The IRS does NOT tax settlement awards from personal injury lawsuits if these cases demonstrate “observable bodily harm.” So, if the injuries are visible, the IRS considers compensation money awarded because of those injuries tax-free. Do not include these settlements in the income section of your tax forms.

Full Answer

Do I have to pay taxes on a settlement?

In most cases, the taxation law treats these settlements as “other income,” and you will not pay taxes on them. In most cases, these settlements are taxable unless they were obtained through a class action lawsuit. If you’re filing a lawsuit for a class action that was lost, you won’t be awarded any compensation for the damages.

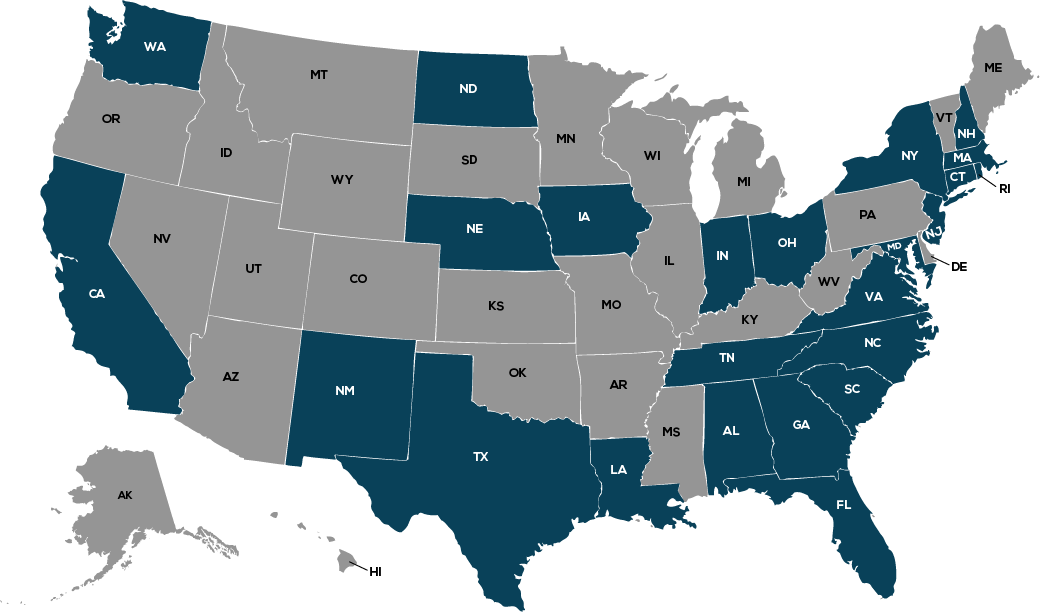

Who are the companies involved in the Takata airbag lawsuit?

This is the informational website for the proposed economic loss class action settlements with BMW, Honda, Mazda, Nissan, Subaru, and Toyota in a class action lawsuit styled In Re: Takata Airbag Products Liability Litigation, Master Case No. 1:15-MD-02599-FAM.

Are class action lawsuit settlements taxable?

Typically, class action lawsuit settlements are taxable when they exceed $100,000. The amount you receive from these lawsuits is often referred to as a “xoxo” or a taxable event. This is a term for an award of wrongful death.

Are personal injury settlements tax deductible?

If you receive a settlement for personal physical injuries or physical sickness and did not take an itemized deduction for medical expenses related to the injury or sickness in prior years, the full amount is non-taxable. Do not include the settlement proceeds in your income.

Is the auto airbag settlement taxable?

It will come as no great surprise that the answer is almost universally yes. Settlement money counts as income, and the amount, including any interest on the award, must be declared accordingly.

What type of settlement is not taxable?

personal injury settlementsSettlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

Do you have to pay taxes on a class action settlement?

Do you have to pay taxes on lawsuit settlements? Simple answer: yes. A large amount of money collected without at least informing the IRS is simply not legal. In many cases, they will ask for a share of the profits as well.

What part of a settlement is taxable?

Punitive damages and interest are always taxable. You might receive a tax-free settlement or judgment, but pre-judgment or post-judgment interest is always taxable (and can produce attorney fee problems).

How can I avoid paying taxes on a settlement?

How to Avoid Paying Taxes on a Lawsuit SettlementPhysical injury or sickness. ... Emotional distress may be taxable. ... Medical expenses. ... Punitive damages are taxable. ... Contingency fees may be taxable. ... Negotiate the amount of the 1099 income before you finalize the settlement. ... Allocate damages to reduce taxes.More items...•

Can the IRS take my settlement money?

If you have back taxes, yes—the IRS MIGHT take a portion of your personal injury settlement. If the IRS already has a lien on your personal property, it could potentially take your settlement as payment for your unpaid taxes behind that federal tax lien if you deposit the compensation into your bank account.

What do I do if I have a large settlement?

Here is a list of steps to take once you receive a settlement.Take a Deep Breath and Wait. ... Understand and Address the Tax Implications. ... Create a Plan. ... Take Care of Your Financial Musts. ... Consider Income-Producing Assets. ... Pay Off Debts. ... Life Insurance. ... Education.More items...

Where do I report a class action settlement on my taxes?

Reporting Class Action Awards The individual who receives a class-action award must report any and all income received on Line 21 of Form 1040, for miscellaneous income. This amount is included in adjusted gross income and is taxable.

Is it worth joining class action lawsuit?

In most cases, it is a good idea to join the class action if you believe you suffered injuries or financial losses caused by the defendant. We do recommend you give us a call and discuss your situation with one of our class action lawsuit attorneys before you make a decision, however.

Will I get a 1099 for a lawsuit settlement?

If your legal settlement represents tax-free proceeds, like for physical injury, then you won't get a 1099: that money isn't taxable. There is one exception for taxable settlements too. If all or part of your settlement was for back wages from a W-2 job, then you wouldn't get a 1099-MISC for that portion.

How long does it take to get paid after a settlement?

While rough estimates usually put the amount of time to receive settlement money around four to six weeks after a case it settled, the amount of time leading up to settlement will also vary. There are multiple factors to consider when asking how long it takes to get a settlement check.

Why is a W 9 required for settlement?

The Form W-9 is a means to ensure that the payee of the settlement is reporting its full income. Attorneys are frequently asked to supply their own Taxpayer Identification Numbers and other information to the liability carrier paying a settlement.

Are legal settlements 1099 reportable?

If your legal settlement represents tax-free proceeds, like for physical injury, then you won't get a 1099: that money isn't taxable. There is one exception for taxable settlements too. If all or part of your settlement was for back wages from a W-2 job, then you wouldn't get a 1099-MISC for that portion.

Is a lump sum payment in a divorce settlement taxable?

Generally, lump-sum divorce settlements are not taxable for the recipient. If the lump-sum payment is an alimony payment, it is not deductible for the person who makes the payment and is not considered income for the recipient.

Are legal settlements tax deductible?

Generally, if a claim arises from acts performed by a taxpayer in the ordinary course of its business operations, settlement payments and payments made pursuant to court judgments related to the claim are deductible under section 162.

OK Cool. What’S This All About then?

For those who haven’t heard, Takata Corporation is a Japanese auto parts company that manufactured airbags that were the subject of several lawsuit...

So, This Thing I Got in The Mail – Is It A Recall Notice?

In short, no. The notices that some of you may have received are simply to make you aware that class actions have been settled and that it may be t...

What Can I Expect from The Settlement?

Great question! But unfortunately, it doesn’t have a simple answer that will apply to everyone across the board. In general, if you own one of the...

Wait – How Did They Even Get My Mailing address?

The company whose car you purchased – whether it BMW, Mazda, Subaru or Toyota – has your information on file because, well, you bought their car. A...

What is the number to call for a Mazda settlement?

Subaru Settlement. Toyota Settlement. To submit a Registration/Claim Form online, please select the “Start a Registration/Claim Form” button. Please check this website or call the toll-free line, 1-888-735-5596, periodically for updates.

Does a settlement notice mean a recall?

Your receipt of a Settlement Notice does not mean your vehicle is subject to a recall. Please refer to the National Highway Traffic Safety Administration’s website, www.NHTSA.gov/recalls, for the latest information about Takata recalls and to determine if your vehicle is subject to a recall. BMW Settlement. Ford Settlement.

What car companies are involved in the Takata Airbag lawsuit?

The lawsuit alleges that certain car companies, including Honda, manufactured, distributed, or sold vehicles with defective Takata airbag inflators. The inflators can, upon deployment, rupture and expel debris or shrapnel at the driver or passenger and/or otherwise affect the airbag’s deployment, and that the Plaintiffs sustained economic losses as a result.

How to contact Honda Settlement?

If you are not sure whether you are included in the Class, you may review important documents regarding the Honda Settlement on the Documents section of the website or you may contact the Settlement Notice Administrator, toll-free, at 1-888-735-5596. Back To Top.

Why did Honda settle the recall lawsuit?

Both sides in the lawsuit agreed to a settlement in order to increase recall completion rates and to avoid the cost and risk of further litigation , with the goal of enhanced customer satisfaction. As a result of the Settlement, the Class Members can get the benefits of the Settlement and in exchange, Honda received a release from liability. The Settlement does not mean that Honda broke any laws or did anything wrong. Furthermore, the Court did not decide which side was right.

What is Honda's lawsuit?

Honda denies that it has violated any law, denies liability, and denies that it engaged in any wrongdoing with respect to the manufacture, distribution, or sale of the Subject Vehicles. Back To Top.

What is a class action?

In a class action, people called “Class Representatives” sue on behalf of other people who have similar claims. All of these people together are the “Class” or “Class Members” if the Court approves this procedure.

When was the Honda settlement final order?

The Final Order Approving Class Settlement and Certifying Settlement Class was entered for the Honda Settlement on February 28, 2018.

Who is the Special Administrator for Honda Settlement?

The Court has directed Patrick A. Juneau of Juneau David APLC to act as the Settlement Special Administrator. Their role in the Honda Settlement is to oversee and administer the Settlement Fund.

How to check if your car was included in a settlement?

You could check your Vehicle Identification Number to see if your car was included in the settlement, go to the individual page for your automaker, or jump right in and start filling out a claim form. If you don’t have all the information to fill out the form immediately, don’t worry.

Who makes Takata airbags?

For those who haven’t heard, Takata Corporation is a Japanese auto parts company that manufactured airbags that were the subject of several lawsuits against automakers including Mazda, BMW and more. The lawsuits claim that the Takata-brand airbags are defective and can potentially explode on impact – and that the car companies should be held liable for selling vehicles in which these airbags were installed.

What Can I Expect from the Settlement?

Great question! But unfortunately, it doesn’t have a simple answer that will apply to everyone across the board.

How much did BMW pay for class action lawsuit?

While some companies are still fighting the claims, four automakers– BMW, Mazda, Subaru and Toyota – have agreed to pay a total of $553 million to settle the class actions against them. Now, anyone with the affected vehicles may be eligible to claim compensation. Hence, your class action settlement notice. (The latest settlement covers these four ...

Can you claim money from class action lawsuits?

In short, no. The notices that some of you may have received are simply to make you aware that class actions have been settled and that it may be time for you to claim some money. Here’s what the settlement site says about the state of the recalls:

Does a settlement notice mean a recall?

Your receipt of a Settlement Notice does not mean your vehicle is subject to a recall. Please refer to the National Highway Traffic Safety Administration’s website, www.safercar.gov, for the latest information about Takata recalls and to determine if your vehicle is subject to a recall.”.

What is class action lawsuit?

Class action lawsuits normally involve a large number of people. A relatively small group of named plaintiffs represent thousands or even millions of other people, class members, who suffer losses due to the action (s) of the defendant, normally a large business. When they reach a class action settlement, individual payments are made to ...

What is a damages award payment?

Damage award payment to reimburse for medical expenses when it comes to emotional distress if the expense was deducted for tax purposes.

Is a medical expense settlement taxable?

However, if the damage payments replace a payment that would not have been taxable, most probably such income needs not to be reported. Here are some examples of taxable settlements: The recovery of costs for deductions, such as a medical expense or attorney fee deduction, constitute taxable damage.

Do you have to pay taxes on class action settlements?

The big question is “do I have to pay taxes on the money received from a class action lawsuit?“ If you are waiting for a definite “no”, we have to disappoint you. There is no definite “yes” or “no” answer to this question. It depends on the nature of the claims involved. Some settlements may be treated as taxable income while others don’t. In case the payment is not taxable, the parties may arrive at a lower class action settlement payment. However, in most cases, this is an acceptable solution for the plaintiffs because the class members will not have to report the payments as income. If that is not the case, you must remember to report the earnings to the IRS.

Is a settlement taxable?

Now let’s see which settlements are taxable. Normally when the action is instituted by a small business, it is economic in nature and most probably is taxable. For example, lost profits are treated as taxable income. They would be taxed anyway even if there was no lawsuit.

Is a washing machine settlement taxable?

Other examples of non-taxable settlements include:

Is a class action settlement taxable income?

Some settlements may be treated as taxable income while others don’t. In case the payment is not taxable, the parties may arrive at a lower class action settlement payment. However, in most cases, this is an acceptable solution for the plaintiffs because the class members will not have to report the payments as income.

What does it mean to pay taxes on a $100,000 case?

In a $100,000 case, that means paying tax on $100,000, even if $40,000 goes to the lawyer. The new law generally does not impact physical injury cases with no punitive damages. It also should not impact plaintiffs suing their employers, although there are new wrinkles in sexual harassment cases. Here are five rules to know.

What is the tax on a 1099?

1. Taxes depend on the “origin of the claim.”. Taxes are based on the origin of your claim. If you get laid off at work and sue seeking wages, you’ll be taxed as wages, and probably some pay on a Form 1099 for emotional distress.

Is there a deduction for legal fees?

How about deducting the legal fees? In 2004, Congress enacted an above the line deduction for legal fees in employment claims and certain whistleblower claims. That deduction still remains, but outside these two areas, there's big trouble. in the big tax bill passed at the end of 2017, there's a new tax on litigation settlements, no deduction for legal fees. No tax deduction for legal fees comes as a bizarre and unpleasant surprise. Tax advice early, before the case settles and the settlement agreement is signed, is essential.

Is attorney fees taxable?

4. Attorney fees are a tax trap. If you are the plaintiff and use a contingent fee lawyer, you’ll usually be treated (for tax purposes) as receiving 100% of the money recovered by you and your attorney, even if the defendant pays your lawyer directly his contingent fee cut. If your case is fully nontaxable (say an auto accident in which you’re injured), that shouldn't cause any tax problems. But if your recovery is taxable, watch out. Say you settle a suit for intentional infliction of emotional distress against your neighbor for $100,000, and your lawyer keeps $40,000. You might think you’d have $60,000 of income. Instead, you’ll have $100,000 of income. In 2005, the U.S. Supreme Court held in Commissioner v. Banks, that plaintiffs generally have income equal to 100% of their recoveries. even if their lawyers take a share.

Is emotional distress taxed?

If you sue for intentional infliction of emotional distress, your recovery is taxed. Physical symptoms of emotional distress (like headaches and stomachaches) is taxed, but physical injuries or sickness is not. The rules can make some tax cases chicken or egg, with many judgment calls.

Is $5 million taxable?

The $5 million is fully taxable, and you can have trouble deducting your attorney fees! The same occurs with interest. You might receive a tax-free settlement or judgment, but pre-judgment or post-judgment interest is always taxable (and can produce attorney fee problems).

Is punitive damages taxable?

Tax advice early, before the case settles and the settlement agreement is signed, is essential. 5. Punitive damages and interest are always taxable. If you are injured in a car crash and get $50,000 in compensatory damages and $5 million in punitive damages, the former is tax-free.

Is a settlement for physical injury taxable?

If you receive a settlement for personal physical injuries or physical sickness and did not take an itemized deduction for medical expenses related to the injury or sickness in prior years, the full amount is non-taxable. Do not include the settlement proceeds in your income.

Is severance pay taxable?

If you receive a settlement in an employment-related lawsuit; for example, for unlawful discrimination or involuntary termination, the portion of the proceeds that is for lost wages (i.e., severance pay, back pay, front pay) is taxable wages and subject to the social security wage base and social security and Medicare tax rates in effect in the year paid. These proceeds are subject to employment tax withholding by the payor and should be reported by you as ‘Wages, salaries, tips, etc.” on line 1 of Form 1040.

Do you have to report a settlement on your taxes?

Property settlements for loss in value of property that are less than the adjusted basis of your property are nottaxable and generally do not need to be reported on your tax return. However, you must reduce your basis in theproperty by the amount of the settlement.

Is interest earned on a lawsuit taxable?

Interest earned on a lawsuit settlements is taxable income and should be entered as a Form 1099-INT. Punitive damages are taxable and should be reported as “Other Income” on line 21 of Form 1040, even if the punitive damages were received in a settlement for personal physical injuries or physical sickness.

Can a class action suit be reported on a 1099?

Normally a class action suit would be reported on a 1099 MISC form and not a 1099 INT, which is used to report taxable interest paid from a financial institution. if this is reported to you on a 1099 INT, whoever issued this to you reported it on the incorrect form.