“A settlement in car insurance is the amount that a car insurance carrier agrees to pay after a claim is submitted. A settlement can come from your insurance or another driver’s. Since you’re submitting a personal injury protection claim, your settlement will come from your own insurance.

How to get a good car insurance settlement?

Tips for Negotiating an Injury Settlement With an Insurance Company

- Position yourself to get the best settlement from the insurance company after any kind of accident. Updated By David Goguen, J.D. ...

- Have a Settlement Amount in Mind. ...

- Do Not Jump at a First Offer. ...

- Get the Adjuster to Justify a Low Offer. ...

- Emphasize Emotional Points. ...

- Put the Settlement in Writing. ...

- More Information About Negotiating Your Personal Injury Claim. ...

How should I deal with a car insurance settlement?

- How do you respond to a low settlement offer? ...

- Send a letter back to the insurance company outlining what you think the settlement should be and why

- Check with the Department of Insurance in your state for any ongoing problems with the insurance company you’re dealing with

Which is the best car insurance with good claim settlements?

Best Car Insurance. Nationwide (800-421-1444) is the only one we strongly recommend. They beat all the others with fast claims service and a generous claim payout philosophy.

How to negotiate an auto insurance settlement?

Instead, consider using any and all of these tactics:

- Do your own research.

- Contact local dealerships.

- Keep detailed records and take into account any extra options and features your car had.

- Compare your research with that of the insurer.

- Be courteous.

- You are attempting to get the fair market value of the vehicle – not what you think it is worth. ...

What are insurance settlements?

The payment of proceeds by an insurance company to the insured to settle an insurance claim within the guidelines stipulated in the insurance policy.

What does settlement Amount mean in car insurance?

Answered on Jul 06, 2021. “A settlement in car insurance is the amount that a car insurance carrier agrees to pay after a claim is submitted. A settlement can come from your insurance or another driver's. Since you're submitting a personal injury protection claim, your settlement will come from your own insurance.

How much are most car accident settlements?

The average settlement amount for a car accident is approximately $41,783.00. This figure may be high in comparison to national averages across the United States because the data includes more car accident settlements involving serious injuries.

Why do insurance companies want to settle?

When an insurance company offers you a settlement, they are essentially acknowledging their client's fault in the accident. They want you to settle to avoid litigation or going to court. Insurance companies usually do not want to get legal help involved.

How do I find out how much my settlement is?

After your attorney clears all your liens, legal fees, and applicable case costs, the firm will write you a check for the remaining amount of your settlement. Your attorney will send you the check and forward it to the address he or she has on file for you.

How long does a car insurance claim take to settle?

Total loss claim – this means your car isn't repairable (also known as a write-off). At this point, your insurer will agree a settlement figure with you which is likely to be agreed within 30 days, once your insurer has assessed the car and agreed it is a write off.

What percentage does a lawyer get in a settlement case?

What Percentage in a Settlement Case Goes to the Lawyer? A lawyer who works based on contingency fees takes a percentage of your settlement at the end of your case, which is often around one-third of your settlement, per the American Bar Association (ABA).

How much money can you get from a neck injury?

How much is a neck injury worth? It will vary depending on the type of injury, but the average payout for a neck injury is between $5,000 and $50,000. Soft tissue neck injury claims are worth between $5,000 and $20,000 on average. Neck disc injury cases that result in surgery average over $200,000.

How much money can you get from a minor car accident?

In cases where injuries were minor, a passenger might receive up to $3,000 from a claim, however, in serious car accidents where more severe damages, passengers may receive up to $1 million for pain and suffering.

Do insurance companies try to get out of paying?

Insurance companies will seek to decrease payments or deny claims for injuries caused by an insured person's actions. After becoming injured, victims of accidents want nothing more than to move on from the traumatizing experience.

Should I settle with the insurance company?

Remember, the insurance claims adjuster does not work for you. They work to protect the insurance company. The insurance company is under no obligation to settle your claim or pay you a fair amount for your claim. You must protect yourself.

Do insurance companies want to settle quickly?

Insurance companies want to settle cases right away, because they don't want you to have an opportunity to speak to a personal injury lawyer. If an insurance company is offering you any money, it is always advisable that you at least have a consultation with an attorney.

What does settlement Amount mean?

Settlement Amount means, with respect to a Transaction and the Non-Defaulting Party, the Losses or Gains, and Costs, including those which such Party incurs as a result of the liquidation of a Terminated Transaction pursuant to Section 5.2.

How do insurance companies calculate a settlement?

How Do Insurance Companies Determine Settlement Amounts?The type of claim you are making. ... The policy limits and amounts allowed for recovery. ... The nature and extent of your injuries. ... The long-term effects of your accident on your life. ... The strength of your case. ... The distribution of fault. ... Previous matters.

What does it mean when a claim is settled?

Claim settlement is the process by which an insurer pays money to the policyholder as compensation for an accident or vehicle injury.

What reduces the amount paid in a claims settlement?

Car insurance coverage The insurance company pays up to the policy limits. They also reduce the settlement by the amount of any applicable deductible. Car insurance coverage can limit the amount of a settlement even if the damages are greater than the policy limits.

How is a claim settled in the case of theft of the insured car?

In the case of theft of a vehicle a claim can be made by following the steps below: Step 1: Register an FIR (First Information Report) at the neare...

How can I locate the nearest garage associated with my insurer?

To locate your nearest garage authorised by your insurer, you can either call and enquire on the customer service helpline of the insurance provide...

When and to whom do I need to submit the documents?

Policyholders are required to submit the documents to the surveyor when the vehicle is at the garage for repairs.

What is the role of the surveyor in the claim settlement process?

When a claim is raised by any policyholder the insurance company sends a surveyor to conduct an inspection to assess out and understand the extent...

Can an individual make a claim if the insurance policy had expired a day before the accident?

No, you cannot make a claim if your car insurance policy has expired. It is thus very important to renew the policy in time because no claim can be...

What are the documents required to register a claim?

To register a claim, you need a copy of an FIR (in case of an incident), ID proof, Address proof, and policy details.

Are natural calamities covered under car insurance?

Yes, natural calamities including flood, cyclone, earthquake, hurricane etc. are covered under Comprehensive as well as Standalone Own-Damage car i...

What is the meaning of No Claim Bonus?

No Claim Bonus is a reward provided by the insurance company to the policyholder at the time of renewing the insurance policy for not making any cl...

When is a claim settled in a cashless manner?

Whenever the repair is done at a network garage of the insurance provider, a claim is settled in a cashless manner.

Can my claim be rejected?

Yes, an insurance claim can be rejected in the following cases: If the repairs are made before making a claim. If any changes are made to the car w...

Your Auto Insurance Company vs. Theirs

Don't fret if your state doesn't require auto insurance companies to reimburse you for sales tax. Public policy is generally on your side anyways.F...

Are You First Party Or Third Party?

Drivers unfamiliar with the auto insurance claims process may not know the difference between first party and third party. Here's the difference.Wh...

Sometimes You Have to Ask

State laws vary on the topic of recouping expenses after your car is totaled. There are states that require car insurance companies for both first...

Shop Around For Car Insurance

If you're not totally satisfied with your auto insurer, it's probably time to review Insure.com's annual ranking of the best auto insurance compani...

What is Car Insurance Claim Settlement?

Car Insurance Claim is the process under which a car insurance policyholders requests the insurer to compensate for the expenses/damage incurred by him/her due to an unfortunate event involving his/her car. The amount and extent of the claim amount depend on the Insured Declared Value (IDV) of your car and the type of car insurance policy bought by you - third party, own damage or comprehensive.

What is claim settlement?

The claim settlement is the ultimate goal of purchasing car insurance. The settlement of claim means the offering of compensation to policyholders for damage or loss to their cars. The car insurance claim can be settled in two ways which are cashless and reimbursement claim settlement, where the former is more preferred.

How to File for Car Insurance Third Party Insurance Claim?

The following steps will guide you in filing a third party insurance claim:

How Many Car Insurance Claims Can You Make in a Year?

There is no limit to the number of insurance claims you make within a year. However, it is advisable to refrain from filing a claim if the damage is not significant. The cost of the damage should ideally be higher than your NCB amount and your deductibles. Moreover, multiple claims can make your premium rate higher during your next renewal.

What is the Maximum Time in Which the Insurance Provider Should Settle a Claim When All Documents are Submitted?

After you submitted all the required documents processing the car insurance claim should not take more than 30 days. In rare cases, when there is some complication that requires further investigation it should be completed within six months.

How to contact insurance about a car accident?

You can do this by calling the customer care number of the insurer or through the insurer’s official website or mobile app (if available). The insurer will provide you with a claim reference number after registering your claim.

Why is my car insurance rejected?

Below are some of the common reasons which lead to rejection of car insurance claims by insurers: Occurrence of accident/mishap involving the insured car outside the geographical location stated in the insurance policy. Occurrence of accident when the driver is under the influence of intoxicants.

How long does it take to get a loss settlement check?

Generally, once the car has been declared a total loss, you may receive a loss settlement check in just a few days. But - as with all types of settlements, the process could take longer if you disagree with the amount the insurance company is offering or if you were the third party in the accident.

What is the insurance policy for a first party auto total loss?

When the insurance policy provides for the adjustment and settlement of a first-party auto total loss, the insurer must either (1) offer a replacement auto with all applicable “taxes, license fees, and other fees” paid, or (2) make a cash settlement which includes all applicable taxes, license fees, and other fees.

What is total loss car insurance?

To ensure that you can get around if your car is damaged beyond repair, it’ s important to have total loss car insurance coverage.

How to total a car?

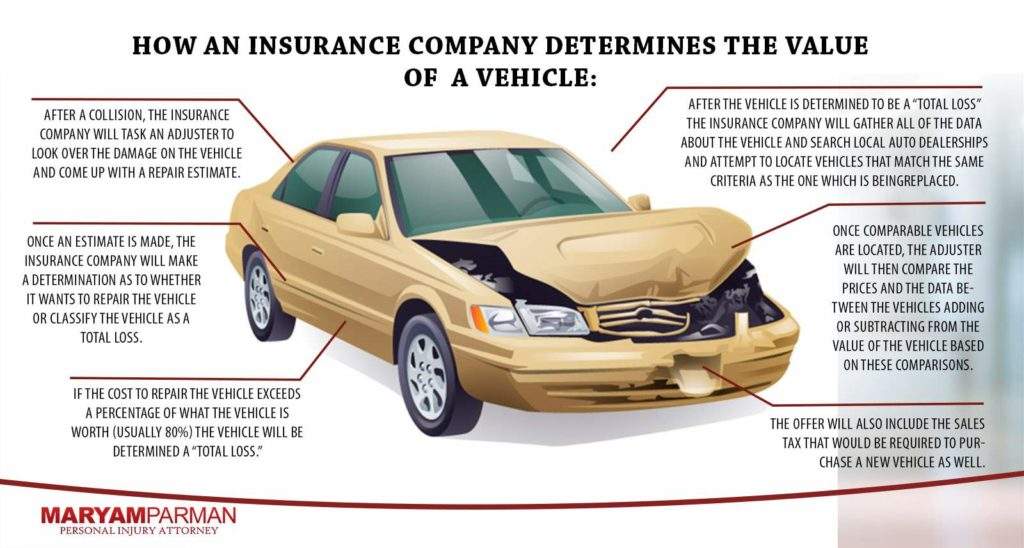

If you think your car was totaled in a collision, the first step is to call your insurance company and evaluate the damage. The adjuster can determine whether it’s a total loss or not.

What makes a car totaled?

So, what separates normal damage from a “total loss?” It depends on the cost of repairing the damage and the value of your car.

What is the actual cash value of my car?

You might assume that the actual cash value of your car is whatever you paid for it. Unfortunately, that’s not the case – your vehicle’s ACV is probably much lower. Why?

What is 10902 insurance?

Code § 10902, or (3) vehicle completely stripped or burned. When a carrier elects to repair the car to its pre-accident condition, it’s not required to pay for any loss of value to the vehicle, which can occur after a seriously damaged vehicle is fully repaired.

What factors are used to calculate a settlement for a car accident?

These include: The type and nature of property damage. Whether or not a party is injured.

How to get a higher settlement with insurance companies?

Hire a proven attorney. The Colossus system will take the lawyer’s success rate against insurance companies into account, assigning a higher settlement amount to clients of successful attorneys.

What to do if you are in a wreck with an uninsured driver?

If you are in an accident in which an uninsured driver is at fault, you will either have to sue the driver personally for the cost of repairs and medical expenses or you will have to file a claim with your own insurance company.

What does an auto adjuster do?

The adjuster has two jobs: to assess the damage from an accident and to negotiate as small a settlement to you as possible . Although most adjusters will assess an auto insurance settlement fairly and in good faith, understanding how those settlements are calculated can help you get the best payment possible.

What is the value of a car?

The value of your car is the depreciated value , which includes age and mileage of the vehicle. The depreciated value is unlikely to be close to the price of a brand new car, and it is possible that it could be less than you owe on the vehicle if you have a car loan.

What happens if you live in a no fault state?

If you live in a “no fault” state, your own car insurance will pay up to your policy limit for personal injury and medical bills. Even in a “no fault” state, he damage to property is covered by the insurance company of the driver who caused the accident.

How is the amount of a liability claim determined?

This amount is determined by the strength of your liability claim and the extent of your damages.

What happens if you receive a large settlement?

Large settlement: If you receive a large settlement that represents several years of income all at once, you will most likely end up being taxed at a higher rate than you usually pay.

How much of a settlement do you have to pay in taxes?

Even though your lawyer (working on contingency) will take roughly one-third of your settlement, you will be responsible for taxes on the entire settlement amount in addition to paying the Social Security and Medicare taxes.

How much tax is paid on a structured settlement?

You'd receive a Form 1099 from the insurance company each year. Typically, a structured settlement can save you between 25% and 35% of taxes on interest income that would otherwise be subject to tax.

What happens if you get a check for a totaled car?

Using our example, if the insurance company determines your vehicle's value is $12,000, and it was totaled in an accident, they will write you a check for $12,000 minus your deductible, putting you back in the same financial place that you started before the accident. You have gained nothing financially (actually, you are slightly less wealthy after paying the deductible), so the IRS will leave you alone.

What is compensation for lost wages?

Compensation for lost wages is intended to replace what you would have earned had you not been injured. If you don't make a complete recovery, you may also receive compensation for future lost wages.

Is car accident settlement taxable?

Unfortunately, there is not only one answer because car accident insurance settlements can have several different components, and some of those are taxable while others are tax exempt.

Is auto accident compensation taxable?

However, there can be instances where auto accident compensation is taxable, but it depends on how your settlement is structured and what is included. While the money to repair or replace your vehicle is usually not taxable, items such as pain and suffering or emotional distress may fall into the taxable category.

How long do you have to file a car accident claim?

Depending on the state, you may have from 1 to 6 years to file a lawsuit against the other driver for car accident damages.

What to do if you are at fault for a car accident?

Once it becomes clear that the other driver was at fault, you have the following options: File a lawsuit against that driver.

What happens if you send a demand letter to your insurance company?

Once you send the demand letter, the insurance company will investigate your case and determine whether to accept or deny it. If the insurance provider accepts your claim, it will make a settlement offer. At this point, both parties will negotiate to come to an agreement. If the company denies your claim, it will likely allow you to make an appeal to the claims adjuster. If you are suing the other driver, you will need to make an initial filing by drafting a complaint and submitting it to a county or district court.

Why do parties settle before going to court?

Parties tend to settle before going to court because a favorable outcome isn't guaranteed in a jury trial. By filing an insurance claim, you can recover damages for any medical expenses, loss of income, and pain and suffering damages that resulted from your car accident.

What are the two types of car accident liability?

Generally, there are two types of systems regarding car accident liability: At-fault system. No-fault system. Your car accident settlement process will depend on which system your state follows.

What states require car insurance?

Almost all states (except Virginia and New Hampshire) require drivers to carry car insurance. Generally, there are two types of systems regarding car accident liability: 1 At-fault system 2 No-fault system

What happens if a company denies your claim?

If the company denies your claim, it will likely allow you to make an appeal to the claims adjuster. If you are suing the other driver, you will need to make an initial filing by drafting a complaint and submitting it to a county or district court.