Following a Federal Trade Commission (FTC) settlement with an automaker earlier this year, nearly 500,000 car owners and lessees could receive a cash payment of at least $5,100. And depending on how the IRS interprets this settlement, those taxpayers could have to pay taxes on part – or all – of their settlement.

Do you have to pay taxes on a settlement?

Tax Implications of Settlements and Judgments The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code.

Are lawsuit settlements and damages taxable?

Lawsuit settlements and damages are generally separated into two categories: taxable and nontaxable. There are exceptions to every rule and each lawsuit claim is unique. Again, we suggest seeking advice from an account where possible. Remember, according to the IRS gross income includes “all income from whatever source derived”.

What forms of payment does the FTC accept?

The FTC currently issues payments by check, prepaid debit card, and PayPal. A payment or claim form sent as part of an FTC settlement will include an explanation of and details about the case.

Do I have to pay taxes on an FTC refund?

The FTC does not require you to forfeit any rights you may have under federal or state law to get your refund. Do I have to pay taxes on a check I received as part of an FTC refund program? If you have any questions about how your payment may affect your taxes, please consult a tax advisor.

Is the FTC sending out checks?

The Federal Trade Commission, through its refund administrator, is mailing 690,000 checks totaling more than $152 million to consumers who lost money to a massive payday lending fraud scheme operated by AMG Services, Inc.

How much are the FTC refund checks?

The FTC will be sending 86,752 checks averaging about $56 each. People who receive checks should deposit or cash them within 90 days, as indicated on the check. Recipients who have questions about their checks can call the refund administrator, Epiq, at 800-591-4238.

Does filing with FTC do anything?

The FTC cannot resolve individual complaints, but it can provide information about what steps to take. The FTC says that complaints can help it and its law enforcement partners detect patterns of fraud and abuse, which may lead to investigations and stopping unfair business practices.

What is FTC refund?

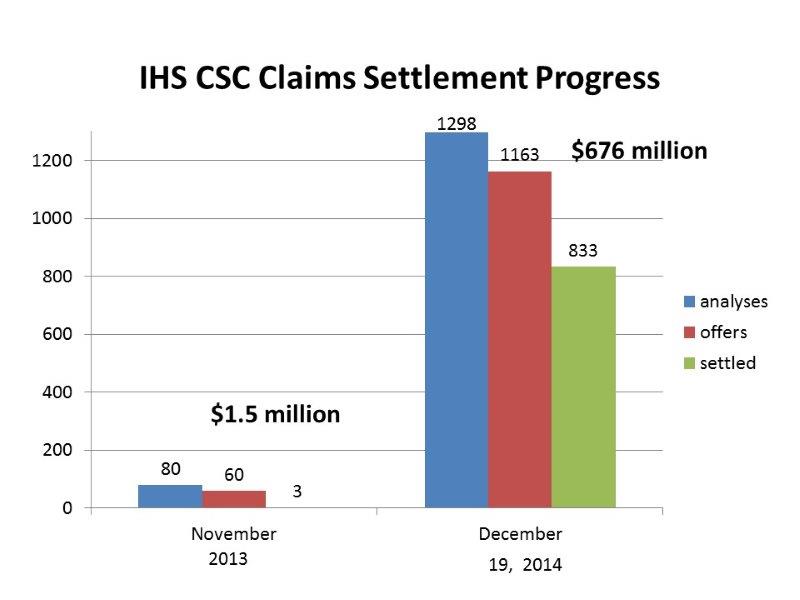

Enforcement. The FTC enforces consumer protection laws to stop illegal business practices and get refunds to people who lost money. The chart below includes recent FTC cases that resulted in refunds. If you'd like to know more about how the refund program works, visit this page about the FTC's process.

How much is the FTC vs AMG check?

FTC to Issue $152M in Checks to Additional Victims of AMG Services. The Federal Trade Commission announced Thursday (May 19) that it will mail 690,000 checks, amounting to over $152 million, to customers who were defrauded by a payday lending fraud scheme run by AMG Services and the company's owner, Scott Tucker.

What is the FTC and progressive refund?

The Federal Trade Commission is returning more than $172 million to consumers who overpaid for merchandise they purchased using rent-to-own plans provided by Progressive Leasing. More than two million consumers will receive refund checks.

How long does it take to hear back from FTC?

How long does it take for the FTC to respond to a FOIA request? Our goal is to respond within the timeframe outlined in the Freedom of Information Act, which is twenty working days, or approximately one month, but this may vary with the complexity of the request.

What does FTC mean in court?

Federal Trade CommissionLegal Definition of Federal Trade Commission independent agency charged with preventing unfair or deceptive trade practices.

Is it worth filing a complaint with the BBB?

One good option is to file a complaint with the Better Business Bureau (BBB). The BBB helps consumers settle disputes related to sales, contracts, customer service, warranties, billings, and refunds every year. It accepts complaints even if the company that's harmed you doesn't belong to the Better Business Bureau.

How do I know if I get an AdvoCare settlement check?

If you don't have a PayPal account and would prefer to get a check, call 1-855-744-1802. If you get a check, please cash it within 90 days. Visit the AdvoCare Refunds page for more information. The refund administrator, Analytics, is available at 1-855-744-1802 if you have questions.

Can you sue the FTC?

Individuals and businesses cannot sue under the FTC Act.

Will I get a check from AdvoCare lawsuit?

Thanks to the FTC's lawsuit, starting May 5, 2022, more than 224,000 people who lost money to the AdvoCare pyramid scheme will be getting checks or PayPal payments. If you get a check or PayPal payment from FTC v. AdvoCare, cash or accept it quickly.

Does the FTC owe me money?

The FTC never requires you to pay upfront fees or asks you for sensitive information, like your Social Security number or bank account information. If someone claims to be from the FTC and asks for money, it's a scam.

How do I check the status of my FTC complaint?

How can I check the status of my request? If you submitted your request through the FTC's Public Access Link, or PAL, click here. Or you could email us at [email protected] .

How long does it take for T Mobile to refund money?

Refunds may take up to 30 days to process. We will refund the purchase price, excluding rebates, special discounts, and restocking fees.

What is the tax rule for settlements?

Tax Implications of Settlements and Judgments. The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code. IRC Section 104 provides an exclusion ...

What is the purpose of IRC 104?

IRC Section 104 provides an exclusion from taxable income with respect to lawsuits, settlements and awards. However, the facts and circumstances surrounding each settlement payment must be considered to determine the purpose for which the money was received because not all amounts received from a settlement are exempt from taxes.

What is employment related lawsuit?

Employment-related lawsuits may arise from wrongful discharge or failure to honor contract obligations. Damages received to compensate for economic loss, for example lost wages, business income and benefits, are not excludable form gross income unless a personal physical injury caused such loss.

What is a 1.104-1 C?

Section 1.104-1 (c) defines damages received on account of personal physical injuries or physical sickness to mean an amount received (other than workers' compensation) through prosecution of a legal suit or action, or through a settlement agreement entered into in lieu of prosecution.

What is the exception to gross income?

For damages, the two most common exceptions are amounts paid for certain discrimination claims and amounts paid on account of physical injury.

Is emotional distress excludable from gross income?

96-65 - Under current Section 104 (a) (2) of the Code, back pay and damages for emotional distress received to satisfy a claim for disparate treatment employment discrimination under Title VII of the 1964 Civil Rights Act are not excludable from gross income . Under former Section 104 (a) (2), back pay received to satisfy such a claim was not excludable from gross income, but damages received for emotional distress are excludable. Rev. Rul. 72-342, 84-92, and 93-88 obsoleted. Notice 95-45 superseded. Rev. Proc. 96-3 modified.

Is a settlement agreement taxable?

In some cases, a tax provision in the settlement agreement characterizing the payment can result in their exclusion from taxable income. The IRS is reluctant to override the intent of the parties. If the settlement agreement is silent as to whether the damages are taxable, the IRS will look to the intent of the payor to characterize the payments and determine the Form 1099 reporting requirements.

Why should settlement agreements be taxed?

Because different types of settlements are taxed differently, your settlement agreement should designate how the proceeds should be taxed—whether as amounts paid as wages, other damages, or attorney fees.

How much is a 1099 settlement?

What You Need to Know. Are Legal Settlements 1099 Reportable? What You Need to Know. In 2019, the average legal settlement was $27.4 million, according to the National Law Review, with 57% of all lawsuits settling for between $5 million and $25 million.

What to report on 1099-MISC?

What to Report on Your Form 1099-MISC. If you receive a court settlement in a lawsuit, then the IRS requires that the payor send the receiving party an IRS Form 1099-MISC for taxable legal settlements (if more than $600 is sent from the payer to a claimant in a calendar year). Box 3 of Form 1099-MISC identifies "other income," which includes ...

How much money did the IRS settle in 2019?

In 2019, the average legal settlement was $27.4 million, according to the National Law Review, with 57% of all lawsuits settling for between $5 million and $25 million. However, many plaintiffs are surprised after they win or settle a case that their proceeds may be reportable for taxes. The Internal Revenue Service (IRS) simply won't let you collect a large amount of money without sharing that information (and proceeds to a degree) with the agency.

What is compensatory damages?

For example, in a car accident case where you sustained physical injuries, you may receive a settlement for your physical injuries, often called compensatory damages, and you may receive punitive damages if the other party's behavior and actions warrant such an award. Although the compensatory damages are tax-free, ...

What happens if you get paid with contingent fee?

If your attorney or law firm was paid with a contingent fee in pursuing your legal settlement check or performing legal services, you will be treated as receiving the total amount of the proceeds, even if a portion of the settlement is paid to your attorney.

Do you have to pay taxes on a 1099 settlement?

Where many plaintiff's 1099 attorneys now take up to 40% of the settlement in legal fees, the full amount of the settlement may need to be reported to the IRS on your income tax. And in some cases, you'll need to pay taxes on those proceeds as well. Let's look at the reporting and taxability rules regarding legal settlements in more detail as ...

Why are lost wages taxable?

Lost wages are considered taxable because wages are income that would have been taxed if it were received without interruption. Not only will income tax be added, but these wages are also subject to social security taxes and Medicare tax.

Is a car accident settlement in West Palm Beach taxable?

Any of the major claims a West Palm Beach car accident lawyer settles will almost always be nontaxable. Cases handled by personal injury lawyers are an exception to any settlement awards that considered income.

Does the IRS collect taxes on lawsuits?

Most money awarded as a result of a lawsuit claim will be subject to taxes. The IRS is a governing body that exists to collect taxes, and that’s exactly what they do best: they collect taxes!

Is a lawsuit settlement considered income?

Settlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money, although personal injury settlements are an exception ( most notably: car accident settlement and slip and fall settlements are nontaxable). Lawsuit settlements and damages are generally separated into two categories: ...

Is a lawsuit settlement taxable?

Lawsuit settlements and damages are generally separated into two categories: taxable and nontaxable. There are exceptions to every rule and each lawsuit claim is unique. Again, we suggest seeking advice from an account where possible.

Can contingency fees be taxed?

Remember, if a lawyer chooses to work for contingency fees (where the attorney collects fees after winning a case), those fees can be taxed. However, that is not the case with car accident cases or many other personal injury cases like slip and fall or workers compensation [2]. Those contingency fees will not be taxed!

Is emotional distress taxable?

Emotional Distress Awards Are Nontaxable. Any settlement money received for emotional distress is nontaxable if and only if the distress or anguish originated from the physical injury or sickness caused by the accident.

Is a settlement for physical injury taxable?

If you receive a settlement for personal physical injuries or physical sickness and did not take an itemized deduction for medical expenses related to the injury or sickness in prior years, the full amount is non-taxable. Do not include the settlement proceeds in your income.

Is severance pay taxable?

If you receive a settlement in an employment-related lawsuit; for example, for unlawful discrimination or involuntary termination, the portion of the proceeds that is for lost wages (i.e., severance pay, back pay, front pay) is taxable wages and subject to the social security wage base and social security and Medicare tax rates in effect in the year paid. These proceeds are subject to employment tax withholding by the payor and should be reported by you as ‘Wages, salaries, tips, etc.” on line 1 of Form 1040.

Do you have to report a settlement on your taxes?

Property settlements for loss in value of property that are less than the adjusted basis of your property are nottaxable and generally do not need to be reported on your tax return. However, you must reduce your basis in theproperty by the amount of the settlement.

IRC Section and Treas. Regulation

- IRC Section 61explains that all amounts from any source are included in gross income unless a specific exception exists. For damages, the two most common exceptions are amounts paid for certain discrimination claims and amounts paid on account of physical injury. IRC Section 104explains that gross income does not include damages received on account of personal phys…

Resources

- CC PMTA 2009-035 – October 22, 2008PDFIncome and Employment Tax Consequences and Proper Reporting of Employment-Related Judgments and Settlements Publication 4345, Settlements – TaxabilityPDFThis publication will be used to educate taxpayers of tax implications when they receive a settlement check (award) from a class action lawsuit. Rev. Rul. 85-97 - The …

Analysis

- Awards and settlements can be divided into two distinct groups to determine whether the payments are taxable or non-taxable. The first group includes claims relating to physical injuries, and the second group is for claims relating to non-physical injuries. Within these two groups, the claims usually fall into three categories: 1. Actual damages re...

Issue Indicators Or Audit Tips

- Research public sources that would indicate that the taxpayer has been party to suits or claims. Interview the taxpayer to determine whether the taxpayer provided any type of settlement payment to any of their employees (past or present).