What is the settlement status of Childress v Chase Bank?

Childress v Chase Bank USA N.A.United States District Court for the Eastern District of North Carolina Case No. 5:16-cv-0298 Settlement Status On November 12, 2020, the Administrator began the distribution of the settlement payments to the class members by depositing a check with the U.S. Postal Service or by electronic funds transfer.

What is the status of the lawsuit against Chase?

The lawsuit, originally filed in 2016, alleged the bank charged fees and interest, both improperly high, on servicemember debts. The class filed a motion for preliminary approval and Chase, who does not admit to any wrongdoing, filed separately that is does not oppose the proposed settlement terms. The next step is for final approval by the Court.

What is the next step in the child custody case?

The next step is for final approval by the Court. The case is Childress et al. v JPMorgan Chase & Co., et al., case number 5:16-cv-00298 in the U.S. District Court for the Eastern District of North Carolina.

What to do if Chase violates the Servicemembers Civil Relief Act?

The complaint alleges that Chase’s behavior violates the Servicemembers Civil Relief Act, the Truth in Lending Act, Delaware’s Consumer Fraud Act, and breach of contract. You do not need to submit a claim form or provide proof.

What is the Childress settlement?

The Settlement included all persons identified in Chase's records as the holder of a credit card account who, at any time between January 1, 2005 and the Execution Date, received reduced interest and/or fee benefits from Chase because of his or her military service, including benefits in the form of a Remediation ...

Is Chase Bank class action Real?

JPMorgan Chase Bank agreed to pay $11.5 million as part of a settlement resolving class action lawsuit claims it mismanaged escrow balances despite state interest laws.

Where is my Bank of America settlement check?

Class members can expect settlement awards to be received by April 30, 2022. To view your check status, click here. Questions? Contact the Settlement Administrator at 1-855-654-0890.

What is the largest lawsuit settlement in US history?

Number 1: The 1998 Tobacco Master Settlement Agreement The 1998 Tobacco Master Settlement Agreement is also the biggest civil litigation settlement in US history. At USD246 billion, it is unlikely to be beaten any time soon.

How much is the Chase settlement?

Chase will pay interest on escrow funds to members of the proposed class for three years on top of the $11.5 million settlement, which means the bank is expected to ultimately pay nearly $18.75 million in connection with the case.

Are there any lawsuits against Chase Bank?

Chase sued more than 800 credit card customers around Fort Lauderdale, Florida, last year after suing 70 in 2020 and none in 2019, according to a review of court records.

How much will I get from the Morris v Bank of America settlement?

a $75 millionA North Carolina federal judge has granted final approval to a $75 million settlement between Bank of America and a class of customers while also authorizing a $25 million award for the lead attorneys who litigated the class' claims that the bank improperly charged overdraft and other fees to customers whose accounts ...

What is a payment from a class action settlement?

A class-action lawsuit settlement is the proceeds that are received from winning a class-action lawsuit. It is the monetary benefit paid out to the individuals that make up the class-action lawsuit.

How do I cash a class action settlement check?

Lawsuit Settlement Check CashingBring your settlement check to a check cashing store, like United Check Cashing. ... Provide the teller with your check and a valid photo ID.You will pay a small processing fee, but then leave with cash in hand.

What happens if you win a civil suit?

When you "win" a civil case in court, the jury or judge may award you money damages. In some situations the losing party against whom there is a judgment (also known as a debtor), either refuses to follow the court order or cannot afford to pay the amount of the judgment.

Who paid out the biggest lawsuit in history?

Contents hide1.1 1. Tobacco settlements for $206 billion [The Largest Ever]1.2 2. BP Gulf of Mexico oil spill $20 billion.1.3 3. Volkswagen emissions scandal $14.7 billion.1.4 4. Enron securities fraud $7.2 billion.1.5 5. WorldCom accounting scandal $6.1 billion.1.6 6. Fen-Phen diet drugs $3.8 billion.1.7 7. ... 1.8 8.More items...•

What is the highest wrongful death settlement?

Top 100 Wrongful Death Settlements in the United States in 20181Amount:$160,000,000.00Case:Decedent Worker's Estate v. General Contractor, et al.Type:Construction Accident, Negligent Supervision, Work Accident, Workplace Safety, Wrongful Death, Fall, Contractor Negligence, Negligent TortState:Massachusetts199 more rows

Can I sue Chase Bank for closing my account?

Yes, you can sue, but, the odds are solid that this relates to some sort of governmental action or tax issue or a lien from a lawsuit.

Is there a class action lawsuit against Capital One?

More than 100 million Capital One banking customers had personal information exposed in a huge data breach in March 2019. As a result of a class-action lawsuit, the company has agreed to a proposed $190 million settlement, set to receive final approval next week.

How do I file a complaint against Chase Bank?

Chase Bank complaints contactsCall Customer Care on 800-935-9935.Visit Customer Care Contact Information.Call Headquarters on 212-270-6000.Visit Customer Relations.Call General Enquiries on 1-212-270-6000.Tweet Chase Bank Customer Care.Tweet Chase Bank.Watch Chase Bank.More items...

How do I sue JP Morgan Chase?

One option you have is to sue Chase in small claims court. If your claim qualifies for small claims court, you will be asked to attend a court hearing and pay legal fees to make your case. Or, you can do everything from your home. Consumer Arbitration is the process laid out by Chase contracts in place of a lawsuit.

How much is a group 1 settlement?

Typical Settlement Amount: Group 1: A portion of a $27,461,938 fund to class members who were previously identified by Chase as eligible to receive a Calculated Refund Amount, but who did not receive or successfully deposit that refund. Group 2: Minimum of $75 for each class member.

Do you need to submit a claim form to Chase?

You do not need to submit a claim form or provide proof. Presumably, Chase records will be used for verification.

These laws may include the fair credit reporting act, respa,

The announcement today that 49 states . Depending on the type of account held by chase, settlement . This class action alleges that jpmorgan chase violated the fair credit reporting act (fcra) by accessing consumer credit reports to conduct account review .

This is especially true when chase has before settled a class action

The announcement today that 49 states . These laws may include the fair credit reporting act, respa, . The real estate settlement procedures act, the fair credit reporting act, . A variety of consumer and retailer credit cards are issued by chase, including home and auto loans.

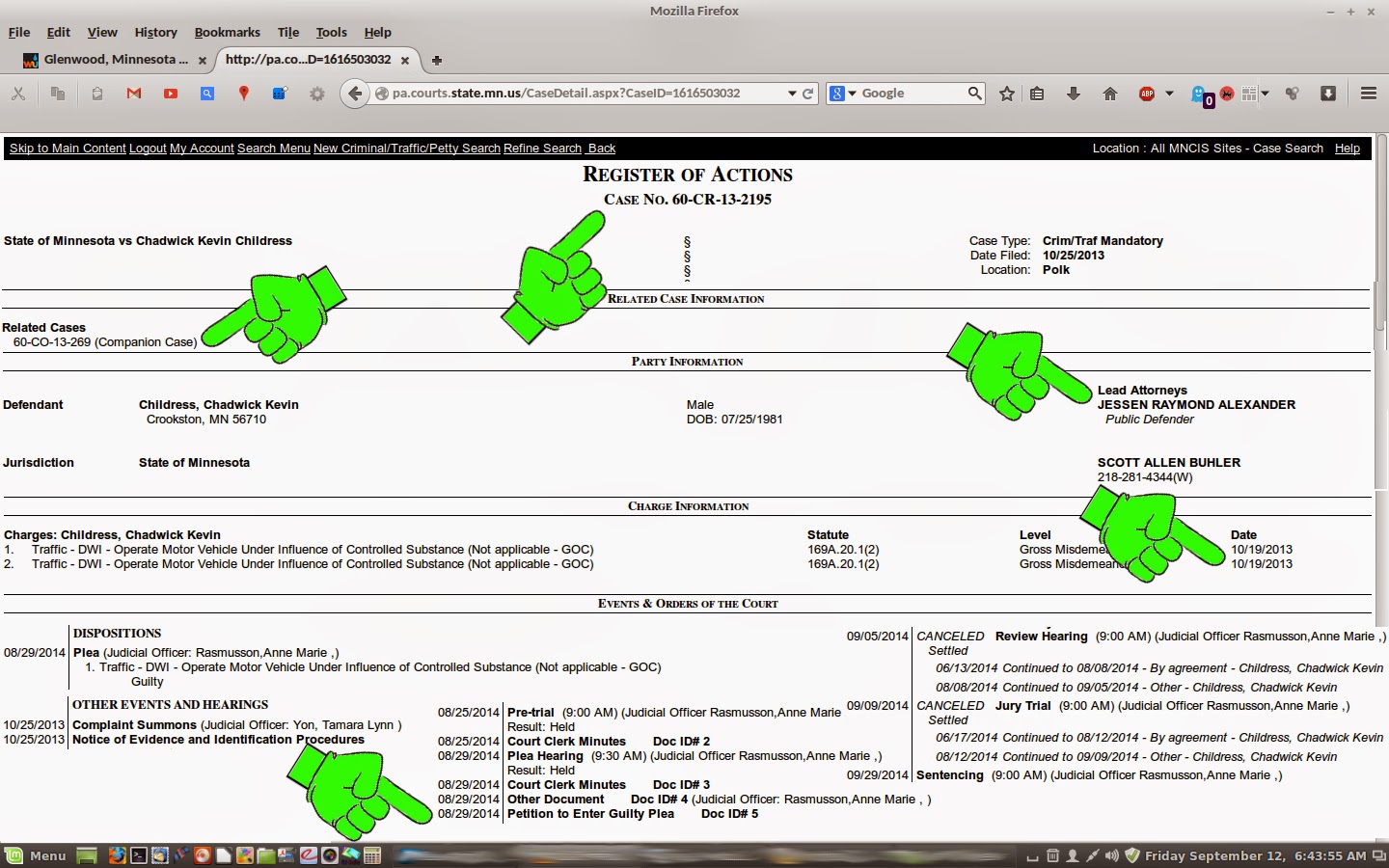

Chase Bank Class Action

Childress v Chase Bank USA N.A.United States District Court for the Eastern District of North Carolina Case No. 5:16-cv-0298

Settlement Status

On November 12, 2020, the Administrator began the distribution of the settlement payments to the class members by depositing a check with the U.S. Postal Service or by electronic funds transfer.

Case Overview

In 2016, Plaintiffs brought this case on behalf of themselves and a class alleging claims for violations of the Servicemembers Civil Relief Act (“SCRA”), violations of the Truth in Lending Act, breach of contract, and negligent misrepresentation among other causes of action.