Yes, the Equifax Data Breach Settlement email and website are real. WHAT WE FOUND Although the Federal Trade Commission (FTC) has previously warned of people attempting to scam Equifax cyberattack victims, EquifaxBreachSettlement.com is a real website and the email Dan received is legitimate, an FTC spokesperson confirmed to VERIFY.

How to dispute items with Equifax?

- Enter your identifying information on the page that reads “Step 1: Authentication”, then hit “Continue”.

- Answer the four questions about your credit file to verify your identity.

- Select the red box that reads “Dispute item” that appears beneath the item in question.

- Upload any supporting documentation to substantiate your claim, then hit “Continue”.

When will Equifax pay settlement?

Settlement benefits for eligible time spent and out-of-pocket losses are likely to begin issuing in fall 2022. The Equifax Data Breach Settlement website will provide updates. If you still have your claim number, you can enter it on the website and check the status of your claim.

Is Equifax Legit and safe?

Yes, having worked for them, Equifax is a legitimate company and safely handles personal information. They are the oldest of the 3 US credit unions founded in 1899. TransUnion and Experian are the others and serve the same role. Can you really make $1,500 to $2,000 a week driving for DoorDash?

Did Equifax let your data get stolen?

WASHINGTON, D.C. — After a massive 2017 data breach that resulted in 147 million people’s sensitive personal and financial data being stolen, Equifax is now being ordered to pay up, according to an announcement from the FTC.. If you were one of the millions of people affected in the breach, Equifax owes you money.

See more

Did Equifax pay settlements?

The company has agreed to a global settlement with the Federal Trade Commission, the Consumer Financial Protection Bureau, and 50 U.S. states and territories. The settlement includes up to $425 million to help people affected by the data breach.”

Is Equifax website safe?

How secure is the information I provide to Equifax.com? Social Security number and credit card number(s) are encrypted before being transmitted to/from our servers. For your security, this site requires the use of a 128-bit SSL compatible browser.

Has anyone received money from Equifax?

After a data breach in 2017 exposed personal data of more than 147 million consumers, including in some cases Social Security and driver's license numbers, credit bureau Equifax agreed to pay hundreds of millions in compensation to help affected consumers.

How do I know if I qualify for Equifax settlement?

To be eligible, your claim for Out-of-Pocket Losses or Time Spent must occur between January 23, 2020 and January 22, 2024 (the “Extended Claims Period”). During the Extended Claims Period, impacted class members may submit claim(s) for cash reimbursement.

What is Equifax settlement?

The company has agreed to a global settlement with the Federal Trade Commission, the Consumer Financial Protection Bureau, and 50 U.S. states and territories. The settlement includes up to $425 million to help people affected by the data breach.

Should I give my SSN to Equifax?

Is it okay to give it to them? Yes. The credit reporting agencies ask for your Social Security Number (or Taxpayer ID Number) and other personal information to identify you and avoid sending your credit report to the wrong person. It is okay to give this information to the credit reporting agency that you call.

Has the Equifax settlement been finalized?

Share this article: Equifax has reached a settlement over its data breach, according to an update put out by the Federal Trade Commission (FTC). The settlement was finalized in January 2022 and the settlement administrator has begun contacting those who filed valid claims, according to the update.

Is Equifax a legitimate company?

Trusted: Equifax is one of the major credit bureaus and has a highly regarded reputation.

How much can you get from a data breach settlement?

Cash payments. You can get compensation for up to 20 hours at $25 per hour for the time you spent taking measures to prevent identity theft or dealing with identity theft. Ten hours can be self-certified, requiring no documentation.

How much is Equifax settlement?

Back in 2017, Equifax infamously suffered a data breach that exposed devastating levels of personal and financial information of about 147 million Americans. Its punishment was a $575 million settlement with the Federal Trade Commission and a pinkie promise to go forth and sin no more.

What are the harms of Equifax?

In its complaint, the FTC alleges that Equifax failed to secure the massive amount of personal information stored on its network, leading to a breach that exposed millions of names and dates of birth, Social Security numbers, physical addresses, and other personal information that could lead to identity theft and fraud ...

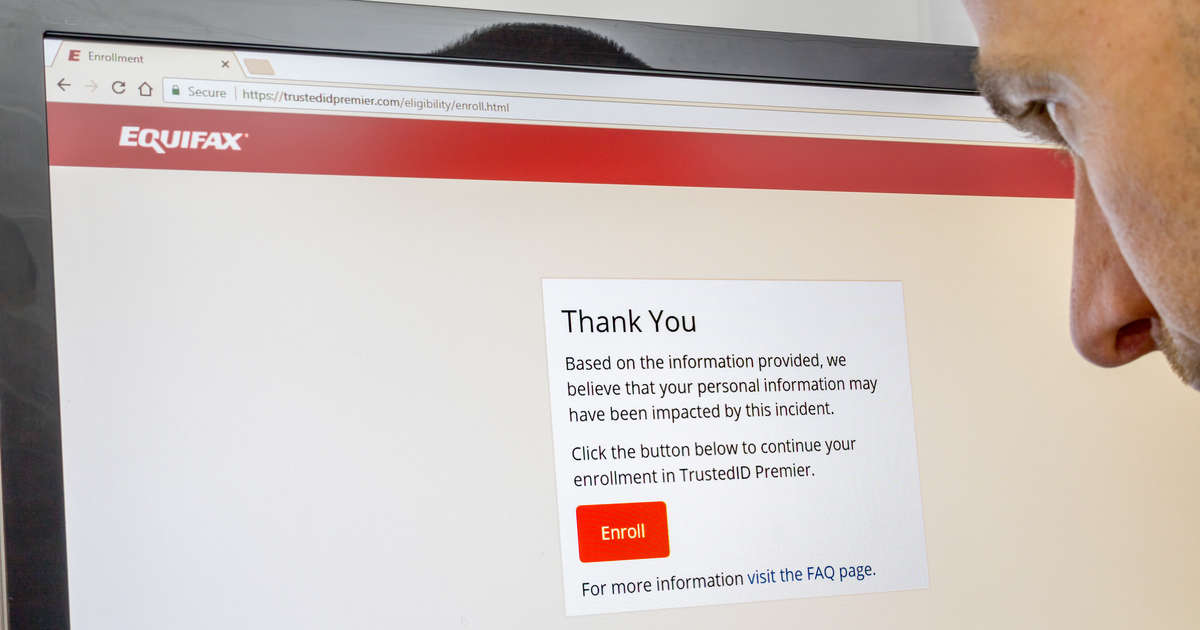

Was I part of the Equifax breach?

Equifax has created a website where you can find out if you have been affected by the breach. The website will ask you for the last six digits of your social security number and your last name, and then will tell you if you have been affected. You can also call 1-833-759-2982.

Is Equifax Credit Score accurate?

Both TransUnion and Equifax are reliable credit reporting agencies that compile reports and calculate your credit scores using different scoring models.

Can Experian be trusted?

Experian is trusted by millions of consumers and businesses and is safe to use. Their free and premium services are readily available but with several layers of protection to shield your information from fraudsters.

Is Equifax or TransUnion more accurate?

Neither score is more or less accurate than the other; they're only being calculated from slightly differing sources. Your Equifax credit score is more likely to appear lower than your TransUnion one because of the reporting differences, but a “fair” score from TransUnion is typically “fair” across the board.

Is Creditkarma safe?

Credit Karma goes the extra mile when it comes to the safe-keeping of our members' personal information. We use 128-bit or higher encryption to protect during the transmission of data to our site and encrypt data at rest. If we suspect any suspicious activity on your account then we'll alert you as soon as possible.

How much did Equifax pay for data breach?

It's been mere days since credit-reporting firm Equifax agreed to pay up to $700 million to settle claims over a massive 2017 data breach and already scammers are trying to exploit the deal to fraudulently get their hands on your personal information.

How to figure out if you are a settlement claimant?

On the settlement website, you can figure out whether you're one of the eligible claimants. Enter your last name and last six digits of your Social Security number in a website operated by the settlement administrator (not Equifax). If told your personal information was affected by the data theft, then you can file a claim.

What is the deadline for filing your claim?

The deadline to file claims is Jan. 22, 2020, for most benefits, and you won't receive anything until the settlement administrator gets the go-ahead from a court — that would be Jan. 23, 2020, at the earliest.

How to make sure you're not handing over sensitive financial information to a fake website?

To make sure you're not handing over sensitive financial information to a fake website, start your claims process on the FTC's Equifax page at ftc.gov/Equifax. The federal agency noted that consumers never have to pay a fee to claim benefits from the settlement and said anyone who calls to urge you to file a claim is most certainly a con artist.

How much can you claim for cyber theft?

People who were harmed in the cybertheft can also claim as much as $20,000 in cash reimbursement for expenses related to the breach. Those include fees to freeze or unfreeze credit reports, as well as for credit-monitoring services; losses from unauthorized charges to accounts; and any payments to lawyers and or accountants.

How long can you claim for identity theft?

You can make a claim for up to 20 hours of time spent dealing with the breach. The good news here is that backing documents aren't required, and you could see compensation for time you spend trying to recover from identity theft (or avoid it in the first place) of $25 an hour (up a maximum of 10 hours -- more than that and you will need documents backing up your additional time spent). You must certify that you are being truthful.

How long does Experian monitor credit?

Consumers impacted by the data breach are entitled to up to 10 years of free monitoring of their credit reports. You can also sign up for at least four years of monitoring services provided by Experian at no cost, or if you already have credit monitoring going, you can file to be compensated for up to $125 in cash.

What happens if you are impacted by Equifax?

If you were impacted by the Equifax data breach, you may seek reimbursement for valid Out of Pocket losses or Time Spent (excluding losses of money and time associated with freezing or unfreezing credit reports or purchasing credit monitoring or identity theft protection) incurred during the Extended Claims Period if you have not received reimbursement for the claimed loss through other means.

When is the deadline to file a claim against Equifax?

The deadline to file a claim for Out-of-Pocket Losses or Time Spent that occurred through January 22, 2020 has passed.

When is the deadline for Equifax?

If you are a class member, the deadline to file Initial Claims Period claim (s) for free credit monitoring or up to $125 cash payment and other cash reimbursement passed on January 22, 2020.

When is the deadline for credit monitoring in 2024?

January 22, 20 24 (For future losses and time) File a claim for Credit Monitoring Services or Alternative Reimbursement Compensation. The deadline to submit a claim to receive the Free Credit Monitoring Services offered under the Settlement, or Alternative Reimbursement Compensation has passed.

When is the extended claim period for credit monitoring?

You may seek reimbursement for valid Out-of-Pocket Losses or Time Spent (excluding losses of money and time associated with freezing or unfreezing credit reports or purchasing credit monitoring or identity theft protection) incurred during the Extended Claims Period (between January 23, 2020 and January 22, 2024) if you have not received reimbursement for the claimed loss through other means.

Is the Equifax settlement final?

By order of the Court, the Settlement cannot become final until the appeals of the remaining objectors are resolved. In September of 2017, Equifax announced it experienced a data breach, which impacted the personal information of approximately 147 million people.

When is the extended claim period for out of pocket loss?

To be eligible, your claim for Out-of-Pocket Losses or Time Spent must occur between January 23, 2020 and January 22, 20 24(the “Extended Claims Period”).

Double-check the website address

It's fairly simple for someone with malicious intentions to create a fake website that looks and acts like a legitimate Equifax settlement website.

It's not just fake websites to watch out for

Setting up a fake website isn't the only way a scammer might try to trick you. You may receive emails or phone calls from scammers pretending to be an Equifax or government official, asking for your personal information to process a claim for you -- don't reply to the email or give any of your personal information over the phone.

How many Americans were exposed to Equifax in 2017?

The personal information of more than 147 million Americans was exposed in 2017 following a massive security breach of consumer credit reporting agency Equifax.

How to get a free Equifax report?

People who meet those qualifications and have already used up their free Equifax report for the year, can request one online by visiting equifax.com/FCRA and filling out the proper information on the website , or they can make the request in writing and include their full name, current and previous addresses, date of birth as well as one item to verify identification like a copy of a Social Security card, pay stub, W2 form, 1099 form, birth certificate, passport, marriage certificate, State ID, Military ID or court documents pertaining to legal name changes.

What was the 2017 Equifax breach?

Equifax users were encouraged to check if they were affected by the 2017 breach, in which Social Security numbers, credit card numbers, drivers license numbers and other personal data was compromised.

What is needed for a free credit report?

One additional source verification will be needed for those requesting free credit reports via mail including a copy of a valid driver's license, utility bill with accurate home address, cell phone bill, pay stub, W2 form, 1099 form, rental lease agreement or house deed, mortgage statement, bank statement or a State ID.

Which credit bureaus give free credit reports?

citizens are able to receive one free credit report every year from each of the three credit bureaus—TransUnion, Experian and Equifax.

Who manages bankruptcy settlements?

Those whose information was released will be able to file a simple form managed by settlement administrator JND, a company known for handling class-action and corporate bankruptcy settlements in which millions of people may be eligible for compensation.

Does Equifax have a security hole?

While Equifax has since patched its security hole, the breach has presented a prime opportunity for American consumers to brush up on their know-how of filling out a request for a proper credit report. Under the Fair and Accurate Credit Transactions Act of 2003, U.S. citizens are able to receive one free credit report every year from each of the three credit bureaus—TransUnion, Experian and Equifax.