.jpg)

How are settlement agreements treated for tax?

Generally speaking, employers can pay the first £30,000 compensation for the Settlement Agreement tax free, but this will not apply to all payments. Tax on Settlement Agreements differ according to a range of considerations. How Settlement Agreement payments are treated for tax purposes will depend on what kind of payment they are.

How much can my employer pay for a settlement agreement?

Generally speaking, your employer can pay the first £30,000 compensation for the Settlement Agreement tax free, but this will not apply to all payments. Tax on Settlement Agreement differs according to a range of considerations.

How much of a settlement is tax free?

The first £30,000 of a settlement payment is tax-free. Sometimes this is called a compensation payment or an ex-gratia payment. Ex gratia just means, “as a gift”. In the case of tax law and employment, it means your employer was not obliged to pay it under the terms of your contract of employment. Is a redundancy payment taxable?

What makes a settlement agreement legally binding UK?

To make these binding in law there must be a ‘consideration’ paid, usually of a small sum of £100-£200. This payment is fully taxable and liable to national insurance contributions. Some Settlement Agreements may also include a consideration associated with a confidentiality clause.

Is a settlement agreement subject to tax?

Settlement agreements (or compromise agreements as they used to be called), usually involve a payment from the employer to the employee. Such payments can attract income tax or national insurance contributions – but they can also sometimes rightly be paid tax free.

Do you pay tax on a settlement agreement UK?

Usually a settlement agreement will say that you will be paid as normal up to the termination date. These wages are due to you as part of your earnings and so they will be taxed in the normal way.

How can I avoid paying taxes on a settlement?

How to Avoid Paying Taxes on a Lawsuit SettlementPhysical injury or sickness. ... Emotional distress may be taxable. ... Medical expenses. ... Punitive damages are taxable. ... Contingency fees may be taxable. ... Negotiate the amount of the 1099 income before you finalize the settlement. ... Allocate damages to reduce taxes.More items...•

Are settlement agreements tax deductible?

Generally, if a claim arises from acts performed by a taxpayer in the ordinary course of its business operations, settlement payments and payments made pursuant to court judgments related to the claim are deductible under section 162.

What type of legal settlements are not taxable?

Settlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

What is the tax rate on settlement money?

It's Usually “Ordinary Income” As of 2018, you're taxed at the rate of 24 percent on income over $82,500 if you're single. If you have taxable income of $82,499 and you receive $100,000 in lawsuit money, all that lawsuit money would be taxed at 24 percent.

What do I do if I have a large settlement?

– What do I do with a large settlement check?Pay off any debt: If you have any debt, this can be a great way to pay off all or as much of your debt as you want.Create an emergency fund: If you don't have an emergency fund, using some of your settlement money to create one is a great idea.More items...•

How can you avoid paying taxes on a large sum of money?

Research the taxes you might owe to the IRS on any sum you receive as a windfall. You can lower a sizeable amount of your taxable income in a number of different ways. Fund an IRA or an HSA to help lower your annual tax bill. Consider selling your stocks at a loss to lower your tax liability.

Should a settlement agreement be paid through payroll?

Once all parties have signed a Settlement Agreement, compensation is usually paid within 7-21 days. However, certain payments will be made through the payroll on the usual payroll date such as outstanding salary and accrued holiday and bonuses or commission payments.

Are lump-sum settlements taxable?

Under Section 104(a)(2) of the federal Internal Revenue Code, damages paid "on account of" a physical injury or wrongful death are excluded from an individual's income tax. But importantly for those who depend on this settlement, the investment income earned from a lump-sum settlement can be fully taxable.

Is a lump-sum payment in a divorce settlement taxable?

Generally, lump-sum divorce settlements are not taxable for the recipient. If the lump-sum payment is an alimony payment, it is not deductible for the person who makes the payment and is not considered income for the recipient.

Do employers have to pay legal fees for settlement agreements?

Often your employer pays your legal costs in full The proposed settlement agreement probably contains a clause confirming that your employer will make a contribution towards your legal costs. This contribution may cover your fee in full, in which case there's no charge to you personally.

Do you pay tax on a compensation payout?

Compensation for personal suffering and injury is exempt from capital gains (and income) tax. The exemption applies to 'compensation or damages for any wrong or injury suffered by an individual in his person or in his profession or vocation'.

Is an ex gratia payment tax free UK?

Tax Implications The first £30,000 of an ex gratia payment made to you by your employer will be tax-free. You must inform HMRC of the payment at the end of the tax year to ensure you do not pay any income tax or national insurance on it.

Does full and final settlement include VAT?

If the payment is made under a settlement agreement, the agreement should provide that any VAT is payable in addition to the principal amount, otherwise the payment will be treated as VAT-inclusive.

Should a settlement agreement be paid through payroll?

Once all parties have signed a Settlement Agreement, compensation is usually paid within 7-21 days. However, certain payments will be made through the payroll on the usual payroll date such as outstanding salary and accrued holiday and bonuses or commission payments.

How much tax will you pay on your settlement agreement?

Usually (but not always) an employer offers a settlement agreement because your employment is coming to an end.

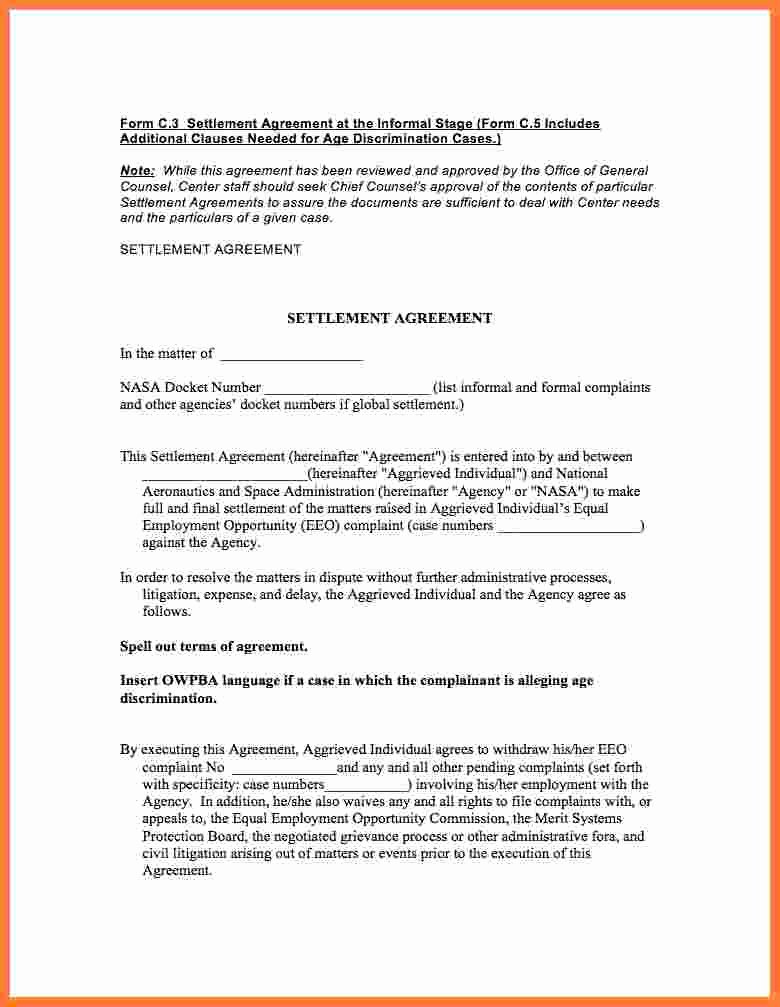

What is settlement agreement?

Settlement agreements are often used in the context of a redundancy situation, sometimes as a way for your employer to avoid a redundancy procedure. This usually means that your employer will consider your statutory redundancy payment entitlement. A statutory redundancy payment is a payment that you are legally entitled to when your employment ends ...

Are wages taxed if paid as part of a settlement agreement?

Usually a settlement agreement will say that you will be paid as normal up to the termination date. These wages are due to you as part of your earnings and so they will be taxed in the normal way.

Is a Payment in Lieu of Notice taxable?

If you’re receiving a payment in lieu of notice (“PILON”), that payment must be taxed as though you had worked your notice.

Is holiday pay taxable?

When your employment ends, you’re entitled to be paid for any holiday you haven’t taken. This also forms part of your taxable income, even if it’s paid under a settlement agreement.

What happens if you don’t pay the right amount of tax?

Your employer should understand how different payments are treated for tax. But that’s not a guarantee that they’ll get it right.

What happens to tax payments when you are terminated?

As long as the payment is made because your employment is being terminated, for whatever reason, then the tax laws covering Termination Payments will apply.

What are Settlement Agreements tax considerations?

Settlement Agreements are legally binding agreements between an employer and an employee, formerly known as a Compromise Agreement. Whether you are an employer letting staff go or an employee about to lose your job, Settlement Agreement advice from a solicitor is essential.

What is a settlement agreement?

Settlement Agreements are legally binding agreements between an employer and an employee, formerly known as a Compromise Agreement. Whether you are an employer letting staff go or an employee about to lose your job, Settlement Agreement advice from a solicitor is essential.

What deductions are made for all payments made for the period up to the point that the contract of employment ends?

All payments made for the period up to the point that the contract of employment ends are subject to deductions of tax and national insurance in the normal way.

What is the OT tax rate?

Your employer now has to deduct tax at the OT tax code rate which may mean making deductions at different rates from 20% to 45% depending on the size of the excess. The OT Code does not include any personal allowances and divides the different tax bands into twelfths.

Does notice pay have to be taxed?

Since April 2018, the Finance Act (2018) has made it clear that notice pay must always be taxed and subject to National Insurance. All Settlement Agreements require you to indemnify your employer on any excess tax which remains unpaid after termination. This means that if there is excess tax, you would have to pay.

Is a pension contribution subject to tax?

Contributions to registered pension scheme. Payments made direct into a pension scheme are treated separately and are not subject to tax. There are annual and lifetime allowances for contributions to registered pension schemes and contributions in excess of these allowances do incur tax charges.

Can a disability payment be made free of tax?

Payment on account of a Disability or Injury. A payment can be made free of tax where it is on account of a disability or injury (and also death). The payment must relate to the fact of the injury or disability and not any consequential effect on earnings.

What is a settlement agreement?

Settlement Agreements are legally binding agreements between an employer and an employee, formerly known as a Compromise Agreement. If you are an employer letting staff go, Employment Law advice from a solicitor is essential.

What is the first £30,000 exempt from tax?

Compensatory payments made for loss of office or loss of employment are exempt from taxation on the first £30,000.

Is a settlement agreement taxable?

This payment is fully taxable and liable to national insurance contributions. Some Settlement Agreements may also include a payment associated with a confidentiality clause. These are also subject to deductions.

Is a Pilon payment subject to tax?

Since April 2018, all payments in lieu of notice (PILON) must be subject to taxation and national insurance.

Is a notice period taxable?

Where a settlement is negotiated after a gross misconduct dismissal or where your employee has resigned, with immediate effect, the notice period must be paid as a taxable payment and cannot be included in the £30,000 tax free compensation payment.

Is outplacement training taxable?

Contributions to the cost of outplacement counselling or similar training are not taxable and are usually paid directly by the employer to the provider and do not count towards the £30,000 tax free exemption.

Is a pension contribution subject to tax?

Contributions to a registered pension scheme. Payments made direct into a pension scheme are not subject to tax. However, there are annual and lifetime allowances for contributions to registered pension schemes. Contributions in excess of these allowances do incur tax liability.

What is a PAYE settlement agreement?

A PAYE Settlement Agreement ( PSA) allows you to make one annual payment to cover all the tax and National Insurance due on minor, irregular or impracticable expenses or benefits for your employees.

Do you pay 1A National Insurance on P11D?

include them in your end-of-year P11D forms. pay Class 1A National Insurance on them at the end of the tax year (you pay Class 1B National Insurance as part of your PSA instead) Some employee expenses are covered by exemptions (which have replaced dispensations).

What is a settlement agreement?

A Settlement Agreement is a contract between an employer and an employee, which settles claims an employee might have, such as: unfair dismissal, breach of contract and workplace discrimination. An employee is required to have independent legal advice on a settlement agreement – usually from a solicitor. What is a Compromise Agreement? ...

Why is a settlement agreement important?

This is important because usually a settlement agreement will be drafted to be the entire agreement, meaning any payments or benefits not covered in the agreement will be lost; • deleting clauses that are unreasonable or to remove or minimize risk.

What is a COT3 agreement?

A COT3 agreement is a much simpler straightforward agreement that does not have to adhere to the formalities of a settlement agreement because it is ...

What is the legal requirement for an employee to have their own legal advice?

It is a legal requirement that an employee has their own legal advice from a qualified person, usually a solicitor. A solicitor will advise on the terms and effect of the settlement agreement so you can decide if you want to accept the offer. Your employer has an interest in you obtaining advice from a solicitor because otherwise ...

Why does my employer have an interest in my advice?

Your employer has an interest in you obtaining advice from a solicitor because otherwise the written agreement (even if signed by you) will not legally prevent you from bringing statutory employment claims, for example unfair dismissal or discrimination.

What is the effect of a settlement counter offer?

The main effect of the agreement is that you won’t be able to bring an employment tribunal or court claim. Settlement counter-offer: I’m not happy with the financial terms: Some employees are not satisfied with the financial deal or the terms of the agreement and will instruct their solicitor to negotiate for them.

What is the stronger legal basis for a claim?

The stronger the legal basis for a claim, the more likely it is that employers will be receptive to negotiations to increase the compensation and amend terms in the employee’s favour. You may want to make changes to the Settlement Agreement wording to protect you.

What is the tax rule for settlements?

Tax Implications of Settlements and Judgments. The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code. IRC Section 104 provides an exclusion ...

What is employment related lawsuit?

Employment-related lawsuits may arise from wrongful discharge or failure to honor contract obligations. Damages received to compensate for economic loss, for example lost wages, business income and benefits, are not excludable form gross income unless a personal physical injury caused such loss.

What is a 1.104-1 C?

Section 1.104-1 (c) defines damages received on account of personal physical injuries or physical sickness to mean an amount received (other than workers' compensation) through prosecution of a legal suit or action, or through a settlement agreement entered into in lieu of prosecution.

What is the exception to gross income?

For damages, the two most common exceptions are amounts paid for certain discrimination claims and amounts paid on account of physical injury.

Is a settlement agreement taxable?

In some cases, a tax provision in the settlement agreement characterizing the payment can result in their exclusion from taxable income. The IRS is reluctant to override the intent of the parties. If the settlement agreement is silent as to whether the damages are taxable, the IRS will look to the intent of the payor to characterize the payments and determine the Form 1099 reporting requirements.

Is emotional distress taxable?

Damages received for non-physical injury such as emotional distress, defamation and humiliation, although generally includable in gross income, are not subject to Federal employment taxes. Emotional distress recovery must be on account of (attributed to) personal physical injuries or sickness unless the amount is for reimbursement ...

Does gross income include damages?

IRC Section 104 explains that gross income does not include damages received on account of personal physical injuries and physical injuries.