What you should know about the Equifax breach settlement?

The Federal Trade Commission (FTC) has issued a consumer alert regarding the Equifax Data Breach. In September 2017, Equifax announced a data breach, which affected the personal information of 147 million people. Under a recent settlement filed, Equifax agreed to spend up to $425 million to help people affected by the data breach.

What you should do after Equifax data breach?

- Everyone should monitor their bank and credit card accounts to spot unauthorized activity. ...

- You should also place a fraud alert with each of the three major CRAs. ...

- You can consider signing up for Equifax’ credit monitoring service. ...

- You may want to take an additional step: placing a security freeze. ...

How to protect yourself from the Equifax breach?

You should:

- Scrutinize all credit card and bank statements. Take note of small, but suspicious, charges. ...

- Check your credit report from all three credit bureaus. This will help you determine if unauthorized accounts have been opened in your name. ...

- Refrain from giving out personal information over the phone or through email. ...

What should I do after the Equifax data breach?

What to do if your account is compromised

- Least sensitive — change your password. If you’re notified that one of your online accounts has been compromised, change your password immediately.

- Moderately sensitive — notify your bank. If your card payment numbers have been stolen, notify the bank or company that issued the card immediately.

- Most sensitive — notify Equifax and TransUnion. ...

How do I know if I was part of Equifax breach?

Equifax has created a website where you can find out if you have been affected by the breach. The website will ask you for the last six digits of your social security number and your last name, and then will tell you if you have been affected. You can also call 1-833-759-2982.

Which credit Bureau had the breach?

Equifax, one of the three largest consumer credit reporting agencies in the United States, announced in September 2017 that its systems had been breached and the sensitive personal data of 148 million Americans had been compromised.

Is there a class action lawsuit against Equifax?

In 2017, hackers broke into Equifax in a breach that exposed the financial information of 147 million Americans. A federal court in 2020 approved a $380 million settlement of class actions lawsuits, with no finding or judgment of wrongdoing made.

Is Equifax a legitimate company?

Trusted: Equifax is one of the major credit bureaus and has a highly regarded reputation.

How much will each person get from Equifax settlement?

Under the settlement terms, Equifax agreed to set up a fund to provide free credit monitoring and identity theft protection to consumers, as well as provide cash payments to people affected by the breach—up to $20,000 per person.

Has anyone received money from Equifax breach?

After a data breach in 2017 exposed personal data of more than 147 million consumers, including in some cases Social Security and driver's license numbers, credit bureau Equifax agreed to pay hundreds of millions in compensation to help affected consumers.

Are Experian and Equifax the same?

Equifax: An Overview. Experian and Equifax are the two largest credit bureaus in the U.S. Both companies collect and research credit information of individuals and rate the overall ability to pay back a debt. Credit bureaus like Experian and Equifax provide the information they gather to creditors for a fee.

How do I check my Equifax claim?

You can also log into your myEquifax account and view your status by clicking the “check status of a dispute” button. If you are checking your status by mail or phone, please make sure you have the confirmation number that was provided to you when you submitted your dispute.

How long does a data breach claim take?

In reality, how long a data breach claim takes simply comes down to the circumstances of the case. Some cases could be resolved in a few months, whereas others may end up being pursued for several years.

Why did I get an email from Equifax?

If you receive emails, texts, or calls from any person or company claiming to be Equifax or anyone else related to the data breach, they are probably an imposter scam. You should not open or respond to such communications.

Does Equifax send email alerts?

If you've signed up for credit monitoring from Equifax, you will be informed by email of any changes or events related to your credit report. Some of these email alerts are triggered by regular actions you take yourself, like buying a cell phone or financing new furniture.

Is the Equifax data breach settlement?

Equifax data breach settlement. In 2017, Equifax announced a breach that exposed the personal data of approximately 147 million people. The legal settlement is now final. Here's how you can use the services provided through the settlement to protect and monitor your credit.

Was there a data breach at Experian?

Once again, we see another major data breach – this time it's the credit-checking firm Experian who has been hacked, exposing the details of 15 million consumers who applied for T-Mobile USA postpaid services between Sept. 1, 2013 and Sept.

Did TransUnion get hacked?

Hackers say a password set to “password” compromised a TransUnion South Africa server in a data leak they claim includes millions of personal records. TransUnion confirmed the security incident but did not acknowledge whether a weak password was involved.

Has TransUnion ever been hacked?

TransUnion was compromised by the hacker group 'N4aughtysecTU' which demanded a $15 million (R225 million) ransom over four terabytes of compromised data. The hacker group claims the information in its possession contains everything from credit scores to banking details and ID numbers.

Did Experian get hacked?

Twice in the past month KrebsOnSecurity has heard from readers who had their accounts at big-three credit bureau Experian hacked and updated with a new email address that wasn't theirs. In both cases the readers used password managers to select strong, unique passwords for their Experian accounts.

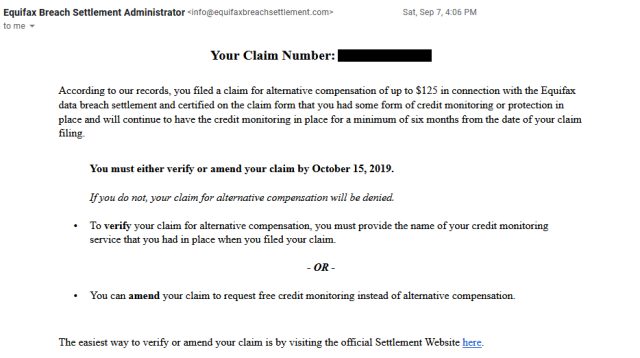

Claim

Equifax data breach settlement emails offering a free membership for Experian IdentityWorks are legitimate.

Origin

In late January 2022, Google users looked to Reddit and elsewhere to find out if an email for the status of the Equifax data breach settlement was a “scam or legit,” as readers often do after receiving such notices.

How much did Equifax pay for data breach?

It's been mere days since credit-reporting firm Equifax agreed to pay up to $700 million to settle claims over a massive 2017 data breach and already scammers are trying to exploit the deal to fraudulently get their hands on your personal information.

How to figure out if you are a settlement claimant?

On the settlement website, you can figure out whether you're one of the eligible claimants. Enter your last name and last six digits of your Social Security number in a website operated by the settlement administrator (not Equifax). If told your personal information was affected by the data theft, then you can file a claim.

What is the deadline for filing your claim?

The deadline to file claims is Jan. 22, 2020, for most benefits, and you won't receive anything until the settlement administrator gets the go-ahead from a court — that would be Jan. 23, 2020, at the earliest.

How to make sure you're not handing over sensitive financial information to a fake website?

To make sure you're not handing over sensitive financial information to a fake website, start your claims process on the FTC's Equifax page at ftc.gov/Equifax. The federal agency noted that consumers never have to pay a fee to claim benefits from the settlement and said anyone who calls to urge you to file a claim is most certainly a con artist.

How much can you claim for cyber theft?

People who were harmed in the cybertheft can also claim as much as $20,000 in cash reimbursement for expenses related to the breach. Those include fees to freeze or unfreeze credit reports, as well as for credit-monitoring services; losses from unauthorized charges to accounts; and any payments to lawyers and or accountants.

How long can you claim for identity theft?

You can make a claim for up to 20 hours of time spent dealing with the breach. The good news here is that backing documents aren't required, and you could see compensation for time you spend trying to recover from identity theft (or avoid it in the first place) of $25 an hour (up a maximum of 10 hours -- more than that and you will need documents backing up your additional time spent). You must certify that you are being truthful.

How long does Experian monitor credit?

Consumers impacted by the data breach are entitled to up to 10 years of free monitoring of their credit reports. You can also sign up for at least four years of monitoring services provided by Experian at no cost, or if you already have credit monitoring going, you can file to be compensated for up to $125 in cash.