How to properly record a HUD settlement?

- Deposit made by the buyer

- The loan amounts

- The amount owed by the seller to the buying party is a credit entry and must record. ...

- Property tax and assessment pro-ration credits from seller to the buyer of the HUD Settlement Statement

- Lastly, any additional credits to the buyer will be entered here from any source, if not from the seller

Does the rebate appear on the hud-1/settlement statement?

Does the rebate appear on the HUD-1 Settlement Statement? Yes, we work with the closing attorney and your lender from the beginning of the transaction to make sure that your rebate is accounted for properly.

What is an Alta/Closing Disclosure/HUD-1 statement?

ALTA Settlement Statements are used in conjunction with the HUD-1 settlement statement. Under the new CFPB regulations, most real estate transactions require the use of the new Closing Disclosure Form. However, the HUD-1 settlement statement is still used in certain cases such as: Home equity revolving lines of credit.

What is a short sale HUD-1?

What is a Short Sale HUD-1 ? It is a document listing all the debits and credits in a real estate transaction . It is created for the benefit of the buyer and the buyer's lender. However, that does not stop the short sale seller's lender from asking for the HUD-1 during the approval process.

What is another name for a HUD-1?

The HUD-1 form, often also referred to as a “Settlement Statement”, a “Closing Statement”, “Settlement Sheet”, combination of the terms or even just “HUD” is a document used when a borrower is lent funds to purchase real estate.

Is the HUD-1 Settlement Statement the same as the closing disclosure?

Another big distinction between the Closing Disclosure and the HUD-1 is where the HUD-1 listed all terms, charges and credits for both the buyer and the seller, the Closing Disclosure has a separate form for the buyer as it does for the seller. This provides for more consumer protection at the closing table.

What replaced the HUD settlement statement?

The Closing Disclosure combines and replaces the HUD-1 Settlement Statement and the final Truth-in-Lending (TIL) statement. The form mirrors the information provided on the Loan Estimate.

In which section of the HUD-1 closing statement does the settlement statement appear?

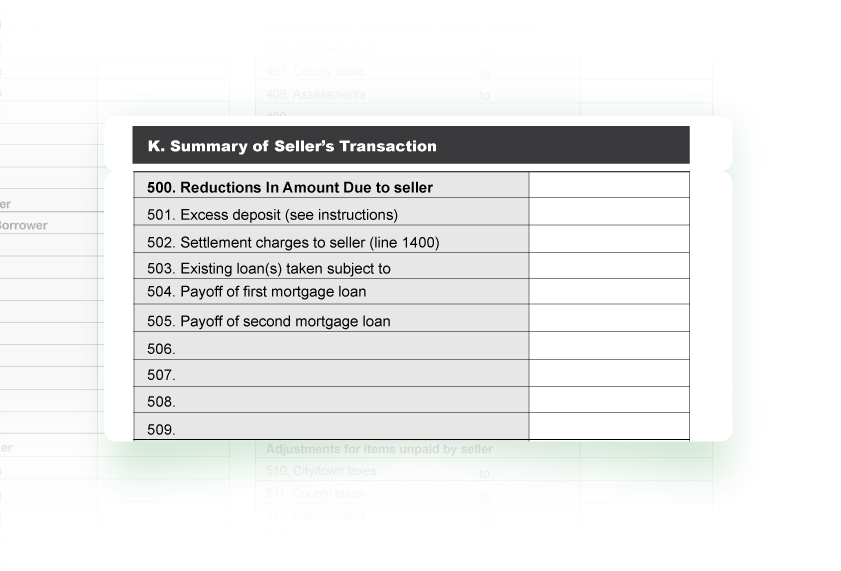

HUD-1 Section L: Detail of Settlement Charges for Borrower and Seller. Section L contains a long list of settlement charges. Charges shown in the left column are paid by the borrower, and charges shown in the right column must be paid by the seller.

Are HUD-1 Settlement Statements still used?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exception: reverse mortgages.

When should I receive the HUD-1 Settlement Statement?

In such case, the completed HUD-1 or HUD-1A shall be mailed or delivered to the borrower, seller, and lender (if the lender is not the settlement agent) as soon as practicable after settlement.

What is the HUD now called?

GTranslate. The Federal Housing Administration (FHA) is part of the U.S. Department of Housing and Urban Development. We provide mortgage insurance on loans made by FHA-approved lenders.

Where can I find my HUD-1?

HUD-1 Forms | HUD.gov / U.S. Department of Housing and Urban Development (HUD)

How do I get my HUD payoff statement?

Requests for payoff statements, subordinations, releases, and other documentation specific to these programs can be submitted to:Payoff Requests: [email protected] Requests: [email protected] Requests: [email protected] Partial Claim document submittal: [email protected] items...

Is a settlement statement the same as a closing statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

What is the difference between a closing disclosure and a HUD?

The HUD-1 form, listing all closing costs, is given to all parties involved in reverse mortgage and mortgage refinance transactions. Since late 2015, a different form, the Closing Disclosure, is prepared for the parties involved in all other real estate transactions.

What is the primary purpose of the settlement statement?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

Is a closing disclosure the same as a settlement statement?

Closing Disclosure When you are in the process of closing, you will receive a settlement statement. They arrive three days before closing from your lender. This document is commonly known as the “closing disclosure.” Essentially, this is for buyers to review in advance before closing.

Is a settlement statement the same as a closing statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

What is the difference between a closing disclosure and a HUD?

The HUD-1 form, listing all closing costs, is given to all parties involved in reverse mortgage and mortgage refinance transactions. Since late 2015, a different form, the Closing Disclosure, is prepared for the parties involved in all other real estate transactions.

What is the difference between a closing statement and a closing disclosure?

A closing statement or credit agreement is provided with any type of loan, often with the application itself. A seller's Closing Disclosure is prepared by a settlement agent and lists all commissions and costs in addition to the net total to be paid to the seller.

What is HUD-1 Settlement Statement?

Janet Wickell. Updated January 29, 2020. The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called closing agents, to itemize all charges imposed upon a borrower and seller for a real estate transaction.

What is HUD-1 form?

The statutes of the Real Estate Settlement Procedures Act (RESPA) required that the HUD-1 form be used as the standard real estate settlement form in all transactions in the United States that involved federally related mortgage loans. 2.

When Is a HUD-1 Used in 2020?

The HUD-1 settlement statement is still used in 2020 for reverse mortgages. These types of mortgages are very popular with sellers over the age of 62 who want to pull equity out of their homes. 4

When Is the HUD-1 Distributed?

Before October 3, 2015, RESPA stated that borrowers should be given a copy of the HUD-1 at least one day prior to settlement. 5 However, entries could easily still be coming in, right up until a few hours before closing.

What is the 701 and 702 section?

This section deals with the commissions paid to real estate agencies. Lines 701 and 702 show how the commissions are split between two participating agencies. 6

What is tabulated before being brought forward to page 1 in Section L or page 2?

Many entries are tabulated before being brought forward to page 1 in Section L or page 2. Columns contain charges that are paid from either the borrower's or the seller's funds. Your closing statement probably won't have entries in all these lines.

Who studied the statement of sale?

Most buyers and sellers studied the statement on their own, with the assistance of their real estate agent and the settlement agent. The idea was that the more people who reviewed it, the more likely it became that errors would be detected.

What is a HUD-1 settlement statement?

A HUD-1 settlement statement, also referred to simply as a settlement statement , details every charge associated with your new loan. It also outlines who is responsible for each of those charges — the buyer or the seller — as well as any credits you may receive for things like taxes, insurance or deposits.

What is the first page of a HUD settlement statement?

The first page of the settlement statement has a transaction overview, including the amount of cash you need to bring to closing. The sections below are highlighted so you can have an idea of what they look like on the HUD-1 settlement statement you’ll receive.

What is a HELOC loan?

A HELOC is a mortgage-based line of credit that works much like a credit card. It allows you to pull from your home’s existing equity (or the value of the home that you own, compared to what you still owe to your lender) on a revolving basis.

How long does it take to pay down a HELOC?

You can borrow as much as you need up to your maximum loan amount, then pay it down to zero as many times as necessary during a set draw period that usually ends after 10 years.

What is section 200 in mortgage?

No. 4 (Section 200): Amount paid by or on behalf of borrower. This section details any credits you receive toward costs you’ve already paid or that the seller is paying. Line 201 shows the money you’ve already paid, such as an earnest money deposit, while Line 202 reflects the principal amount of the new loan.

How many sections are there in a settlement statement?

The settlement statement lists charges in three sections. The first section shows charges that cannot change. The next section outlines charges that cannot change by more than 10%, while the final section outlines charges that may change.

Do you need to review a HUD-1 settlement statement before closing?

If you’re getting ready to close on a mortgage, you’ll typically review a closing disclosure. However, if you’re taking out a home equity line of credit (HELOC), a mortgage for a manufactured home that is not attached to real estate or a reverse mortgage, you’ll need to review a HUD-1 settlement statement before you head to the closing table.

Why was the HUD-1 Settlement Statement required in 2010?

The reason behind all of these amendments and changes was to create more transparency and progress in consumer protection, which leads us into the 1986 HUD-1 Form.

What is the difference between HUD-1 and HUD-1?

Another big distinction between the Closing Disclosure and the HUD-1 is where the HUD-1 listed all terms, charges and credits for both the buyer and the seller, the Closing Disclosure has a separate form for the buyer as it does for the seller. This provides for more consumer protection at the closing table. Another change that came up ...

What is the real estate settlement procedure act?

1974: The Real Estate Settlement Procedures Act (RESPA) was created to help protect consumers from foul practices, forcing lending institutions to disclose settlement costs upfront. This act is enforced by the Consumer Financial Protection Bureau (CFPB) and includes all types of mortgages. RESPA requires different disclosures during different parts of the home closing process and also offers protection to consumers in areas including: 1 Limiting the amount put into escrow for real estate charges 2 Allowing buyers to use their own title company and title insurance 3 Prohibiting lenders from receiving a fee in exchange for a referral

How long does a loan estimate need to be in the hands of the buyer before closing?

These two documents must be in the hands of the buyer at least 3 days prior to the closing date in order to find any errors or issues before closing. If certain changes are made to the disclosure, the 3-day waiting period starts over. This is one big change with the new TRID rules.

What is HUD-1 form?

1986-2015: Prior to October 2015, the Settlement Statement was known as the HUD-1, which is a standard government form issued by the Closing Agent that lists all credits, charges and home loan terms for both the buyer and the seller in all real estate transactions that required a mortgage. The charges for both the borrower and seller were listed on the same form, with borrower charges on one side of the form and seller charges on the other.

When did the HUD-1 change to the closing disclosure?

The Consumer Financial Protection Bureau (CFPB) took over administration from HUD and replaced the HUD-1 with the Closing Disclosure in October of 2015. It is similar to the HUD-1 in that it details the loan terms and costs, including the interest rates, closing costs, taxes, monthly payments, and more.

What is the Truth in Lending Act?

1968: The Truth in Lending Act (TILA) was established by the Federal Reserve Board for consumers in regards to lenders and creditors. It afforded a consumer the right to know the annual percentage rate (APR) and the cost of the loan for the borrower.

What is HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a standardized mortgage lending form in use in the United States of America on which creditors or their closing agents itemize all charges imposed on buyers and sellers in consumer credit mortgage transactions.

What is a HUD-1?

The HUD-1 (or a similar variant called the HUD-1A) is used primarily for reverse mortgages and mortgage refinance transactions. The reference to 'HUD' in the form's name refers to the Department of Housing and Urban Development . Federal regulations require that unless its use is specifically exempted, either the HUD-1 or the HUD-1A, ...

What is the HUD-1A used for?

Federal regulations require that unless its use is specifically exempted, either the HUD-1 or the HUD-1A, as appropriate, must be used for all mortgage transactions that are subject to the Real Estate Settlement Procedures Act.

When do you need to inspect a HUD-1?

The settlement agent must permit the borrower to inspect the HUD-1 or HUD-1A settlement statement, completed to set forth those items that are known to the settlement agent at the time of inspection, during the business day immediately preceding settlement. Items related only to the seller's transaction may be omitted from the HUD-1.

Is a HUD-1 exempt from the Truth in Lending Act?

The TRID rule mandates the use of a Closing Disclosure form instead. The use of the HUD-1 or HUD-1A is also exempted for open-end lines of credit (home -equity plans) covered by the Truth in Lending Act and Regulation Z. A HUD-1 or HUD-1A Settlement Statement is prepared by a creditor or, more typically, by the settlement agent who conducts ...

What information is provided on a HUD-1 Settlement Statement?

Aside from the basic details of the involved parties, consisting of the buyer and seller , the lender , property details and settlement agent details, unsurprisingly the majority of the settlement statement consists of figures. Lots of figures.

What is HUD 1?

HUD is an acronym for Housing and Urban Development, and represents the arm of the U.S. government department responsible for legislation relating to home ownership and property development within the United States of America. The HUD-1 form, often also referred to as a “ Settlement Statement ”, a “ Closing Statement ”, “ Settlement Sheet ”, ...

When will be my first mortgage payment?

An example is if the closing is September 15, the first mortgage payment will not be until November 1. The November 1st payment will represent the principal and interest for October. The interest from Sept 15-Sept 30 will be prepaid on the closing date.

Why are the values between the GFE and final HUD figures different?

Many times the GFE and the final HUD figures do indeed differ from each other. The GFE figures are presented by a lender within 3 days of applying for ta loan. In many instances, these figures may increase or decrease. Many of these GFE disclosures cannot exceed a 10% tolerance given by the bank. Unless they are figures that can be shopped for, any tolerance of over 10% must be reduced by the Lender to adhere to the 10% tolerance level.

What is HUD-1 form?

The HUD-1 form, often also referred to as a “ Settlement Statement ”, a “ Closing Statement ”, “ Settlement Sheet ”, combination of the terms or even just “ HUD ” is a document used when a borrower is lent funds to purchase real estate. Another acronym used in relation to the HUD form is GFE, which means ‘ Good Faith Estimate ’.

When is the HUD form required?

According to the RESPA act, the HUD form is to be used by all lenders of loans providing funds for real estate purchases and refinances of real estate loans and must be given to the borrow at least one day prior to the date of settlement.

Can a bank be a settlement agent?

The settlement agent can take the form of a title agency, mortgage broker, even the bank could act as a settlement agent however it is recommended hiring an experienced real estate law firm experienced in real estate closings to take care of the closing.

What is HUD-1 statement?

The settlement agent shall use the HUD-1 settlement statement in every settlement involving a federally related mortgage loan in which there is a borrower and a seller. For transactions in which there is a borrower and no seller, such as refinancing loans or subordinate lien loans, the HUD-1 may be utilized by using the borrower's side of the HUD-1 statement. Alternatively, the form HUD-1A may be used for these transactions. The HUD-1 or HUD-1A may be modified as permitted under this part. Either the HUD-1 or the HUD-1A, as appropriate, shall be used for every RESPA-covered transaction, unless its use is specifically exempted. The use of the HUD-1 or HUD-1A is exempted for open-end lines of credit (home-equity plans) covered by the Truth in Lending Act and Regulation Z.

Who completes HUD-1?

The settlement agent shall complete the HUD-1 or HUD-1A, in accordance with the instructions set forth in appendix A to this part. The loan originator must transmit to the settlement agent all information necessary to complete the HUD-1 or HUD-1A. (1) In general. The settlement agent shall state the actual charges paid by ...

Who must state the actual charges paid by the borrower and seller on the HUD-1?

The settlement agent shall state the actual charges paid by the borrower and seller on the HUD-1, or by the borrower on the HUD-1A. The settlement agent must separately itemize each third party charge paid by the borrower and seller.

Can HUD-1 be modified?

The HUD-1 or HUD-1A may be modified as permitted under this part. Either the HUD-1 or the HUD-1A, as appropriate, shall be used for every RESPA-covered transaction, unless its use is specifically exempted.

The History of Real Estate Settlement Procedures

HUD-1 Settlement Statement

- 1986-2015:Prior to October 2015, the Settlement Statement was known as the HUD-1, which is a standard government form issued by the Closing Agent that lists all credits, charges and home loan terms for both the buyer and the seller in all real estate transactions that required a mortgage. The charges for both the borrower and seller were listed on ...

The Current Closing Disclosure

- 2015-today: Now let’s get down to the nitty gritty on what is expected in the here and now. The Consumer Financial Protection Bureau (CFPB) took over administration from HUD and replaced the HUD-1 with the Closing Disclosurein October of 2015. It is similar to the HUD-1 in that it details the loan terms and costs, including the interest rates, closing costs, taxes, monthly payments, a…

A Couple Tips

- Take the time to read through these documents to look for mistakes, and ask your lender and Real Estate Agent to help you what you don't understand. Don’t assume that the Closing Disclosure is correct. Mistakes happen, so don’t be afraid to ask questions or seek clarification before you sign the paperwork at closing. If it is a major mistake, the buyer can obtain an explanation, and even …