in exchange, the landlord provides them with a place to live.

What is an executory contract?

An executory contract is an ongoing agreement between two parties who are responsible for completing certain obligations over a set period of time. They are written agreements that ensure each party is clear about their own and the other’s responsibilities.

What happens to executory contracts in bankruptcy?

Through bankruptcy court, the debtor party will go through a process of listing all the property included in their bankruptcy estate. For executory contracts that are prepetition (in effect before the bankruptcy petition) and not post-petition (signed after the petition), the debtor in possession of the contracts decides if they would like to surrender the contracts or keep them.

What is an example of an executed contract?

An example of an executed contract is the purchase of a vehicle in one lump payment. The contract is immediately complete after the sale is over.

Why is a contract necessary?

A contract is necessary any time two people rely on one another for specific products, services, or payments. Outlining the exact payment schedule and expectations provides security for both parties. Should any disputes arise, the people involved can reference the contract — the specifics will all be in writing.

What is a franchise agreement?

Franchise agreements use executory contracts since someone is paying to run a business under the brand name of a larger entity. The franchise owner agrees to follow certain guidelines in exchange for the branded property and support that the larger company provides over the course of the franchise ownership period.

What is an executory contract?

The classic definition of an executory contract (and also an unexpired lease) is one where , when a bankruptcy case is filed, both parties still have unperformed obligations such that the failure of one to perform would constitute a breach of the agreement.

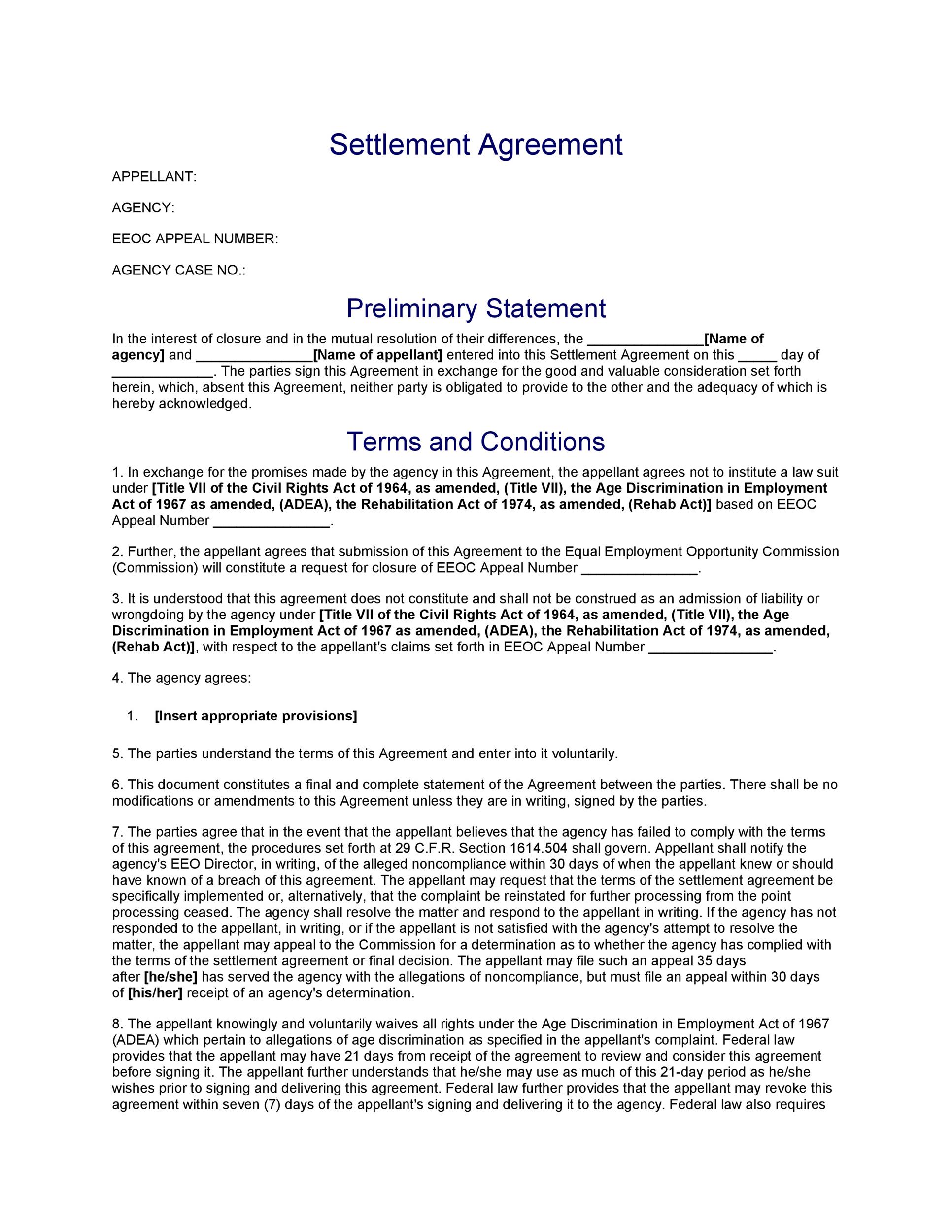

What is a settlement agreement in bankruptcy?

Harner first ruled that the Settlement Agreement (which, as noted above, Cho never signed) “represents the agreement reached by the parties and should be recognized as a valid and enforceable contract.” [i] The next issue was whether the Settlement Agreement was an executory contract. The classic definition of an executory contract (and also an unexpired lease) is one where, when a bankruptcy case is filed, both parties still have unperformed obligations such that the failure of one to perform would constitute a breach of the agreement. The unperformed obligations must be material and not trivial. [ii]

When a contract is executory, can a debtor in a bankruptcy case either assume or reject it?

When a contract is executory, a debtor in a bankruptcy case can either assume or reject it. Typically, a court will respect a debtor’s business judgment. A contract can be assumed if a debtor cures defaults and gives adequate assurance of future performance. [v]

Did the plaintiffs have an agreement to settle a lawsuit with the business to transfer to them?

Several years before the motion was granted, the Plaintiffs thought they had an agreement to settle a lawsuit with the business to transfer to them. But that didn’t happen. Motion practice in state court and a resulting bankruptcy case led to the motion to reject.

Did Cho sign the settlement agreement?

But when the agreement was put in writing (the “Settlement Agreement”), Cho would not sign it. Plaintiffs filed a motion to enforce the agreement. The state court judge ruled for the Plaintiffs, but Cho still would not sign, and Plaintiffs moved to hold him in civil contempt.

Can a plaintiff file a claim for damages if the executor refuses to sign?

Rejection of an executory contract constitutes a breach of the agreement just before the petition date and permits the non-breaching party to file an unsecured claim for damages. But, while the Plaintiffs could file a claim for damages, Judge Harner made clear that the law would not allow them to seek specific performance. In other words, the Plaintiffs couldn’t force the Debtors to transfer the dry cleaning business.

What is an executory contract?

Executory Contract. An executory contract is a contract made by two parties in which the terms are set to be fulfilled at a later date. The contract stipulates that both sides still have duties to perform before it becomes fully executed. The contract is often in place between a debtor or borrower and another party.

What happens when an executory contract files bankruptcy?

When an individual who is party to an executory contract files bankruptcy, he is not automatically relieved from his performance under the terms of the contract. His options include (1) confirming in writing that he intends to continue to fulfill the terms of the contract, or (2) rejecting the contract within the bankruptcy.

What is a development contract?

Development contract: Contractor receives payment from the owner when building milestones are complete; contractor performs duties for the building owner. Car lease: Consumer makes lease payments to the dealership; the dealership provides the car in return.

Why is it important to read a contract before signing?

In this case, having an experienced attorney review the contract before signing helps protect the parties from entering into an agreement they are unable or unwilling to fulfill.

What is the legal process that takes place when a person or business is unable to pay their outstanding debts?

Bankruptcy – a legal process that takes place when a person or business is unable to pay their outstanding debts.

What is civil suit?

Civil Suit – a case in which a person who feels he been wronged brings legal action against another person or entity to collect damages from the person who wronged them.

Why is the settlement agreement void?

When the employer failed to make the payment due under the settlement agreement, the employee filed a lawsuit claiming the settlement agreement was void because the consideration specified in the agreement had never been paid and sought to recover the original claim amount rather than the $50,000.

When is a release in a settlement agreement effective?

A Release in a Settlement Agreement is Not Effective Until All Amounts Due are Paid. An employee and his employer entered into a settlement agreement concerning a severance and salary dispute that required the employer to pay $50,000.

What is the presumption in a settlement agreement?

The presumption was that the parties’ contemplated that the original claim was merely “suspended” pending performance of the accord (payment of the amount due). The Court reasoned that had the employer simply paid as it promised in the settlement agreement, the employee would not have been allowed to revive its original claims, ...

Is a settlement agreement an executory agreement?

The Court rejected the employer’s argument because in Washington, a settlement agreement is presumed to be an “executory accord” unless the parties clearly intended the agreement to be a substituted contract as the employer was asserting. With an executory accord, pending full performance of the accord (the compromise agreement) ...